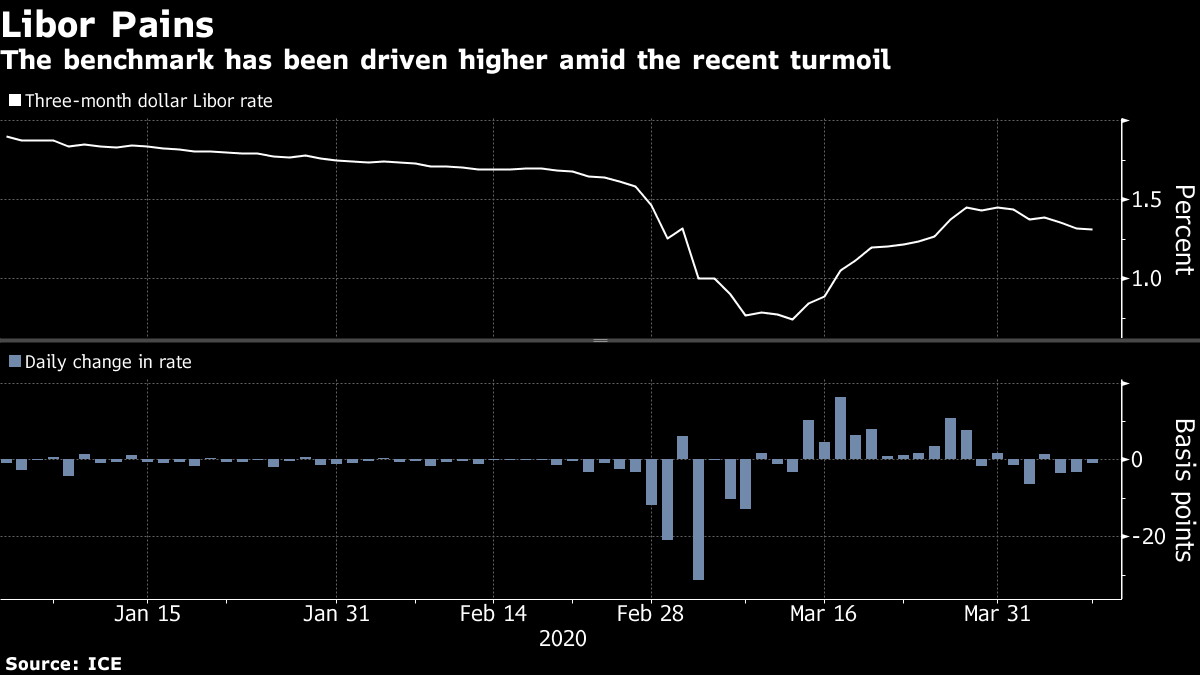

| The U.S. says there is no longer any basis to give Hong Kong special treatment. Protests across the U.S. could undermine the push to revive the economy. Asian markets are set for a mixed start to the week. Here are some of the things people in markets are talking about today. The United States now has no basis to treat Hong Kong more favorably than mainland China, U.S. Secretary of State Michael Pompeo said Sunday, after Beijing moved to pass a bill to curb the city's freedom. The comment highlighted the growing tension between the world's two largest economies amid the coronavirus pandemic and a new flare-up in Hong Kong's pro-democracy protests. Pompeo said that China's leadership has broken its promise of preserving Hong Kong's autonomy. Hong Kong's government said actions threatened by Donald Trump are "unjustified" and the People's Daily, the mouthpiece of China's Communist Party, wrote that the plans outlined by the U.S. president were "gross interference" in Beijing's affairs and were "doomed to fail." Meanwhile, Trump said he's planning an expanded a G-7 leaders' meeting in the autumn, potentially after the November election. Violence erupted in dozens of cities following the death of George Floyd, a black Minneapolis man who died after a white police officer pressed a knee into his neck for more than eight minutes. Some demonstrators broke off to rampage through shopping districts, including Rodeo Drive in Beverly Hills and State Street in Chicago, and set fire to police cars and municipal buildings. After the Covid-19 deaths of more than 104,000 Americans, unprecedented government intervention and massive disruptions to business and everyday life, the scenes of unrest across the country were a bleak contrast to the recent optimism of the markets. Stocks in Asia looked set for a mixed start as investors weighed the simmering U.S.-China tensions against violent protests in some American cities. The yen edged up. With Amazon scaling back deliveries and Apple closing some stores Sunday, investors are trying to estimate how the U.S. violence over the weekend will impact the economy's reopening. Currency markets showed an initially muted reaction, though focus will be on the opening of U.S. equity futures. Meantime, President Donald Trump's long-touted response to China's crackdown on Hong Kong included a barrage of criticism but stopped short of fully escalating tensions between the two nations. The S&P 500 ended higher on Friday, when futures in Japan and Hong Kong climbed. Global stocks rose for a second month in May. Australia's central bank will keep the stimulus flowing when it meets Tuesday, a day before data that will reveal whether a record recession-free run is drawing to a close. Reserve Bank of Australia Governor Philip Lowe is expected to keep both the cash rate and three-year bond yield target unchanged at 0.25%. The bank only bought government securities on two days in May as markets settled and borrowing costs fell. The question now is whether a recession will be avoided. Australia's economy is emerging from hibernation as governments begin relaxing lockdown restrictions. The RBA sees GDP shrinking 10% in the first half of this year, with most of that concentrated in the current quarter. As China was welcoming in the world's largest hedge funds four years ago, a Hangzhou-based quantitative fund was burning through motherboards and buying the wrong types of servers as it figured out machine learning. Those "silly mistakes" quickly made way for Zhejiang High-Flyer Asset Management's integration of machine learning into the strategies it uses to invest its 20 billion yuan ($2.8 billion) in assets, said Chief Executive Simon Lu. It now boasts its own super computer, a 60-strong team of engineers and data scientists and a confidence that belies its five years in the business. Ranked as 2019's No. 1 stock hedge fund by data provider Shanghai Suntime, High-Flyer drew more assets last year than the combined collections of the dozens of foreign funds jostling for a piece of the market. Meanwhile, second-ranked Shanghai Minghong has more than quadrupled the money it manages since 2018 to nearly 40 billion yuan, making it China's biggest quant hedge fund. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning It's easy to forget, given everything that's gone on this year, that we're actually in the midst of a massive retooling of the financial system. Libor— the interest rate to which trillions of dollars worth of assets are tied — is supposed to be phased out by the end of 2021. Key deadlines in the transition process are coming up this year, and there's a big question mark over whether they'll be met. There's an even bigger question mark over whether financial regulators should be attempting this kind of shift when markets are still relatively fragile after the sell-off that we saw in March. At the same time, that particular bout of volatility arguably drew attention to one reason why moving away from Libor might be a good thing. Even as the Federal Reserve unleashed its huge liquidity operations, the interbank borrowing rate (as measured by Libor) remained relatively elevated although secured lending rates (as measured by SOFR) started to come down relatively quickly.  Whatever you think of the Libor transition and its timing, it's clear this is a big deal for financial markets and something worth talking about. This week on the Odd Lots podcast we'll be publishing five special episodes on the topic. We talk to everyone from a former interest-rate trader who was one of the first to warn about potential Libor manipulation to the man in charge of overseeing the move to Libor's replacement. Subscribe to Odd Lots on Apple, Spotify or YouTube so you don't miss it. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia and beyond. Sign up here to get our weekly roundup in your inbox. |

Post a Comment