| Want to receive this post in your inbox every morning? Sign up here Violence erupts across American cities, China responds to U.S. moves on Hong Kong, and Europe slowly emerges from lockdown. Death and Division Protests over the killing of an unarmed black man by a Minneapolis police officer across U.S cities turned to chaos and violence, bringing new rifts to a nation on the brink of recession and struggling to emerge from virus lockdown. For his part, President Donald Trump is seizing on the divisions inflamed by George Floyd's death to portray himself as an icon of law and order, a strategy intended to shift the election-year conversation away from his handling of the pandemic that's killed more than 100,000. The president on Sunday blamed the protests on Antifa, a loosely organized leftist movement that is a frequent target of conservative critics, and said he would declare the group to be terrorists. Tit for Tat Chinese government officials told major state-run agricultural companies to pause purchases of some American farm goods including soybeans as Beijing evaluates escalating tensions with the U.S. over Hong Kong. The U.S said it would start looking into eliminating the policy exemptions that allow America to treat Hong Kong differently from the mainland. Meanwhile, China used the unrest on U.S streets to turn the tables after weathering criticism from America over its crackdown in Hong Kong. Propaganda outlets played up scenes of burning buildings and harsh police responses in the U.S. China's decision to impose sweeping new national security legislation on Hong Kong has stirred up pro-democracy protests and alarmed foreign governments. Europe Tastes Freedom Two of Europe's most virus-stricken countries are cracking open their shuttered economies as governments desperate to limit the worst recession in living memory seek to pull off a balancing act against the threat of a new scourge. Today in the U.K., some schools, outdoor markets and car showrooms will open their doors and people will be allowed to gather with non-family members outside. Italy is preparing to open its borders and lift a ban on inter-regional travel within the nation on June 3. Markets U.S. futures turned negative after Chinese officials told agriculture companies to pause imports of some American farm goods, jarring with the more buoyant mood in Asia. Overnight the MSCI Asia Pacific Index climbed 1.6% while Japan's Topix index added 0.3%. In Europe, the Stoxx 600 Index was 0.7% higher at 6:17 a.m. S&P 500 futures were down 0.2%, the 10-year Treasury yield was at 0.667% and WTI crude oil was lower. Coming up... Manufacturing PMI for May is due at 9:45am with expectations for a reading of 40, which indicates contraction.The Treasury is expected to auction more than $100 billion worth of bills at 11:30am. Earnings are expected from Autohome Inc., EnerSys and Thermon Group Holdings, Inc. What we've been reading This is what's caught our eye over the last 24 hours - Beekeeper's plight points to $109 billion remittances problem.

- Unsold truffles tell tale of broken $3.4 trillion food chain.

- We all might be flying in planes again soon.

- NYC's finance jobs won't recover for six years.

- Goldman rolls back pessimistic stock outlook.

- Anger is right. Rioting is wrong.

- Christo, artist known for massive, fleeting displays, dies.

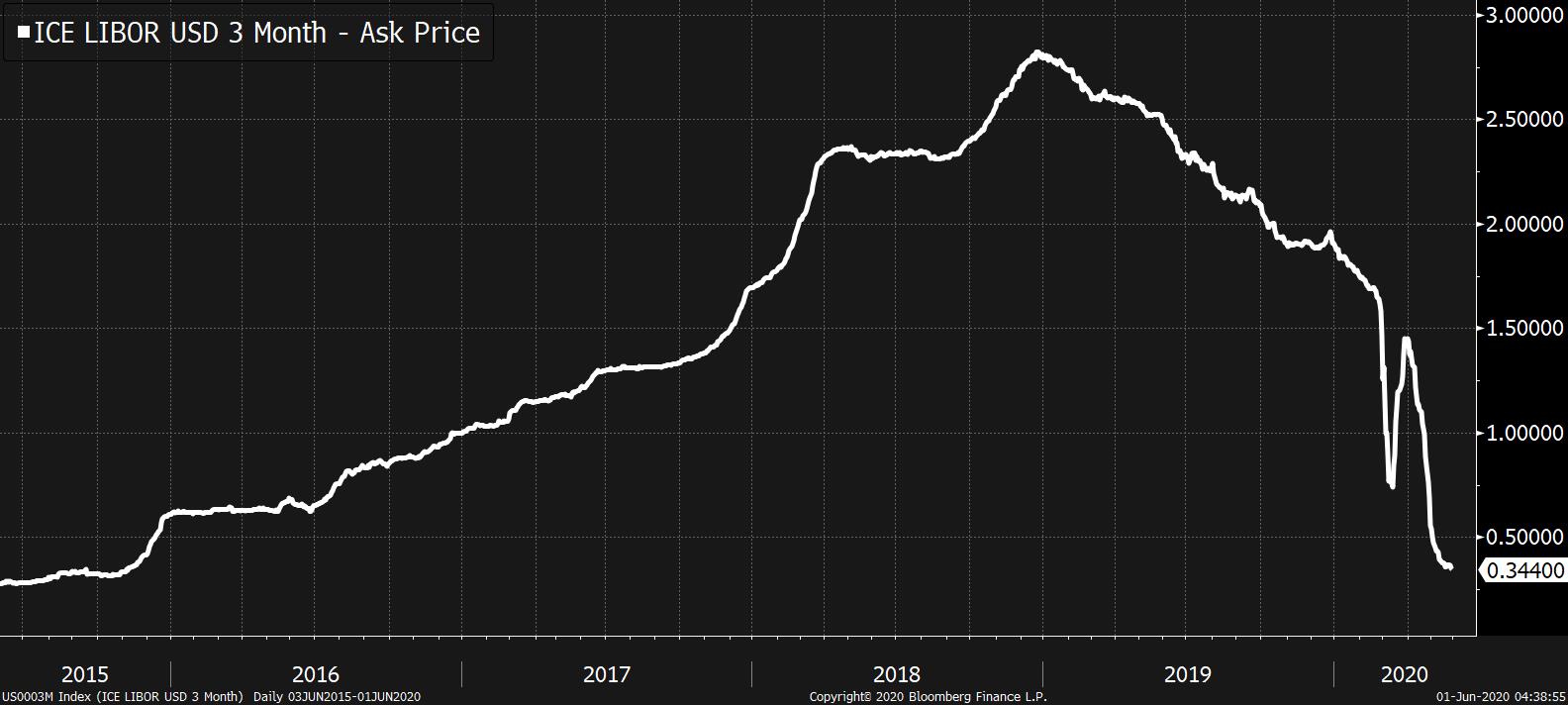

And finally, here's what Joe's interested in this morning In the past several weeks, there's been renewed attention on the extraordinary power that social networks like Twitter and Facebook have in modern public life. Depending on your perspective, they either censor too much content, or they let lies and misinformation run wild. But for all the frustration people feel towards these companies (and others) their strength only seems to grow. This phenomenon was something I kept thinking about during a series of recent podcasts I recorded alongside my co-host Tracy Alloway. This week, Monday through Friday, we're publishing five episodes of Odd Lots all about a single topic: Libor. It's the dominant, benchmark interest rate off of which some $350 trillion worth of financial assets are priced. Its flaws have been known for over two decades, and yet it has persisted this long due to inertia and network effects -- the same things that keep social networks so dominant. Libor is finally set to be retired over the next year or so, but it is an extraordinarily difficult task to get rid of it and transition it to a new benchmark. And as you listen to the series, you'll appreciate why, and why getting rid of anything so dominant is so difficult. Check out the first one today, on the man who blew the whistle on Libor way back in the mid-90s.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment