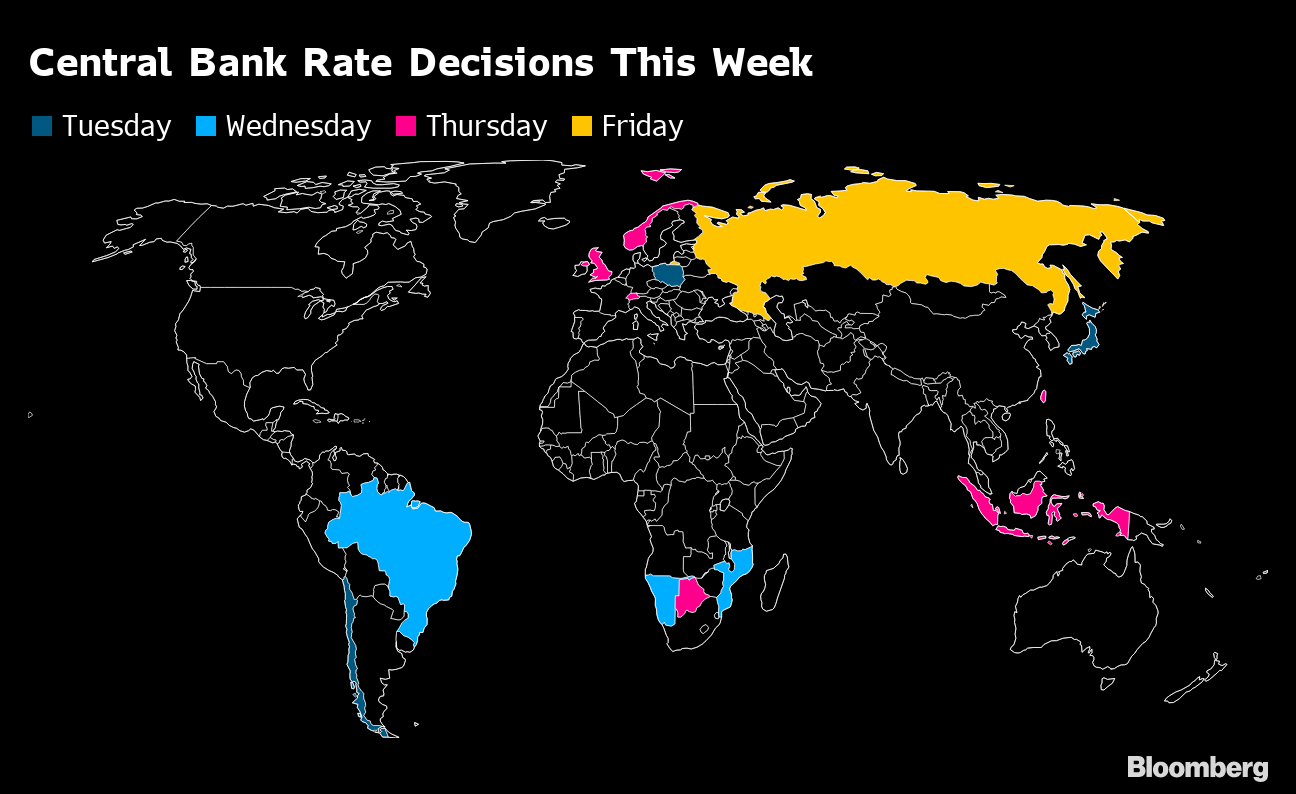

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The first (virtual) meeting since January between British Prime Minister Boris Johnson and the presidents of the European Commission, Council and Parliament on Brexit is supposed to give fresh impetus to months of gnarly negotiations. Last week's publication of a detailed schedule of talks over the summer made clear that some progress has been made, despite the tough rhetoric from both sides. While the political intervention puts Brexit back in the spotlight, the meeting was always a requirement of the U.K.'s withdrawal deal: it won't be a place for negotiation. Don't ignore the symbolism, but don't expect today to make or break anything. — Ian Wishart and Viktoria Dendrinou What's Happening Pompeo Calling | EU foreign ministers will hold a video conference today with U.S. Secretary of State Mike Pompeo in a bid to foster transatlantic cooperation on geopolitical issues. The two sides have been at odds on topics ranging from China's tighter noose on Hong Kong to Israel's planned West Bank annexation and Turkey's encroachment in Syria. Braving the Beaches | As Germany and a raft of other European countries ease travel restrictions from today, some tourists are making plans in earnest. The question is whether there will be enough of them to save the summer for the southern economies. Hellenic Hospitality | At least one country in southern Europe is opening to foreign visitors, seeking to monetize a successful handling of the pandemic. Greece is taking a gamble on tourism, the lifeblood of the economy, which only recently recovered from a decade-long crisis. Green Talks | The world's greenest recovery package is set to get a thumbs up from EU energy ministers when they hold talks today. They'll emphasize the sector's role in the economic rebound, pointing at the huge investment needed to boost energy savings, spur renewables and develop storage. Spanish Stimulus | The Spanish government will today present a 3.75 billion-euro stimulus program for the auto industry, and is planning to put forward a plan for tourism later this week. Supporting the two sectors that, combined, account for about 22% of output, will be key to the recovery. In Case You Missed It Virus Update | The WHO reported a record 4.5% increase in virus cases Saturday, and infections jumped in Beijing and Tokyo, sparking concern about a resurgence. China is locking down part of its capital due to an outbreak it said came from Europe. Here's the latest. Macron's Vision | In a speech to the nation on Sunday, Emmanuel Macron sought to pivot his leadership forward to an economic recovery and his bid for re-election in 2022. The French president confidently flagged a reboot to his administration, though the risk is that while virus infections have slowed, festering domestic grievances will resurface. The Conte Factor | Meanwhile in Italy, the popularity of Giuseppe Conte has triggered speculation that he might become leader of the Five Star Movement, with an opinion poll suggesting he could turn the party into the nation's leading force. Yet that same support is fueling tensions within his administration. First Jabs | AstraZeneca and four EU countries said they reached an agreement to provide 300 million to 400 million doses of a possible vaccine in stages starting from the end of 2020. The deal marks the first concrete result for the alliance created earlier this month. Lasting Damage | As the world economy emerges from an unprecedented recession, one of the biggest questions is: How many of the millions of lost jobs are gone for good? The hope is that waves of stimulus should spark a revival in hiring — but the risk is that the pandemic is inflicting a "reallocation shock." Chart of the Day  Central banks across Europe hold monetary policy meetings this week, with Poland, Switzerland and Norway expected to keep rates at record lows. Russia — which decides on Friday — is predicted to cut its benchmark by at least 75 basis points as fears about the ruble and inflation fade. Today's Agenda All times CET. -

9 a.m. Video conference of ministers responsible for cohesion policy -

9:30 a.m. EU energy ministers video conference to discuss green aspects of proposed recovery plan -

11 a.m. Eurostat to publish trade in goods reading for April -

2 p.m. EU foreign ministers video conference to discuss transatlantic relations with U.S. Secretary of State Pompeo -

2:30 p.m. Conference call between Johnson and leaders of EU institutions aimed at injecting new momentum in stalled Brexit talks -

3:45 p.m. EU Parliament's ECON Committee holds public hearing on economic impact of Covid-19 outbreak, with IMF Chief Economist Gopinath and OECD Chief Economist Boone -

4:30 p.m. Bruegel fireside chat with IMF Managing Director Georgieva -

EU Commission Vice President Jourova speaks at Brussels Forum 2020 on 'Combating disinformation to secure democracy' - Partial border reopenings in European countries, including Germany

- U.K continues its easing of the coronavirus lockdown, with non-essential retailers opening

- Two-day Austrian government conclave on virus stimulus begins

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment