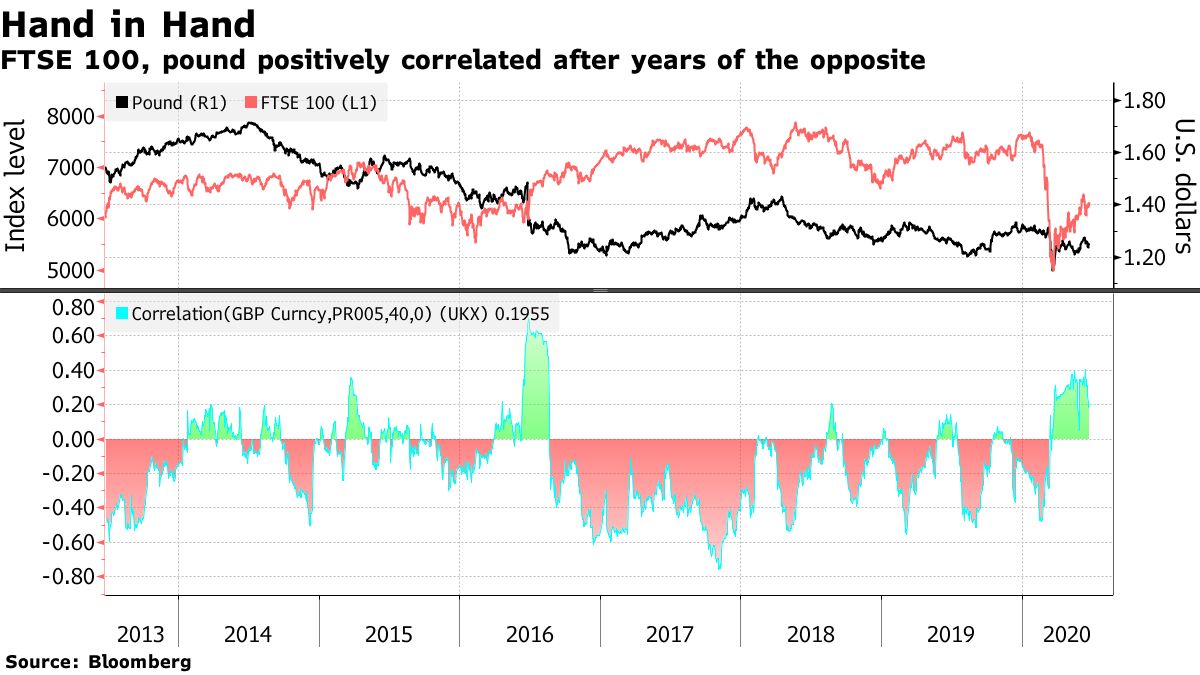

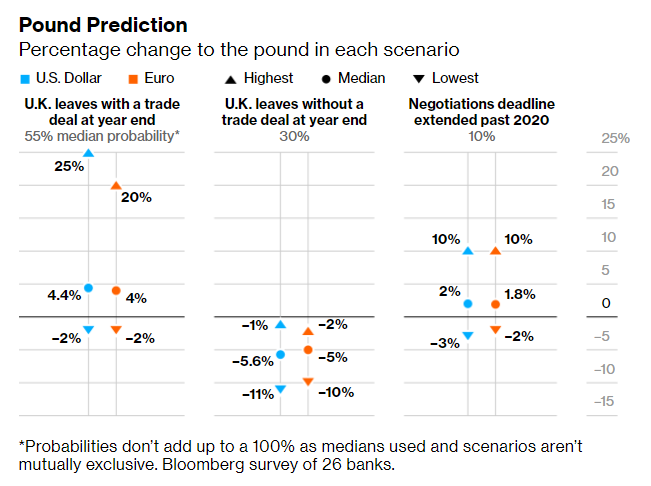

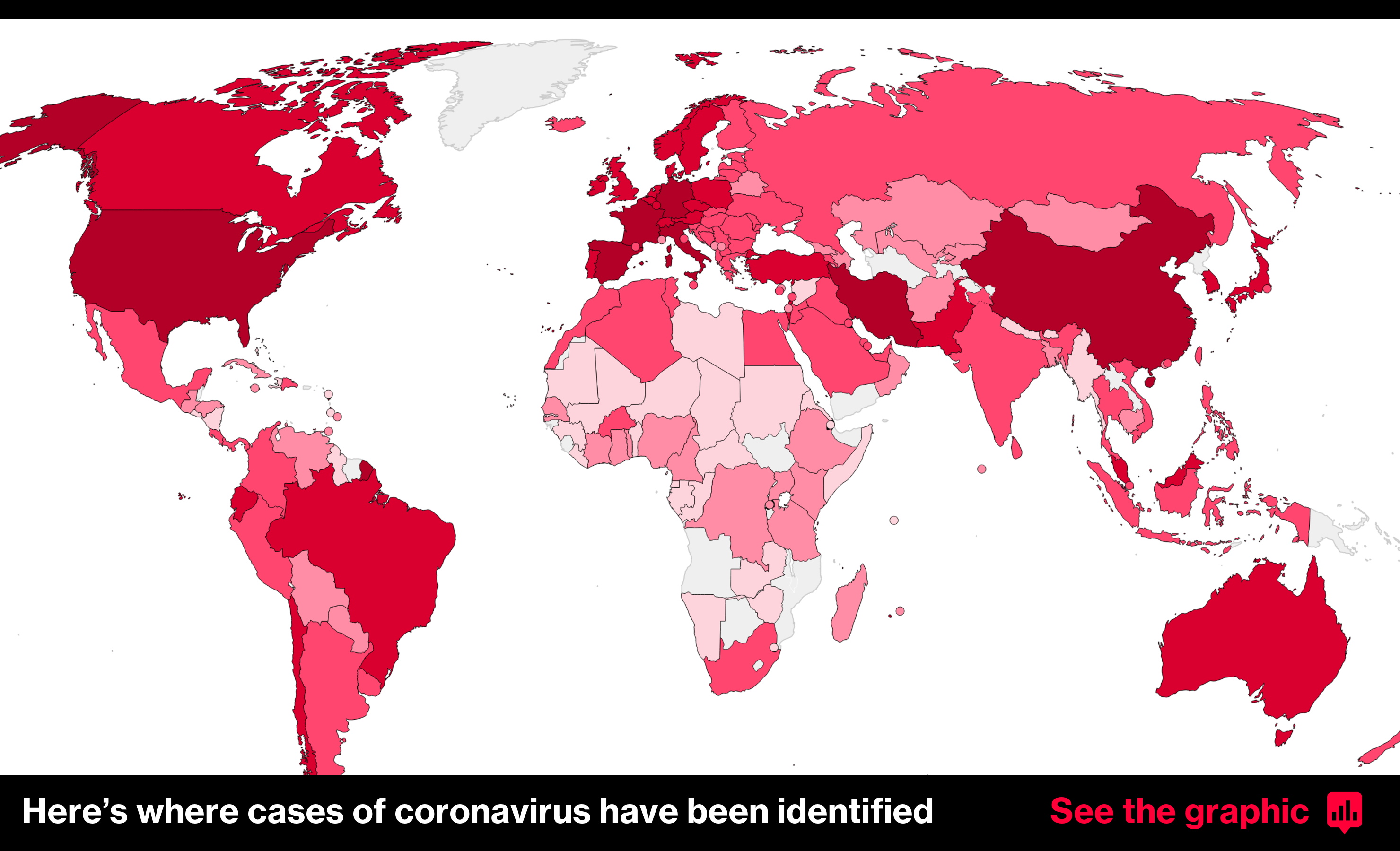

| What's Happening? Four years since the referendum, Brexit is still haunting British stocks. The FTSE 100 Index has trailed its international counterparts over the past four years, and in local currency terms is trading near levels it was at just before the vote. In dollar terms, the FTSE's under-performance is even more striking, showing a nearly 20% drop. After years of moving in opposite directions, the FTSE 100 and the pound are now moving hand-in-hand again. Given the heavy weighting of exporters in the U.K. benchmark, which benefit from a weak pound, it's been more usual for the pair to trend away from each other. You can read Michael Msika's story in full here. The last time stocks and sterling were as positively correlated was in the volatile period after the 2016 referendum. Tensions over the ongoing trade talks are likely to be playing into the current reversal.  On Wednesday, the EU's chief negotiator, Michel Barnier, warned the "moment of truth" for a trade deal will be in October when the bloc's 27 leaders hold a summit. When both sides resume talks next week, they will need to compromise, Barnier said, before warning that "the level playing field is not for sale." Barnier's counterpart David Frost has ruled out a potential compromise over the level playing field—and warned that the U.K expected movement from the EU. Read More: U.K. Rejects Mooted Compromise in Setback to EU Talks  If the two sides do manage to reach a deal, the likely boost to the pound will just about help it recover from the coronavirus pandemic, according to a Bloomberg poll of strategists. An accord would likely drive sterling up 4.4% to above $1.30, its level in March, according to my colleagues Anooja Debnath, Eddie Spence and Maria Elena Vizcaino.  Whichever way the negotiations end, most analysts are increasingly gloomy about the outlook for the British economy. Given a messy break with the EU at the year-end is likely only to complicate the recovery from the coronavirus lockdown, speculation is growing that Boris Johnson is getting keener to strike a deal. "EU and U.K. leaders recognize that the last thing anyone needs right now is a disruptive no-deal Brexit," said Simon Harvey, a currency market analyst at Monex Europe Ltd. "Even if it's just a bare-bones deal that avoids large scale goods tariffs going up, some type of agreement is likely to get inked this year." — Edward Evans Beyond Brexit Introducing the new Bloomberg CityLab. Sign up for the CityLab Most Popular, a weekly digest on the future of cities. Sign up here for our daily coronavirus newsletter, and subscribe to our Covid-19 podcast.  Click here for the latest maps and data on the spread of coronavirus. Want to keep up with Brexit? You can follow us @Brexit on Twitter, and listen to Bloomberg Westminster every weekday. Share the Brexit Bulletin: Colleagues, friends and family can sign up here. For full EU coverage, try the Brussels Edition. For even more: Subscribe to Bloomberg All Access for our unmatched global news coverage. |

Post a Comment