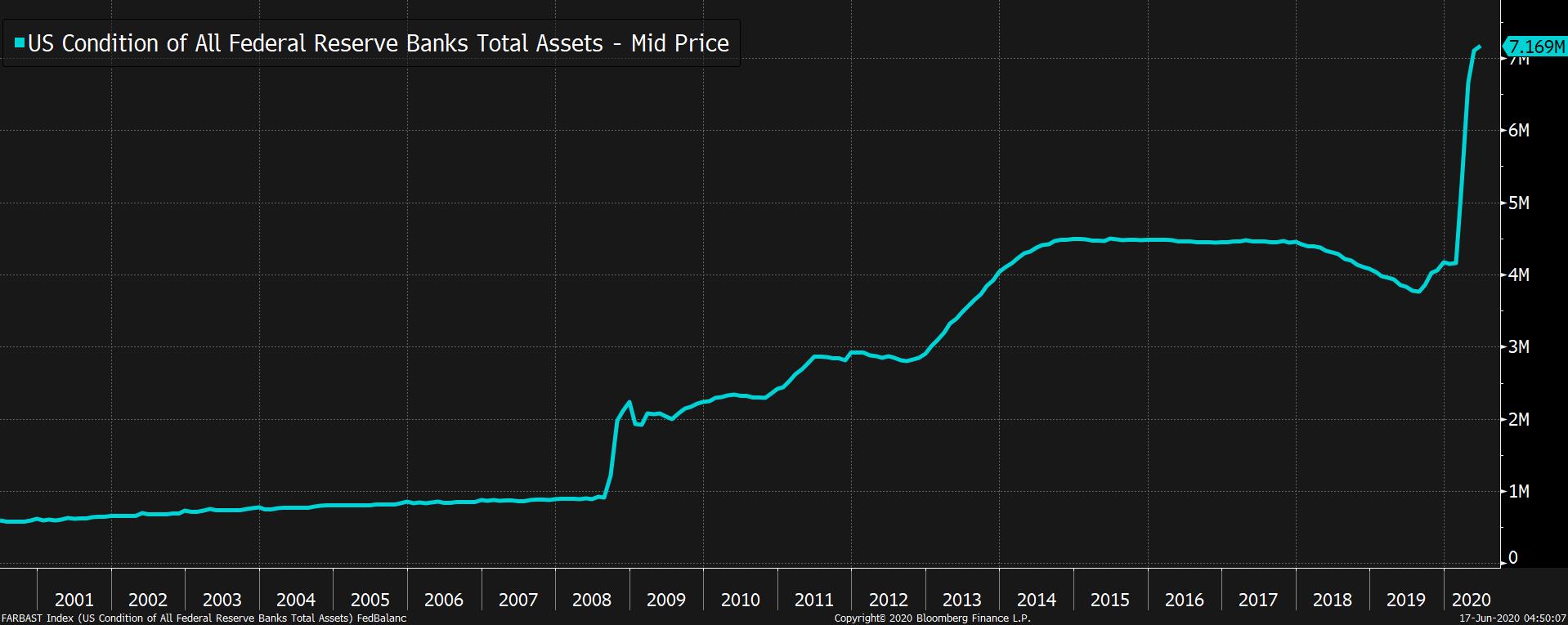

Beijing escalates measures to tackle outbreak, Powell's second day of testimony, and U.S. plans a reset of its WTO tariff commitments. Cluster upThe number of cases rose to 137 in the new coronavirus outbreak in Beijing, with infections linked to the cluster spreading far from the city. Authorities there added to yesterday's school closure order with hundreds of flight cancellations today, disrupting what was a strong recovery in the country's domestic travel market. Elsewhere, the outbreak continues to rage across South America, with Brazil posting a record 34,918 new cases yesterday. In the U.S. cases rose in Florida while hospitalizations in Texas hit a record as concerns remain that some states may have reopened too quickly. Powell Part IIFed Chairman Jerome Powell is back in Congress today, this time in front of the House Financial Services Panel from 12:00 p.m. In his testimony yesterday he gave a cautious outlook for the U.S. economy, saying that even a significant improvement in the employment situation may leave the labor market "well short" of levels seen before the pandemic shutdown. Those sentiments were echoed by Federal Reserve Vice Chairman Richard Clarida in a separate speech yesterday in which he warned that the economic damage may threaten the stability of inflation expectations. Trade resetAlso in Washington today, President Donald Trump's trade chief Robert Lighthizer will tell the Senate Finance Committee that the time has come for the U.S. to renegotiate its fundamental tariff commitment at the World Trade Organization, according to his prepared remarks. He is also due to address the House Ways and Means Committee where he will give an update on the White House's China-focused trade policy. While data shows that trade with the world's second largest economy has fallen, the surplus of other nations such as Vietnam and Mexico has surged. Speaking of international relations, the U.S. government sued to block the publication of former National Security Advisor John Bolton's tell-all book. Markets mixedThe continuing battle among investors between concerns over increases in virus cases and optimism about stimulus measures is not showing a clear winner yet today. Overnight the MSCI Asia Pacific Index added 0.1% while Japan's Topix index closed 0.4% lower. In Europe, the Stoxx 600 Index was 0.2% higher by 5:50 a.m. with investors favoring more defensive sectors. S&P 500 futures were broadly unchanged, the 10-year Treasury yield was at 0.743% and oil was lower. Coming up...U.S. building permits and housing starts data for May, published at 8:30 a.m., are expected to show a strong rebound from April's dismal data as construction work restarted. Canadian CPI for May is also at that time. Crude traders will be keeping an eye on inventories data at 10:30 a.m. after last week's rise to record high. As well as Powell, we will also hear from Federal Reserve Bank of Cleveland President Loretta Mester later. Earnings today include ABM Industries Inc. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningOver the years, you've certainly seen this chart hundreds of times. It's the size of the Federal Reserve's balance sheet and it's very popular among various knaves and chart criminals, who cite it as evidence that our financial markets have become hopelessly distorted.  However the usefulness of knowing this singular numbers (which currently stands at a bit over $7.1 trillion) has always been in doubt, since it really reveals very little about the actual stance of monetary policy. That's never been more clear than it is right now.

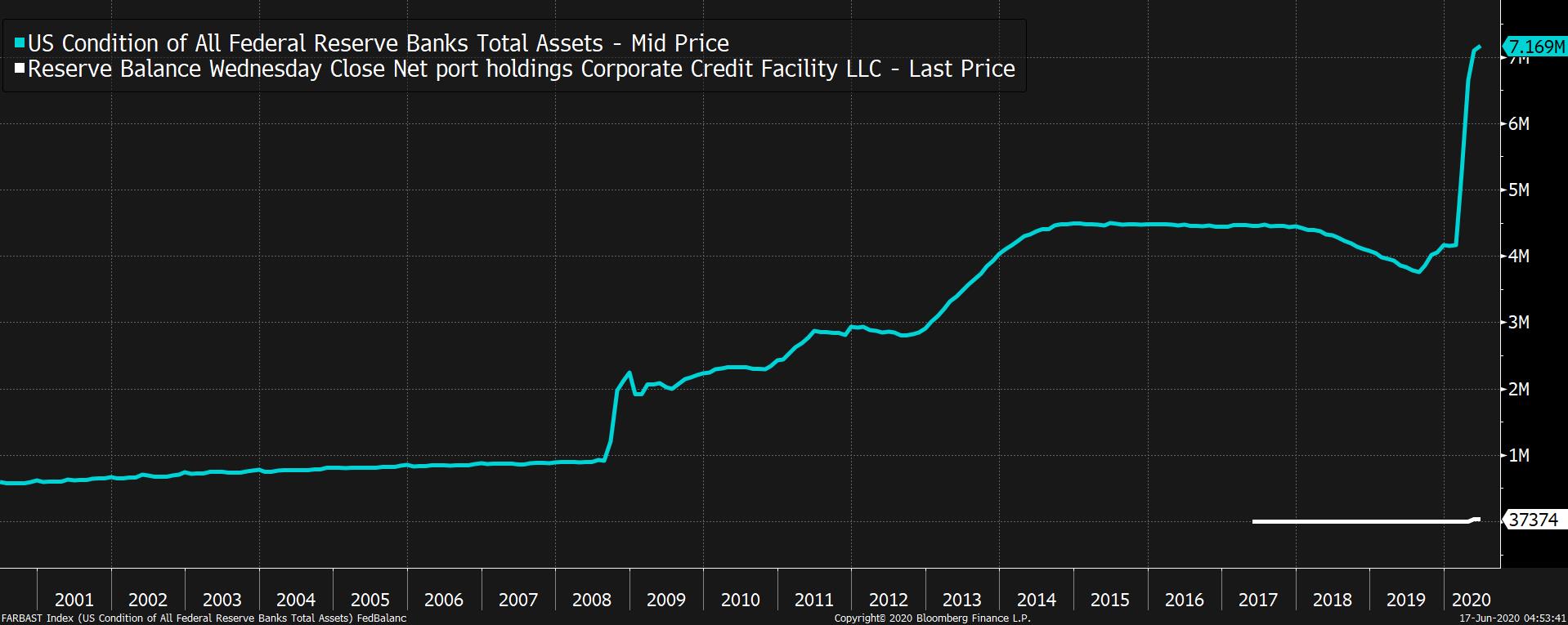

Here's why. This is a chart of the Fed Balance Sheet, and there's also a line denoting how much money it's spent on backstopping the corporate debt market, in white.  As you can see, the Fed's corporate credit holdings are a mere rounding error relative to the total balance sheet, and actually even that number is inflated, since it includes money the Fed got from Treasury to capitalize the bond buying facility as opposed to actual asset purchases.

But what's important is that even though the amount of corporate bonds the Fed has bought (primarily through ETFs at this point) is nominal, the Fed has helped catalyze a massive boom in credit issuance. In 2020, corporations have already issued over $1 trillion in investment grade debt, which is by far the fastest pace ever. By establishing itself as a "lender of last resort" in the corporate credit space, other players have rushed in and done the Fed's job for it. If you know there's a lender of last resort, you don't need the lender of last resort. (The ECB is still the GOAT at this, with Mario Draghi having established a program to backstop sovereign debt in 2012 that ended the euro crisis without ever having spent a single euro cent).

So with such a huge disconnect between the number of dollars spent to execute a policy, and the massive impact, we can recognize that there's basically no meaningful link between the size of the balance sheet and the stance of monetary policy. So now we can all stop using that chart to make a point.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment