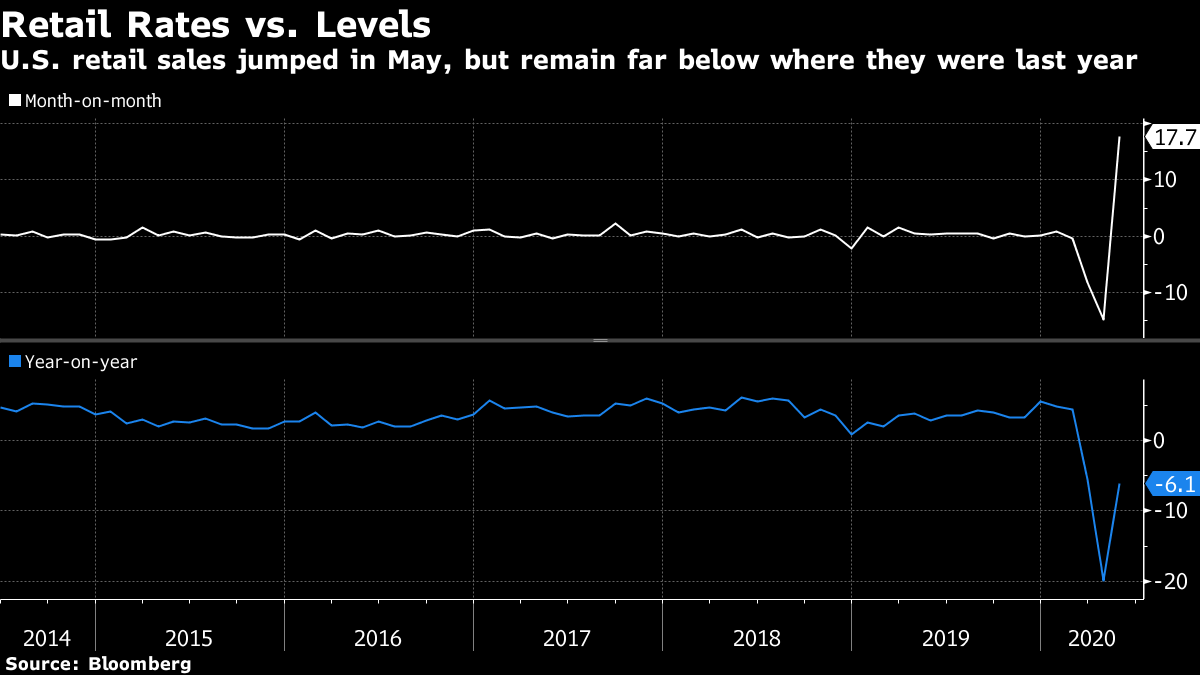

| Beijing shuts schools to stem a surge in coronavirus cases; the China-India conflict escalates into deadly clashes; and stocks in Asia are set to open mixed. Here are some of the things people in markets are talking about today. Beijing has ordered all schools to close in an escalation of containment measures as it struggles to halt a new coronavirus outbreak which has already spread to neighboring provinces. The Chinese capital on Tuesday lifted its emergency response to level two and said that people will have to be tested for the virus before being allowed to leave the city. The total reported number of infections has reached 106, according to the National Health Commission, while cases linked to the Beijing cluster have already been reported in two provinces in China's northern region. Meanwhile, China's customs authorities have started testing all shipments of imported meat for the coronavirus. And salmon farmers have been hit by restrictions in China, where a new outbreak of the coronavirus was blamed on imported fish. In the U.S., Florida reported that new cases rose to the highest level since the pandemic began and Texas saw hospitalizations and new infections surge, more signs that the coronavirus outbreak is worsening in some U.S. states. Brazil had record daily cases. Here is how Bloomberg is tracking the pandemic. A seven-week military standoff between India and China escalated into a deadly conflict along their contested Himalayan border for the first time in more than four decades, signaling a sharp deterioration in ties between the two regional giants. It's unclear what sparked the clashes or how many died in Monday's violence — so far India has confirmed 20 of its troops were killed. A military spokesperson in China's western battle zone command said in a statement there were casualties on both sides, without elaborating. Just two days ago it appeared efforts to lower the temperature on both the diplomatic and military fronts were working, with the two sides indicating they were pulling back forces while talks continued. The uptick in tensions comes amid a rising din of nationalism stoked by both governments as the two powers jostle for regional influence. Asian stocks looked set for a mixed start to Wednesday following the prior session's surge, as investors assessed more evidence of a recovery taking hold in the U.S. economy against lingering concern for more coronavirus outbreaks. S&P 500 futures slipped at the open after earlier U.S. equities advanced with Treasury yields, while the dollar strengthened. Futures on Japanese shares slipped along with those in Hong Kong, while contracts in Australia rose. Data showed U.S. retail sales jumped by the most on record and Federal Reserve Chairman Jerome Powell said the U.S. economy may be bottoming out but still has a long way to go before it reverses the substantial damage done by the pandemic. Oil opened lower after climbing above $38 a barrel. A top HSBC executive sought to reassure clients and staff after the bank's controversial support of China's proposed security law in Hong Kong, saying that the escalating political rhetoric won't diminish the appeal of the two markets. The bank's clients have raised the topic of Hong Kong in nearly every discussion in recent days, HSBC's co-head of global banking and markets Greg Guyett said in an internal memo to colleagues, adding that he has addressed those concerns by pointing to HSBC's role as a "bridge" between Asia and Western economies. He also reiterated HSBC's stance on the proposed Chinese security law, which the bank supported earlier this month. The memo comes after HSBC's stance prompted anger among U.K. and U.S. politicians. People are less willing to fly now than they were at the height of the coronavirus lockdown, according to research carried out for the airline industry's main trade group. Only 45% of those polled in late May and early June said they'd be prepared to board a plane within one or two months of restrictions being lifted, down from 60% in April, the International Air Transport Association said Tuesday. Other indicators also point to an uncertain demand environment. New bookings are down 82% from a year ago, according to IATA, improving only slightly from a low point in April. Demand for long-haul flights remains close to zero. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning We live in unusual times but they're not without historical parallel. We've seen plenty of people, for instance, looking at the Black Death of the Middle Ages or the Spanish flu pandemic of 1918 for insight into how the current coronavirus outbreak might play out. On that note, Jamie Catherwood, aka Twitter's "Finance History Guy," does a great job of parsing primary historical sources to dig up interesting nuggets that relate to current events. Some of them are surprisingly relevant to the modern world and worth considering, especially in the context of surprisingly good U.S. retail sales data that came out on Tuesday.  For instance, he notes that during the Spanish flu, the U.S. economy witnessed something surprisingly similar to the "Amazon Effect" that we talk about today. Because so many people were stuck at home and avoiding crowded shops, they ended up ordering a lot more through the famous catalog of Sears, Roebuck & Co. — in much the same way as many are ordering more online via Amazon now. Back then, mattress sales apparently jumped as doctors recommended bed rest for sick patients. Today we're seeing sales of gloves, masks and ventilators surge. Catherwood will be on an upcoming episode of Odd Lots to discuss these parallels plus a whole lot more. Subscribe so you don't miss it. There's now a Japanese edition of Five Things. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment