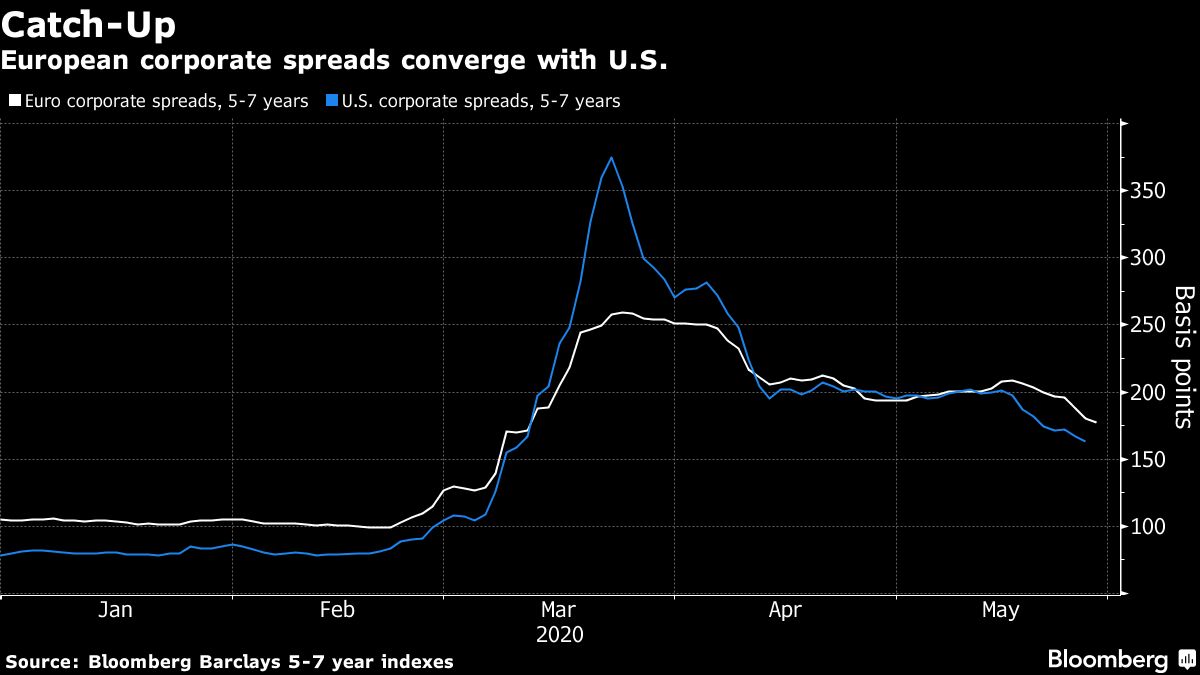

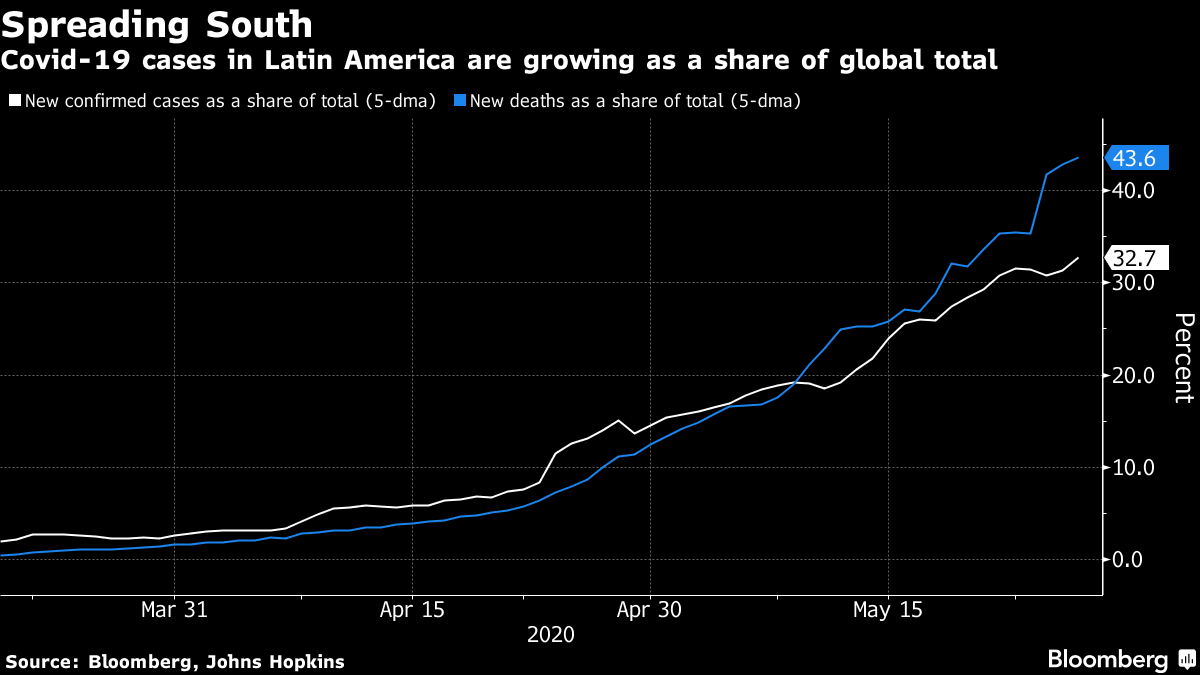

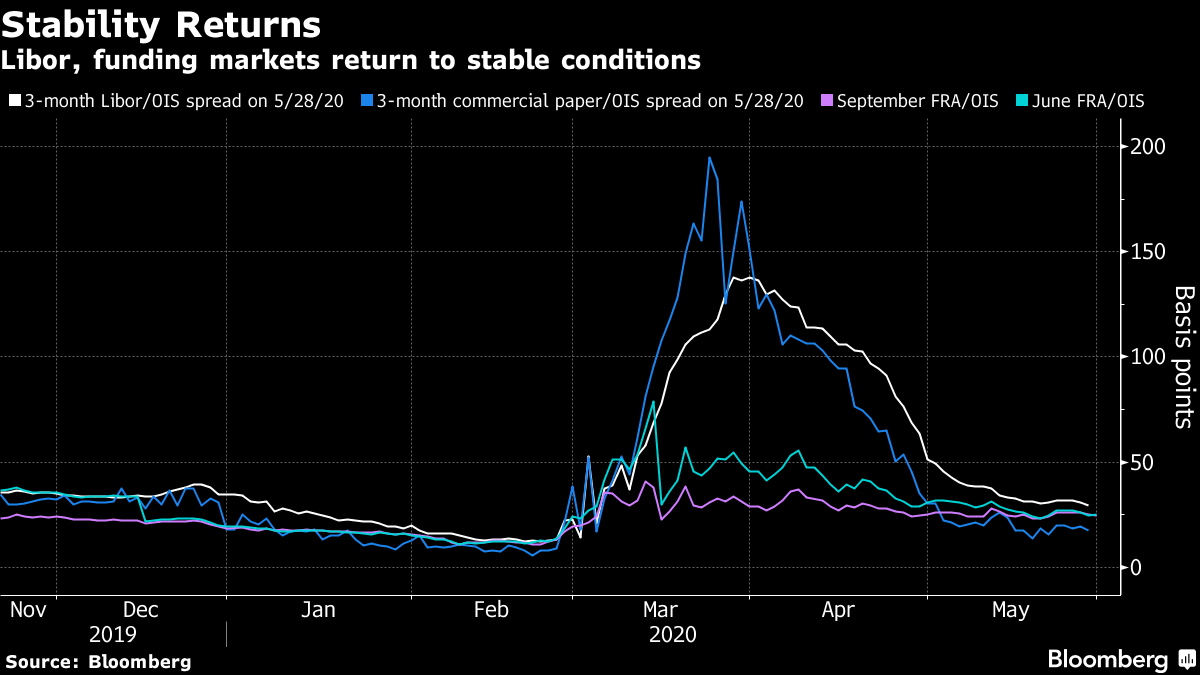

| Welcome to the Weekly Fix, the newsletter that's not getting excited until Austria signs up. –Emily Barrett, FX/Rates reporter. Sizing It Up Make that 750 billion euros ($832 billion). That's how much European Commission President Ursula von der Leyen pitched for an historic EU rescue fund – a mixture of loans and grants – barely a week after the German and French leaders floated a 500 billion deal. There's even some sign the Frugal Four -- Austria, Sweden, Denmark and the Netherlands -- may be willing to compromise in their united front against grants. Von der Leyen's opening gambit could entail as much as 82 billion euros for Italy. But while some regional stocks got a little dizzy at the prospect of a transfer union (the "mother of all triggers"), European rates and currency markets are keeping a lid on their enthusiasm. Italy's spread versus Germany has narrowed, but only as far as its levels at the start of April. Corporate bonds premiums in Europe have closed some of the gap to the U.S. in recent rallies. And while the single currency has climbed to its strongest level versus the dollar in several weeks, Morgan Stanley is still neutral, as "some hurdles and votes need to be first overcome" before the euro likely to make much more headway.  Deal, No Deal China's National People's Congress approved the national-security legislation that's triggered a new round of tensions with the U.S. -- including a declaration by Washington that it no longer considers Hong Kong an autonomous territory -- and inflamed protests in Hong Kong. Despite all that, the market reaction has been isolated. China's yuan tested a record low in offshore trading, and Hong Kong's equity market revisited the darkest days since Asia's 1998 financial crisis, but global stocks strode on toward pre-March highs this week. Bond markets -- even domestic ones -- seem sanguine in the face of a potentially major rewiring of the global financial network. Dollar bond sales in Asia are on track for the busiest May ever, and Chinese companies are leading the way to market with WeChat operator Tencent selling its first such issue in over a year. This may be surprising, considering the global business at stake. But "markets are notoriously poor at pricing political risks," says Mark Sobel, a former Treasury official and current chair of Official Monetary and Financial Institutions Forum. And the renewed U.S.-China turmoil is a big whack of political risk. It's a threat to global growth -- as if there weren't enough already. In an email exchange this week, Sobel pointed to the likely hit to globalization: "Regionalization and reshoring may be on the rise; protectionism could increase; and technological bifurcation for national security purposes could emerge." "The withholding of Hong Kong's certification as autonomous from China is another example of the 'Cold War,'" he said, "Perhaps some market participants ascribe it to election posturing and are not paying heed." Global investors could quickly shift their attention if these hostilities start morphing into a trade war. They're still battle-scarred from a protracted U.S.-China trade dispute, which only just got past the preliminaries of a deal in January. As Bloomberg's China Today column points out, markets are far more sensitive to the language of trade and tariffs, and are filtering out tortured diplomacy over human rights and technological hardware. Moreover, and probably most compellingly, investors are hitching their wagons to a fledgling recovery in the U.S. Under Duress But the resurgence of hostilities between the world's two largest economies barely obscures the trauma unfolding in parts of the developing world. As economies in Asia and the U.S. gradually reopen, Latin America has become the epicenter of the crisis, accounting for roughly a third of new cases globally and more than 40% of daily fatalities.  Alicia Garcia Herrero, chief Asia Pacific economist at Natixis, laid out the policy challenge facing developing countries, as "the first line of defense – namely, using a country's monetary policy room to support growth – is becoming ineffective as investors shy away from weak currencies. Capital controls could provide a temporary relief but are costly as they would imply losing access to foreign funding altogether. Self-insurance and regional insurance schemes are an option for a select few, especially in Asia, but the duration and depth of the shock is uncertain, which justifies exploring other potential options." A former IMF economist herself, Herrero has joined calls for the organization to devise a more efficient programs aimed at "a more targeted set of liquidity facilities with quicker disbursement and less conditionality." While official institutions and the G-20 have mobilized around relief efforts, including selective suspension of debt service payments, the response from private creditors has been … complicated. Forbearance isn't simple -- fiduciary duties are one thing, and investors are also quick to point out that many governments are deterred by the risk of losing market access. And some have managed to sell hard-currency debt since the pandemic took hold – including Guatemala and Bahrain. But as this week's OddLots podcast highlighted, some may face a terrible choice between servicing debt and investing in health care. The Institute of International Finance Thursday released a toolkit for talks between government and private creditors, to try and speed what could be an agonizingly slow and ultimately costly, case-by-case, approach to offering relief. Options include exchanging cash to help offset debt payments, or amending bond terms. Lazard Asset Management EM portfolio manager Denise Simons says the reopening of the world's largest economies, combined with supply cuts from OPEC, is dragging oil prices out of the ditch. And the IIF is already talking of "stabilization," as its daily tracking of non-resident portfolio flows shows they're trickling back after an historic exodus back in March, with the assistance of the biggest interventions of all, from the Federal Reserve. No Shots Fired Well, the Fed has actually bought some corporate debt, so it unleashed a little bit of firepower. In fact, the latest Fed data show the net portfolio holdings of corporate credit facilities jumped to $35 billion this week, though TD Securities assures us this springiness is due mostly to technical accounting for Treasury capital contributions. The point remains that the Fed's most controversial support measures had largely calmed credit-market distress, before they even launched. UBS credit strategist Matthew Mish identifies three turning points for the Fed's primary- and secondary market corporate credit facilities, the third being the actual launch. By far the biggest spread impact was in the first and second: the initial March 23 announcement; and the early-April expansion to increase the equity support and include fallen angels and high yield ETFs. That success doesn't mean the programs are going anywhere soon. The Ne York Fed's Liberty Street Economics blog wasn't exactly taking a victory lap in this week's post. While issuance has rebounded and corporate bond prices are recovering, spreads are "still elevated." Mish expects the Fed will scoop up roughly $150 billion of corporate debt in these facilities over the next year. The greater benefit will be to the investment-grade assets, while high yield has to contend with the prospect of defaults rising to 9%, and another $210 billion in fallen angels, compounded by "higher contagion risks from another wave of defaults and downgrades for leveraged loans/CLOs," by UBS's reckoning. Potpourri Money markets are gearing up for higher interest rates. Oh, and funding markets are all A-OK.  Remember the election? China came up. Algos are stalking Chicago's silenced trading pits. Brad Setser at the Council on Foreign Relations noticed a big difference between this crisis and the last (inflows to bank deposits seem a pretty strong endorsement of post-crisis regulations..) |

Post a Comment