| Want to receive this post in your inbox every morning? Sign up here More signs of economic rebound, Trump faces backlash over crackdown, and more fun in commodities land. Getting better Global investors pricing in a strong rebound in economic activity got some good news this morning when PMI data from the euro area confirmed that the region is starting to recover as lockdown measures are eased. Add to that the prospect of continued talks over a massive new stimulus package for Germany and expectations of new purchases from the European Central Bank tomorrow. PMI data for the U.S. economy, published at 9:45 a.m. Eastern Time, is also expected to show an improvement. Back firing President Donald Trump's show of strength when he held a Bible aloft outside St. John's Episcopal Church in Washington DC is increasingly looking like a miscalculation. The move, which involved clearing a protest from the site before Trump's visit, has been condemned by religious leaders, Democrats and even some Republicans. It also did little to halt the demonstrations with large crowds of protesters marching on the capital's streets yesterday evening in defiance of a 7 p.m. curfew. Joe Biden won a round of democratic primaries yesterday and Ferguson, Missouri elected its first black mayor. Oil and gas The rally in Brent above $40 for the first time in three months came under pressure after doubts emerged about the timing of an OPEC+ meeting to agree on an extension to production cuts. The parties seeking to reach an agreement will also be aware that the rising prices mean U.S. shale production will start to come back on stream, meaning a balance will have to be found that maintains market share. U.S. inventories data later is expected to show a further drop in stockpiles. Meanwhile, investors are becoming increasingly concerned that natural gas prices may be next to turn negative as storage nears capacity and demand remains weak. Markets rise The market continues to price the future with its rose-tinted glasses firmly in place. Overnight the MSCI Asia Pacific Index added 1.4% while Japan's Topix index closed 0.7% higher. In Europe the Stoxx 600 Index had risen 1.5% by 5:50 a.m. as investors again preferred cyclical stocks. S&P 500 futures pointed to another strong performance after the Nasdaq 100 within 1% of a record high. The 10-year Treasury yield was at 0.708% and gold slipped. Coming up... Ahead of tomorrow's May payrolls report, ADP employment change is at 8:15 a.m. ISM non-manufacturing, U.S. April factory and durable goods orders are at 10:00 a.m. Also at that time, the Bank of Canada announces its latest policy decision, the last one with Stephen Poloz at the helm. Crude inventories data is at 10:30 a.m. Canada Goose Holdings Inc. and Campbell Soup Co. are among the companies reporting earnings. What we've been reading This is what's caught our eye over the last 24 hours And finally, here's what Joe's interested in this morning After the last U.S. Jobs Report in early May, I wrote about what I thought was the next big risk for the labor market, which is that we'd start to see job losses that were a) increasingly affecting higher paid workers and b) more permanent. Many of the initial waves of layoffs were quasi-furloughs of service jobs (people who work in restaurants, etc.) that could be expected to come back once the lockdowns were lifted and demand returned. However, to the extent that layoffs increasingly affect higher paid, white collar workers, income won't easily be recouped by unemployment insurance, and those positions won't reopen again when the health crisis ends.

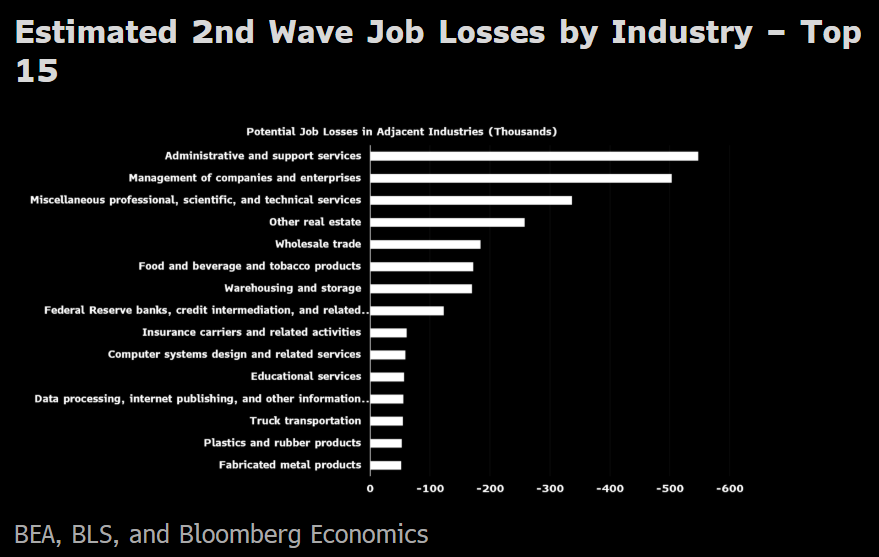

The next jobs report is this coming Friday, and there's no reason to think that the risk has gone away. Fresh data from Indeed shows that over the last month, there's been a substantial increase in job openings in areas like dental care or retail, but that in areas like software and finance, they've continued to fall. Another look at the data from Glassdoor says the same thing, that white collar job openings have continued to shrink every week of this crisis, even as in-person services labor has rebounded. Meanwhile, Bloomberg economist Yelena Shulyatyeva estimates that between 2 and 6 million jobs could be hit in a second wave, as the managerial ranks get hit by pink slips.

As we saw in last month's Personal Income data for April, the initial burst of fiscal stimulus has done a shockingly good job of boosting household income in the wake of historic job losses. As that spending burst fades however, and as the layoffs continue spreading to higher paid workers, massive risks to the labor market, household income, total demand, and therefore everything in the economy remain.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment