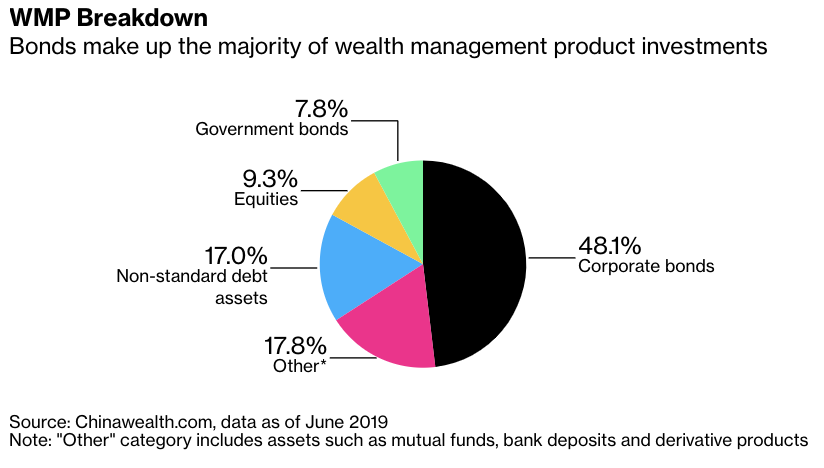

| Details on China's proposed national security law for Hong Kong are out, investors are keeping a close eye on the spike in U.S.coronavirus cases, and yield curve control looks like the next big thing in global monetary policy. Here are some of the things people in markets are talking about today. China confirmed that a proposed national security law would allow Beijing to override Hong Kong's independent legal system, shedding new light on a move that has stoked tensions with the U.S. and threatens the city's status as a top financial center. The proposal said the central government will have jurisdiction over an "extremely small" number of national security cases under "specific circumstances," according to draft language released on Saturday by the official Xinhua News Agency. It added that China will establish a new bureau in Hong Kong to analyze the security situation, collect intelligence and "lawfully handle national security cases." The draft bill also calls for Hong Kong to establish a new committee to protect national security, which will be supervised and accountable to Beijing. The chief executive will oversee the committee, as well as appoint judges to handle criminal cases brought under the law. Authorities in Beijing will have the final say on interpreting the law. As central banks pump trillions into the world economy, investors are setting their sights on what could be the next big thing in global monetary policy: yield curve control. The strategy, which involves using bond purchases to pin down yields on certain maturities to a specific target, was once deemed an extreme and unusual measure, only deployed by the Bank of Japan four years ago after it became clear that a two-decade deflationary spiral wasn't going away. No longer. This year, the Reserve Bank of Australia adopted its own version. And despite officials' attempts to cool it, speculation is rife that the U.S. Federal Reserve and Bank of England will follow later this year. Should yield curve control go global, it would cement markets' perception of central banks as the buyers of last resort, boosting risk appetite, lowering volatility and intensifying a broader hunt for yield. While money managers caution that such an environment could fuel reckless investment already stoked by a flood of fiscal and monetary stimulus, they nonetheless see benefits rippling across credit, equities, gold and emerging markets. The Australian and New Zealand dollars slipped as the trading week began, with investors monitoring more signs of coronavirus outbreaks in some large U.S. states.The yen ticked higher in early trading. U.S. equity futures declined in early Asia trading after the S&P 500 Index dipped at the end of last week. Asian stock futures retreated, signaling declines to begin the Monday session. Oil slipped. Markets remain vulnerable as governments gradually ease coronavirus lockdowns and travel restrictions to revive economic growth while attempting to control the spread of Covid-19. Global equities are about 37% higher than the March lows. China suspended poultry imports from a Tyson Foods plant where hundreds of employees tested positive for Covid-19, stoking concerns over the broader implications for U.S. and global meat exports. The suspension announced Sunday is an about-face from just a few days ago, when Chinese officials said food was unlikely to be responsible for a fresh virus outbreak in Beijing.The move is a potential new threat to meat plants across the world that have seen slaughter disruptions because of the virus. In the U.S., hundreds of workers have become ill, and dozens have died. There's also been a recent uptick in infections at facilities in Brazil and Germany. If China continues to suspend shipments based on coronavirus cases reported at processing plants, it could also threaten to undermine promised agricultural purchases as part of the Washington-Beijing trade deal. Meanwhile, California's new cases rose by a record and Florida infections jumped more than the weekly average; overall, U.S. infections rose 1.2%. Here is how Bloomberg is tracking the virus. Japanese companies have long been criticized for hoarding too much cash. Now the habit is being touted as a reason to buy Japan stocks, as the coronavirus pandemic dims the outlook for dividend returns elsewhere. Japan has "improving dividend appeal," with its companies less prone to payout cuts than those in other countries given their net cash positions and improving governance, Jefferies analysts wrote in a report. Lack of capital efficiency, leading to excess cash, has long been cited as a problem for Japanese firms and a reason to undervalue their stocks. Topix-listed firms held 493 trillion yen in cash as of their latest filings, a 75% jump from five years ago, according to data compiled by Bloomberg. Prime Minister Shinzo Abe has been pushing for better stewardship and governance practices since he took office in 2012. Now, the combination of improved dividend payouts and the strong cash balance is being seen as a possible tailwind. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Something big is happening in China's shadow banking system. Wealth management products (WMPs) sold by banks to retail investors are beginning to post losses for the first time ever. At first glance, the notion of an investment product dipping into the red doesn't seem like a big deal, but WMPs have long been marketed as similar to fixed-rate deposits, with an implicit guarantee that the bank would always make them whole. China's regulators, wary of burdening the financial system with trillions of dollars of additional liabilities, began encouraging banks to transition to net asset value-based models that would explicitly put retail investors on the hook for any losses. Fast forward to today and, as Bloomberg reports, about 3% of the outstanding WMP market has dipped below its net asset value and some investors are (unsurprisingly) outraged.  It's worth remembering the role played by WMPs: They're a key cog in China's shadow banking machine, helping to provide funding for the purchase of a whole host of other assets and lubricating prices in the process. Bank of America Merrill Lynch's David Cui once described them as "the biggest funding source for the shadow banking sector" and warned that a slowdown in WMP sales may have "important implications on asset prices across the board, especially bonds' and stocks', and possibly properties." There's now a Japanese edition of Five Things. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment