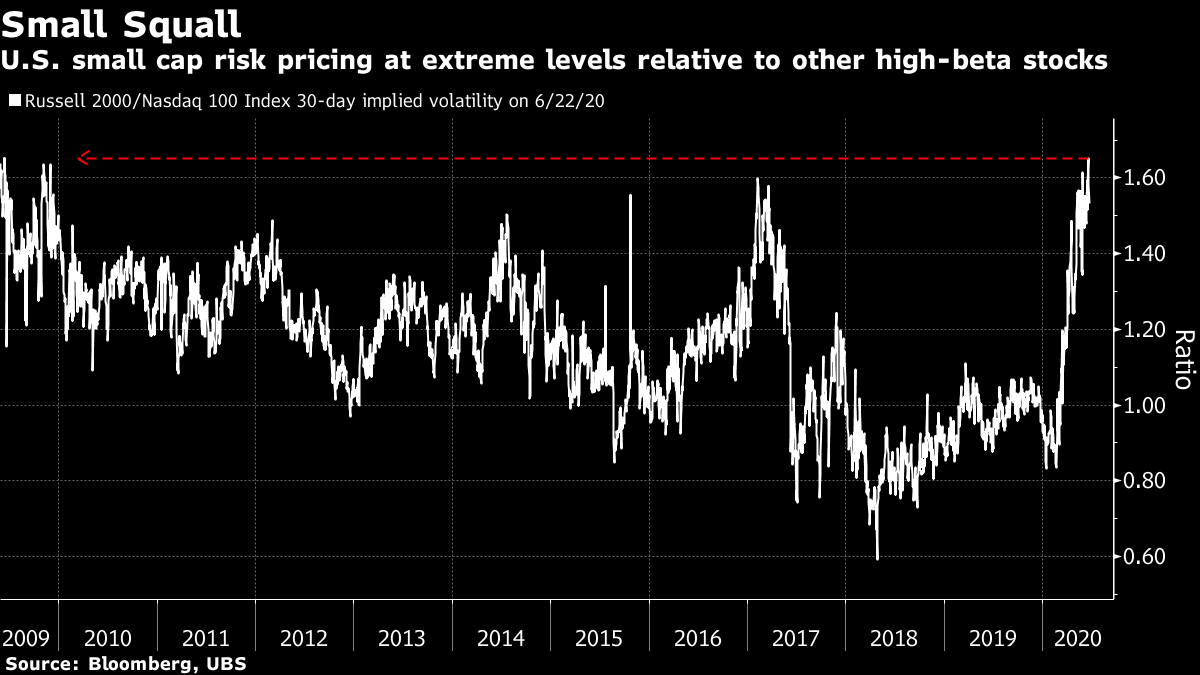

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Misinterpreted comments on the U.S. and China's trade deal roil markets, virus infection rates continue to cause concern and the Wirecard scandal rolls on. Here's what's moving markets. 'Fully Intact' President Donald Trump was forced to make clear that the trade deal between the U.S. and China is "fully intact'' after adviser Peter Navarro's comments were interpreted as a decision to end the agreement, sending stocks tumbling. Geopolitical sparring between the European Union and China emerged at a meeting on Monday, with criticism leveled at Beijing over its plans to curb Hong Kong's autonomy and allegations that China has spread disinformation about the coronavirus. Meanwhile in Europe, Spain is considering a major boost to its loan guarantee scheme and EU environment ministers will meet on Tuesday to discuss combining efforts to boost the bloc's economy with climate change goals. Flu Season U.S. health agencies are preparing themselves for the Covid-19 pandemic to stretch into the winter, meaning they expect it to be active at the same time that flu season puts pressure on health services. Vice-President Mike Pence also expressed concern about the number of young people testing positive. The White House, meanwhile, is scaling back on screening visitors for the virus as Washington, D.C. moves into phase two of its response and attempting to open up the economy. President Trump turned his ire towards mail voting following a weekend of setbacks for his re-election campaign. His team reiterated the claim that he was joking at his event in Tulsa when he said he had ordered testing to be slowed down. The Rally The question of when, or indeed if, the day trader-aided stock rally is going to end continues to rage. Traders are bolstering their defenses against the situation turning negative, pumping money into protective equity options, gold and longer-maturity bonds. Warnings about sky-high valuations are ringing on Wall Street while gold, in another potentially ominous portent, is close to 2012 highs. Stay-at-home plays are also getting a little boost as worries rise about a possible second wave of the virus. But some are still optimistic that a V-shaped bounce back for the economy is on the way. Wirecard Scandal Wirecard AG's spectacular fall is likely to be only the beginning of the story. The shares plunged again after it said the missing cash which has caused its downfall may not have existed in the first place. Its lenders want more clarity, bondholders are preparing for restructuring talks and at least one bank is considering terminating its credit line. It also emerged that the payments processor reportedly briefly eyed a tie-up with Deutsche Bank AG back in 2019. Germany's financial regulator said the scandal is a "complete disaster" and the question is turning to how to save the business, or if it should be saved at all. Coming Up… Asian stocks rose and both European and U.S. futures are pointing to a positive open following the whipsawing caused by Navarro's comments. Euro-area, U.K. and U.S. PMIs are due and index provider MSCI Inc. will release the results of its 2020 market classification review. Watch for any reaction to a PSA Groupe investor saying the carmaker's merger terms with Fiat Chrystler Automobiles NV need to be revised. And watch Cineworld Group Plc, with cinemas and museums among the next in line to reopen under the U.K. government's easing of virus restrictions. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Investors are most sensitive about the prospects for small-cap shares — at least if you go by pricing in the U.S. options market. Seen as highly exposed to growth and the uncertainty surrounding it, investor risk expectations for smaller stocks have hit extreme levels relative even to other high-beta shares — those most levered to market moves. Thirty-day implied volatility for the Russell 2000 Index has risen to an 11-year high relative to that of the Nasdaq 100, which is loaded with volatile tech stocks. Strategists at UBS have suggested that while implied volatility will likely remain high for smaller shares, investors could use the extreme levels to fund some downside protection bets in broader market benchmarks. But whether you're a bull or a bear, investors with small-cap exposure are expected to be in for a very bumpy ride.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment