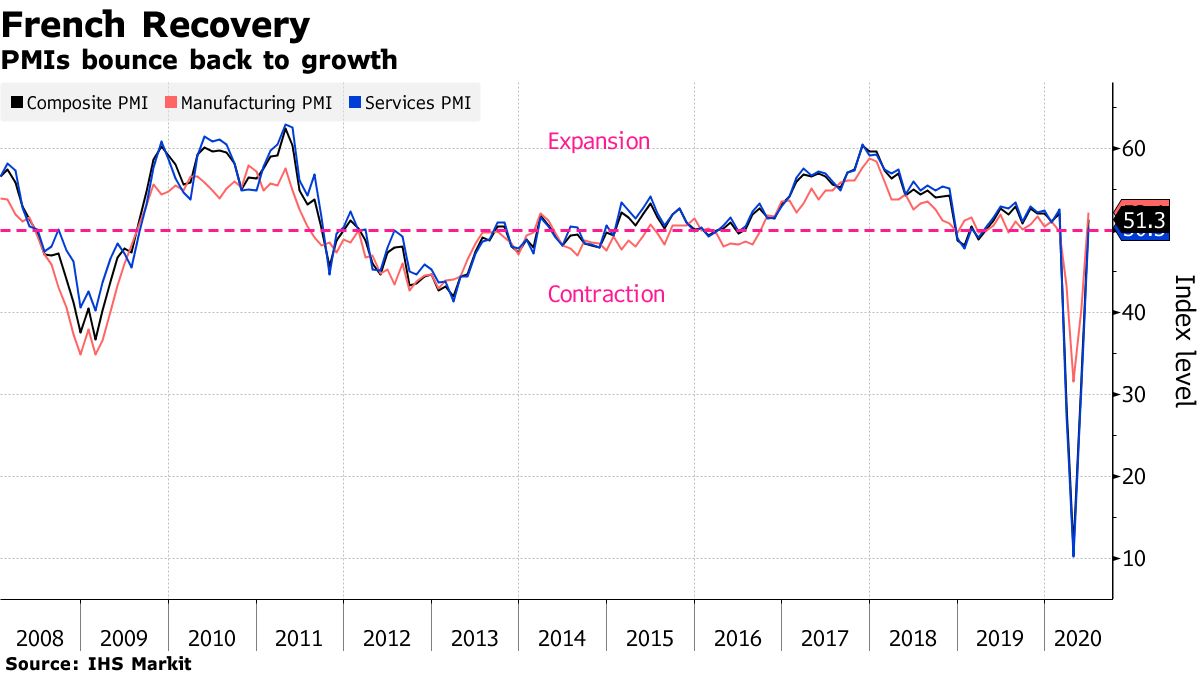

| A surge in U.S. virus cases raises alarm bells. China is tightening its grip on the Hong Kong economy. And the U.S. considers more stimulus. Here are some of the things people in markets are talking about today. Anthony Fauci, the U.S. government's top infectious-disease expert, told Congress he was seeing a "disturbing surge" in new cases. As many as 31 states have R0 figures above 1, according to the Rt.live website, meaning that each person with the virus infects at least one other. Newly diagnosed cases of Covid-19 and other indicators of the pandemic's spread soared in hot spots across the U.S., driving city and state officials to consider slowing or reversing reopening plans. Cases are surging in Texas, Florida, Arizona and in California, which on Tuesday broke its record for new cases for the fourth day in the past week. Coronavirus infections in the U.S. increased by 35,695 from the same time Monday to 2.33 million, according to data collected by Johns Hopkins University and Bloomberg News. The 1.6% gain was higher than the average daily increase of 1.3% the past seven days. The World Trade Organization said its worst-case scenario for cross-border commerce this year will likely be avoided, depending on whether there's a second wave of outbreaks. Novak Djokovic, the world's leading men's tennis player, tested positive for Covid-19 days after an exhibition tournament in the Balkans featuring him was cut short. England eased more restrictions as deaths continued to fall. Here is how Bloomberg is tracking the virus. Stocks in Asia were poised for a muted start after gains for U.S. equities faded into the close, with concerns mounting that a spike in virus cases in some states could impact the speed of the economic rebound. Gold rose to the highest since 2012. Futures dipped in Japan, while those in Hong Kong were flat and Australian contracts edged higher. S&P 500 futures ticked lower at the open. Earlier, the S&P 500 jumped as much as 1.2% before paring the gain by two-thirds on reports that a surge in cases in several hotspots in the South and Southwest of the U.S. threatened to derail plans to ramp up reopenings. The Nasdaq Composite hit another all-time high. The dollar fell and Treasuries were little changed. Oil dipped. China is not only tightening its political grip on Hong Kong to rein in the restive city, it's pushing harder to deepen its influence over the international finance hub's business life. From real estate to initial public offerings, debt issuance and telecommunications, mainland Chinese companies — many of which have government backing — are playing increasingly assertive roles in almost every corner of the city. It's a shift that has been in progress since the handover in 1997. While supporters of greater economic integration point to the growth-boosting impact of Chinese investment in Hong Kong, critics see it as yet another reflection of the city's diminishing autonomy from the mainland. That concern has swelled in recent weeks after China said it would impose contentious national security legislation on Hong Kong. The Trump administration is discussing another stimulus package with lawmakers that could be passed in July, the latest effort to revive the U.S. economy amid the coronavirus pandemic, said Steven Mnuchin. The U.S. treasury secretary said Tuesday in an interview during the Bloomberg Invest Global virtual event that he expects the American economy to exit recession by year's end. President Donald Trump has said he's considering sending another round of economic stimulus payments in a rescue package that he expects will be released "over the next couple of weeks." Meanwhile, the misery spreading through the U.S. economy is posing a significant threat to Trump's re-election in November. Australians' trust in China to act in the world's best interests has plummeted, highlighting the Australian government's challenge in mending a worsening diplomatic spat with its largest trading partner. The annual Lowy Institute Poll released on Wednesday shows that 23% trust China to act responsibly in the world, down from 52% two years ago. Confidence in President Xi Jinping's ability to handle global affairs has almost halved since 2018 to 22%. Still, the survey — conducted in late March among 2,448 adults — shows Trump isn't a beneficiary of Australians' increasing antipathy toward China. The American leader has the trust of only 30% of those polled to do the right thing in world affairs, even as 78% believe Australia's key alliance with the U.S. is important to the nation's security. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning One of the most interesting things about the current state of the economy is the data coming out of it. A lot of those numbers, as currently constructed, just aren't very good at capturing what happens when an entire economy essentially shuts down for a month for two and then restarts. Take, for instance, the PMIs that came out of Europe overnight. Those showed an economic rebound underway, with French data even unexpectedly rising above the all-important level that marks the difference between contraction and expansion. But of course, as I've written in this space before, PMIs measure a very particular thing, and that is the rate of change in manufacturing and services, rather than absolute levels. So while France's composite PMI came in at 51.3 for June, it doesn't tell us anything about how much further the French economy needs to go in order to get back to the place it was before the coronavirus outbreak.  In fact this rates-versus-levels debate currently applies to a whole bunch of economic data ranging from payrolls to retail sales. That makes this particular moment in economic analysis especially interesting since it means there are data to support two very different economic narratives: One that tells the story of a rapid rebound, and one of a massive loss of output. It's basically Choose Your Own Adventure time in the world of economic analysis. There's now a Japanese edition of Five Things. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment