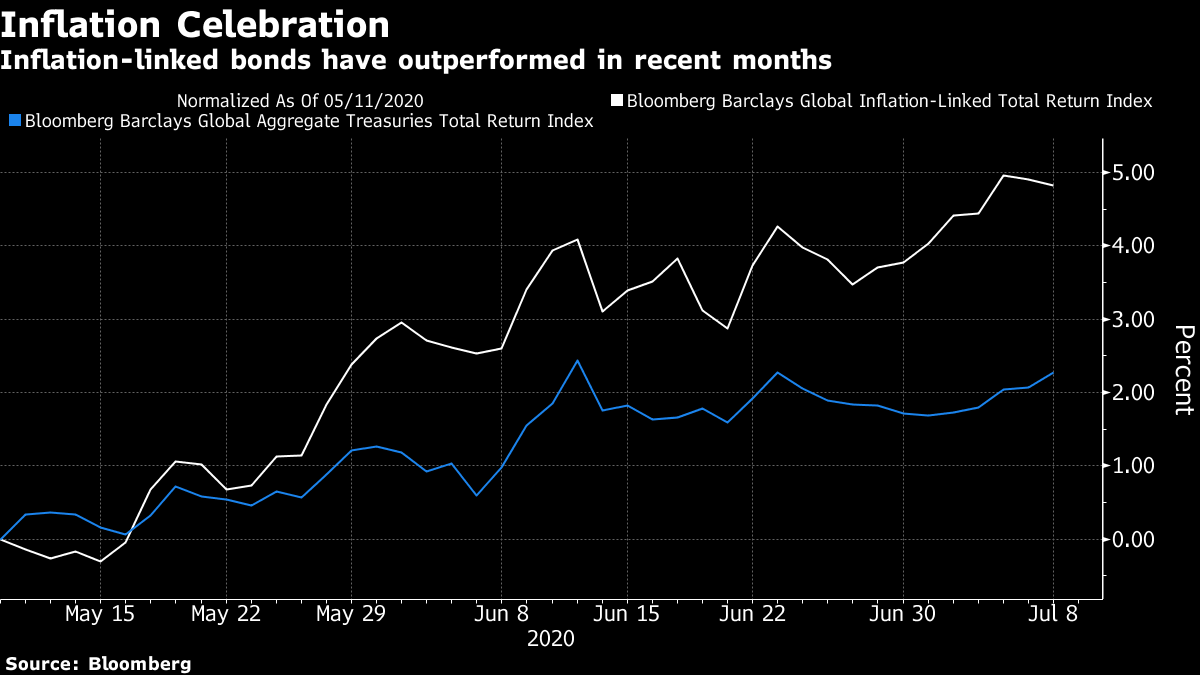

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The Eurogroup has a new leader, Wirecard's banking unit garners buyer interest, and the ECB is likely to step up emergency purchases. Here's what's moving markets. Spikes Record spikes of Covid-19 infections in Hong Kong and Tokyo fueled fears of a second wave hitting Asia and the numbers flowing out of the U.S. won't soothe concerns. Florida, Arizona, Texas and California are all seeing deaths hit record levels and the infection rate for the country as a whole topped the average. Add to this that Australia is putting curbs on the number of citizens able to return in order to take pressure off its quarantine system. The World Health Organization is also launching a review of its response to the pandemic following criticism about its approach from the U.S. Middle Man Ireland's Paschal Donohoe will lead the group of euro-area finance ministers called Eurogroup, taking over from Portugal's Mario Centeno on Monday. Germany, France, Italy and particularly Spain, all of whom had backed Spain's Nadia Calvino for the post, were angered by a loss that they failed to see coming. The centrist Irish politician has forged a reputation as a consensus builder at home, and will need to bridge the gap between Europe's so-called Frugal Four and virus-ravaged southern Europe as the bloc charts its course out of economic crisis. There's an EU summit on the budget and a region-wide coronavirus aid package scheduled to start a week from today. Mystery Man Wirecard received interest from 18 parties for its banking unit, two weeks after the greatest accounting scandal in modern German history pushed the payments group into insolvency. Its former COO, Jan Marsalek, who was fired days after the revelations, remains nowhere to be found. In a strange twist, the Financial Times reported Thursday that the 40-year old Austrian boasted of ties to the intelligence community during a 2018 meeting with traders in London, where he also showed off "highly protected" documents, including the formula for Russia's infamous novichok nerve agent. Not Done The ECB is likely to expand its pandemic purchase program of 1.35 trillion euros by December, according to a Bloomberg survey of economists, with most expecting an extension and a top-up of 500 billion euros. The euro zone's economy remains on course for the biggest contraction in its history. The central bank's Governing Council convenes Thursday. Coming Up… European stock-index futures are drifting lower and Asian shares pared their weekly advance amid concern that the spike in virus cases will derail the region's recovery. Oil is also headed for a weekly decline as the higher virus rates fuel worries about demand. It's a quiet day for European companies before earnings season gets started next week, with Switzerland's EMS-Chemie AG reporting a 28% slump in first-half profit. On the data front, we'll get industrial production numbers from France and Italy. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Though the impact of the pandemic on inflation is still a matter of much debate, there may be early signs in the bond market that at least some investors are preparing to bet on its return. A Bloomberg Barclays gauge of global inflation-linked bonds — which aim to protect holders from inflation — is up about 5% over the past two months, double the return of an index of regular government bonds. Meanwhile, France received record demand this week for its first syndicated sale of inflation-linked bonds in more than two years, with more than 16 billion euros in bids for the 3 billion euros of securities sold. The signs of interest in inflation protection come with expectations for consumer-price gains still at historically low levels. Five-year inflation swaps in both Europe and the U.S. — gauges of future inflation expectations — are below where they started the year, at just 1.1% and 1.8% respectively. And the continued slide in global value shares relative to their growth counterparts suggests equity investors don't yet have the same level of interest in betting on inflation's return. So the demand could just be a reflection of supply dynamics in the government bond market, rather than wagers that price rises are just around the corner. But its a trend worth keeping an eye on.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment