| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here.

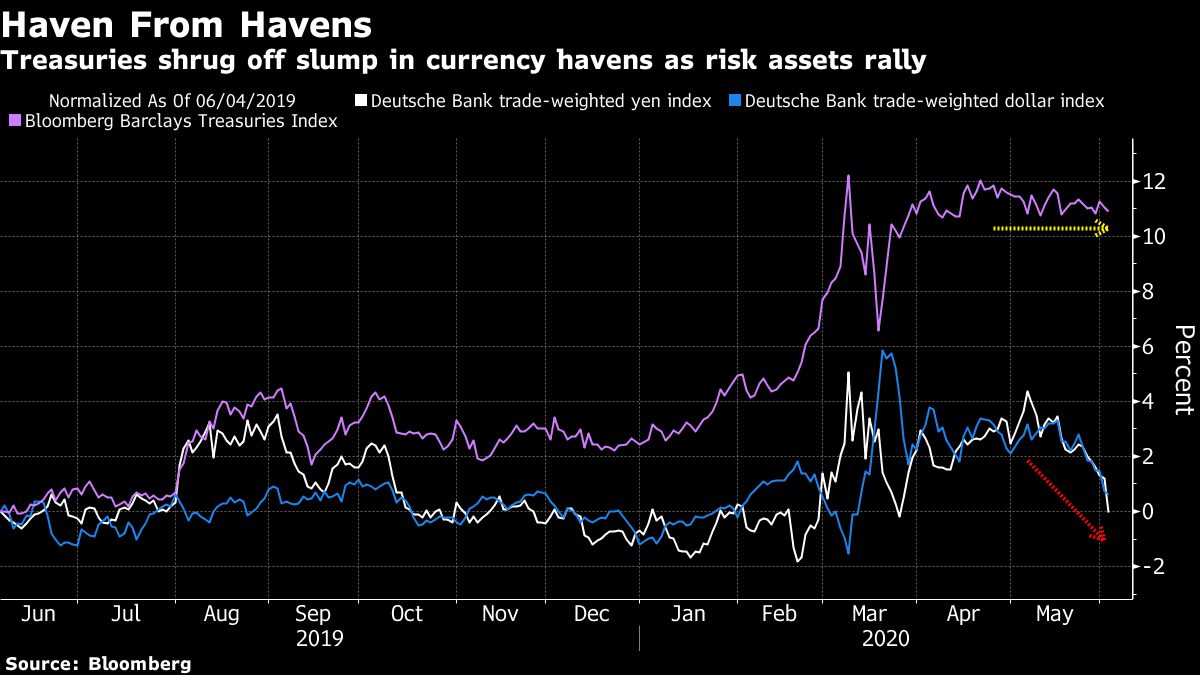

Good morning. Speculation about Brexit talks mounted, the White House's response to protesting was lambasted and Zoom Video Communications Inc. saw its sales surge. Here's what's moving markets. U.K. Compromise Talk The pound rose to its highest level in over a month against the dollar on speculation this week's Brexit talks might start to yield a hint of progress. Britain is expected to signal a willingness to compromise on issues like fisheries and trade rules, The Times of London reported, though U.K. Prime Minister Boris Johnson's spokesman dismissed such hopes as "wishful thinking by the EU." The deadline to extend a transition period beyond this year is at the end of the month. For now, sterling is on its longest winning streak since March amid broader weakness in the U.S. currency. Trump's Response Criticized President Donald Trump faces dwindling options to stem protesting in the U.S. after a backlash erupted over the government's violent dispersal of peaceful protests outside the White House. The move faced criticism from religious leaders, Democrats and some Republicans. Trump's response motivated Democratic donors to pour money into Joe Biden's presidential campaign, with the election now just five months away. Instagram was flooded with images of black squares in support of the demonstrations Tuesday. More Gains Likely Stocks continue to rebound as focus remains on the easing of lockdowns, despite the U.S. unrest and tense relations between Washington and Beijing. Credit Suisse, for one, reckons the economic bounce back post-virus might be quicker than is priced-in. Asia shares mostly rose overnight and European equities look set to gain for a third day Wednesday. Elsewhere, oil edged up as OPEC and its allies edge closer to a consensus on extending production cuts. Zoom's Revenue Surge All those lockdown Zoom beers and quizzes are paying off for the company's shareholders. Zoom Video Communications Inc.'s quarterly revenue surged about 170% as Covid-19 made the service part of the world's corporate and social infrastructure. It now attracts more than 300 million participants some days, up from 10 million in December. The firm expects fiscal year revenue of as much as $1.8 billion, up from a forecast of as much as $915 million in early March. The stock -- which is already up more than 200% in 2020 -- slipped. Coming Up… The German government aims to approve a draft paper today to take initial steps to lift travel restrictions, but not so positive was a delay to Berlin's attempt to broker a deal for added stimulus. In earnings, airline Wizz Air Holdings Plc and Magners cider-maker C&C Group Plc provide updates. Also watch shares of LVMH Moet Hennessy Louis Vuitton SE after a report saying the company's deal to buy luxury jewelry firm Tiffany & Co. is uncertain. On the data front, unemployment in the Eurozone is expected to have edged up in April, and the U.S. ADP employment number is likely to be ugly ahead of Friday's jobs report. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning It's not quite the dog that didn't bark in the night but one notable market haven is refusing to buckle amid the bullish risk sentiment -- Treasuries. Investors betting on a quick economic recovery from the coronavirus pandemic have pushed risk assets higher and havens such as the dollar and yen sharply lower in recent weeks, yet U.S. government bonds have barely moved. Deutsche Bank AG's trade-weighted indexes of the dollar and yen have each slumped about 2% in the last two weeks, while the Bloomberg Barclays Treasuries Index is little changed. Of course the unprecedented monetary stimulus from the Federal Reserve is helping to keep a lid on U.S. yields, and dulling signals emanating from the bond market. But many investors have concerns the risk rally is outpacing the global economic recovery and the lack of upward movement in Treasury yields would support that. It may be a delayed move -- 10-year U.S. yields look to be posting a trend of higher lows and threatened to break upward in early Asia trading Wednesday. And any sharp move higher in Treasury yields could quickly squash risk sentiment, if for example it suggested Fed stimulus was no longer working. But I still wonder if bullish traders would be happier chasing risk assets higher if this particular haven was a tad weaker.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment