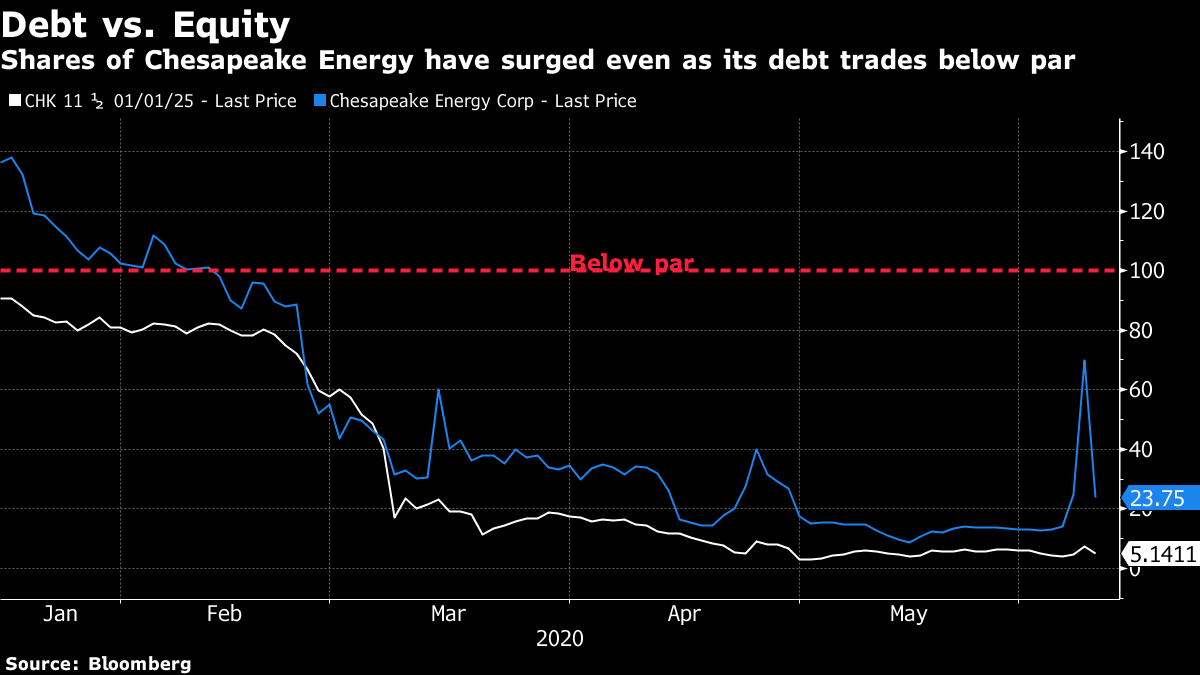

| Legendary investor Kyle Bass makes an audacious bet on the Hong Kong dollar peg. Yet another airline is thrown a lifeline. Stocks are set to take a breather after the stunning rally. Here are some of the things people in markets are talking about today. Asian stocks were poised for a lower start Wednesday after U.S. equities retreated on concern the recent risk-asset rally had run too far. Treasuries climbed. Futures in Japan and Australia declined, with contracts little changed in Hong Kong. The S&P 500 halted a surge that drove the gauge higher for 2020, dipping less than 1%. Treasury yields sank to as low as 0.8%, while the dollar reclaimed some earlier losses to trade flat. Oil rose in a late rally ahead of inventory data on Wednesday and after Libya once again closed its top oil field shortly after reopening. Stocks have swung from depression to euphoria in a record-breaking rally that added $21 trillion to global equity markets. Much of that has been driven by retail investors who dived back into the market as stocks rebounded. Now large investors are bemoaning missing the rally, with Tudor Jones saying it's time for "humble pie." Kyle Bass is going for broke on a currency trade that has burned bearish speculators for more than three decades. The Dallas-based founder of Hayman Capital Management is starting a new fund that will make all-or-nothing wagers on a collapse in Hong Kong's currency peg, people with knowledge of the matter said. Bass, best known for his prescient bet against subprime mortgages before the 2008 financial crisis, will reportedly use option contracts to leverage the new fund's assets by 200 times. While the strategy is designed to generate outsized gains if Hong Kong's currency tumbles against the dollar, investors stand to lose all their money if the peg is still intact after 18 months. Bass declined to comment. A vocal critic of China's Communist Party, the 50-year-old investor wrote in a Newsweek op-ed last month that Hong Kong has become "ground zero for the ideological clash between democracy and heavy-handed Chinese communism." Cathay Pacific Airways became the latest global carrier to receive a lifeline to get through the coronavirus pandemic, with the company's chairman saying a plan to raise HK$39 billion ($5 billion) from the Hong Kong government and shareholders was necessary to avoid collapse. The beleaguered airline will sell HK$19.5 billion of preference shares along with HK$1.95 billion of warrants to the government. It also proposed a rights issue, reported earlier Tuesday by Bloomberg News, to raise about HK$11.7 billion. The plans are subject to shareholder approval at an extraordinary general meeting around July 13. A government-connected entity called Aviation 2020 Ltd. also is extending a HK$7.8 billion bridge loan, the carrier said. The government will own 6.08% of Cathay through Aviation 2020 after the deal and have two observers on its board. The airline will cut executives' salaries and offer more unpaid leave to its workers, and job cuts are possible. SoftBank's Vision Fund is preparing to cut to staff by about 15% after reporting record losses for the last fiscal year, according to a person familiar with the matter. Rajeev Misra, head of the London-based Vision Fund, has expanded the number of planned cuts in recent days to as many as 80 employees out of roughly 500, said one of the people. The fund had planned to cut about 10% of its workforce as of last month, Bloomberg News has reported. SoftBank Group International is reducing its staff by about 26 out of 230, said another person familiar with the matter. Bloomberg News reported last month that the the group's cuts were expected to be about 10%. Spokespeople for the Vision Fund and SoftBank Group declined to comment. Asia's stabilizing financial markets are allowing the region's central banks to exhale as currencies find their feet and investor money returns. It's a crucial reprieve after unprecedented outflows from emerging markets and currency turmoil that followed the coronavirus outbreak. As countries slowly begin reopening and the Federal Reserve likely pauses for now, the pressure is off central bankers in the region to cut interest rates even lower. A tracker of capital flows into emerging economies by the Institute of International Finance found portfolio flows are back in positive territory. Currencies like Indonesia's rupiah, which crashed to a 22-year low, is now up more than 7% against the dollar in the past month. Others like the Thai baht, South Korean won and Malaysian ringgit have also rebounded. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Distressed debt investing has been around for a long time. It typically involves buying the bonds of bankrupt companies at ultra-low prices and hoping that you can generate profits as the company sells off assets during liquidation and returns the resulting money to its lenders. Now, it seems we have distressed equity investing on our hands. As Bloomberg reports, the share price of at least half a dozen companies that have either declared bankruptcy or are on the verge of doing so have surged in recent days. It's a bizarre turn of events since equity is at the bottom of the capital stack, meaning shareholders typically don't get much (if anything) in a bankruptcy process.  The weird result of all this is that you would have basically doubled your money by investing in Hertz on the day it filed for Chapter 11 protection. Shares of Chesapeake Energy were trading at $14.05 just a week ago and climbed to almost $70 before the company announced a potential bankruptcy filing on Tuesday; they're now trading at $23.75. The stock of struggling department store chain JC Penney was trading at 20 cents and is now at 43 cents (having reached as high as 68 cents). Even weirder is that bonds of many of these companies continue to trade below face value, suggesting debt investors really don't see the possibility of recovering much money in liquidation. And if bond investors are expecting losses, then equity investors *should* normally expect to be wiped out. But of course, we're not in normal times. Not at all. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia and beyond. Sign up here to get our weekly roundup in your inbox. |

Post a Comment