Powell testimony due, North Korea blows up liaison office, and Trump weighs $1 trillion infrastructure bill. Fed upFederal Reserve Chairman Jerome Powell starts his semi-annual testimony before the Senate Banking Committee at 10:00 a.m. Eastern Time this morning. His remarks are widely expected to echo his downbeat assessment of the economy at the post-policy decision press conference last week. Policy makers at the bank are focused on risks to the financial sector, as well as unemployment, with its crisis response widening yesterday to include the purchase of individual corporate bonds. Blown upNorth Korea blew up an inter-Korean liaison office on its side of the border on the divided peninsula in what is the most serious provocation by the isolated state in years. The move, which seems designed to draw maximum global attention without risking an outbreak of further hostilities, comes only days after Kim Jong Un's younger sister, Kim Yo Jung, issued a statement saying it was "high time" to break ties with South Korea. There was also tension at another regional long-running border dispute with India saying three of its soldiers died in a clash with Chinese troops at a section of their unmarked frontier in the Himalayas. Spending upThe Trump administration is preparing a $1 trillion infrastructure spending proposal as part of its stimulus package to revive growth in the U.S., according to people familiar with the plan. Investment of this type has long been a stated priority for President Donald Trump and with the current infrastructure funding law due for renewal on Sept. 30 -- just weeks before the election -- a major package would give him a policy success to talk up. Markets upGlobal equities are rising again today as investors react to news of yet-more government stimulus and central bank support. Overnight the MSCI Asia Pacific Index surged 3.2% while Japan's Topix index closed 4.1% higher. In Europe, the Stoxx 600 Index had gained 2.3% by 5:50 a.m. with every industry sector in the green. S&P 500 futures pointed to a strong open, the 10-year Treasury yield was at 0.741% and oil rose. Coming up...U.S. retail sales are forecast to jump more than 8% in May, following the 16.4% crash in April when the numbers are published at 8:30 a.m. Industrial and manufacturing production for the month, released at 9:15 a.m., are also likely to show a rebound. While Powell's testimony to Congress will be the focus today, Fed Vice Chair Richard Clarida is also speaking later. President Trump is scheduled to sign an executive order on policing. Oracle Corp. and Groupon Inc. are among the companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThere are a lot of Galaxy Brain takes out there about this stock market, and why it's rallied so hard and so seemingly unputdownable. I've written about it several times in the past, but increasingly it seems to come down to three simple factors.

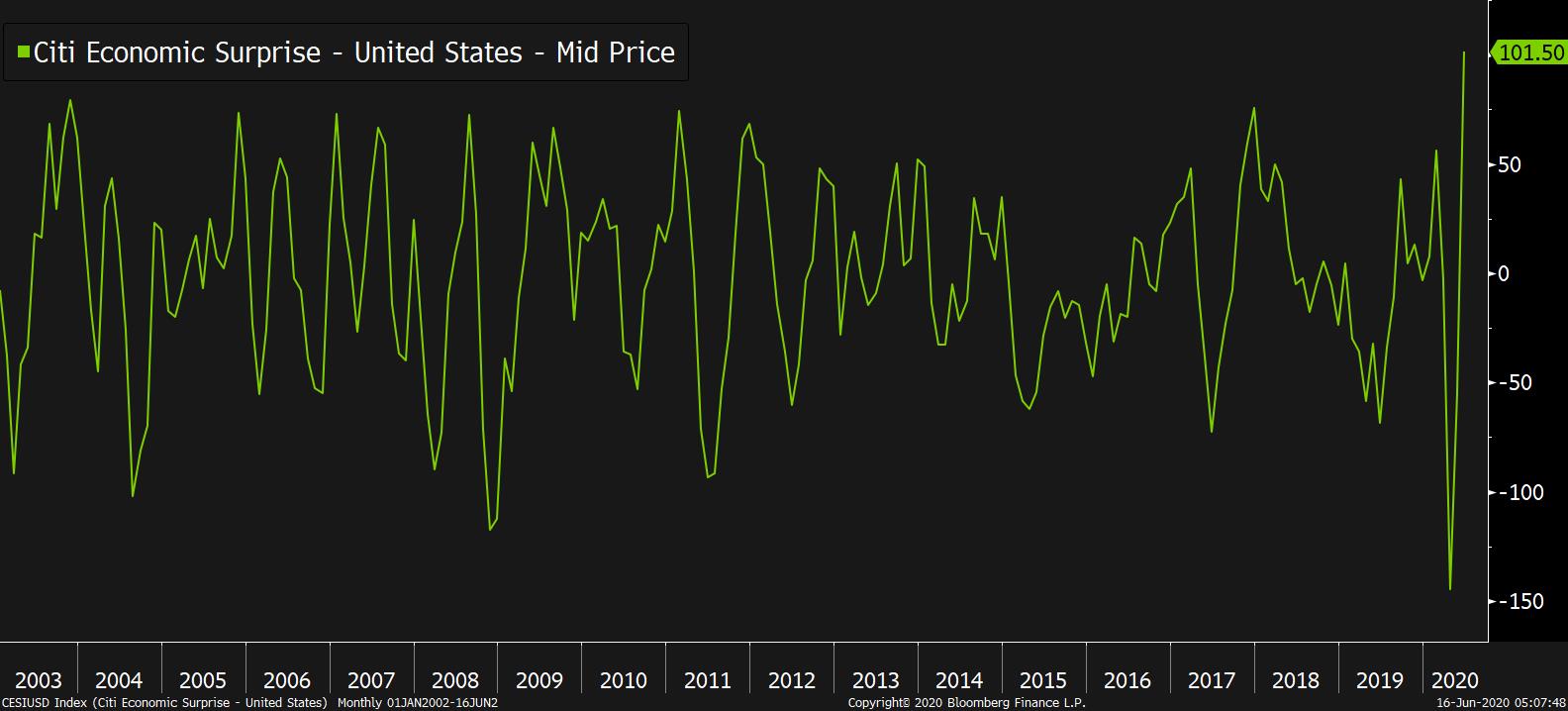

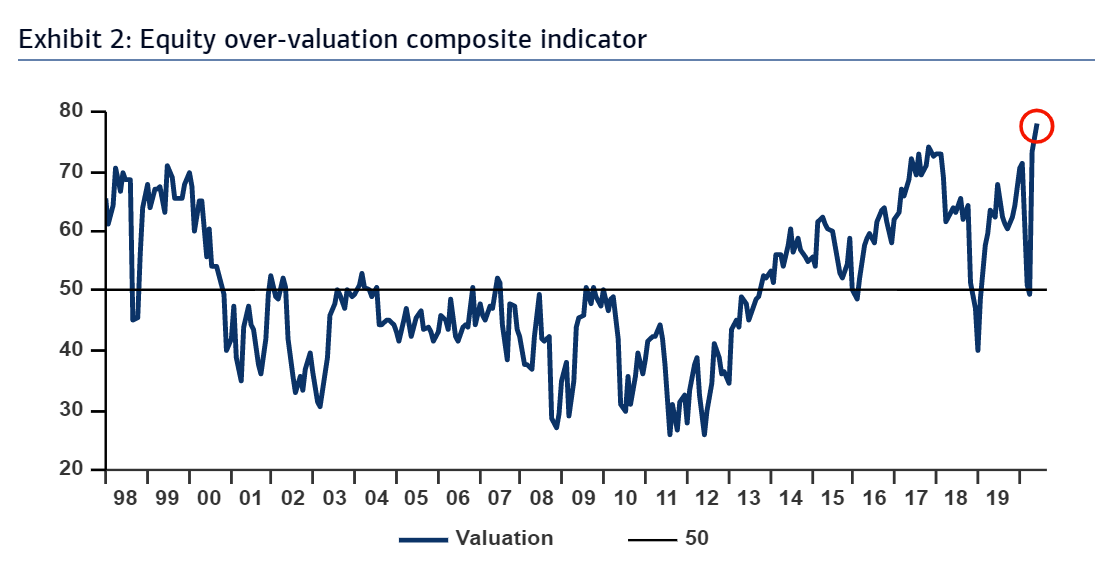

The first is that the real economy has improved A LOT since late March. This makes people uncomfortable, because the economy is objectively still so awful and there are still so many risks out there. But nonetheless, the arrow is up and to the right, and you can see that fact in dozens of different datapoints, whether it's flight activity, housing, used car prices, restaurant activity, gas consumption, job listings and on and on. The second factor is that in addition to the rebound in activity, just from a timing perspective, it's clearly caught people by surprise in terms of how soon it's happened. The Citi U.S. Economic Surprise Index, which measures the degree to which economic data is coming in relative to economist expectations, just hit its highest level in history.  And finally, investors have been caught incredibly offsides throughout this rally, coming into it with an extreme level of underpositioning and skepticism that hasn't really let up. The new Bank of America fund manager survey is out, and it's chock-full of facts speaking to the skepticism of professional investors. A record 78% of investors think stocks are overpriced (see chart below). Only 18% see a V-shaped recovery. Only 37% are even willing to call this a bull market as opposed to a bear market rally.

In the areas that have run up really recently like banks, EM and small caps, Bank of America says hedge funds "violently covered tactical short positions" and investors overall are still holding a lot of cash. Combine the sudden turn in the economic direction along with the fact that everyone was extremely negatively positioned, and there you go, that explains a lot.

Joe Weisenthal is an editor at Bloomberg.

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment