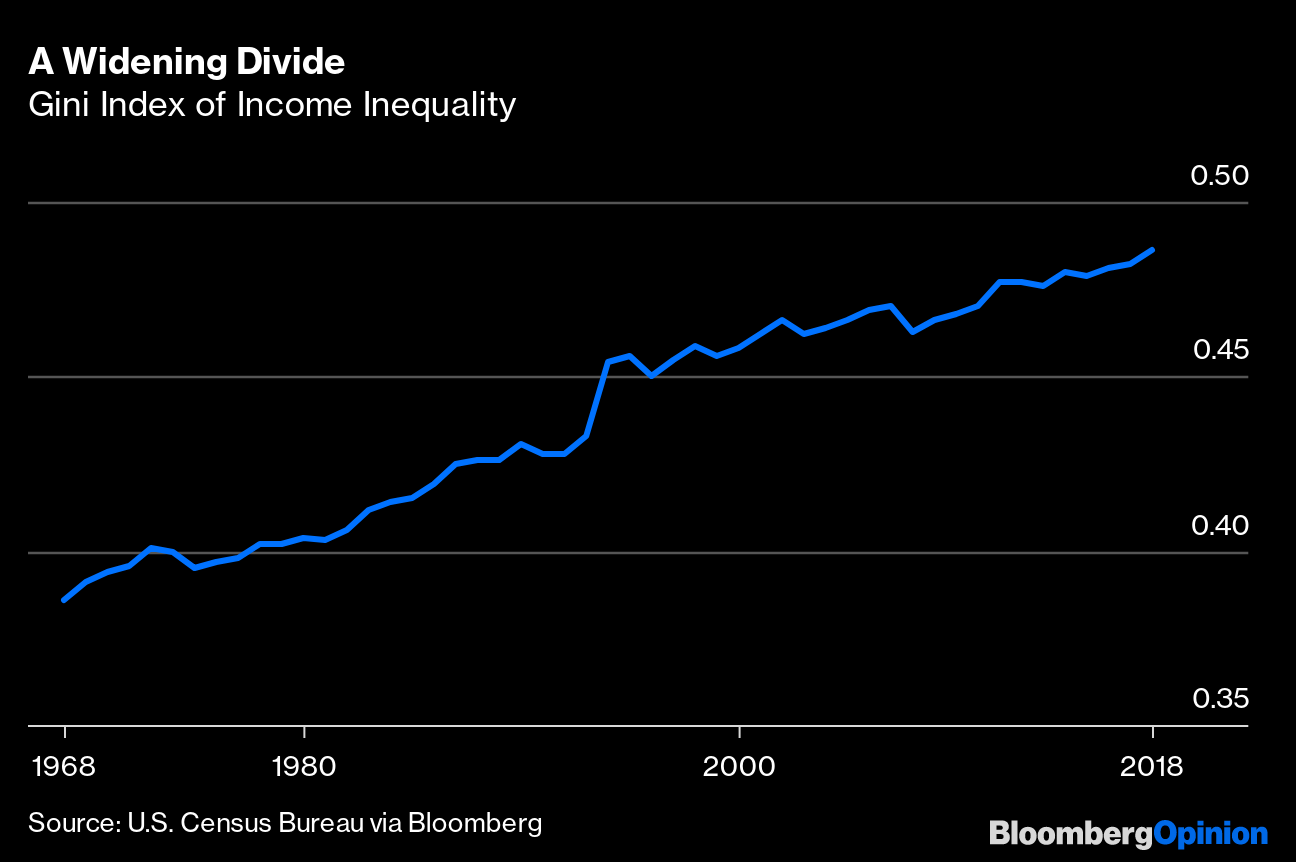

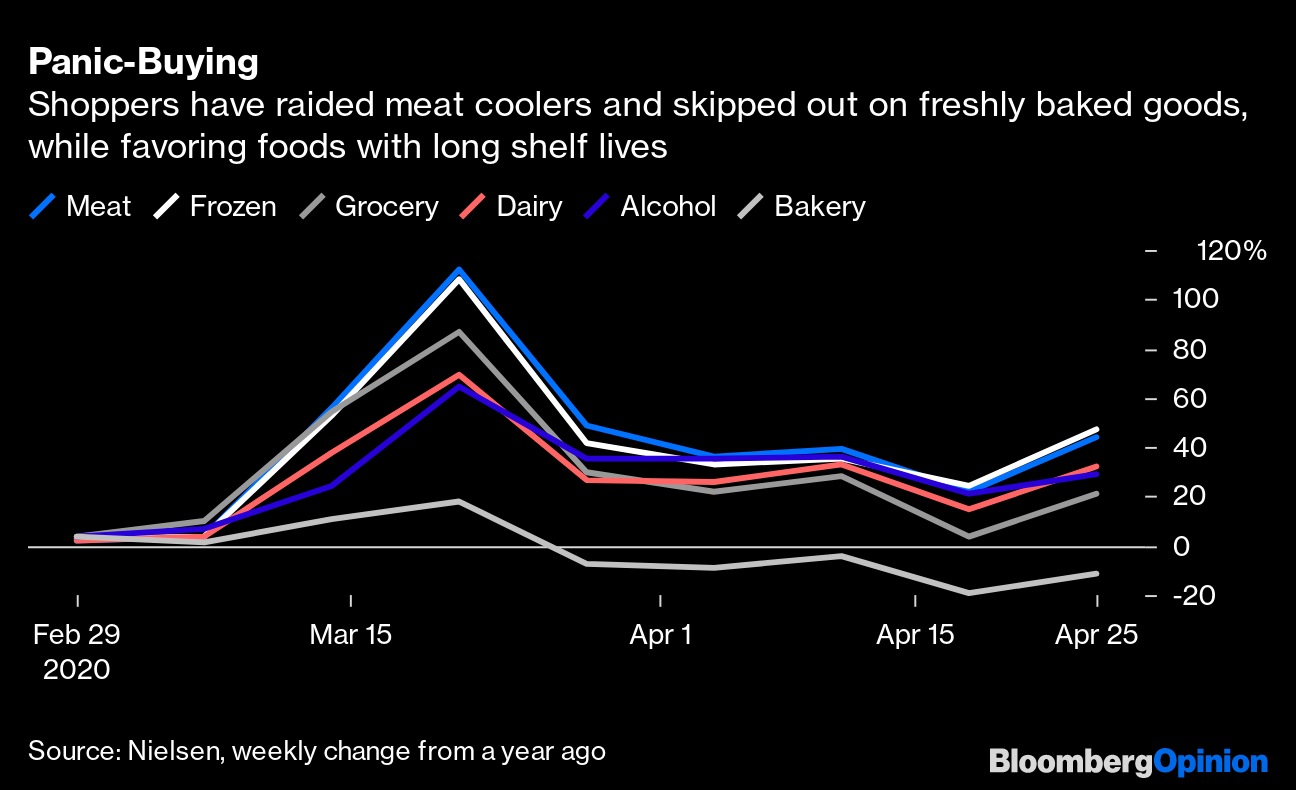

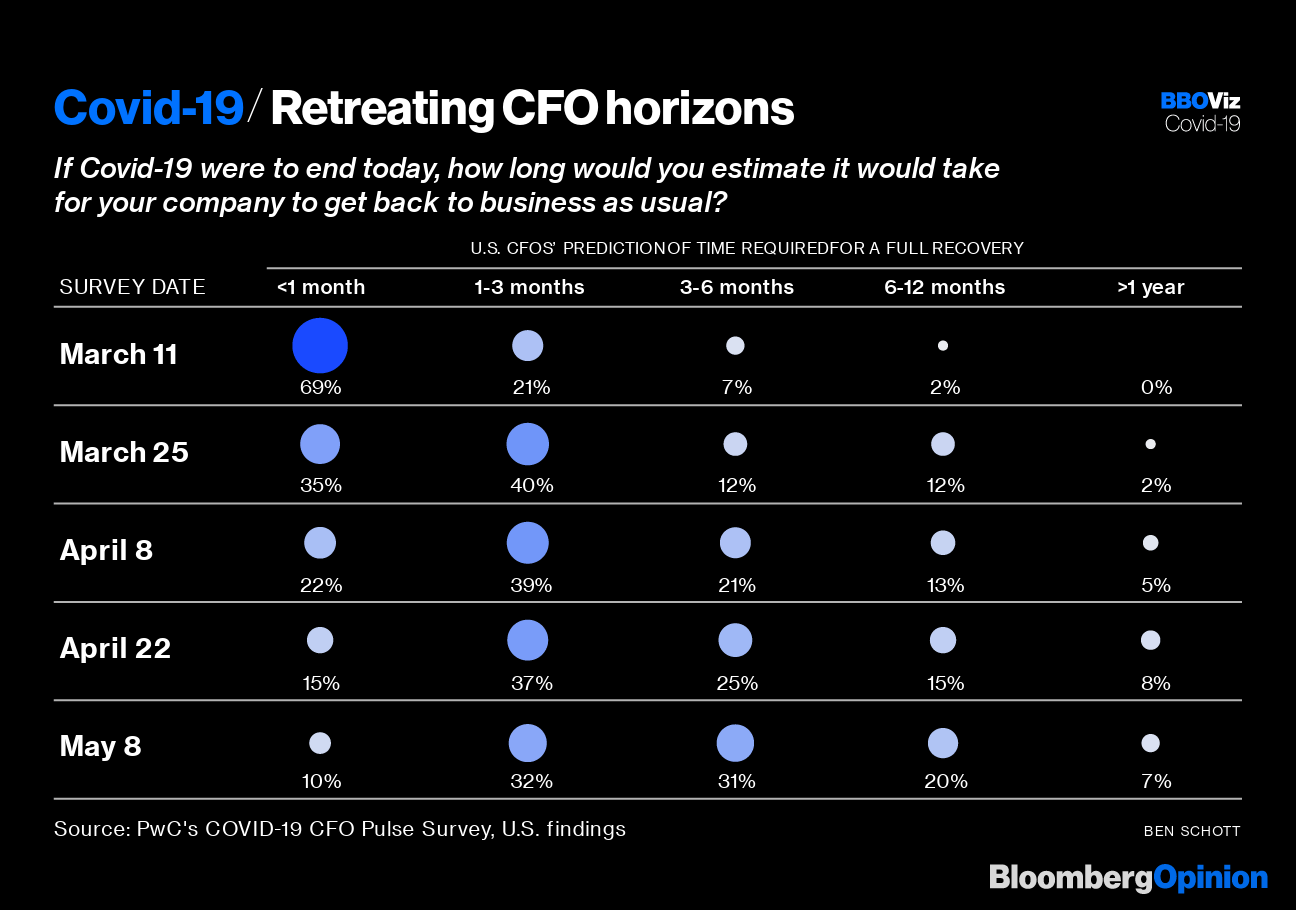

| This is Bloomberg Opinion Today, a dry-goods hoard of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Republican senators, rediscovering their deficit concerns. Photographer: Drew Angerer/Getty Images North America Firefighters Bicker While the House Burns Yesterday this newsletter called out the stock market for irrational exuberance. Today the stock market face-planted. This is certainly due to the vast influence of this newsletter and not because Jerome Powell, Stanley Druckenmiller and David Tepper all threw buckets of ice water on the market at about the same time. In all seriousness, traders have reason to worry. The economy is still teetering on the edge of an abyss, and its caretakers are suddenly haggling over what to do. Powell, the Fed chairman, today said he had no interest in giving President Donald Trump the GIFT of negative interest rates. Narayana Kocherlakota argues the Fed should be throwing every scrap of furniture into the fire to warm the economy up again, and negative interest rates should be on the list. Markets are starting to bang the table for negative rates too, notes Brian Chappatta, but there's no proof these do any good, and a risk they could actually contribute to deflation. (Fun fact: Deflation is one of Tim Duy's Terrible Ds — depth and duration being the other two — that turn a recession into a depression.) Marcus Ashworth suggests the Bank of England should resist the black-hole pull of negative rates too. The Fed can't do any of this alone. But the fiscal policy makers in Congress aren't singing from the same hymnal anymore either. Democrats presented a $3 trillion stimulus plan yesterday, and Republicans are balking. Karl Smith suggests the GOP is right to be skeptical of all the cash being thrown at state and local governments right now. They'll need help, for sure, but maybe it's better to take it slowly and see just what they really need to get through the emergency. Republicans are falling back on an old standby, deficit panic, to explain their reluctance. This may seem hypocritical, given how they stripped the deficit naked, tied it up, stuffed it into a pickle barrel, and shoved it over a waterfall when they cut taxes a few years ago. But Jonathan Bernstein explains "deficits" is really shorthand for "stuff we don't want to spend money on." Unfortunately we need a lot of that stuff right now, leaving the GOP increasingly on the wrong side of this argument — and the economy still teetering on that cliff. Plus ça Change The coronavirus pandemic will CHANGE EVERYTHING, we are always saying. But in many cases it will just make stuff that was already happening happen a lot more. Noah Smith points out inequality has been rising in the U.S. for a long time:  Coronavirus threatens to make inequality much, much worse, Noah warns, in six very specific ways. Justin Fox spots several other trends about to get steroid-fueled, from remote work to de-globalization. Some of these will be good for workers and the economy, some not so much. You might hope one thing that will at least disappear forever in the Covid-19 era is the open office plan. Sorry, no, writes Sarah Green Carmichael. These wide-open spaces where stressed, distracted workers cram together to swap diseases can be made less germy with some simple modifications, Sarah writes. They won't turn that annoying co-worker sitting near you into a person not raised by wolves, but maybe just be glad you have a job at all. The Health Crisis Inside the Health Crisis One of the terrible things about this pandemic has been how, in the middle of the worst health-care crisis in a century, health-care jobs are being slashed. That's because most non-Covid-19-related care has been shut down. Many of us are riding out lockdowns with broken fillings or weird moles that really need a professional look. This is costing not just jobs but also lives and further straining local health-care systems that were already barely staying afloat, warns Bloomberg's editorial board. Governments must help carry these providers and get them safely back to work. Telltale Charts You know what's not great for your health? All that processed food you've been stress-eating and hoarding since lockdowns began. This has been a boon to some fading brands, but Americans will probably ditch them for fresher, healthier fare as soon as possible, writes Tara Lachapelle.  Early in this pandemic, CFOs thought they could get right back to business soon. As Ben Schott illustrates, that optimism keeps fading.  Further Reading Many reopened Asian nations are already dealing with new outbreaks, and some are throwing caution to the wind. — Dan Moss A new Taiwan Semiconductor Manufacturing Co. factory will soon be a nice prize for some U.S. state. — Tim Culpan Apple Inc. and Google have made a good contact-tracing app, but it needs federal buy-in to succeed in the U.S., and Trump seems afraid to give it. — Tae Kim Japan chasing out activist investors will trash progress on corporate reform and hurt the finances of domestic investors. — Anjani Trivedi Bluster has mysteriously failed to win international support for America's pressure campaign on Iran. — Bobby Ghosh ICYMI What if the president tests positive for coronavirus? Covid-19 survivors could suffer health effects for years. Sanofi's CEO said the U.S. has first dibs on its coronavirus vaccine. Kickers Restaurant to enforce social distancing, creepy vibes by filling tables with old mannequins. (h/t Ellen Kominers) Measuring hail involves more than just thinking of the appropriate sports ball. (h/t James Greiff) Behold the faded beauty of abandoned cars. (h/t Mike Smedley) How a photographer re-created the outdoors with household stuff. Note: Please send mannequins and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment