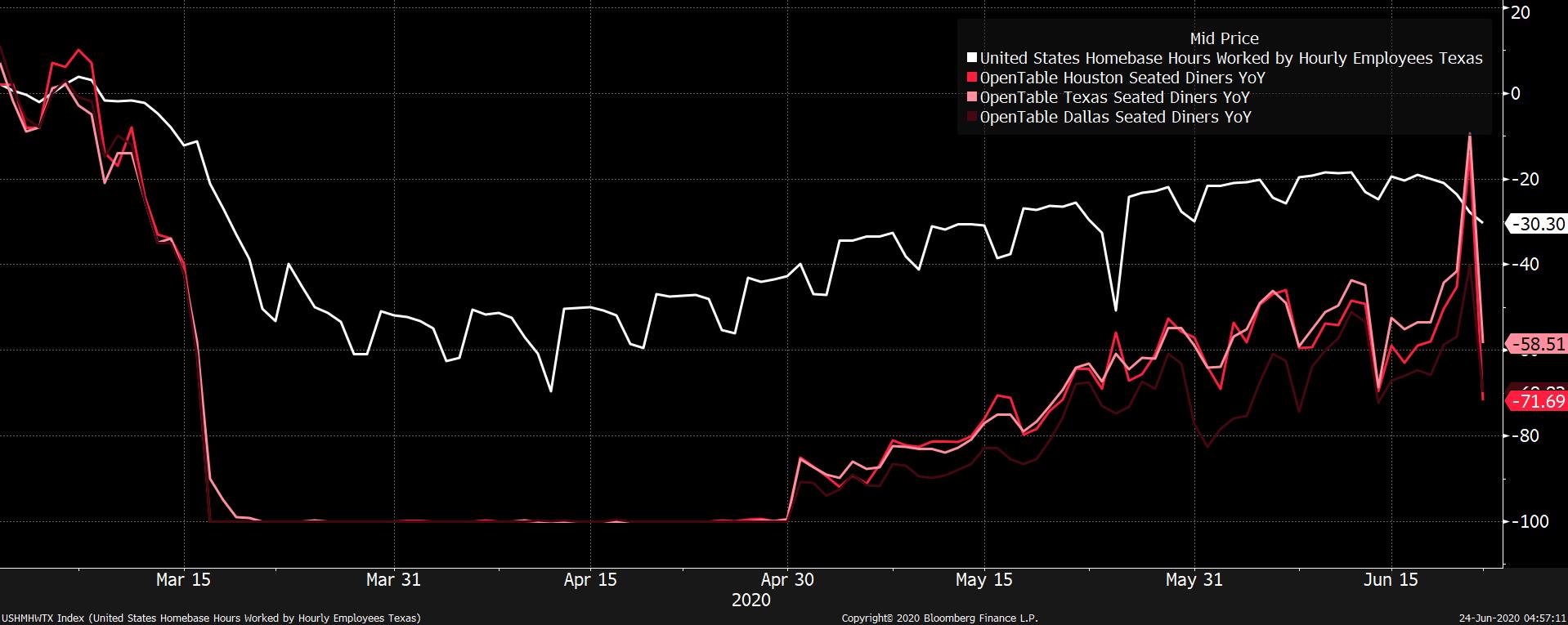

Virus cases surge across the U.S., Europe targeted by new tariffs, and the economic future is unclear as ever. ReversalCoronavirus cases are surging in Texas, Florida, Arizona and in California with city and state officials in hot spots starting to consider slowing or reversing reopening plans. Rather than peaking and tapering, as was seen in Italy and elsewhere, new case numbers in the U.S. are holding at a dauntingly high plateau. Outside America, Germany has also seen rising infections due to local outbreaks, Israel imposed targeted lockdowns while China said the virus has been contained in Beijing. New tariffsRelations between the U.S. and Europe may become more strained over the summer as the Trump administration weighs new tariffs on $3.1 billion of exports from France, Germany, Spain and the U.K. The move is part of the U.S. response to the most recent ruling in the very long-running fight at the World Trade Organization on aircraft subsidies. EU Trade Commissioner Phil Hogan recently told ministers in the bloc that the U.S. had stepped back from settlement talks, adding that the EU would have little choice but to impose its own sanctions in the absence of further discussions. Outlook unclearThere were some signs of optimism among German businesses in the latest Ifo Institute survey of expectations, which rose for a second month. The IMF may rain on those hopes when it publishes updated 2020 economic forecasts at 9:00 a.m. Eastern Time for the first time since April. There were also signs of the longer-term economic damage that has been done in a survey of U.K. employers that showed that a quarter of furloughed workers are likely to lose their jobs when government support ends in September. Markets dropIncreasing trade tensions and the persistence of the coronavirus outbreak in the U.S. are dashing investor optimism. Overnight the MSCI Asia Pacific Index slipped 0.2% while Japan's Topix index closed down 0.4%. In Europe, the new tariff threat helped push the Stoxx 600 Index 1.8% lower by 5:50 a.m. S&P 500 futures pointed to losses at the open, the 10-year Treasury yield was at 0.704% and oil dropped below $40 a barrel. Coming up...The April FHFA House Price Index is published at 9:00 a.m. There is another increase in stockpiles expected when the crude inventories report is released at 10:30 a.m. Chicago Fed President Charles Evans and St. Louis Fed President James Bullard both speak later. The Bloomberg Invest Global conference continues. Blackberry Ltd. reports earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningVirus cases are surging in several states, including Texas which just had its first 24 hours period of 5000 cases. Even in the absence of a newly imposed lockdown, there's a big question out there in terms of what this does to economic activity. After all, back in March, the economy started collapsing before leaders put in social-distancing mandates. So it's extremely important to watch the high frequency data coming out of the states. Here's a chart of dining activity in Houston, Dallas, and Texas overall (the various red lines) as measured by OpenTable, alongside an indicator from Homebase, a software company whose tools are used by small businesses to log employee hours (white line).  It's all noisy, but progress may be stalling out. The white line has rolled over to its lowest level since May, and the red lines, when you look through various spikes, are basically back to levels from a month ago. At the beginning of June, the market narrative was all about a sooner-than-expected and a more-robust-than-expected economic recovery. What we're seeing in Texas is, if nothing else, a suggestion that a clean V is going to be extremely hard to pull off. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment