| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Europe and the U.S. are discussing travel, there are warnings of a "massive outbreak" of the virus in Texas and gloomy predictions for stocks abound. Here's what's moving markets. Travel Restart The European Union and the U.S. are having talks on how to restart travel halted by the pandemic, even after reports that the EU is considering whether to exclude Americans from the initial reopening due to the sharp rise in cases in the country in recent weeks. Those negotiations come at the same time as the U.S. weighs slapping more tariffs on European goods including gin and trucks and as it deals with more demands from China which may deliver a setback to the trade deal between the two. And that's not to mention tensions with Germany over the U.S. withdrawing troops from the country, with Germany questioning a key NATO spending metric behind the U.S. decision. 'Massive Outbreak' The pandemic is spreading through some U.S. states, fueling concerns that a full-blown second wave is on the way and shaking investors. Texas Governor Greg Abbott said the state is seeing a "massive outbreak" and hospital systems are under serious strain. Cases jumped the most on record in Florida on Wednesday, yet Miami Mayor Francis Suarez said stay-at-home measures should be a "last resort." California Governor Gavin Newsom also stopped short of any form of new lockdown, instead urging residents to recommit to stopping the spread of the virus. Experts modeling the outbreak now expect 180,000 deaths in the U.S. by October, with a surge expected at the end of August and into September. U.K. Challenges The U.K., which is preparing for a significant easing of virus restrictions and considering relaxing quarantine requirements for travelers, has also been warned about the potential that a second wave could occur and to start planning for such a scenario now. Businesses are urging Chancellor of the Exchequer Rishi Sunak to ramp-up public spending to shore up the economy, though another headache beyond the virus is emerging for Prime Minister Boris Johnson around a "cash for favors" row involving the housing secretary. On the horizon too, is Brexit. Michel Barnier, the EU's chief negotiator, said the "moment of truth" will come when the bloc's leaders hold a summit in October and will want to see a draft agreement, despite little progress having been made so far. Portents of Gloom For some time, the question was whether the seemingly relentless rally in stocks would end. Now, it's less a question of when it will end than a rush to predict the downfall, evidenced by the violent swing in sentiment on Wednesday as stocks slumped on fears the Covid-19 crisis is far from under control. The drop provides more fuel for crash-obsessed traders furiously hedging their bets, while there is now a disparity between growth and value stocks that brings to mind the tech bubble. Currency traders, meanwhile, are looking even further out, starting to worry that the U.S. election in November won't produce a clear winner and lead instead to more intense uncertainty. Coming Up… Asian stocks and U.S. futures are both lower and European futures are trending marginally in the red as investors fret about the growing virus outbreaks in the U.S. derailing a recovery. Oil prices also slid. The European Central Bank will publish minutes from its latest meeting and policymakers Isabel Schnabel and Yves Mersch are due to speak, as is the Bank of England's Andy Haldane. Watch too for a reaction in shares of Deutsche Lufthansa AG after a top investor said he will vote for the airline's bailout package at a meeting on Thursday, all but assuring it will get over the line. What We've Been Reading This is what's caught our eye over the past 24 hours. - Retail traders piled into European stocks during the rally.

- A worst-case pandemic scenario is unfolding in Brazil.

- The City of London's slavery problem.

- Getting offices to be Covid-compliant.

- The world's best plastic banknote forger caught in Romania.

- Brands built on racism are finally facing a reckoning.

- Summer reading recommendations from black bookstore owners.

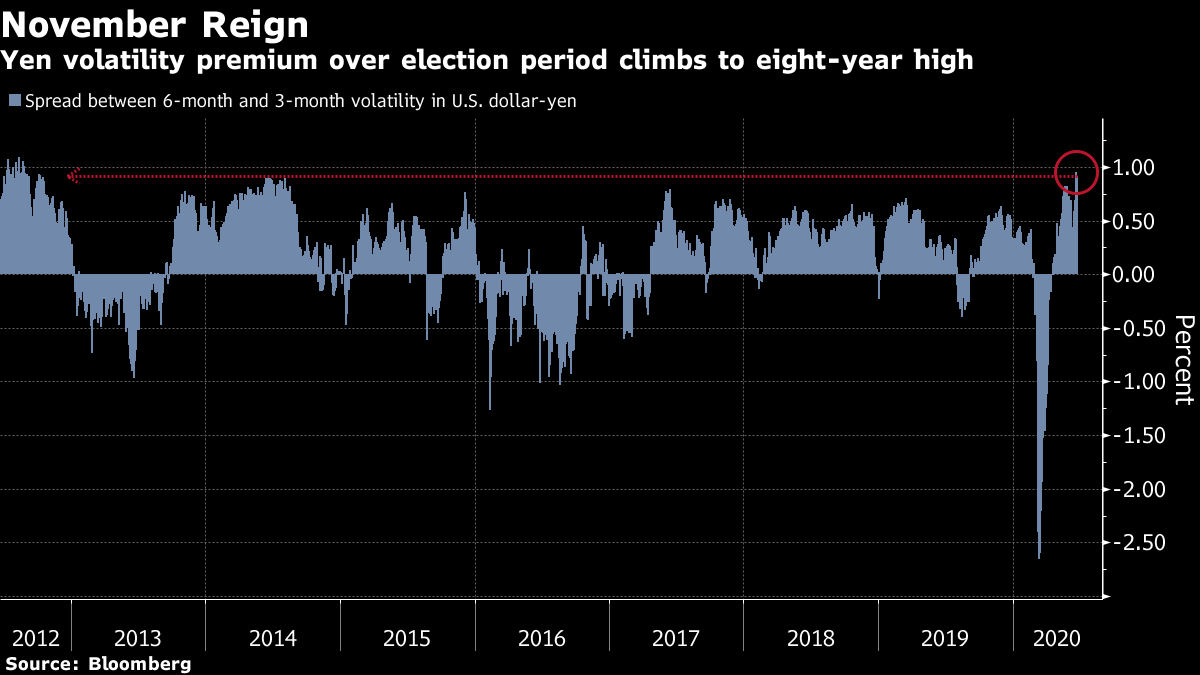

And finally, here's what Cormac Mullen is interested in this morning With the third quarter soon upon us, investors are likely to focus even more intently on the U.S. presidential election in November. Initial signs from the currency market suggest traders are bracing for protracted uncertainty. As my colleague Susanne Barton points out, a measure of expected swings in the traditional haven yen — the spread between six- and three-month implied volatilities to be precise — shows a steep jump around election day that persists into 2021. That contrasts with the run-up to the 2016 election, when gauges of turmoil reflected only a temporary minor uptick in volatility. One fear of course is that the election produces no clear winner, and leads to recounts and court challenges. Another is the unknown impact of increased postal voting due to the coronavirus, and how that might delay results. There is the import and timing of other election results — such as who will get control of the Senate. And there may be uncertainty over any transfer of power, should one be required. All this and more will occupy traders minds — and pricing — as November nears.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment