Whodunnit? Right, let's try to get our story straight. The stock market has just had its worst day since March, when it hit bottom and began a remarkable recovery. Every market movement requires a narrative. So whose fault was it? The candidates for fall guy include: - Jay Powell, the head of the Federal Reserve, who needs more "media training," according to the president's chief economic adviser, for being insufficiently bullish during his press conference Wednesday afternoon and scaring the markets;

- The coronavirus, the "invisible enemy" for sneaking back up on the country unawares and hitting the U.S. with a second wave in states from Florida through Texas and Arizona to California;

- Robin Hood, the name now given to the army of retail investors who can trade virtually for free on Robinhood.com, which started offering commission-free trading last year, and many imitators; markets always peak when retail enters, so they say, and in this case Robinhood turns out to be more like Dennis Moore (who stole from the poor and gave to the rich);

- The Fake News Media, who scared the markets by reporting lots of negative information and implanting fake story lines, particularly about the coronavirus — it almost always makes sense to try to shoot the messenger on these occasions;

- The Short-Sellers, always unpopular with the rest of the market — their capitulation helped the rally in its last few days, the story goes, and now they are reloading the gun by selling short again; and

- The Economy, Stupid. Someone noticed that Thursday's initial jobless claims showed there were still more than a million people signing on for the dole, almost three months after the lockdowns started, and a month after a number of states had reopened for business. This didn't sound good.

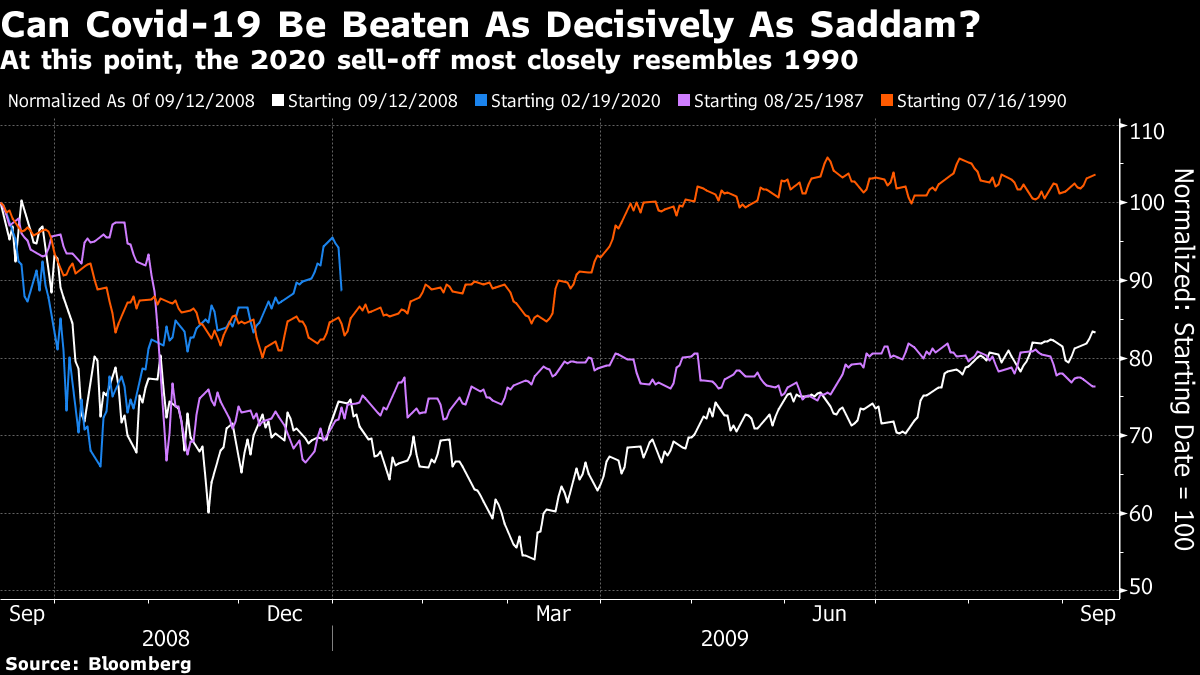

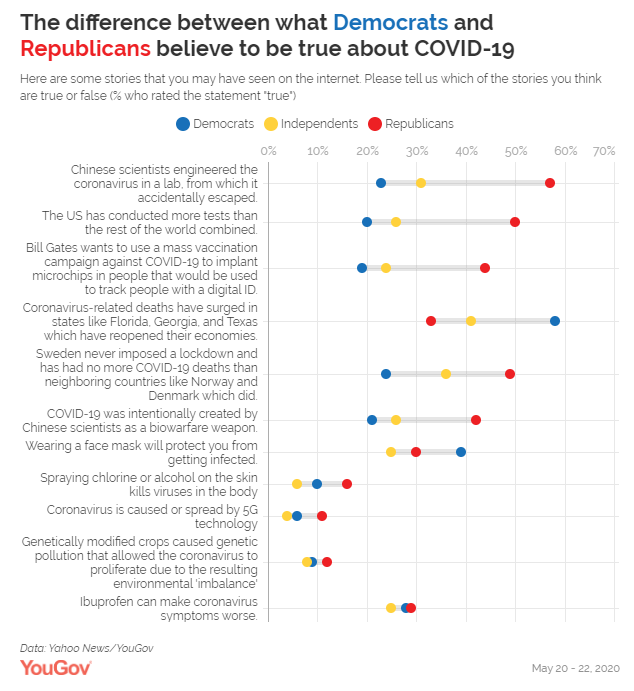

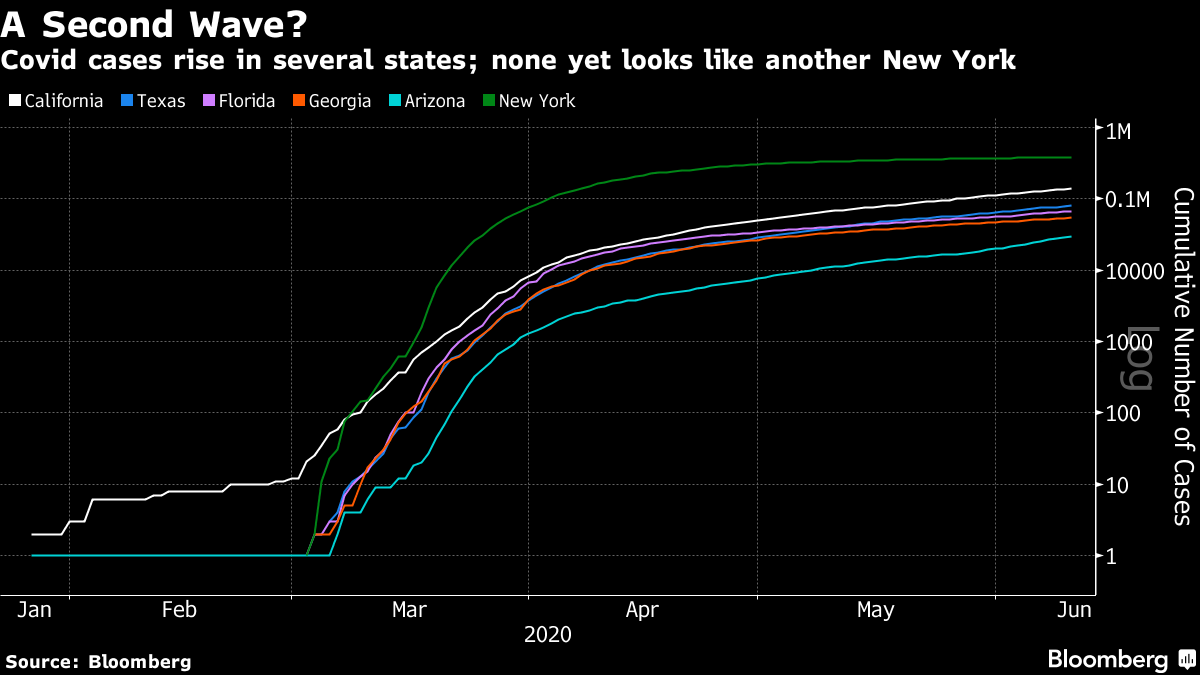

This, I think, is close to a complete list of the reasons that have been ascribed so far for the 6% fall in U.S. stocks Thursday, following declines that had been nearly as bad in Europe. Nobody has tried to blame George Floyd, or the seismic disturbances to the U.S. body politic over the country's inheritance of racial injustice, which is surprising given the way that the issue now completely dominates the agenda. And for some reason I haven't seen anyone attempt to blame China, which can generally be safely blamed for many things. It isn't long since China tried to clamp down on Hong Kong while warning in as many words of a "cold war" — but nobody is talking about that narrative. Meanwhile, I think the single greatest culprit has barely been mentioned. That would be one Donald J. Trump. Before explaining why the president has only himself to blame, let us look at the significance of what just happened. Following the slide of the last three days, the S&P 500 is back below its 200-day moving average, it is more than 11% below its peak, and it never managed to regain that high. It is just about possible that this remarkable run-up has been nothing more than a bear market rally.  It is common to see sustained rallies within long-term bear markets, but this one is very unusual. Comparing it to other big market shocks in recent history, it now looks very unlike the sell-offs associated with the 1987 Black Monday crash, or the 2008 Lehman Brothers bankruptcy. In both cases, the market still hadn't made up anything like as much ground as it has now, even a year later. But this does begin to resemble the slump that followed Iraq's invasion of Kuwait in the summer of 1990. That led to a decline of about 20%, and the market didn't get back to its previous peak until the Iraqi forces had been expelled from Kuwait. The problem with this analogy: Is there any way to achieve a comparably clear victory over the coronavirus?  When it comes to the virus, there is plainly some truth to the notion that markets are getting nervous about the prospects of a second wave in the U.S. — or perhaps more accurately, they are worried that the first wave has far further to go. The graph below shows progress in the states which are now the subject of most concern — California, plus Texas, Florida, Georgia and Arizona. The last four are all "red" states that chose to reopen relatively early, so discussion is clouded by politics. This chart from YouGov produced for Yahoo News gives an idea of how profoundly an American's politics will shape their views on the virus:  As always with the coronavirus, there is also the problem of long lags between infections, symptoms, tests and test results. The results may be colored by the fact that some states got off to a late start in testing. But if we look at cases on a log scale, it is clear that none of these states has yet been able to flatten the curve as much as New York. Texas and Arizona in particular are on a worrying trend. But there is nothing that could be called a "spike" or a "surge" in any of these states, and there was certainly nothing about the data Thursday morning that should have prompted traders to sell, if they hadn't already.  As for the luckless Jay Powell, the claim against him is that he sounded too bearish in his forecasts for the economy. This is a tad specious. As I detailed yesterday, he also promised zero interest rates for the foreseeable future, and gave his word not to do anything to burst any investment bubbles that appeared. That was what the market wanted to hear. Had he tried to sound more bullish on the economy, he would probably have been greeted with a spike in bond yields, which had been moving upward in response to improving data. Stocks would have hated that. When it comes to the others who have been blamed, there are more flaws. Retail investors generally wait too long and buy at the top. But there is no evidence that they suddenly sold Thursday morning. This isn't Robin Hood's fault. The news, fake or otherwise, had been full for days with stories of the remarkable rebound in the stock market. And while the claims data weren't good, they were no worse than plenty of other data in recent weeks. They may have provided an excuse to sell, but they certainly didn't provide a compelling reason to do so. Instead, a sell-off had become inevitable because the market had come so far and so fast, and because it involved pricing for perfection. A second wave of the virus in the U.S. would put all calculations out of whack, and the economy is in any case still in a parlous state. But why do I think Trump is the chief culprit for the market selling off Thursday, rather than any other day? There are months until the polls and things could easily still change, but the view is solidifying that Trump has mishandled the disturbances of the last few weeks, and that this has damaged the Republicans. As I detailed yesterday, research was proliferating from both sell-side and buy-side research outfits, detailing the damage that could be done to stocks by higher corporation tax under a Joe Biden presidency and a Democratic-controlled Senate. According to the Predictit market, the race has started to break dramatically in the Democrats' favor in the last few days:  Meanwhile, Trump finds himself in a difficult place. I was lucky enough to interview Robert Shiller of Yale University on Thursday, in a web conference for Natixis Investment Management, and I asked him why the Chinese narrative seemed suddenly to be having no impact on markets anymore. He replied that narratives need leaders, and that Trump has decided not to hype up his confrontation with China in recent days — probably because he is concerned that this would worry the stock market. This is a problem for Trump, as further saber-rattling would be good politics, whatever we might think about it as trade policy. Meanwhile, he responded to the falls early Thursday by attempting to attack Powell. He wants the stock market to be strong, and he needs it to be someone else's fault if it isn't. So he tweeted: "The Federal Reserve is wrong so often. I see the numbers also, and do MUCH better than they do. We will have a very good Third Quarter, a great Fourth Quarter, and one of our best ever years in 2021." In combination with comments by Larry Kudlow, chairman of the president's Council of Economic Advisors, that Powell needed media training to sound less negative, this sounded like a coordinated attempt to to blame the Fed chairman for the sell-off. It didn't ring true and helped add to a sense that the president is losing control. There are many competing narratives at work. If the second-wave story comes to fruition, it will be hard for stocks to make much progress. The "Fed will do everything it can" narrative will counterbalance that, but is already baked in to prices. There was no good simple neat reason why the stock market suddenly fell quite so much Thursday. It was overdue a fall. But the best single narrative, if we really need one, is that the growing political problems for the president, and the prospect of a Democratic majority with the ability to make market-unfriendly policy, finally reached a critical mass. Survival Tips The Covid lockdown has cruelly robbed a generation of youth. In the U.S., graduation ceremonies are a big deal. After finishing school or college, a walk down an aisle wearing a gown and mortarboard to receive a diploma is a cherished rite of passage. This year's graduates miss out. So it is heartening indeed that the principal ofFrank McCourt High School on the Upper West Side is spending the week traveling through Manhattan and the outer boroughs with a pile of mortarboards, gowns and diplomas, giving students their own personal graduation. There are masks, and there are no other pupils around, but the thought counts for a lot. Meanwhile, our local elementary and middle school, P.S. 187, has taken photos of each of its graduates wearing their robes, blown them up to more than life size, and hung them around the school fence. I am sure many other schools are going to similar lengths to give their graduates something to remember. Teachers haven't been welcomed with quite the wave of gratitude that has met health workers, which is understandable. But parents now understand that distance learning is a poor substitute for school. The office may not be as necessary as we thought it was; the same cannot be said for school. Where I'm going with this is that we should be thankful for teachers. And as this experience has been particularly tough on kids, we all need to look for ways to follow the example of great teachers and give them a sense of normality, as well as a sense that, despite everything, they are making progress. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment