| |

| |  Image Credits: Daniel Boczarski / Getty Images | | When Quibi launched a few months ago, many assumed the mobile-native entertainment platform was a slam dunk: consumers were sheltering in place, and the venture was led by Meg Whitman and Jeffrey Katzenberg, both heavyweights with successful track records. The Wall Street Journal estimates that the service will have just 2 million subscribers at the end of 2021, a stark difference from the 7.2 million initially predicted. Add in the fact that many current subscribers have free trials, and it’s clear that the short-form TV app is not meeting expectations. “Quibi set out with a compelling thesis, but it repeatedly failed to act with conviction,” writes media columnist Eric Peckham, who identified four strategic errors: - Miscalculating the risk of launching during the COVID-19 lockdown;

- Failing to see the central role of interactivity in mobile-native entertainment;

- Creating misaligned financial incentives with the wrong content partners;

- Launching Quibi like a movie instead of like a startup.

To fulfill its promise, Eric recommends that Quibi partner with more innovative partners and experiment further “with all types of interactive stories.” Read the full post-mortem and share your comments here. Thanks for reading, and have a wonderful weekend — let those emails go until Monday morning. Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist Read more | | | |

| |  Image Credits: Buena Vista Images / Getty Images | | Over the last five years, adtech revenue has declined at a nearly 10% compounded annual growth rate. In our last investor survey for this sector — conducted in January before the pandemic — there was widespread evidence of a rapid decline. We reached out to five VCs active in the space to gather their latest thinking. - Eric Franchi, operating partner, MathCapital

- Christine Tsai, CEO and founding partner, 500 Startups

- John Elton, partner, Greycroft

- Pär-Jörgen (PJ) Pärson, general partner, Northzone

- Michael Brown, founder and managing partner, Bowery Capital

Although our respondents acknowledged industry-wide difficulties, “we are still seeing great opportunities,” said MathCapital’s Eric Franchi. Read more | | | |

| |

| |  Image Credits: Peter Dazeley / Getty Images (Image has been modified) | | By comparison, the federal government gave out around $529 billion in loans to businesses as part of the COVID-19 bailout program. Apple takes a 30% cut of subscriptions purchased via the App Store, but after the developers of email app Hey raised a fuss, Cupertino’s platform fee is getting new attention. Will Apple cut its fees to strengthen the developer community and avoid potential legislation? We asked four TechCrunch staffers to weigh in: - Devin Coldewey: The App Store fee structure "seems positively extortionate"

- Lucas Matney: "Apple is teetering on the edge of a PR disaster"

- Sarah Perez: "Most developers today would agree that the App Store is both a blessing and a curse"

- Darrell Etherington: A walled garden helps "maintain a high level of quality and protection for consumers"

Read more | | | |

| |  Image Credits: Bloomberg / Getty Images | | After President Trump released an executive order on Tuesday extending a ban on new work visas, I interviewed Sophie Alcorn, a Silicon Valley-based immigration lawyer (and TechCrunch contributor) to get her take on how it will impact the tech community. “This would be a blow to very early-stage tech companies trying to get off the ground,” she said. “If they have only raised a couple hundred thousand dollars, it may be very difficult to sponsor a founder as an employee for an H-1B transfer.” Read more | | | |

| |  | | “What are the unicorns waiting for?” Alex Wilhelm asks in this morning’s edition of The Exchange. API-powered company Agora priced its IPO at $20 per share, well ahead of the expected $16-18 range. We’ll see what happens after its debut today, but the IPO price values the company at about $2 billion. Read more | | | |

| |  Image Credits: Sunti Phuangphila/EyeEm / Getty Images | | Before you spend thousands on a video ad campaign, this post will give you a better sense of how to use retargeting and segmentation to create custom audiences. A basic principle: familiarity is a marketer’s best friend. Although roadside billboards are poorly targeted, “that doesn't mean brands should be ignoring the principles that made billboards work in the first place.” Read more | | | |

