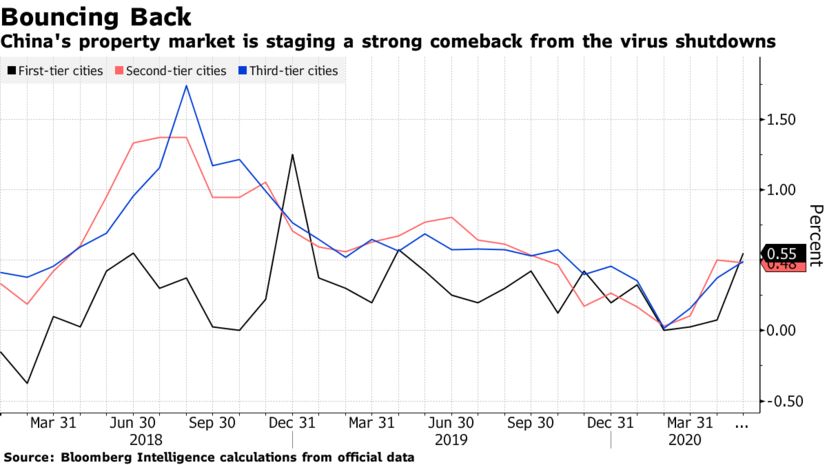

| Here's a sentence you don't read often: Beijing was surely relieved to see that tweet from President Donald Trump. Context of course is important. Peter Navarro, the White House trade adviser and noted China hawk, seemed to have told Fox News in an interview that the phase-one trade deal was off. Financial markets plunged in reaction. And although Navarro hastily issued a statement explaining that's not what he meant, nerves didn't totally calm until Trump's tweet. "The China Trade Deal is fully intact," the U.S. president said shortly after Navarro's clarification.  The phase-one trade deal is important to the Trump administration. That's what this unusual episode from the past week would seem to suggest. It's a view further backed up by what U.S. Secretary of State Michael Pompeo had to say about his secretive meeting in Hawaii with Yang Jiechi, China's top foreign policy official. Pompeo emerged from the rendezvous with nary a detail to share publicly except that Beijing had recommitted to the trade deal. But it's also easy to see why financial markets were so spooked by Navarro. Despite all the recent affirmative comments about the deal, a lot of suspicion remains about how long it will last. One of the biggest sowers of that doubt has been President Trump. Earlier in June, for example, Trump tweeted that he was keeping open the option of completely decoupling the U.S. from China. And in May, the American president wondered aloud during a Fox Business Network interview what would happen if the entire relationship with China ended. "You'd save $500 billion," he proffered at the time. If Trump is keen on keeping the trade deal alive, he's had an unusual way of expressing it. Security Bill Signs are growing that the official enactment of Hong Kong's national security law is near. In this past week, a group of 120 prominent Hong Kong business people, politicians and labor leaders expressed their support for the legislation after meeting with Chinese officials in the city. That followed similar expressions of support by Hong Kong luminaries such as Li Ka-shing and Michael Kadoorie, along with HSBC and Standard Chartered controversially throwing their backing behind the bill. It's also worth noting that the Standing Committee of the National People's Congress, the body empowered to pass the law, begins a new session that starts Sunday and ends Tuesday. That means the legislation could be enacted just ahead of the July 1 anniversary of Hong Kong's return to Chinese sovereignty. Property Rebound Home prices are a sensitive matter in China. There's a broad consensus among authorities that property bubbles are dangerous and unaffordability breeds resentment. It's why Beijing frowns on any overt policies that bolster the property market. But that's not to say there haven't been measures that have helped. One example is residency. Cities around the country have begun making it easier for transplants from other parts of China to gain that status. Residents face fewer limits on home purchases. A number of cities began lowering such thresholds last year. Hangzhou, home to e-commerce giant Alibaba, added more than half a million residents in 2019 for example. More cities have joined in this year. While the objective of these measures may be to attract skilled workers and improve social mobility, one consistent upshot has also been higher home prices.  China's Richest Video games are big business, a point that's been accentuated by the Covid-19 pandemic. With more people either choosing — or forced — to stay home, the industry has seen a surge in gaming activity and revenue. One of the biggest winners has been Tencent. When the company released its "Brawl Stars" title in early June, for example, its number of downloads in China saw a 2.5-times surge. The stock market has reacted accordingly, pushing Tencent's shares to a record high this week, which also resulted in it overtaking Alibaba to become Asia's most valuable company. Tencent Chairman Pony Ma similarly pushed past Alibaba's Jack Ma to become China's richest person. With the threat of resurgent infections still looming over many parts of the world, this trend seems like it has room yet to run.  Pony Ma Photographer: Justin Chin/Bloomberg What We're Reading And finally, a few other things that got our attention: |

Post a Comment