Virus cases pass 10 million, tech shares hit by advertiser pullback and Brexit is back. Bad recordThe number of confirmed cases of Covid-19 passed 10 million over the weekend, with deaths topping 500,000. World Health Organization Director General Tedros Adhanom Ghebreyesus warned that the pandemic has entered a "new and dangerous phase." Texas is fast becoming the new center of the outbreak in the U.S. as Americans become more downbeat about how things are going. Globally, there are signs of new hotspots in Australia, Japan and Austria. Social media campaign Social media company shares are under pressure as advertisers pull back their spending on sites. On Friday Unilever announced it was halting all U.S. advertising on Facebook, Twitter and Facebook-owned Instagram. Facebook Inc. shares are adding to Friday's 8.3% plunge in pre-market trading after more businesses including Coca-Cola Co., Starbucks Corp. and Diageo Plc said they planned to cut spending on social media. Companies are joining a boycott of platforms which critics say fail to adequately police hateful and misleading content. This againThe first in-person Brexit talks since March got underway today in Brussels accompanied by the usual background music of a tight deadline and little sign of compromise. There is some hope that the need to really, really reach a deal this time might help focus minds enough to produce something both sides can swallow. The current round of talks are scheduled to continue until August, with October seen as the very latest a deal could be signed. Markets mixedWhile Friday's miserable end to the week set the early tone for global stock markets, things have started to look up as the session has progressed. Overnight, the MSCI Asia Pacific Index dropped 1.2% while Japan's Topix index closed 1.8% lower. In Europe, the Stoxx 600 Index had recovered earlier losses to trade 0.2% higher by 5:50 a.m. Eastern Time. S&P 500 futures also pointed to a small gain at the open, the 10-year Treasury yield was at 0.648% and oil slipped. Coming up...U.S. pending home sales data for May is expected to show activity started to return to the housing market when it is published at 10:00 a.m. Dallas Fed Manufacturing is at 10:30 a.m. San Francisco Fed President Mary Daly and New York Fed President John Williams speak later. Earnings today include Canada's Cineplex Inc., which has seen its shares pummeled this year from the virus shutdown and the withdrawal of a takeover offer from Britain's Cineworld Group Plc. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIt's common to hear that the stock market has become dangerously disconnected from real economic fundamentals. But arguably the problem is the opposite. It's too connected to the fundamentals.

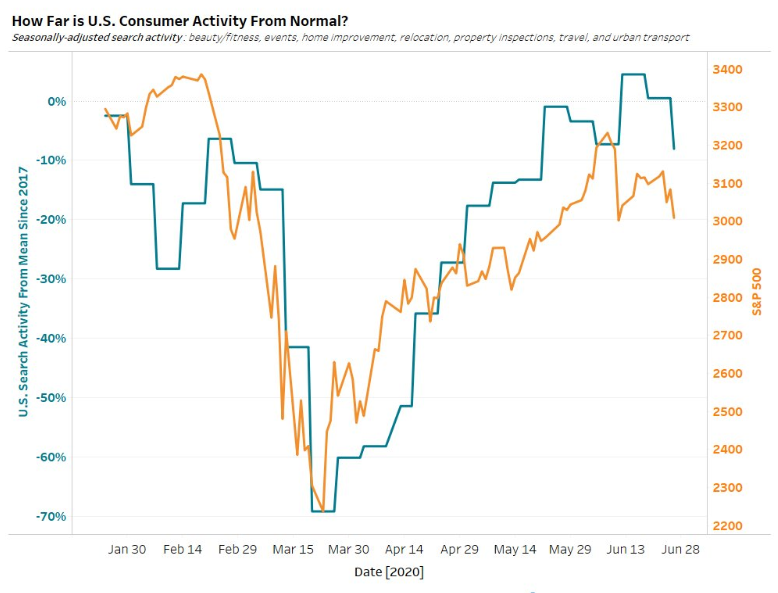

Here's a chart that was shared with and made for me by Ben Breitholtz, a data scientist at Arbor Research, which collects and analyzes alternative economic data sources for the financial industry and other corporate clients. The orange line is the S&P 500. The blue line is an index of numerous Google search terms in the categories of beauty/fitness, home improvement, relocation, property inspections, travel and urban transport. The data is taken from Google Trends, then it's seasonally adjusted (benchmarked back to 2017), and then averaged together to get a gauge of how far above or below normal activity searches are in these areas. Of course, searching for something and buying something isn't exactly the same thing, but it's safe to guess that the two are highly correlated.  Bloomberg Bloomberg You can see the lines almost perfectly line up. There was an incredible plunge in search activity that reversed at the end of March, followed by a surge in activity that peaked in mid-June, right around the recent peak in stocks. Since then, both have been rolling over. That rolling over is, of course, consistent with other things we've seen, such as the virus surge and the services retreat in key states. Someone might look at this and say: "Sure, activity rebounded dramatically, but the market isn't taking into account that the unemployment insurance expansion is set to be retired, and that the $1200 check only went out one time, and the rising virus cases likely mean further slowdowns in activity, and that as layoffs affect higher paid workers and are less temporary, then that will put us into another recession." And all that could very well be true! But all that's saying is that the market isn't taking into account things that haven't happened yet. Because when you look at what has happened, what we've seen is a stunning rebound in activity since the worst days of late March, helped in large part by the $600 extra that unemployed workers are getting through at least the end of July. The issue isn't that the market isn't reflecting fundamentals. It's that it doesn't seem to be taking into account things six inches in front of its face. But that's a different complaint.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment