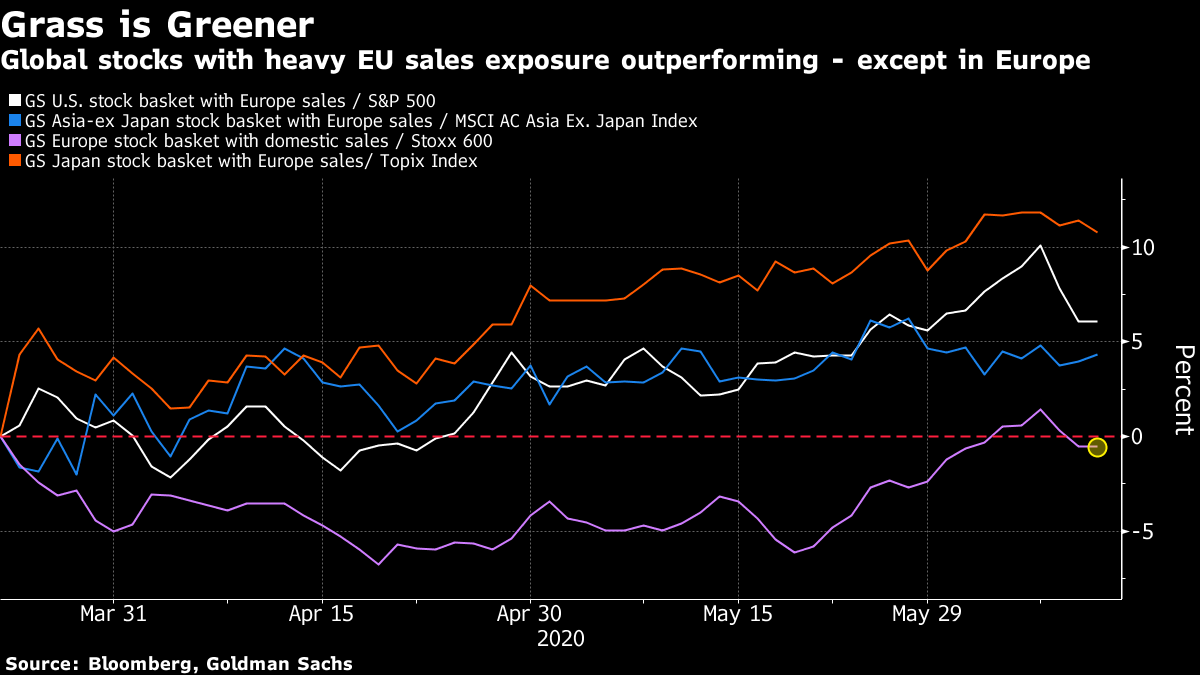

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The Fed sought to reassure, the U.K. is relaxing restrictions further and a big merger in takeout delivery. Here's what's moving markets. 2022 The Federal Reserve gave assurances on its asset-purchase program and said rates are likely to remain near-zero through to 2022 as policymakers work to support the economy's recovery from the Covid-19 battering. Treasuries bulls were energized by the policy decision, gold futures got a boost and traders said the pledges should be positive for equities and credit, too. Treasury Secretary Steve Mnuchin has also backed more stimulus, specifically targeting the businesses struggling to reopen in travel, retail and leisure industries. Fed Chairman Jerome Powell also emphasized inequality in his comments after the decision, expressing concern at the disproportionate job losses for women, black and Latino workers Support Bubble The U.K. further relaxed its lockdown restrictions, saying single parents and adults living alone can now mix in support "bubbles" from this weekend onward. As those rules are relaxed, however, the government continues to face criticism over its strategy and has been urged to address the problems with testing. That, plus the impasse over Brexit negotiations has worsened with envoys rejecting demands to amend chief negotiator Michel Barnier's mandate and offer the U.K. more concessions. Germany has also told citizens to avoid non-essential travel to the U.K. while also extending its travel warning for beyond Europe to August and France is entering into a four-month transition phase as it works to get things back to normal. Second Wave A resurgence in local virus infection rates is hitting U.S. states that have recently reopened, causing concern about a potential second wave as the total number of U.S. cases topped 2 million. This comes after the top U.S. infectious disease official, Anthony Fauci, said the pandemic is far from over. President Donald Trump, meanwhile, is pressing ahead with campaign plans and has spoken with Senate Majority Leader Mitch McConnell to discuss the Republicans at risk in November. Trump will be in Dallas on Thursday where he will announce a program for the country's "holistic revitalization and recovery" before heading to a fundraiser. His Democratic challenger Joe Biden is working to show he is an ally to black voters protesting police brutality, though he has as yet been unwilling to back the kind of policies being demanded. Delivery Deal Businesses that center on delivering goods that customers order online have been among the relative winners during the pandemic and two of the companies exemplifying this trend have made moves to demonstrate confidence that these trends will continue. Just Eat Takeaway.com NV has agreed an all-stock deal to buy GrubHub Inc. valued at $7.3 billion to expand into the U.S. takeout delivery market as orders on its platform have surged with lockdowns preventing people from eating in restaurants. And Ocado Group Plc, the U.K. grocery delivery firm that has seen a similar bounce in order volumes from customers unable to get to the supermarket, is raising $1.3 billion to ensure it is able to meet demand and to continue expanding. Coming Up… Asian stocks fell and European and U.S. stock futures are trending lower after a sobering update from the Fed on the economic outlook, undercutting the hopes for a V-shaped recovery that have propelled the rally in equities. Euro-area finance ministers will meet to discuss the bloc's virus rescue plans and the data day will be topped by Italian industrial production and U.S. jobless claims. Watch also for any reaction to European Central Bank policymakers kicking off the debate on whether any more stimulus will be needed or whether what the bank has already done is enough. Citigroup Inc., at least, thinks the ECB's program is falling short. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Investor optimism toward a European recovery from the coronavirus outbreak is on the rise across the world with one seeming exception — Europe itself. Baskets of stocks with the biggest sales exposure to Europe from the U.S., Japan and elsewhere in Asia have been outperforming regional benchmarks since the March equity lows, according to indexes constructed by Goldman Sachs Group Inc. Meanwhile, the European equivalent — comprising of stocks with mostly domestic sales — is slightly down against the Stoxx 600. There may be some sectoral distortion at play — I don't have full access to the basket constituents — and a foreign exchange effect. But the trend is an interesting one for Europe bulls to keep an eye on. It could suggest European investors don't believe the hype surrounding the region's recovery — they are likely to be closer to the ground, after all. A combination of European Central Bank support, progress toward joint fiscal support programs and the ongoing reopening of economies has helped push Europe's stocks and the euro higher in recent weeks.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment