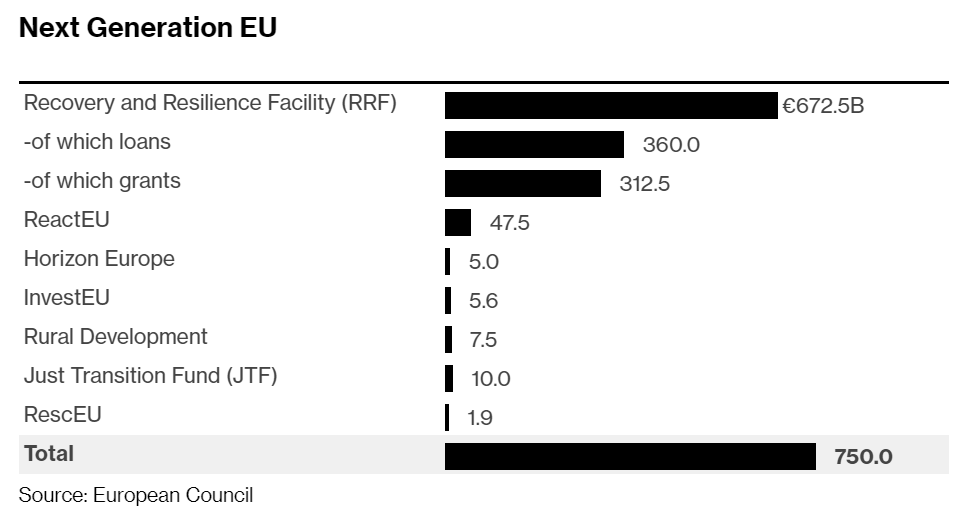

EU leaders agree on stimulus package, Pelosi to meet Mnuchin, and commodities rally. AgreementTalks in Brussels that went on overnight produced a stimulus package worth 750 billion euros ($860 billion). The agreement, which required the unanimous approval of all 27 European Union member states, will see 390 billion euros disbursed as grants with the balance in the form of low-interest loans. All expenditure under the package must be consistent with the Paris Agreement's greenhouse gas targets. Markets reacted positively, with stocks in the region rising. StimulusWith the deal reached in Europe, stimulus attention is already turning to the U.S. where Treasury Secretary Steven Mnuchin will meet with House Speaker Nancy Pelosi this afternoon as both sides of the aisle try to hash out a fiscal package with only weeks left before Congress goes into recess. Republican lawmakers' $1 trillion target is less than a third of what Democrats want for the deal, with President Donald Trump's demand that a payroll tax cut be included also proving contentious. Adding to the time pressure is the imminent expiry of previous stimulus measures that could leave the U.S. economy facing a series of fiscal cliffs. Commodity jumpWest Texas Intermediate for September delivery traded above $42 a barrel this morning as hopes for a recovery in demand re-emerge in the wake of positive news on vaccine trials. The move higher may not be enough to save the shattered U.S. shale industry, with fracking in crisis from the prolonged slump in prices. Precious metals are also performing strongly this morning, with gold adding to gains and silver trading over $20 an ounce in the spot market. Copper held near $6,500 a ton after BHP Group warned of lower output from Chile, while other base metals also rose. Markets riseGlobal markets are building on yesterday's rally, with the EU deal, U.S. stimulus talks and progress on vaccines all adding to bullish sentiment. Overnight the MSCI Asia Pacific Index added 1.5% while Japan's Topix index closed 0.4% higher. In Europe the Stoxx 600 Index had gained 1.1% by 5:55 a.m. Eastern Time, with Germany's DAX Index set to erase all its losses for the year. S&P 500 futures pointed to a rise at the open and the 10-year Treasury yield was at 0.617%. Coming up...The Chicago Fed National Activity Index and Canadian retail sales for May are at 8:30 a.m. The Senate Banking Committee is expected to approve the nominations of Judy Shelton and Christopher Waller for the Federal Reserve's Board of Governors. Secretary of State Michael Pompeo is in the U.K. for talks. Trump's daily coronavirus briefings are expected to resume later. Snap Inc., The Coca-Cola Co., Lockheed Martin Corp. and TD Ameritrade Holding Corp. are among the many companies announcing results today. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThroughout the entire coronavirus crisis, the big question I keep going back to is whether 2020 ends up representing a major turning point in demand-side policy. The early 80s were known for supply-side reforms: Shrinking the welfare state, weakening labor bargaining power, weakening regulations, and generally establishing a reliance on central banks as the institutions responsible for macroeconomic stabilization. That's led to a multi-decade stretch of weak wage gains, a persistent decline in inflation, and a massive boom in asset prices.

Given the absolutely gigantic hit to economies around the world caused by Covid there's been a recognition that massive, immediate fiscal action was necessary. But so far it's been TBD whether fiscal action would become a more permanent feature of the economic landscape. The news out of Europe this morning suggests that it might be more permanent. Not only have leaders agreed on a massive fiscal stimulus deal, but also a mechanism for joint debt-pooling at the EU level. As Claus Vistesen of Pantheon Macroeconomics notes: "The key part of the deal is the commitment to allow the Commission to use its AAA credit rating to borrow €750B that will be channeled into member countries..." If this piece of economic infrastructure persists, it could represent a major upgrade in Europe's ability to use fiscal policy going forward to boost its economy.

It's all still early. But we have this now. And we've also seen a proof-of-concept in the U.S. of how fiscal support to lower-end workers and the unemployed can create a sharp rise in economic activity via the CARES Act. So there's reason to think that there's at least the potential for 2020 to mark a turning point for more robust role for state spending in order to bolster demand, and change the economic trajectory we've been on for the last 40 years.  Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment