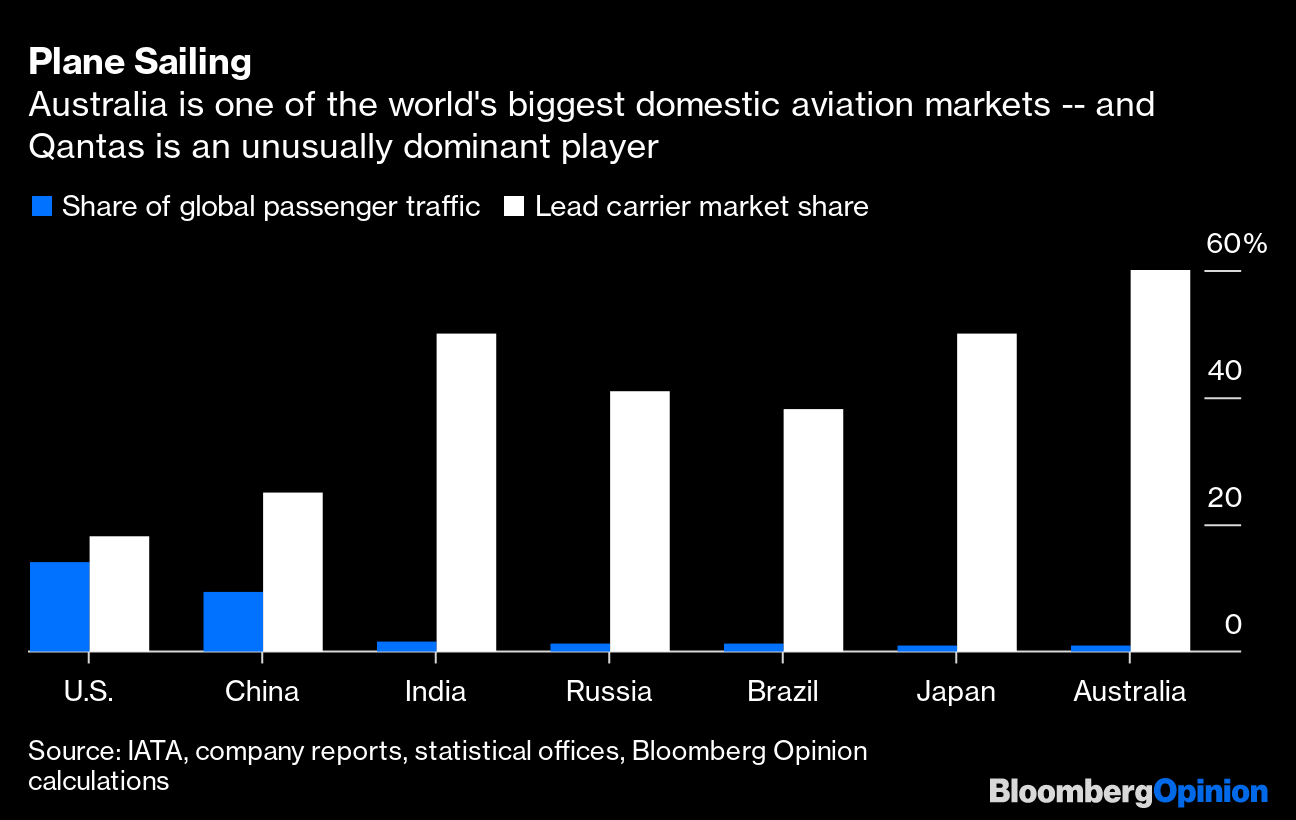

| This is Bloomberg Opinion Today, a 60/40 portfolio of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  The best approach to managing your portfolio. Photographer: Bloomberg/Bloomberg Investing Is Easy We get it: You're still bored. You're still trapped at home. There's still barely any sports. Maybe you always wanted to live a life of danger, but couldn't have imagined that would involve not being careful enough on a trip to Home Depot. One way to get the old pulse pounding, to really feel alive and in-control again, is to gamble on the stock market. Another is to work yourself into a paper-bag-huffing lather about inflation, which can lead you to such exotic fare as gold and Bitcoin. Bloomberg Opinion is not here to tell you how to live your life, but … maybe find some different hobbies? Like, you can kill two months just building a crazy Rube Goldberg device. That seems fun! Because the day-trading thing probably won't work out for you, as Noah Smith wrote this week. As for inflation, you don't need to stock up on barbarous metals or shady cryptocurrencies. An extremely simple, if crushingly dull, inflation hedge is the good old 60/40 portfolio of stocks and bonds, writes Nir Kaissar. Honestly, you really should worry far less about inflation than deflation these days. But even in the 1970s stagflation era some people fear is returning, the 60/40 portfolio kept up with inflation. Yes, U.S. stocks are expensive and probably won't return a mint over the next decade, writes John Authers. But you could diversify into some cheaper stock markets. There are plenty of those, in countries that aren't just letting coronavirus run wild. Because the truly challenging investment ideas are often not worth the pain. For example, Chris Bryant lights a candle for all the short-selling hedge funds who warned us for years that German fintech Wirecard AG was up to no good. It turns out they were right, but they suffered years of losses and abuse for their troubles. For a hot second, it seemed this crisis would at least be a time for "vulture" investors to shine. But the Fed quickly ruined that party by buying basically ALL OF THE BONDS, making bargains scarce, Brian Chappatta notes — although commercial real estate seems to still offer some decent opportunities. Time to lever up and dive in! (This is "humor." Don't do this.) Giving Stimulus Should Be Easy Of course, day-trading has been more tempting lately because stocks never fall, despite dismal coronavirus developments and economic data. It's clear economies around the world need more stimulus. Unfortunately, many policy makers are already going wobbly, just as they did after the financial crisis, warns Dan Moss. And what's happening now makes that crisis look like a toddler birthday party in comparison. Here at home, the Fed seems to think it's done all it needs to do for the moment, in another echo of the previous crisis, writes Ramesh Ponnuru. He argues its policy is obviously still too tight, even though it admits it still has buttons to push. The Fed probably wants an assist from fiscal policy makers, who are still rousting themselves to consider more stimulus. At least they're talking about infrastructure spending, which Karl Smith writes is a good thing. In fact, we need to spend on both public and private projects, to ensure a mix of shovel-ready and long-term projects. Digging a new Hudson River tunnel will take time, for example, but properly air-conditioning an office building to curb coronavirus spread can be start immediately. Fighting Coronavirus Should Be Easier After nearly four months of sacrificing our livelihoods, freedom and decent haircuts to fight Covid-19, Americans are watching hard-fought gains evaporate as the disease surges in states that either opened too quickly or never really shut down at all. One key hot spot is Texas, where Governor Greg Abbott ignored the warnings of experts in his rush to end relatively mild restrictions, writes Tim O'Brien. Now it's coming back to haunt him and everyone in his state, as cases soar and Houston's hospital capacity tops out. So far, Texas has merely paused its reopening. But it's easy to imagine it going back to sheltering in place. In other places with better grips on their outbreaks, it may be possible to use targeted lockdowns to control future flare-ups. This has worked well in parts of Europe, notes Ferdinando Giugliano. Once the virus is out of control again, it's not so effective. Further Coronavirus Reading: Systemic racism makes the pandemic much harder on Black communities. They need immediate relief and long-term solutions. — Mark Whitehouse Welcoming Immigrants Is Easy President Donald Trump may have been angry with the U.S. Supreme Court last week, but today it delivered him a win. Unfortunately a win for Trump in this case was a loss for all immigrants, Noah Feldman writes. The high court ruled asylum-seekers rejected by immigration officials lack the right to argue their case in court. This is based on a misguided reading of an old English anti-slavery ruling and makes it easier for Trump to deprive immigrants generally of due process, Noah writes. This comes on the heels of Trump freezing skilled immigration for the rest of the year. This was ostensibly designed to help American workers, but Bloomberg's editorial board writes it will hurt the economy and slow the recovery, destroying more jobs than it supposedly saves. Telltale Charts Unlike many airlines, Qantas has natural advantages that will help it thrive in this pandemic, writes David Fickling.  Further Reading St. Paul, Minnesota, seems to have figured out this police-reform thing. — Adam Minter Trump's election-year promises ring hollow, given how little anyone believes him. — Jonathan Bernstein While Trump mostly retreats from Latin America, China is filling the void with pandemic relief. — Mac Margolis Here's why you still can't find all the groceries and supplies you want. — Sarah Halzack ICYMI LeBron James got $100 million to build a media empire. Warren Buffett missed out on the crisis. Jack Abramoff got in trouble again. Kickers So it begins: Macaques capture a Thai city, turning a movie theater into a cemetery. (h/t Scott Kominers) Archaeologists find a ring of pits around Stonehenge that may mark an ancient structure. A Renaissance painting reveals how much breeding has changed watermelons. Perceptions of musical octaves are learned, not hard-wired. Note: Please send octaves and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment