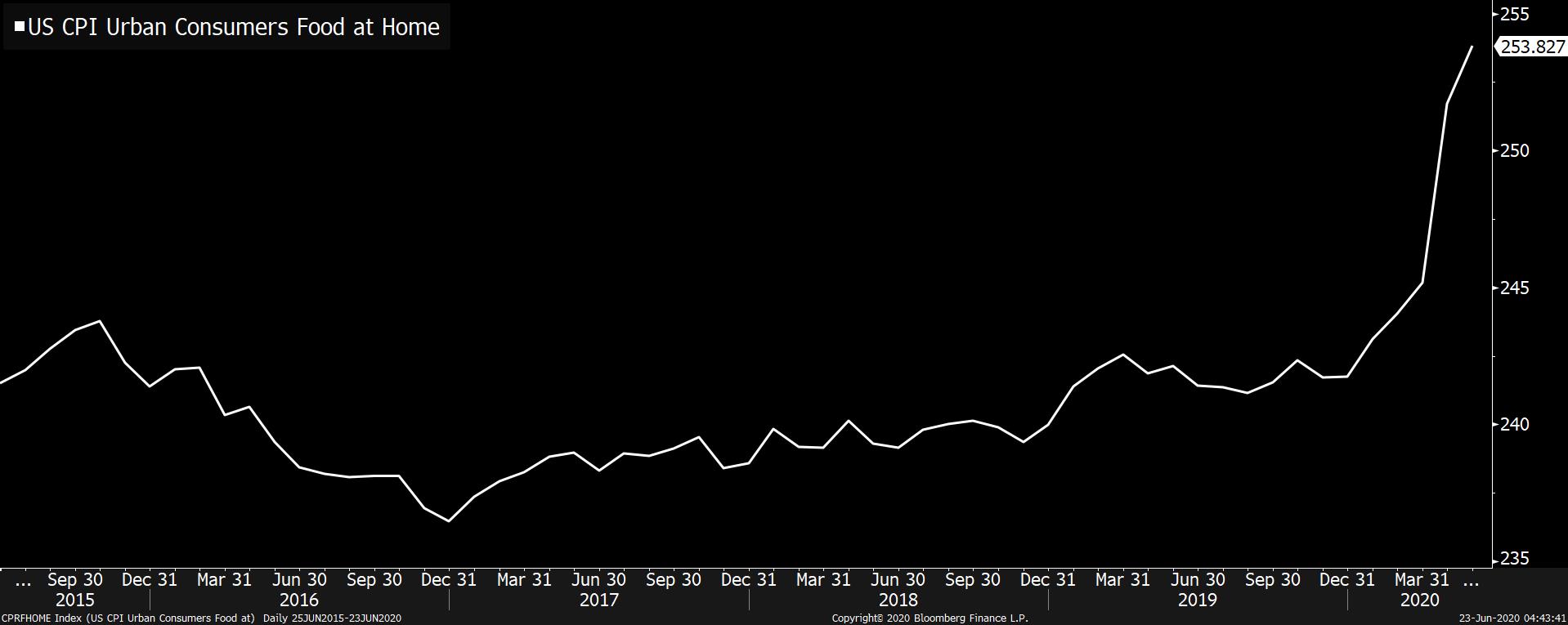

China-U.S. trade deal is "fully intact," it's PMI day, and the virus latest. Bump in the nightU.S. equity futures and Treasury yields briefly plunged after White House adviser Peter Navarro seemed to suggest in an interview on Fox News that the U.S.-China trade deal was over. Markets quickly recovered after President Donald Trump tweeted that the agreement was "fully intact" and Navarro said his comments were taken "wildly out of context." Michael Every, global strategist at Rabobank, wrote in a note that the whipsawed markets were a taste of things to come as he sees no way that China can stick to the terms of the agreement. Slow recovery Purchasing Managers Indexes in Europe pointed to a long, slow recovery in economic activity in the wake of the pandemic shutdown. France produced a notable performance with composite PMI rising to 51.3, passing the 50 level than indicates an expansion from the previous month, well ahead of economist forecasts. A similar reading for Germany came in at 45.8 while in the U.K. it was at 47.6, led by a recovery in manufacturing. There was some hope in the latest World Trade Organization outlook which said that government responses mean their worst-case scenario will likely be avoided. PMIs for the U.S. economy are published at 9:45 a.m. Eastern Time. Pushing on a stringSpeaking of government responses, companies in Europe have taken up less than 15% of the funds made available as loan guarantees by law makers, meaning more than 2 trillion euros ($2.3 trillion) remains untouched as economies continue to reopen. The U.K. government is due to further ease restrictions with Prime Minister Boris Johnson to make an announcement of whether to reduce to guidelines on social distancing. In the U.S. new infections in Florida rose to another high and Texas Governor Greg Abbott said contagion was accelerating at "an unacceptable rate." Markets riseAfter the earlier Navarro kerfuffle, global equity investors quickly got back to the job of buying stocks. Overnight, the MSCI Asia Pacific Index added 0.7% while Japan's Topix index closed 0.5% higher. In Europe better than forecast PMI data helped push the Stoxx 600 Index to a 1.3% gain by 5:50 a.m. It's a similar story with S&P 500 futures which were firmly in the green, the 10-year Treasury yield was at 0.718% and oil was over $41 a barrel. Coming up...U.S. new home sales data for May and the June Richmond Fed Manufacturing Index are both at 10:00 a.m. The focus in Congress today is on coronavirus, with Anthony Fauci to testify in the House and the Senate to hold a hearing on China's culpability for the pandemic. President Trump will be in Arizona, Joe Biden holds an event with former President Barack Obama, and John Bolton's book is published. There are primaries in Kentucky, New York and North Carolina. The Bloomberg Invest Global summit continues with speakers including Treasury Secretary Steven Mnuchin. MSCI will announce the results of its 2020 Market Classification Review. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIf you ever point out that inflation in the United States has been mild, someone is sure to respond with: "but have you been to the grocery store lately!?" I've been hearing people say this line for years in a variety of economic conditions, but lately it's true that there was a rise in food prices. Since the start of the year, food prices are up about 5%.

Still, all you have to do is read this article, and you'll understand that it's got nothing to do with the Fed or any of the standard culprits, and everything to do with the fact that thanks to the virus, the food supply chain is messed up in numerous ways. For example, the shutting of ethanol plants led to a decline in carbon dioxide supplies, which hit food companies that depend on it for refrigeration, forcing them to source it from new suppliers, which raised their costs. Meanwhile, port disruptions in China forced companies like Kraft Heinz to source apple juice from Chile to make Capri Sun. The list of disruptions goes on and on and they all add up to higher prices. Another thing is that the surge in drinking at home (because bars are closed) led to demand strains for aluminum cans. Anyway, with all that's going on, it would be weird if prices didn't go up, even in some fantasy hard-money scenario where we were paying in gold. Sourcing food got harder during the worst of the crisis. It's the market at work.  Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment