| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here.

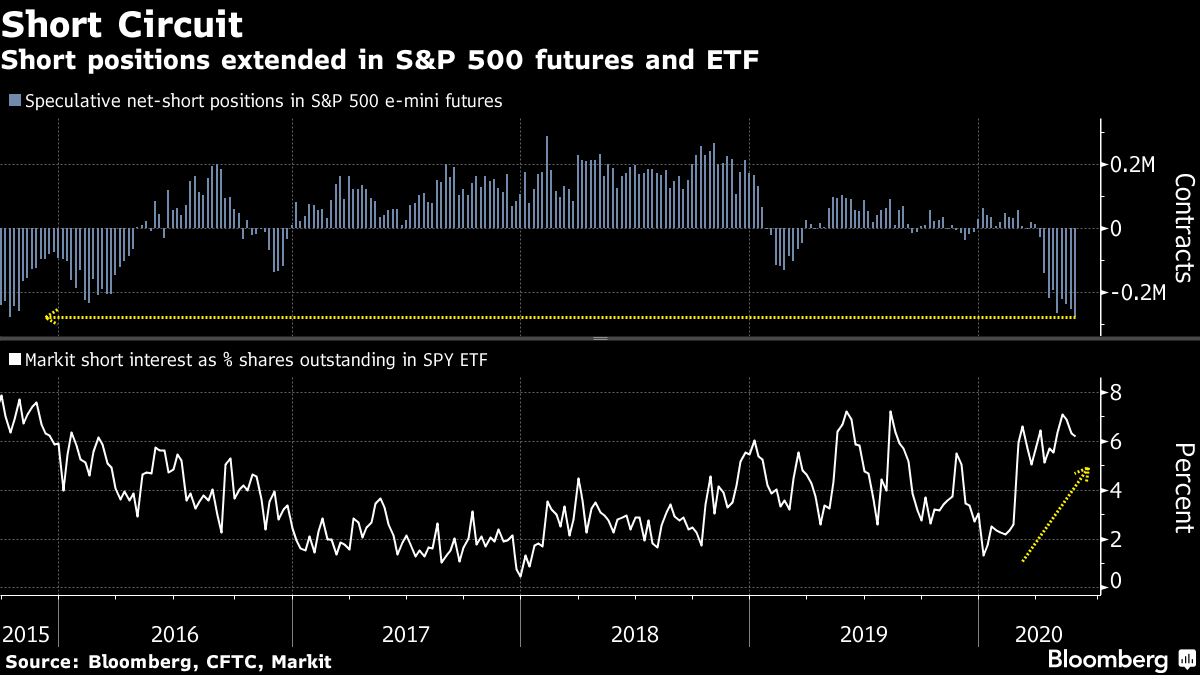

Good morning. U.S. President Donald Trump ramped up his rhetoric on tackling protests, some European markets return after a holiday and Bayer AG's legal outlook is on the agenda again. Here's what's moving markets. `End Lawlessness' President Donald Trump threatened to deploy the military to end "riots and lawlessness" across the country in a Rose Garden address punctuated by the sound of explosions. On Monday he berated state governors for their "weak" approach to violence, spurning calls for him to soften his tone and highlighting the contrasting approaches of the leader and his presumptive rival in this year's election, Joe Biden. New York City imposed an 11 p.m. curfew that failed to stem destruction as the iconic Macy's store was hit, while pepper spray sales on Amazon are spiking. Former boxing champion Floyd Mayweather has offered to pay for George Floyd's funeral. Futures Higher European stock futures are higher as trading resumes in some countries that closed for the Whit Monday holiday. U.S. futures slipped this morning and Asian stocks were mixed, though mostly shrugging off news that China halted purchases of some American farm goods. Some focus was also on news that Gilead Sciences Inc.'s remdesivir drug showed only a limited benefit in a large Covid-19 trial. In foreign exchange, Australia's dollar showed little reaction to the country's central bank keeping its main rate unchanged. The pound was steady as the threat of a no-deal Brexit looms and Prime Minister Boris Johnson aims to reset the U.K.'s agenda. Roundup In Focus Again Remember Bayer AG's Roundup saga? The German chemical giant is back in the news today as it seeks to get a crucial 2018 California court verdict overturned. The company will ask the state appeals court to throw out a jury conclusion that the herbicide product caused grounds keeper Lee Johnson's cancer. He was awarded $289 million before a judge cut the damages to $78.5 million. With tens of thousands of cases unresolved, the decision could be key to keeping liability capped at $10 billion. Shorter Days Eyed Stock traders in the U.K. want to work fewer hours. A survey of more than 140 market participants conducted by the London Stock Exchange showed that most favour a shorter day, noting it could improve liquidity and industry diversity. The LSE says any change would need a unified approach across European bourses and other trading venues, and will now wait for the results of other surveys. At 8 1/2-hours, the European day is two hours longer than in the U.S. Coming Up… On today's macroeconomic data schedule, there's Spanish unemployment and gross domestic product statistics from the Czech Republic. The earnings slate is light. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning There's a ton of reasons for investors not to chase U.S. stocks any higher -- excessive valuations, a disconnect with economic fundamentals, an over-reliance on mega-cap tech names, geopolitical and now domestic tensions. But ironically, it's those most bearish on American stocks that could provide the fuel to drive them even higher. Speculative net short-positions in S&P 500 e-mini futures have jumped to the highest in five years, according to the latest Commodity Futures Trading Commission data. And short interest in the largest U.S. equity ETF -- the SPDR S&P 500 -- is just off this year's high and at historically extended levels. With the U.S. equity benchmark now up almost 37% from its March low, and its tech-heavy Nasdaq 100 peer just 1% or so off a record high, that's a lot of pain for U.S. bears to take. Of course there is no way of knowing if the short positions are hedges for long equity trades in other markets, which would ease the pressure on traders, or what entry and stop-loss levels might be. But it's fair to say that should U.S. stocks continue to grind higher, the risk of a short squeeze exacerbating the move will only intensify.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close |

Post a Comment