| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. More steps to ease lockdowns are on the way, there's fears of a second wave in the U.S. and further intense scrutiny of two bruised German companies. Here's what's moving markets. More Easing In Europe, the U.K. is set to outline the next steps on easing its lockdown measures this week, widely expected to include a relaxation of the 2-meter distancing rules and more guidance on masks and perspex screens in shops. At the same time, Chancellor of the Exchequer Rishi Sunak is preparing to announce more stimulus measures next month, potentially including an emergency cut to value-added tax on goods. Infection rates in Germany rose with outbreaks in meat facilities and refugee centers, cases in Spain are increasing as its government plans to end its state of emergency and French President Emmanuel Macron's popularity has sunk further below that of his prime minister. Second Wave The number of Covid-19 cases in the U.S. is continuing to gain, with Florida seeing the biggest daily increase since the start of the pandemic, providing more fuel to those worried that a full-blown second wave could emerge. President Donald Trump's rally in Tulsa, Oklahoma is unlikely to have soothed those concerns, with a smaller-than-anticipated crowd mostly eschewing wearing masks and hearing the president claim that the rise in cases was down to more testing. Democratic rival Joe Biden has started building his presidential transition team and raised more money than Trump and the GOP for the first time in May as both teams ramp up their spending. Lufthansa and Wirecard Two stories will dominate Germany's corporate news this week. National carrier Deutsche Lufthansa AG faces the risk that its bailout will not be approved by shareholders, raising the risk it will collapse into insolvency. This comes after billionaire Heinz Hermann Thiele built up a position as Lufthansa's biggest shareholder and expressed dissatisfaction at the terms of the government's package. Competing for attention will be Wirecard AG following its spectacular fall at the end last week, with plenty more questions to come for former German business darling, which has now said that the missing $2.1 billion which caused its shares to plunge probably doesn't exist. Yields Global bond markets may be set for some major changes. The next big trend in global central banking could be yield curve control, by which banks will use bond purchases to pin down yields on certain maturities. It had been considered an extreme measure but Australia's central bank has started a form of it and now speculation is rife that the Federal Reserve and Bank of England could follow suit. Europe's bond market could also be set for a tectonic shift whereby the European Union itself becomes a major issuer in a market currently dominated by individual countries. Bond traders, meanwhile, are turning to alternative data like social distancing and hospitalizations for clues on the rate path. Coming Up… Stocks in Asia kicked off the week in a mixed fashion and the same can be said for European and U.S. futures, with the former trending lower and the latter higher as investors continue to weigh infection numbers against reopening economies. The European Union and China will hold talks on their future relationship, the U.S. and Russia will meet to discuss arms control and look for any reaction to the details now released on China's proposed Hong Kong security law. Meanwhile, it will be a relatively quiet day for data and earnings. What We've Been Reading This is what's caught our eye over the weekend. - JPMorgan says get more selective in the second half.

- The stock rally is feeding inequality.

- Racial justice takes center stage in the suburbs.

- Singer Akon is building his a city in Senegal.

- Covid-19 does not mean the end of cities.

- Kurt Cobain's MTV Unplugged guitar sells for $6 million.

- What to watch now in Europe's travel stocks and banks.

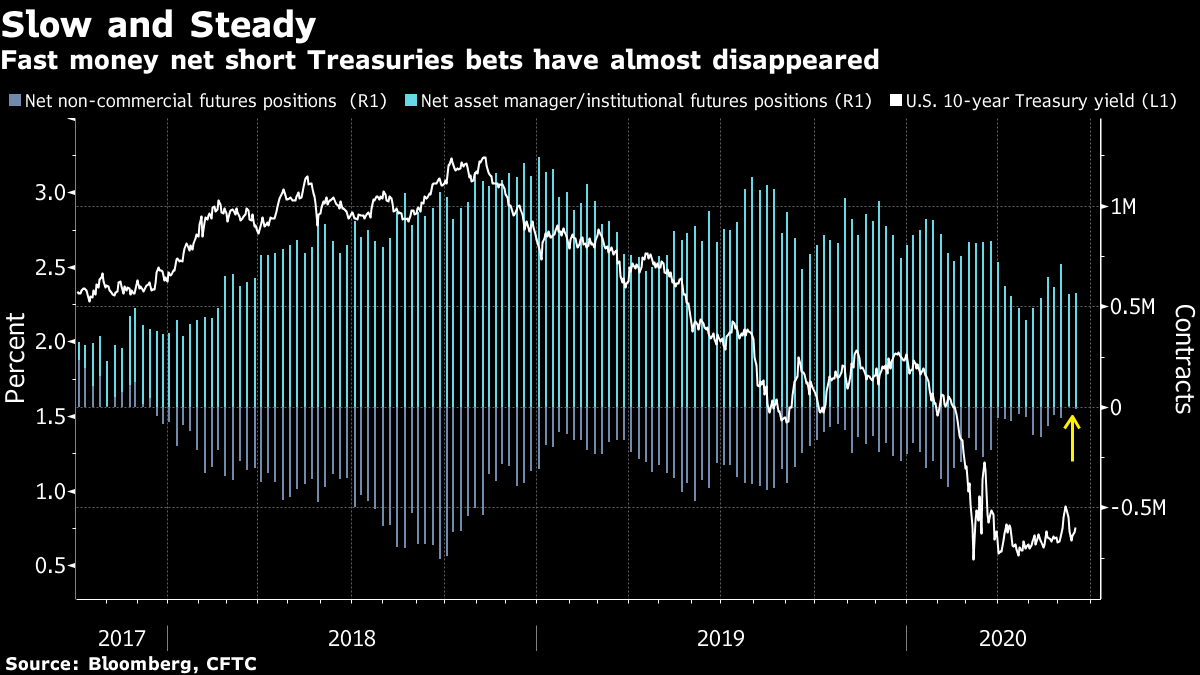

And finally, here's what Cormac Mullen is interested in this morning The battle between speculators and longer-term investors over the fate of U.S. Treasuries is all but over, at least according to the futures market. With bearish hedge fund bets almost a mirror image of their institutional counterparts' bullish wagers for much of the last two-and-a-half years, fast money positions are now almost completely neutral, according to the latest data from the Commodity Futures Trading Commission. Benchmark Treasury yields have collapsed to around the 0.7% level from a then seven-year high of 3.2% in 2018 — when the difference in positioning between the two types of investors reached a peak. Still, it's noticeable that while hedge funds have quickly taken on board one of the first rules of markets — don't fight the Fed — they haven't turned net bullish Treasuries. Despite central bank bond purchases and concerns over the continuing impact of the coronavirus, expectations likely remain high among the fast money contingent that the U.S. economy will normalize and yields could soon push higher.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment