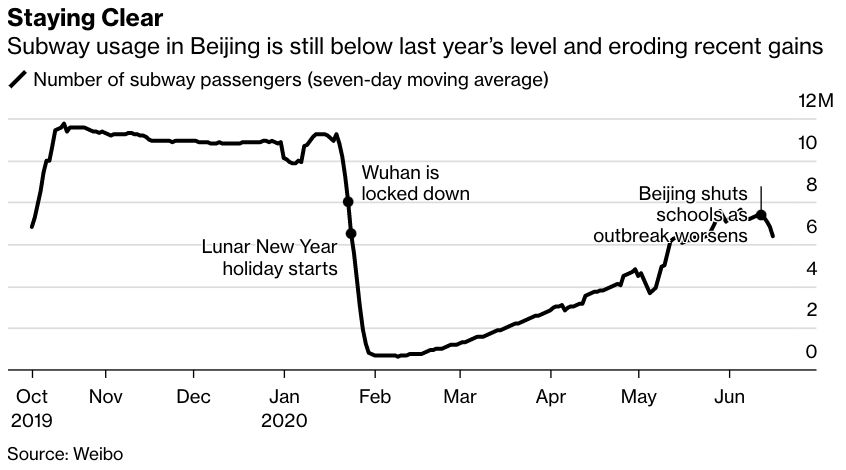

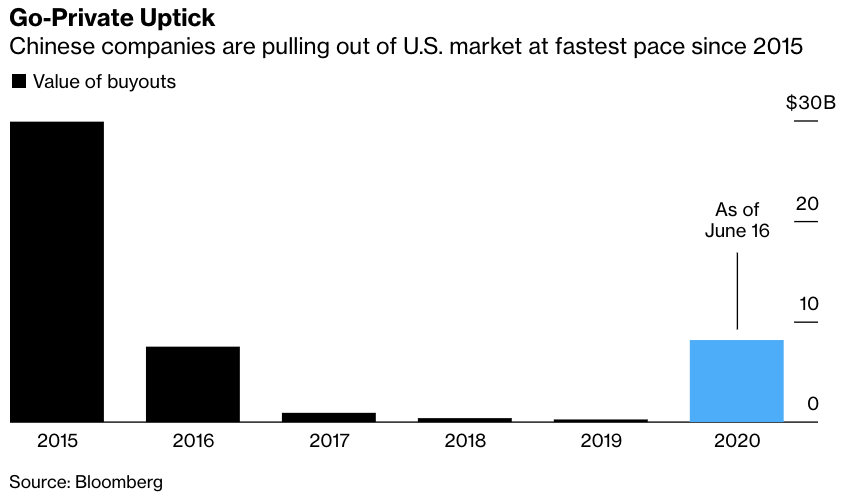

| Beijing's descent from conqueror of Covid-19 to exemplar of second-wave resurgence happened with astonishing speed. When the Chinese capital announced on June 13 that 45 people linked to the city's largest wholesale food market had tested positive, it was the first time in two months that a local infection had been identified. Beijing by then was feeling almost normal again. Restaurants were buzzing with diners, the streets were clogged at rush hour and people were starting to remove their masks. But things changed in a snap. Swaths of the city were quickly locked down, schools were shut soon after and the testing of tens of thousands commenced straight away. Data even showed fewer passengers riding the city's subway.  Making it all the more jarring was that this was happening in Beijing, the heart of Chinese power. The city is home to not just China's political and military leadership, but also the executives who keep its oil refineries, communications networks and banking system humming. It was supposed to be, as President Xi Jinping had previously described it, a fortress against the pandemic. Beijing is certainly China's best-resourced city for combatting Covid-19; it's too important not to be. That a flare up should occur there unavoidably begs the question of if any place is safe from a new wave of infections. Increasingly, the answers appears to be no. Border Brawl The details that have emerged of the clash between Indian and Chinese soldiers high up in the Himalayas where the countries share a contentious border have been harrowing. They fought in sub-zero temperatures wielding rocks, iron rods and bamboo poles wrapped in barbed wire. Twenty Indian soldiers are dead, with an unknown number of casualties on the Chinese side. Both countries have since sought to deescalate the situation. Military conflict is in neither's interests, especially with Covid-19 resurgent in Beijing and the daily increase in Indian cases hitting new highs. While the situation on the border appears to have stabilized, the relationship between the world's most populous countries looks more fraught than it has been in decades. As Bloomberg Opinion's David Fickling points out, that's the far more worrying development. Financial Decoupling The online classifieds firm 58.com became the fourth Chinese company this year to announce a deal to delist its shares from an American exchange. At a cumulative value of $8.1 billion, those deals are already the most since 2015, and there's half a year to go yet. The same is happening in IPOs, where global banks have been walking away from deals to list Chinese companies in the U.S. The latest was UBS dropping off the IPO of China's biggest LGBTQ dating app. Add to the calculation that Washington appears set to pass legislation that could force Chinese companies off American exchanges and these developments appear to point to an ever more pronounced threat of financial decoupling.  Security Bill Chinese lawmakers this week officially began the process of drafting Hong Kong's national security law. While much remains unknown about what the legislation will look like, including when the Standing Committee of the National People's Congress might pass it, some details have started to emerge. It will not be retrospective, for instance, according to the deputy head of China's top agency overseeing policy for Hong Kong. But Beijing will retain the power to directly enforce the law in Hong Kong in "rare circumstances." Hong Kong Justice Secretary Teresa Cheng added that when the city government is consulted on the bill, it will argue that it's important for cases be tried locally. Whatever the final law looks like, its passage does seem almost certain to spark more unrest. Kidnapping Being a billionaire certainly has its perks. But there's danger as well, as illustrated by the ordeal faced this past week by He Xiangjian, the founder of consumer-appliance maker Midea Group. It began Sunday when five men broke into He's home in the southern Chinese city of Foshan. Luckily, He's son was able to escape and alert local authorities, who secured the release of China's seventh-richest person by early Monday. While abductions are rare, they are not unprecedented. One of the more famous episodes was the kidnapping of Li Ka-shing's son Victor in 1996 by the organized crime figure "Big Spender" Cheung Tse-keung. The younger Li was released after a ransom of $129 million was paid.  He Xiangjian speaks in Foshan city, south China's Guangdong province in 2018. Photographer: Wei Hui/Imaginechina via AP Photo What We're Reading And finally, a few other things that caught our attention: |

Post a Comment