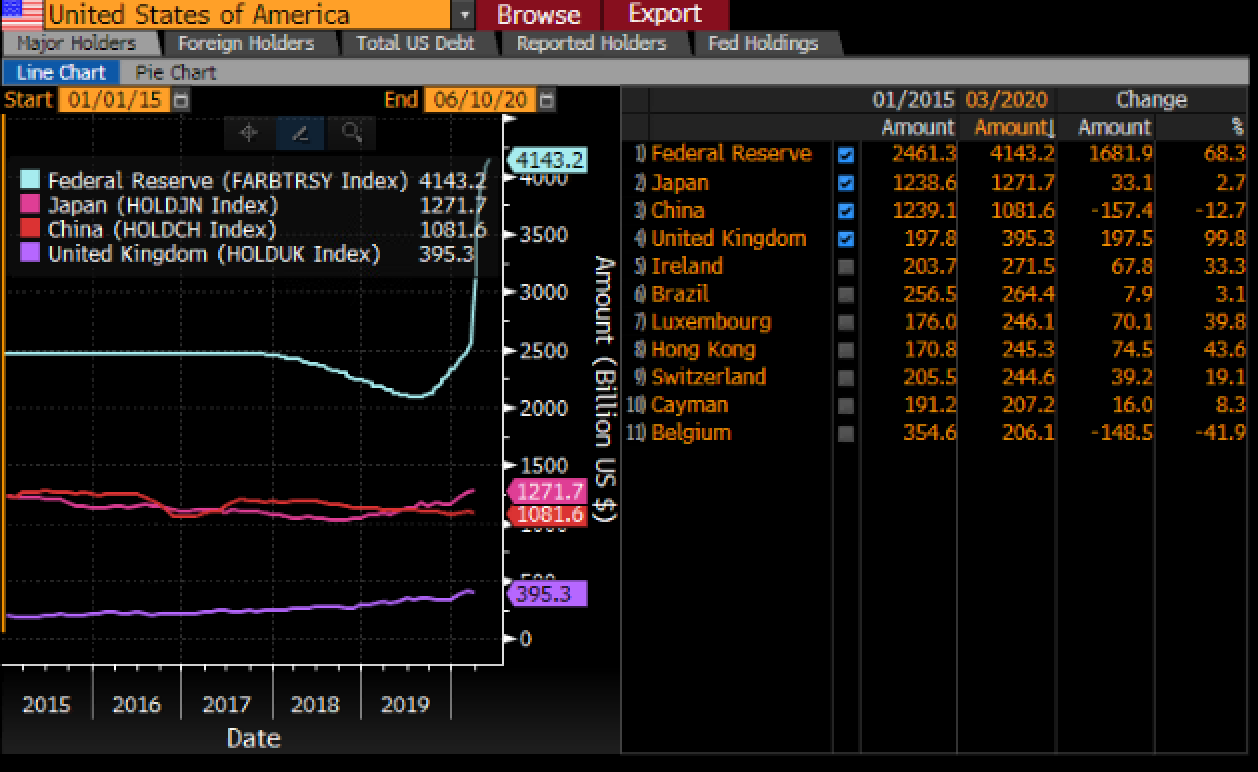

More signs of a second virus wave, stocks recover some ground, and almost two decades of U.K. growth wiped out. Houston, we have a problemThe growing warnings about a possible second wave of the coronavirus gained some urgency when officials in Houston said they are "getting close" to reimposing stay-at-home orders. In Florida, the seven-day total of new cases is the highest since the pandemic began. The IMF warned that the economy is recovering slower than expected from the shutdowns, with its Chief Economist Gita Gopinath saying the fund's next round of forecasts on June 24 will be worse than April's outlook. Treasury Secretary Steven Mnuchin yesterday said the U.S. cannot have another lockdown, even if there is a surge in cases. Growth unwindStatisticians are still counting the economic costs of the first wave of the pandemic. Figures released in the U.K. this morning showed growth there plunged an unprecedented 20.4% in April, which added to the March 5.8% drop means almost two decades of expansion was effectively wiped out in two months. Data this morning showed euro-area industrial production plunged 17.1% in April. Germany's government signed off on the implementation of a sweeping 130 billion-euro ($145 billion) stimulus package. RecoveryThe massive rout in U.S. equity markets yesterday which saw major indexes plunge more than 5% seems to have already run out of steam. Overnight the MSCI Asia Pacific Index dropped 1.2% while Japan's Topix index closed 1.2% lower. But in Europe the Stoxx 600 Index was 1.2% higher by 5:45 a.m. Eastern Time, recovering early session losses. S&P 500 futures point to a strong rally at the open, while still falling far short of recovering yesterday's losses. The 10-year Treasury yield was at 0.713% and gold was higher. Oil volatilityThe crude market has had a difficult few days, with yesterday's 8.2% plunge in West Texas Intermediate highlighting the fragility of the recovery in the wake of last weekend's OPEC+ deal. Thursday saw a record outflow of more than $128 million from the WisdomTree's WTI Crude Oil ETF, one the largest crude funds. Crude in New York was trading at $36.57 a barrel by 5:45 a.m., slightly higher on the day. Coming up...U.S. import and export prices for May are expected to show some growth when the numbers are published at 8:30 a.m. The University of Michigan sentiment index is also predicted to show a small improvement at 10:00 a.m. The Baker Hughes rig count at 1:00 p.m. will probably hold below 300 as shale production in the U.S. has yet to start a major recovery. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morningThe renewed haven buying that drew the global benchmark yield back from last week's highs near 1% is validation for Treasury bulls. It's also reassurance that demand can keep up with the breakneck pace of supply. That remains a critical question for the Treasury as it plows on with fundraising for a multi-trillion-dollar effort to avert a generation-defining recession. The Congressional Budget Office estimates that pandemic relief will swell the deficit by $2.2 trillion this fiscal year. There are myriad ways to look at the measures of, and forces on, supply and demand. One big one is the Treasury International Capital data that show monthly changes in foreign holdings of U.S. Treasuries (the next batch, for April, is out Monday). It might as well be a Rorschach test, given the variety of interpretations, but this latest one showing an historic drop at the peak of the pandemic-driven market turmoil looked menacing.

Also alarming was this balance of payments data from Japan, which holds the largest share of U.S. Treasuries outside the country. Investors from the country dumped a record amount in April, turning to higher-yielding Italian and Australian bonds. On the other hand, the timing around the end of the Japanese fiscal year suggests these flows "could be more idiosyncratic than beginning a new trend," said BMO Capital Markets strategist Jon Hill. And the drop in dollar-yen hedging costs over the past couple of months may also help support Japanese demand. Moreover, the pile of U.S. government debt the Fed holds in custody for international accounts has grown steadily since mid-April. The Fed's efforts to head off a dollar-supply shortage -- via swap lines and repos -- have been successful in preventing any heavier liquidation of Treasury holdings, which means "central banks are now in a position where they are able to restore their former securities positions," according to Jefferies economists Tom Simons and Aneta Markowska.  In the meantime, the debate over whether Treasuries are still a destination of choice for international investors is largely moot. It's all about the Fed. Follow Bloomberg's Emily Barrett on Twitter at @notthatECB Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. A Japanese edition of Five Things is coming soon.世界のビジネスニュースが届くニュースレターへの登録はこちら。日本時間の朝に配信します。 |

Post a Comment