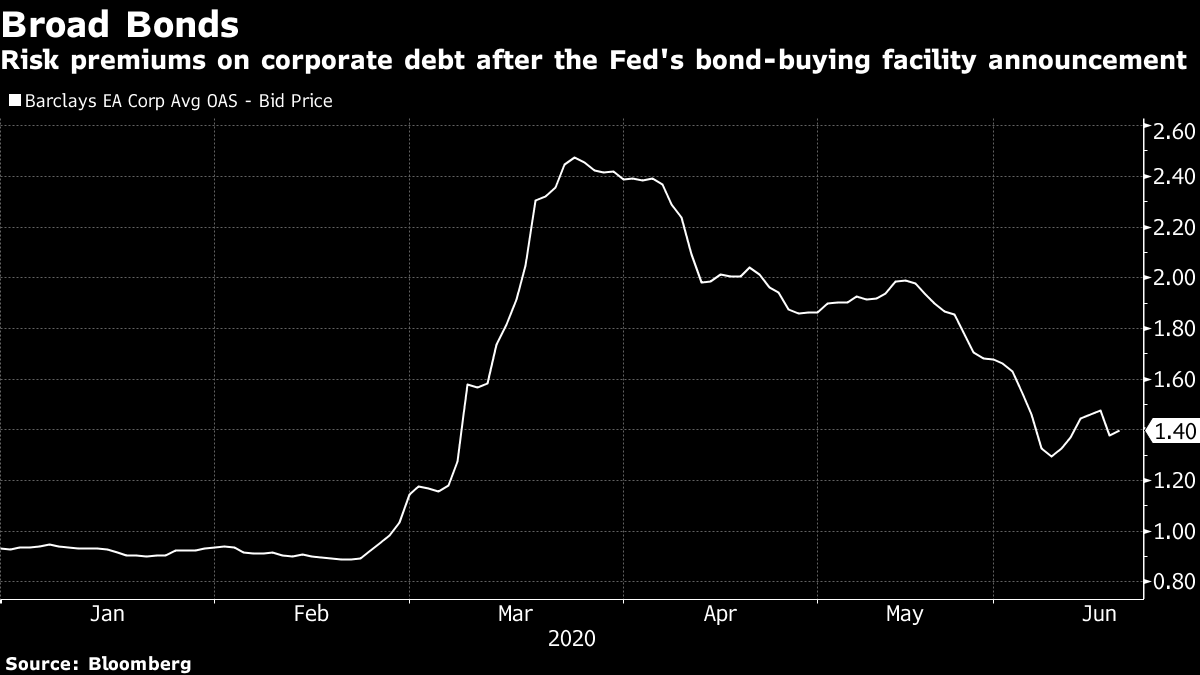

| John Bolton says Trump sought Xi's help with his re-election bid. The second outbreak in Beijing poses a serious threat to Xi Jinping's credibility. China's most volatile shares will soon be able to move 20% daily. Here are some of the things people in markets are talking about today. Bolton's Revelations Former U.S. National Security Advisor John Bolton writes in a new book that President Donald Trump asked Chinese leader Xi Jinping to help him win re-election by buying more U.S. farm products, according to an excerpt published by the Wall Street Journal. The disclosure is part of a devastating portrayal of Trump's conduct of foreign policy by Bolton, the most senior official in this White House so far to publish an account of his experience. The book — which describes a "confluence in Trump's mind of his own political interests and U.S. national interests" — is poised to further burden Trump's already struggling effort to secure a second term. A Trump campaign spokesman, Tim Murtaugh, said in an interview on Bloomberg Television that "John Bolton is just trying to sell books, that's all there is to it." But the White House is already struggling to consistently rebut Bolton's account. As Chinese officials in Wuhan struggled to contain a deadly coronavirus outbreak in January, it was Xi Jinping who stepped in and took control. Now, the president who declared himself personally responsible for every aspect of the China's response to the pandemic faces a rapidly growing outbreak in Beijing. The cluster of more than 130 cases in the city risks undermining the government's narrative it handled the epidemic better than many western nations. It could also upend its nascent economic recovery if it turns into a second wave. The stakes are even higher for Xi, who has staked his credibility on China's response and sought to frame himself as a global leader in the crisis. There are external challenges, too. He's navigating a U.S. president bidding for re-election who has taken to frequent outbursts against China, recently including punishing Chinese officials for imprisoning more than one million Muslims in the Uighur region. And now China is embroiled in a risky spat with neighboring India after an altercation in a remote, disputed border area of the Himalayas left 20 Indian soldiers and an unknown number of Chinese troops dead. Asian stocks were poised for a muted open after gains fizzled in U.S. equities and Treasuries and the dollar ended flat, with investors continuing to weigh an increase in coronavirus cases against optimism about stimulus measures. Futures in Japan were little changed, while contracts ticked lower in Hong Kong and Australia. The S&P 500 Index swung between gains and losses for most of Wednesday on light volume before turning red late, with the energy, real estate and financial sectors leading the declines, while Apple and Microsoft helped the Nasdaq Composite close positive. Elsewhere, crude fell and and gold remained steady. China's investors are bracing for a major shakeup in the nation's stock market: For the first time in decades, some shares listed in Shenzhen will be allowed to move as much as 20% either way in a single session. It's double the cap that's been in place since 1996, imposed to limit swings in the country's then-nascent stock exchanges. More than 3,000 shares across China fell by that limit on Feb. 3, when markets reopened after a holiday to an escalating coronavirus crisis. The new rules will apply to the technology-focused ChiNext board, a $1 trillion market where speculative trading is rampant. Many of its biggest stocks feature in well-followed benchmarks like the FTSE China A50 Index or the CSI 300 Index. While no date has been set for the changes, fund managers, brokerages and day traders are preparing for the potential increase in volatility. Big banks are finally hiring again, and coders are in demand. Lenders including DBS Group, OCBC and Citigroup are adding workers to their tech departments in the region despite the economic downturn. Financial institutions are especially hungry for mobile app designers and data scientists who can build systems to crunch figures and move business online, recruiters say. "Over the past few months, we have certainly seen the banking sector slow down its hiring due to Covid-19," said Bethan Howell, a Hong Kong-based consultant at financial recruiter Selby Jennings. "However, we are now seeing the hiring freezes thawing and with this, a large amount of roles" emerging in technology, Howell said. The recruitment plans are a promising sign for workers in an industry that remains under pressure to reduce headcount, and underscore how banks see tech investment as a priority even as the pandemic hammers economies. Asia has emerged faster from the months-long lockdown, giving room for lenders in the region to step up recruiting. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning So the Federal Reserve has gone into the indexing business. Having already begun buying corporate debt through exchange-traded funds, the central bank announced this week that it will carry through on its pledge to buy debt by pegging its purchases to a custom portfolio of bonds based on its own "broad market index." Because so much money is now riding on how the Fed defines that index, there's been a lot of attention paid to just how the thing might be composed. In that respect, it's a great reminder that index construction is a subjective exercise full of implicit values and assumptions rather than an absolute reflection of things as they are.  To wit, early estimates from analysts at CreditSights have the Fed's portfolio skewed towards lower-rated investment grade debt, such as triple B or below. Eligible bonds need to be issued by U.S.-based companies (or subsidiaries), which probably means a whole lot of debt sold by companies like AT&T, Comcast, Apple, Microsoft and Verizon. The whole point of tailoring a custom index is to allow the central bank extra flexibility to target credits in need of support that aren't necessarily included in the ETFs created by BlackRock and Vanguard. It's fascinating to watch just how the Fed differentiates its own benchmark from two heavyweights in the index business. There's now a Japanese edition of Five Things. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment