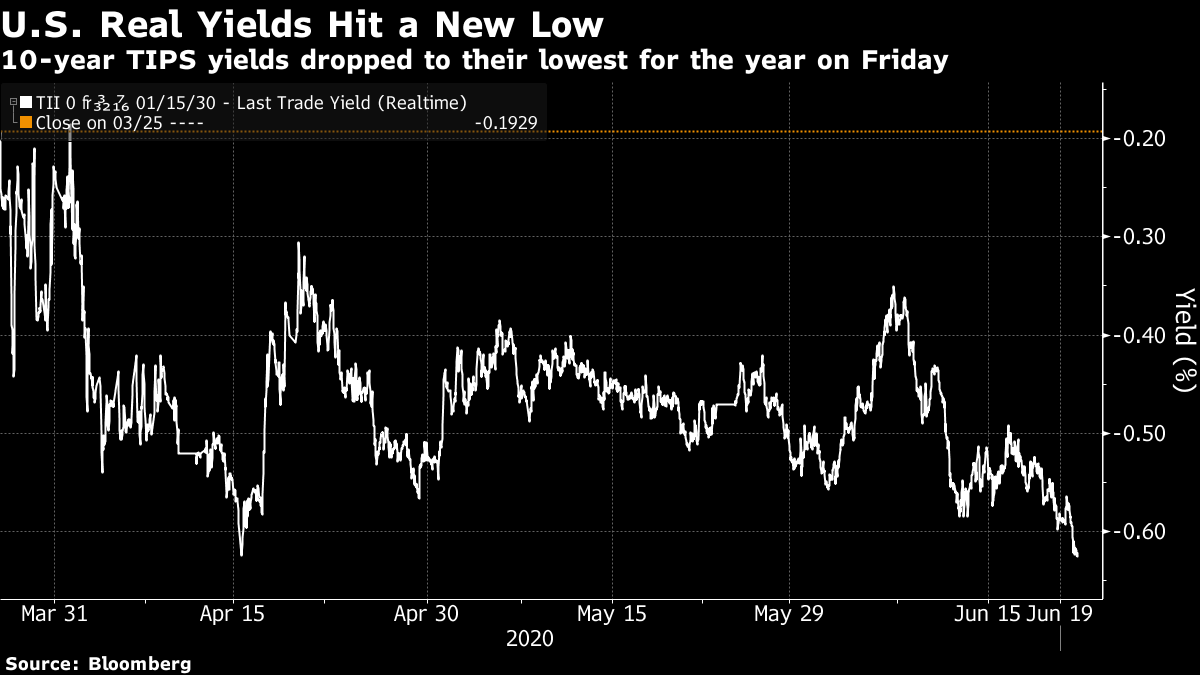

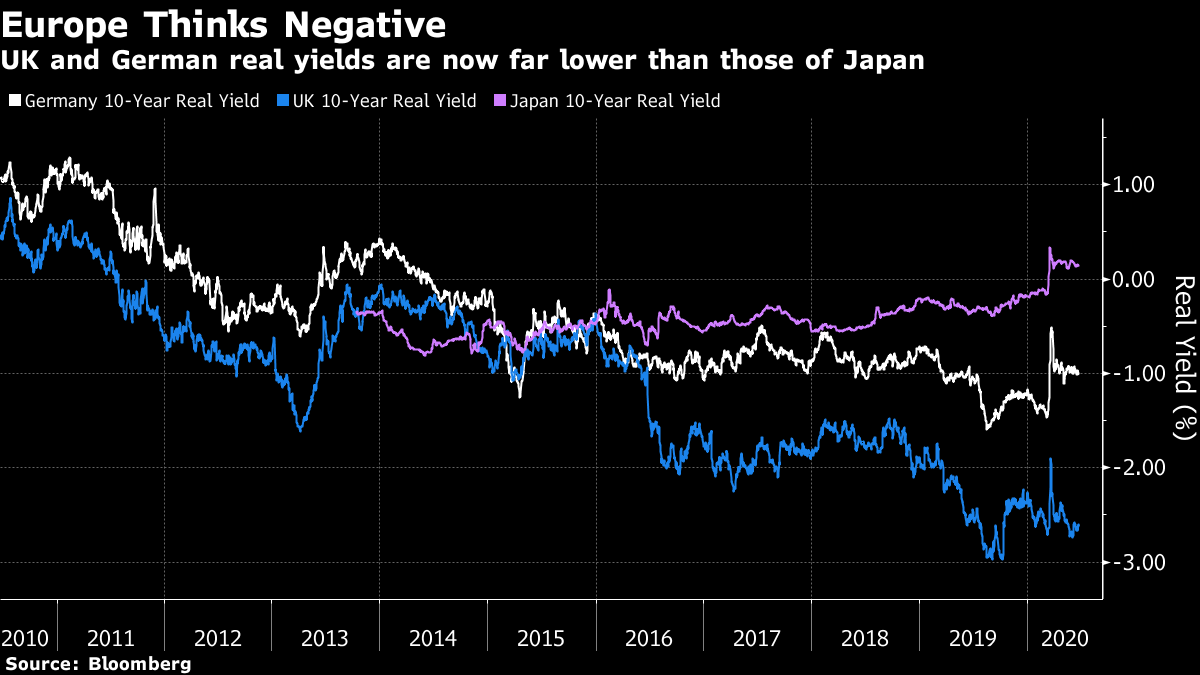

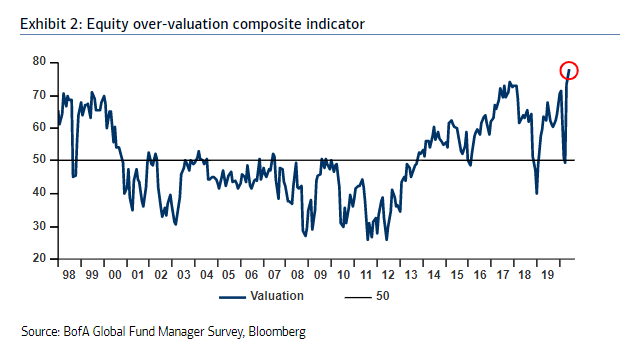

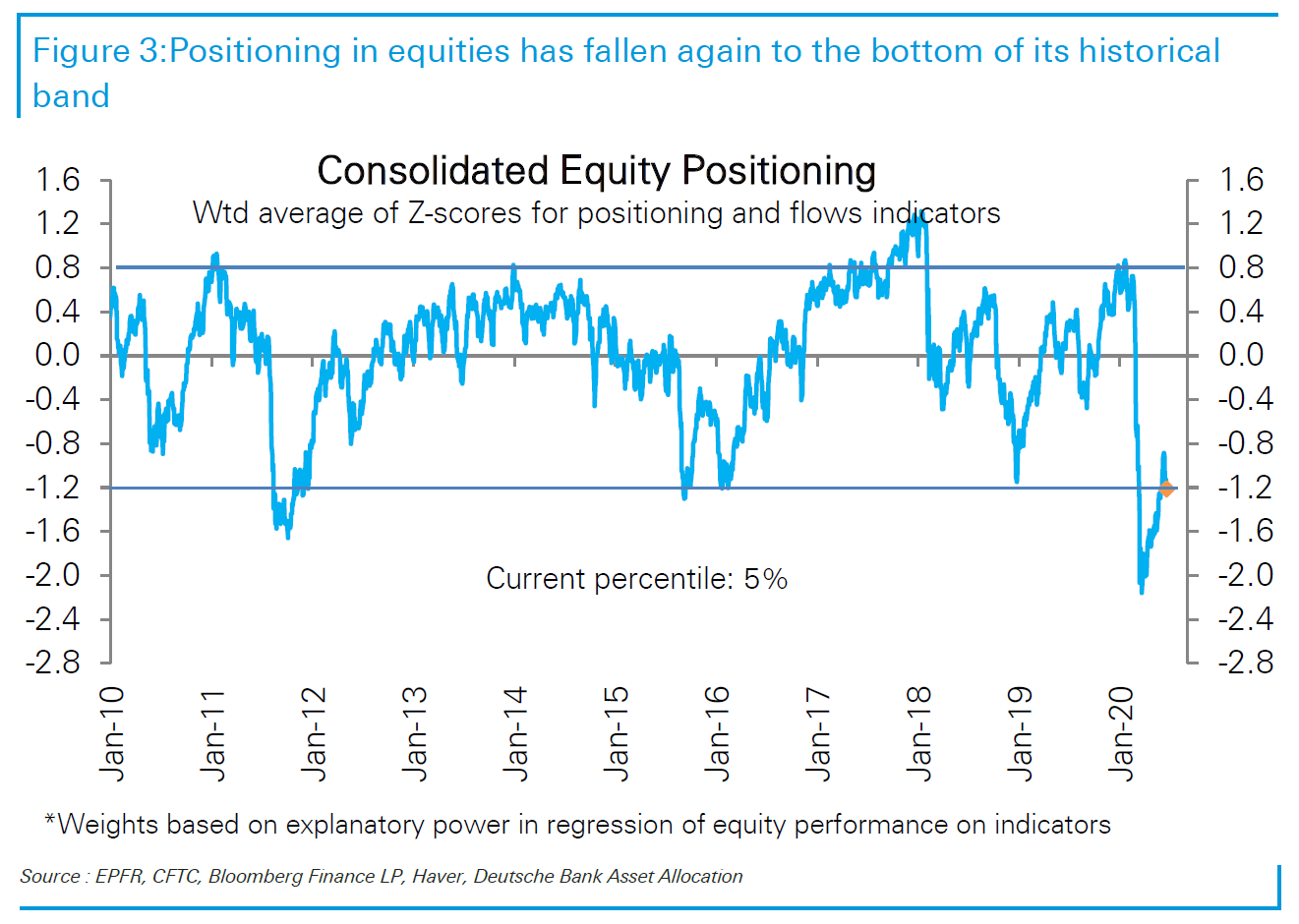

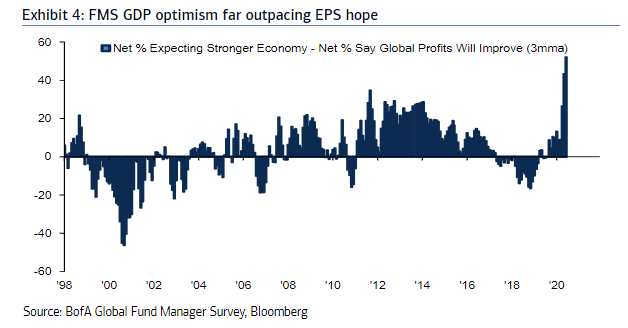

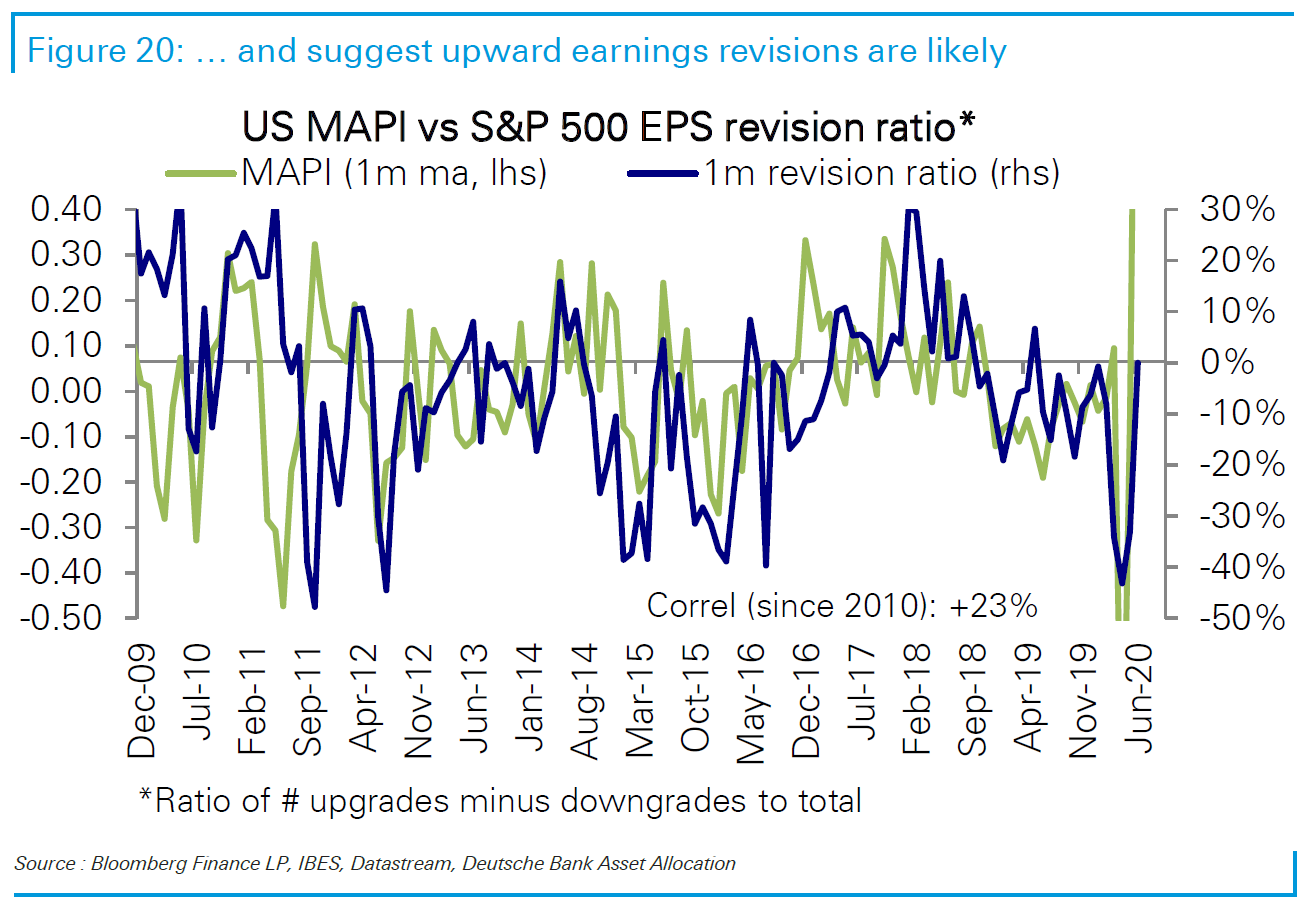

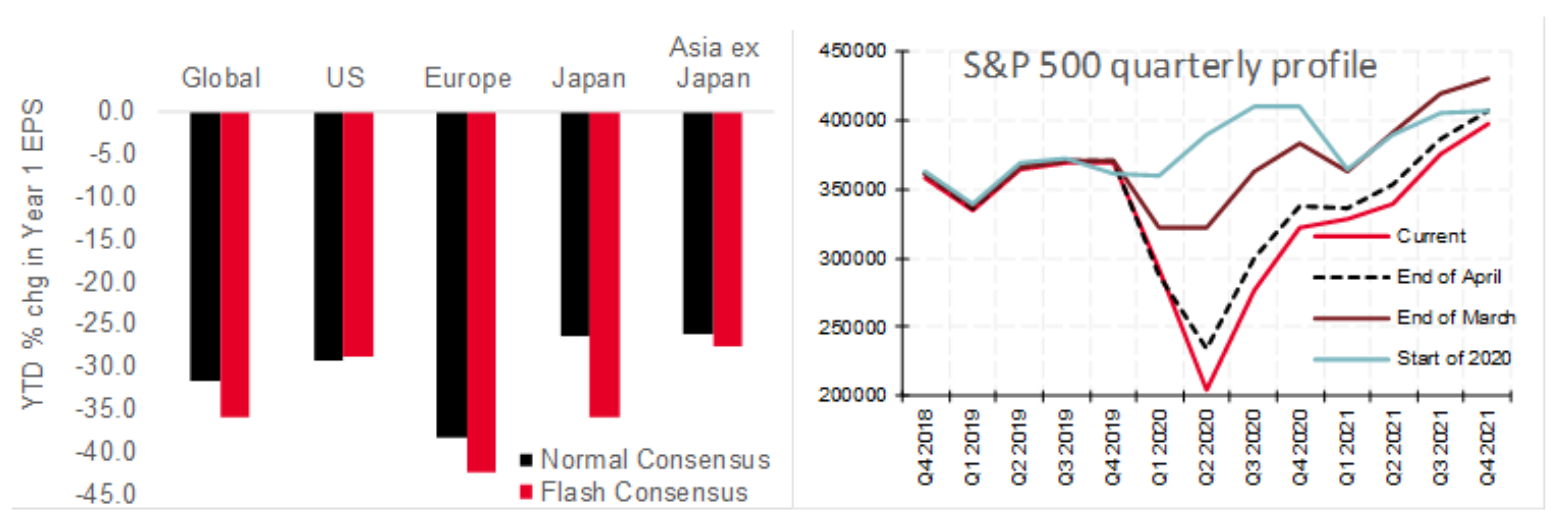

| Ending a sleepy summer week, traders managed to reach a major landmark. The 10-year real yield (as shown by Treasury Inflation Protected Securities, or TIPS, and which can also be expressed as the nominal yield with the breakeven rate of inflation subtracted) dropped to a new low for the year. At below -0.6%, it was also a fresh nadir since the so-called taper tantrum of 2013:  On their face, negative real yields imply great bearishness about the future of the economy. They also act as a great prop for gold, whose greatest disadvantage as a financial asset is that it pays no income. When safe assets like Treasuries effectively pay a negative return, gold therefore becomes that much more attractive. Over the last decade, the relationship between the precious metal and real yields has been close — and the decline in the latter is now bringing gold up toward its 2011 high:  The phenomenon of negative real yields isn't unique to the U.S. In Germany and particularly the U.K., yields are above their recent troughs — but much more negative than in the U.S. Meanwhile Japanese real yields, helped by very low inflation expectations, are now slightly positive:  The pressure on real yields also remains clear the further forward we go. Yields on 30-year Treasuries have been stable for the last three months, while inflation expectations have been steadily rising. With the market appearing to work on the assumption that yield curve control is already here, and that nominal yields won't be allowed to rise, negative real yields look likely:  They aren't great news for savers. Negative real yields imply that saving in a "safe" fixed income account is guaranteed to lose them money in real terms. They can be seen as part of "financial repression" — when governments use their power to force people to lend to them at ridiculously low rates, and prod savers into taking greater risks. Another implication of such low real yields is that there is deep lack of confidence in the buying power of the currency. Look at the ratio of the S&P 500 to gold since August 1971, when the Bretton Woods tie between the dollar and gold was ended. After much variation, the S&P has held its value less well. (Stocks do of course pay a yield, so an investment in the S&P 500 with dividends reinvested would still have returned far more than gold since 1971.)  When there is such a lack of confidence, it generally makes sense to buy hedges against the weakening value of money, or in other words to buy inflation hedges. That means gold, or stocks. If bond yields are to be held where they are by central banks, that means they are forcibly prodding investors into riskier investments. The best piece of news in all of this is that it becomes very cheap to hedge against inflation. As I failed to make clear how to do this in the last Points of Return, I would like to point to the following chart, which shows the performance of exchange-traded funds in long-dated Treasuries, the S&P 500 and in TIPS, since the beginning of 2016. TIPS have performed terribly compared to their most obvious alternatives in recent years. Inflation, as in the measure used to determine the payouts made by TIPS on maturity, is unlikely to rise much if at all in the near term. So buying hedges against inflation via the TIPS market isn't expensive now, and should remain cheap for a while:  Companies Aren't the Economy Stock markets enjoyed a rebound last week, but remain below their recent highs. They also face some strange contradictions. The proportion of global fund managers believing that equities are overvalued is the highest since BofA Securities Inc.'s survey started in 1998, according to its latest reading:  This hasn't stopped the market's fastest rebound in history. And if we look at the ongoing chart of positioning in equities kept by Deutsche Bank AG's equity strategist Binky Chadha, investors remain almost as lightly positioned in stocks as at any time in the last decade:  This suggests that volatility could be ahead, but also that it will be hard for equities to fall much from here. The rally of the last few weeks was driven primarily by short-covering as bears gave up; there is still very little true confidence in stocks. There is also very, very little confidence in earnings, despite growing hopes that the economy will be able to make a swift recovery from the coronavirus. As the BofA survey shows, the gap between those expecting a stronger economy and those expecting strong earnings has never been wider. Even if economic activity picks up, the logic is that it will be harder for companies to return to full profitability. In the current environment, it will certainly be harder for them to juice earnings per share with corporate buybacks, and there will be pressure on them to repair balance sheets, so the disjunction makes some sense:  However, Chadha suggests that it is likely to be resolved in favor of higher equities. His measure of economic surprises (labeled US MAPI in the chart below) is at a decade-long high, and has over time been correlated closely with the EPS revision ratio (the proportion of companies whose earnings forecasts are being revised upward). That implies that EPS estimates will rise (although note that Chadha's figures also suggest that EPS should have been downgraded much more sharply as the initial shock of the Covid-19 lockdowns was working its way through the system):  The recovery in the stock market owes much to the recovery in economic optimism. Now, by this logic, we should expect a swift return to ISM survey numbers above the 50 level that divides expansion from recession, and we should also expect a rebound in earnings optimism in short order. This is a quiet season for brokers to change earnings forecasts, as the end of the quarter approaches. In a couple of weeks, after the end of the quarter and the long July 4 weekend in the U.S., earnings will move back to the top of the agenda. From what we can tell from the most recent revisions, however, optimism about U.S. earnings is already beginning to return, while the rest of the world remains very bearish. The following chart, from Andrew Lapthorne, chief quantitative equity strategist at Societe Generale SA, shows "flash" estimates (that have come through recently), in comparison with the broader standard measure of consensus earnings. Downgrades appear to be over in the U.S., but are continuing in the rest of the developed world. And even though investors are far more bearish about corporate profits than about the economy, they are still expecting something that looks very much like a V-shaped earnings recovery, with profits by the end of next year no weaker than they were expected to be at the beginning of this year, before words like Covid, coronavirus, antibodies, remdesivir, hydroxychloroquine and the rest entered our lives:  If the disconnect between earnings and the economy is really going to be resolved this way, it implies that we are all going to be let off very lightly. Hope springs eternal.

Survival Tips

If you need a little optimism, try reading the latest Bloomberg book club selection, Factfulness, by the late Hans Rosling. For a distillation of the philosophy of the book, take a look at the summary on the Gapminder website, set up by the author and his son and daughter-in-law. Their point, based on great knowledge of public health trends across the world, is that the planet is in better shape than we think it is. Our problem, they say, is that we need to: accept that humans don't see reality just as it is. There's too much information for us to process it all. That's why we all have an attention filter in our heads. But this attention filter is hard wired to make us care more about dramatic information, which easily leads to a stressful over-dramatic impression of the world. In turn, all good young journalists are trained to filter for the most dramatic news, as this is what readers, viewers and listeners are most interested in. The result is not "fake news" as so often alleged; but it does end in a vicious circle of overly dramatic interpretations of the world around us, in which it feels as though we are only ever going backward. It's almost as though the less you know the better. If you want to view the world of 2020 a little less dramatically, then Factfulness and the Gapminder website are for you. Let it happen. We will be holding an online Q&A on the terminal early next month. Alternatively, it's a way of asking yourself: Is it true? Always a worthwhile question. Enjoy the week.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

|

Post a Comment