| |  Image Credits: Aaron P/Bauer-Griffin / Getty Images | | If current trends hold, consumer foot traffic in the Golden State will return to “normal” levels on September 19, 2020, according to John Kelly, CEO of Zenreach. Using data sourced from WiFi and digital marketing, he determined that retail walk-in traffic nationwide was declining before most shelter-in-place orders were issued, but “the rate of the rebound… varies widely by state and locality.” Read more | | | |

| |  Image Credits: Koala | | Timeshares are an afterthought for most travelers: to browse, book and pay for a visit, customers must use proprietary exchanges that offer a subpar UX, especially when compared to platforms like Airbnb. Connie Loizos interviewed Mike Kennedy, co-founder and CEO of Koala, to learn more about how he’s addressing the pain points in a $10.2 billion (and growing) industry. In March, Koala closed a $3.4 million seed round. “Now, to see if it sinks or swims.” Read more | | | |

| |  Image Credits: Nanxi wei / Unsplash (Image has been modified) | | Insurtech unicorn Lemonade’s S-1/A indicates that the company expects to price its IPO at $23 – $26 per share, a move that would value the company between $1.3 and $1.47 billion, writes Alex Wilhelm. “Is that expected valuation interval strong, and, if not, what might it portend for other insurtech startups?” he asks. Read more | | | |

| |  Image Credits: Bloomberg / Getty Images | | Plaid co-founder Zach Perret appeared on Extra Crunch Live last week to discuss his company’s $5.3 billion purchase by Visa, so we weren’t shocked when he suggested that “every financial services company should be a fintech company.” Given the number of underbanked consumers in the U.S. and around the world and widespread new interest in investing and saving, fintech’s TAM is massive and largely untapped. Listen/watch the entire chat via YouTube, or click through to read the highlights (and see Zach’s reading list compiled from the bookcase in the background of his Zoom call). Read more | | | |

| |  Image Credits: krisanapong detraphiphat / Getty Images | | Although many investors say COVID-19 hasn’t broken their stride, Natasha Mascarenhas found that some less-experienced VCs “are looking for unique ways to de-risk themselves.” She reached out to a few partners to find out how they’re adapting to the current environment and found that some are experimenting with liquidity strategies, while others are benefiting from a renewed interest in diversity and inclusion. Read more | | | |

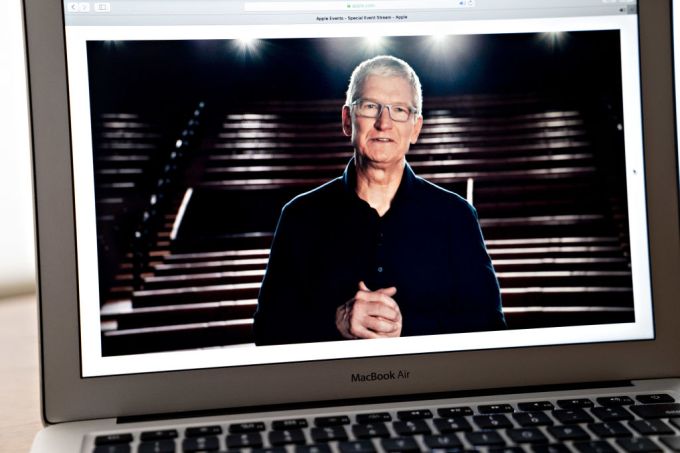

| |  Image Credits: Bloomberg / Getty Images | | “The show must go on” is an entertainment industry cliché, but when it comes to Apple’s WWDC keynote, it’s almost a law of nature. Instead of awkwardly staging a virtual event, Apple “artfully embraced the uncanny experience” it staged for a global audience, writes Brian Heater. Although “there were still some first-time issues,” it “turns out there are some fringe benefits to being one of the three most valuable companies in the world.” Read more | | | |

| |  Image Credits: Hoxton Ventures | | London-based VC firm Hoxton Ventures recently announced its second round at $100 million, a substantial hike from its 2013 $40 million debut fund. Even through the first fund fostered three unicorns (Babylon Health, Darktrace and Deliveroo), it took the team years to get its second over the line. “Fundraising is our Achilles' heel,” acknowledged founding partner Hussein Kanji. “We're quirky, but we're good at what we do. But that doesn't mean it's always an easy sell.” Read more | | | |

| |

| |

| |

| |

Post a Comment