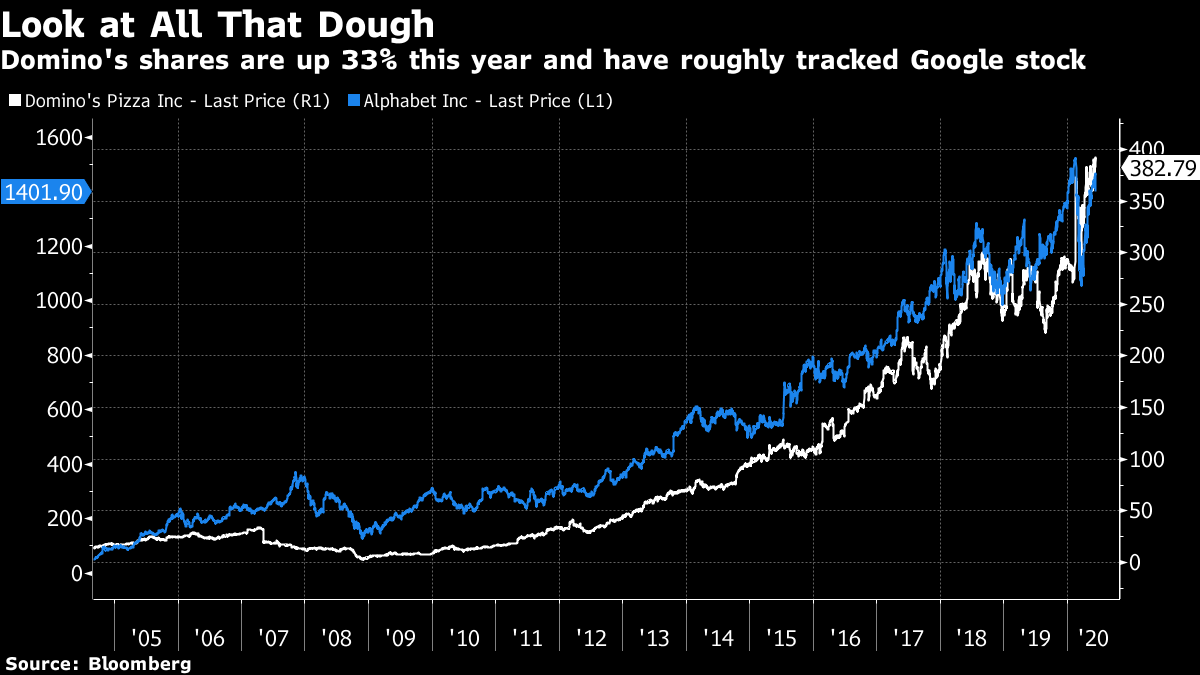

| The U.S. Treasury Secretary says America shouldn't shut down again, despite the threat of a second wave. Asian stocks look set to drop after a rout on Wall Street. And Hong Kong is rivaling Singapore's monopoly on selling China stock futures. Here are some of the things people in markets are talking about today. U.S. Treasury Secretary Steven Mnuchin said the country shouldn't shut down the economy again even if there is another surge in coronavirus cases. "We've learned that if you shut down the economy, you're gonna create more damage — medical problems that get put on hold," Mnuchin said Thursday on CNBC. "We can't shut down the economy again." Mnuchin added that he believes President Donald Trump made the right decision to urge states to ease social distancing rules that have crippled the U.S. economy. He said that in the event of a resurgence, it will not be necessary to impose restrictions again because Covid-19 testing and contact tracing are improving and officials understand more about how to contain outbreaks. More than 2 million people in the U.S. have been infected so far. While the U.S has seen a decline in some medical services during the lockdown, health experts have warned that it's a false choice to weigh those directly against the pandemic. Here's how Bloomberg is tracking the virus. Asian stocks looked set to slump after U.S. equities tumbled the most in 12 weeks, as worries over a jump in coronavirus cases added to concern the recent rally had gone too far. Treasuries surged with the dollar. Futures in Japan, Hong Kong and Australia were all at least 2% lower. Earlier, the S&P 500 sank almost 6% and only one company in the index finished higher. Airlines, cruise and travel shares that soared in recent weeks bore the brunt of the selling. The KBW Bank Index of financial heavyweights slid 9%, and energy producers joined a rout in oil. The yen pushed higher and the euro retreated. Elsewhere, crude oil tumbled almost 9% amid Thursday's large moves in global markets. European shares slumped. ... Must come down. Recent converts to a one-way trading blueprint popularized on Twitter and in chat rooms have learned it is not quite the bullet-proof strategy it had recently seemed. "Stocks only go up" was the philosophy, and however tongue-in-cheek the intent, it got a jarring refutation Thursday as the S&P 500 plunged 6% and almost $2 trillion was erased from equities. Selling was worst in areas of the market embraced by armies of retail investors that have swarmed to equities in the last month, including airlines, energy producers and banks. While the slide is still small next to the advance that lifted the S&P 500 by 45% since late March, at the very least it highlights the shaky foundations of a rally occurring alongside the worst economy in a generation. Small traders who dived in over the last few weeks absorbed their first big dose of pain. Whether they stick around now will go a long way in determining the tenor of the next few weeks. In any case, in a stock market inundated with retail investors rushing in to buy anything that moves, the swift reversal we're seeing was more or less inevitable. Singapore's role as a regional equity derivatives trading center may be curtailed after it lost a major index-licensing deal to Hong Kong. The next battle front between the two Asian financial hubs will be on China stock futures. Rivalry in the hedging tool for mainland equities sets up a skirmish between the cities that have competed as centers for a range of finance businesses from share listings to wealth management, analysts say. Singapore Exchange Ltd. is currently the only overseas platform where investors can trade Chinese A-share futures, and the product accounts for about half of the bourse's equity derivatives volume. That may be short-lived as Hong Kong Exchanges & Clearing Ltd. said last year it's working on a similar hedging tool for mainland stocks with MSCI Inc., which is still pending regulatory approval. "The launch would end Singapore Exchange's monopoly on offshore derivatives based on China's A shares," said Bruce Pang, head of macro research at China Renaissance Securities. Australia's resource industry is set to aid the economic recovery once again as higher prices and expansion plans assist the nation emerging from its coronavirus lockdown. Mining accounts for nearly 6% of gross domestic product but plays an outsized role in national income, delivering dividends to pension funds and funds for government coffers. Iron ore, the nation's biggest export, has broken $100 a ton amid off-shore supply concerns, providing a timely budget boost. The government's most recent budget numbers from December were based on iron ore falling to $55 a ton, excluding freight, by the June quarter of 2020. Now that Australia is in recession, it is more reliant than ever on China's stimulus into its own economy, which spurred a mining investment boom Down Under back in 2009. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Consider two companies. The first one went public in 2004, saw its share price multiply 28-fold in the years since and is now considered one of the greatest technology giants of all time with an uncanny ability to mine and sift user data. The second company also went public in 2004. It also experienced the same trajectory in the equity market. And it also does the exact same thing with data. Crucially, the second company does something the other one does not. It delivers pizza. The two are of course Alphabet (née Google) and Domino's Pizza.  Similarities between the share price of the world's biggest search engine company and the pizza chain have been remarked upon before. But they're worth considering again in the context of the coronavirus, when containment measures have sparked a surge in demand for at-home food delivery. On the next episode of the Odd Lots podcast, we speak with Jonathan Maze, editor-in-chief at Restaurant Business Magazine, about what makes the Domino's business model — using technology to deliver affordable food in an incredibly efficient way — so special. We've already seen that the coronavirus crisis seems to be solidifying consumer trends that were already at play. In this case, Domino's seems to be showing the importance of digital prowess in even the most physically oriented of businesses (taking pizza from one place to another place). A Japanese edition of Five Things is coming soon. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment