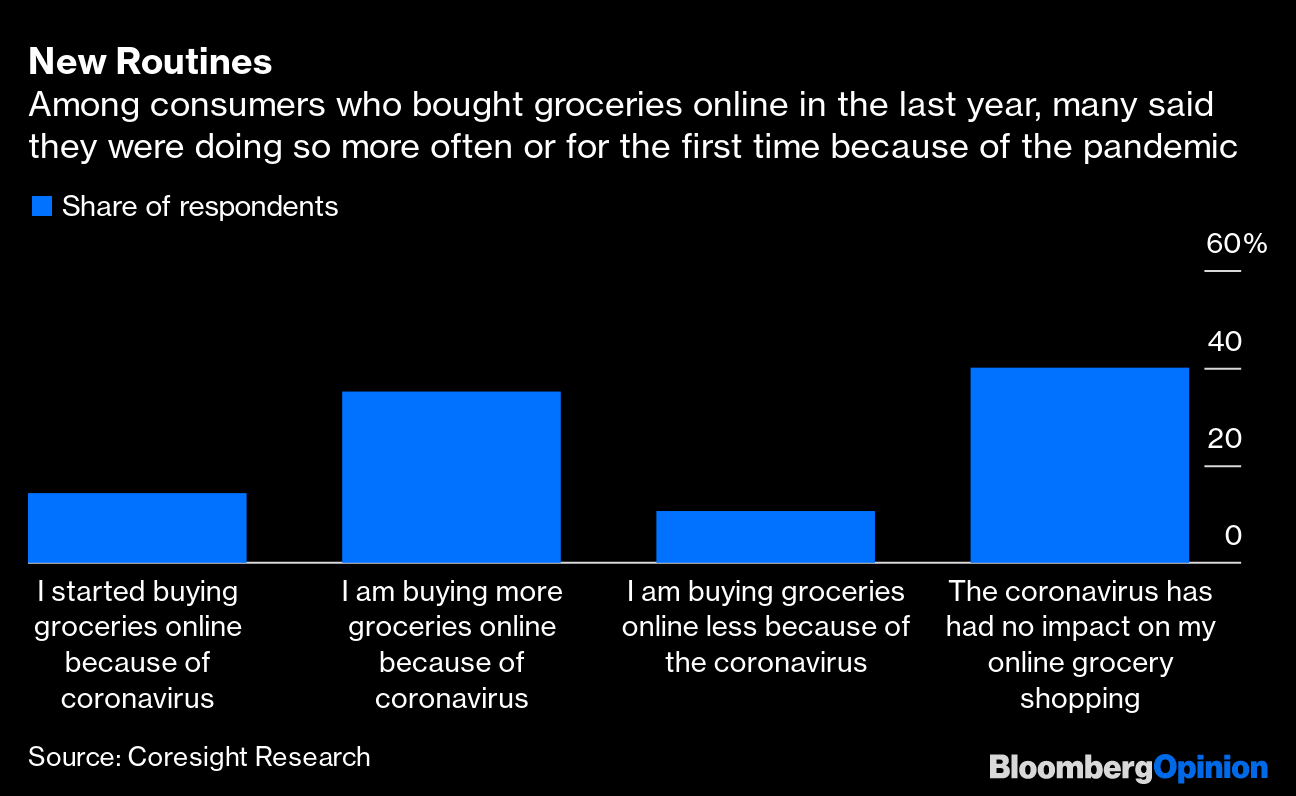

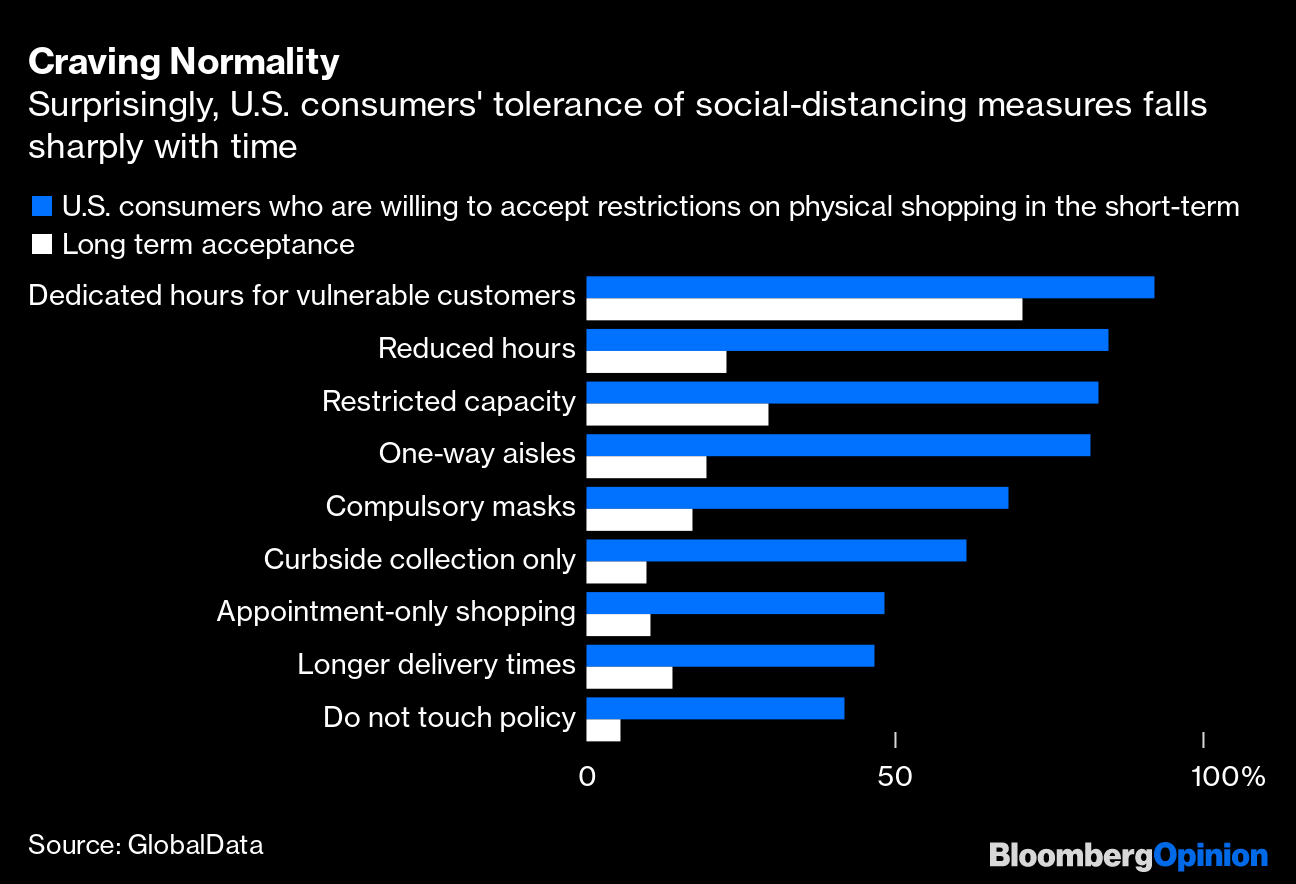

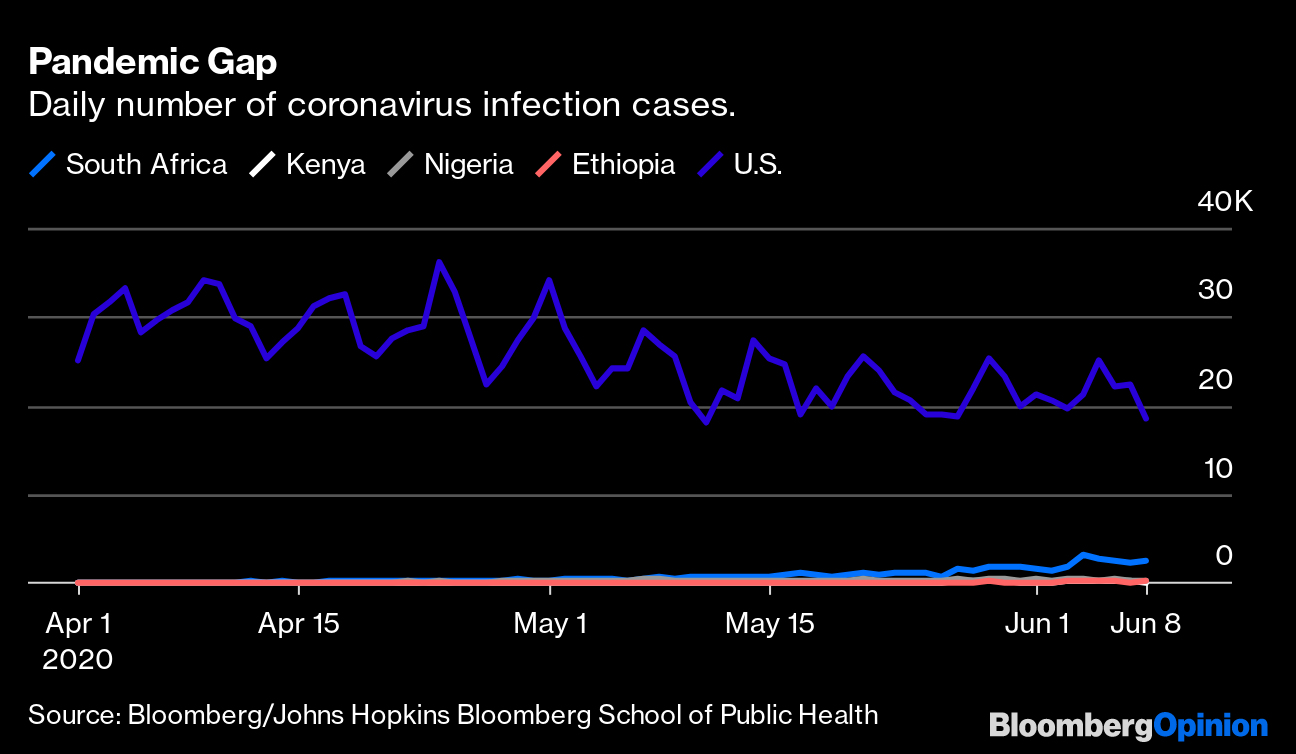

| This is Bloomberg Opinion Today, a bond-buying plan of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Looming large in the markets. Photographer: Chip Somodevilla/Getty Images North America The Powell Put In times of crisis, you often hear warnings not to eat your seed corn to stay fed, or burn your furniture to stay warm, or some such. But what if you have an infinite supply of seed corn and/or furniture to spare? The Federal Reserve is testing these limits lately, throwing everything into the market's maw to keep it satisfied. Yesterday it broke out a new corporate-bond-buying plan that seemed entirely unnecessary, as Brian Chappatta wrote. The bond market has been doing just fine, thanks to the Fed's earlier strenuous interventions. But the stock market has been less than fully exuberant this week, as coronavirus cases flare anew in the U.S., China and elsewhere. This may or may not have inspired the Fed's intervention, but it sure feels as if Fed Chairman Jerome Powell just cut the ribbon on a shiny new market put, writes John Authers. Intentional or not, this may just make traders expect more rescuing the next time they get slightly out of sorts. Across the Pond, European policy makers have also heroically saved markets from meltdown. But they may be setting the conditions for a future crisis too, by flooding banks with cash while also relaxing capital requirements on owning European sovereign debt. As Marcus Ashworth and Elisa Martinuzzi note, this will boost banks' profits now but also leave them even more exposed to the credit risks of borrowers with recent histories of hard times. But when you're cold and hungry, it's easier to accept the burning furniture and seed corn. Nobody right now is eager for the Fed to emulate the People's Bank of China, which has lately been making market volatility worse, writes Shuli Ren. Meanwhile, Americans with retirement plans full of stocks and bonds have barely had to suffer during this crisis — that is, assuming we did the smart thing and left our portfolios alone. As Nir Kaissar writes, such discipline isn't always easy when everything's going bonkers. Even market legends lose their nerve. Generous central banks make it much easier for us to stay calm — for now, anyway. Further Markets Reading: Don't worry: CLOs won't wreck the financial system. — Brian Chappatta We'll Still Need That Stimulus The whole seed-corn argument gets applied to fiscal policy too. But the U.S. government has a rare opportunity to borrow at historically low rates and to spend it in ways that foster healthy growth. This isn't the time to sweat deficits. One positive is that the typically feckless U.S. Congress has been surprisingly aggressive in this crisis, notes Bloomberg's editorial board. But it still needs to do more; the economy faces a slow reopening and long-term damage. For example, the Paycheck Protection Program has so far lent small businesses more than $511 billion, keeping many of them afloat through the lockdowns, writes Michael R. Strain. But now they'll need more to survive the months to come. There's a strong possibility this could all be Joe Biden's mess to inherit in January 2021. If so, then he can't make the same mistakes President Barack Obama made after the financial crisis, writes Karl Smith. Bending to pressure from the right and the left, Obama paid too little attention to the strength of the recovery. Let's hope his former underling took notes. No, Coronavirus Isn't Cured Yet We're all impatient for this pandemic nightmare to end. So we naturally latch onto any bit of hopeful news and blow it out of proportion. Today, for example, Oxford researchers said the anti-inflammation drug dexamethasone saved lives among the most severely ill Covid-19 patients in a substantial trial. This is a positive development, writes Max Nisen, and suggests similar drugs could have similar effects. But its benefits are still too limited to justify, say buying up American Airlines stock, as many did. The Big Continue to Get Bigger, Grocery Edition If you're anything like certain newsletter writers holed up in New Jersey, then this pandemic has introduced you to the joys of online grocery shopping. There are also sorrows, of course: weird substitutions for sold-out items, bruised fruit, a maddening inability to procure large tortillas. But these are minor. It's easy to imagine just getting Cheerios and ramen noodles and the like shipped in bulk forever, a permanent part of a new way of life. The trouble is, this mainly benefits massive retailers that can afford to build robust online and delivery operations, notes Sarah Halzack: Amazon.com Inc., Target Corp. and Walmart Inc., to name a few. Regional and smaller grocers may have a tougher time surviving than ever.  Telltale Charts Retailers may be opening up, but with restrictions that make shopping much less fun, writes Andrea Felsted.  Africa has had fewer coronavirus cases and less economic disruption than much of the rest of the world, writes Matthew Winkler.  Further Reading The WTO's negotiating and dispute functions need reform or it will become useless for free trade. — Chuck Grassley Supreme Court conservatives must doubt Chief Justice John Roberts will join them in expanding gun rights. — Francis Wilkinson EU regulators are targeting Apple's App Store dominance, and it's a good thing; it disadvantages smaller app makers. — Tae Kim Germany's coronavirus tracing app won't work because it's not coercive enough. — Andreas Kluth Duterte's crackdown on media in the Philippines could be bad news for investors. — Clara Ferreira Marques Trump shouldn't bother trying to save the baseball season. — Jonathan Bernstein ICYMI North Korea apparently blew up a new liaison office to own South Korea. Indian soldiers reportedly died in a clash with Chinese troops. The U.S. tumbled to 10th place in global competitiveness rankings. Kickers The FDA approved a video game as a prescription treatment for ADHD. (h/t Scott Kominers) The 100-year-old stud tortoise that saved his species by mating a bunch finally retired. (h/t Mike Smedley) Why gravity isn't like other forces. Here's the real reason we procrastinate. Note: Please send prescription video games and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment