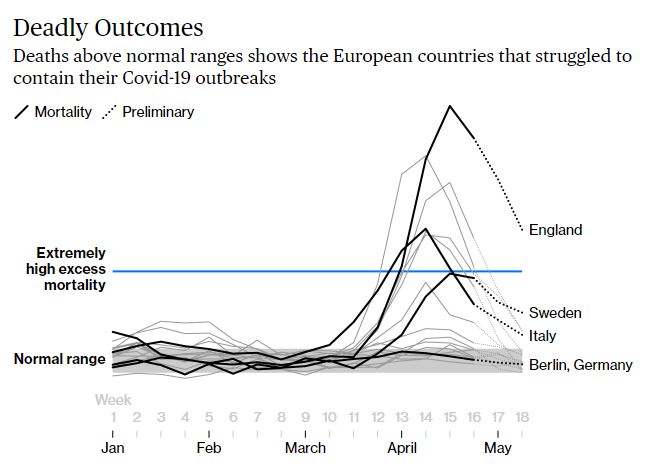

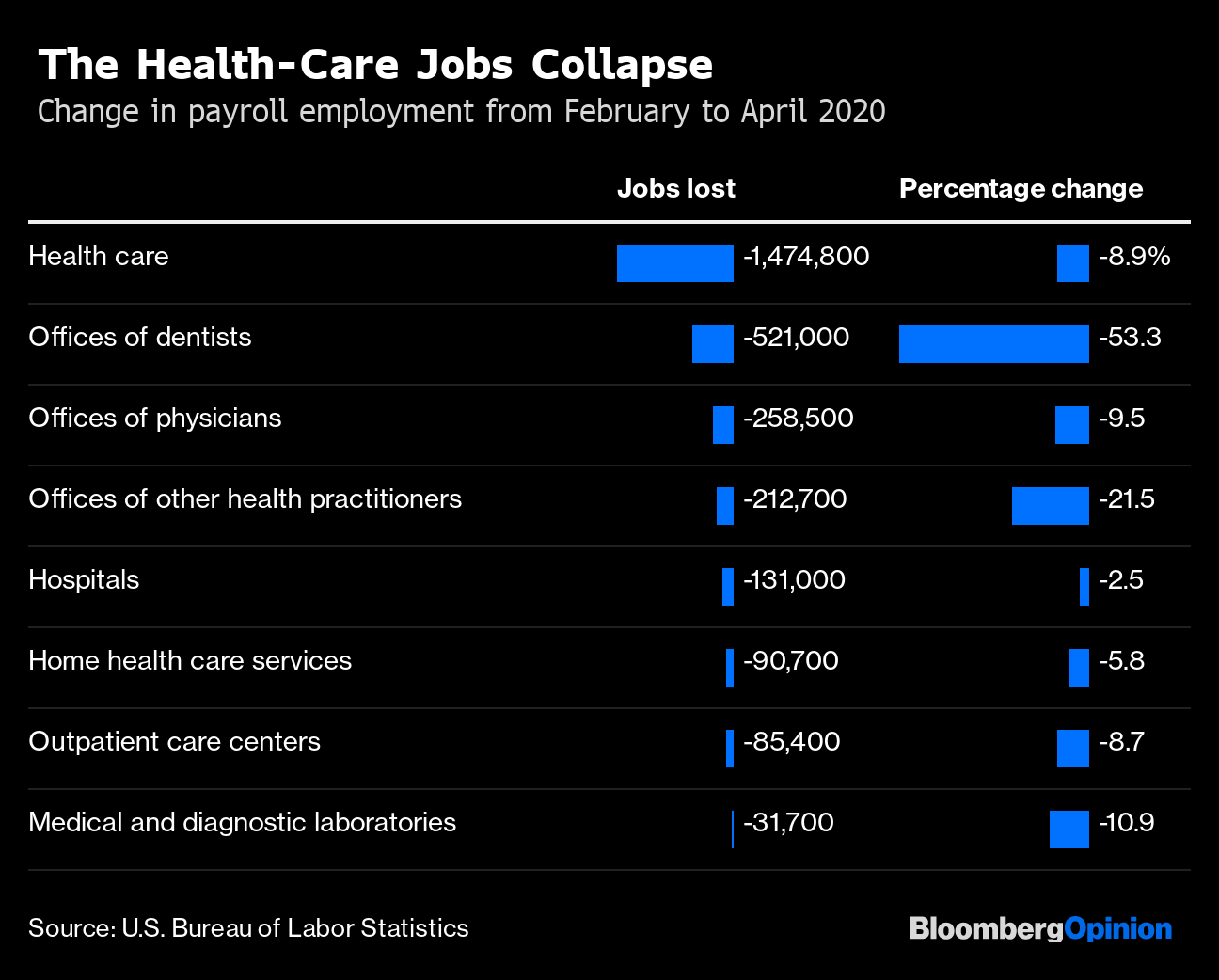

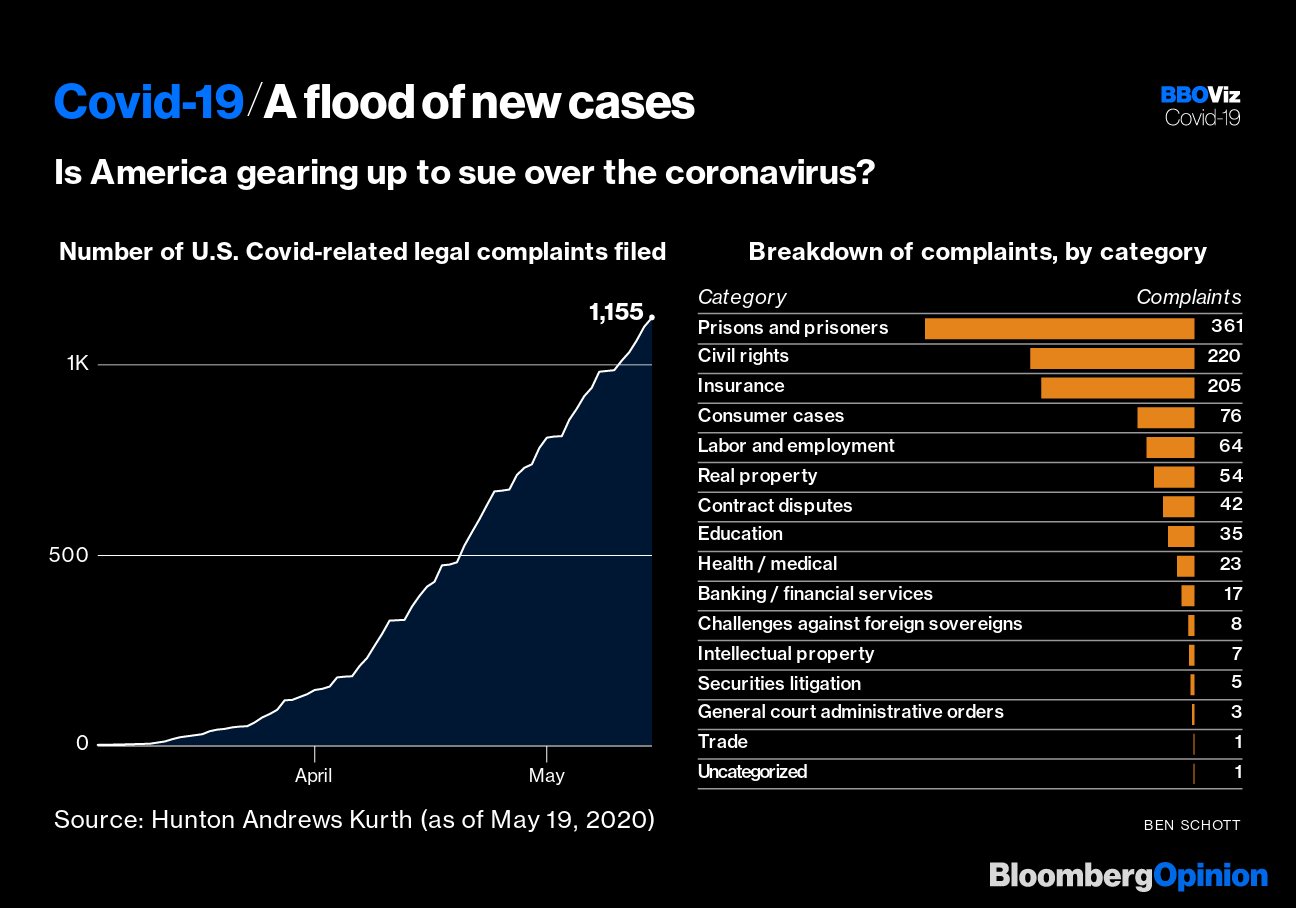

| This is Bloomberg Opinion Today, a spaghetti plate of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  It's the stuff you don't see coming that gets you. Photographer: Cindy Ord/Getty Images North America Coronavirus: The Less We Know One of the most frustrating and terrifying things about this pandemic is its unpredictability. From its effects to how it spreads, it keeps surprising us, usually in unpleasant ways. News out of China suggesting the coronavirus may have mutated in a new wave there is the latest example — though it could also be an example of the misinformation and conclusions-jumping the disease's mysterious nature inspires. Even our responses have been hard to read. Elaine He charted the results of the various pandemic-fighting efforts across Europe and came up with a plate of spaghetti. Some countries with strict lockdowns (think Italy) suffered more deaths than those with more-relaxed policies (think Sweden). The poor U.K. has just been a shambles no matter what it does.  So what to make of this? For starters, lockdowns can be effective, but they must be timed right, and it may be even better to have adequate testing and tracing capability. Even then, you still don't know. Countries with the best pandemic-fighting records keep fighting fresh waves of the disease. Australia has been relatively spared from catastrophe, but all this uncertainty has David Fickling anxious about Aussies rushing out to pat each other on the back in large groups. Here in the U.S., President Donald Trump is pushing to reopen the economy, apparently on the assumption this will revive growth and his re-election chances along with it. But it's a dubious political gamble, writes Jonathan Bernstein. We still don't know just how much the disease will rebound with any reopening, how much fear that will inspire, and how much that alone will slow the economy right back down. Moderna Mess Biotech, like many other kinds of tech, is a business that often involves showmanship. It's kind of necessary, if you want to raise cash — which you definitely do — to hype your big idea and/or experimental drug and hope your results eventually cover the check your mouth just wrote. Moderna Inc. might have done just a bit of that Monday, announcing with great huzzah extremely early results from a coronavirus vaccine trial, just before it turned around and sold stock to eager investors. There's nothing particularly wrong with this, aside from the fact that ONLY THE ENTIRE WORLD is desperately hoping for an end to this pandemic. The stock market reacted to Moderna's announcement as if boxes of shots were already being loaded onto trucks. When Stat came out the next day and noted the very large caveats to Moderna's story, the market sagged along with the hopes of millions. As Max Nisen writes, perhaps companies in the race for this vaccine should exercise much more caution than usual, given the extreme attention being paid. But the episode exposed many things about the stock market, notes John Authers. First, that traders love a good story, much more than boring old data or the scientific method. Second, for all we talk about how the market is ignoring the pandemic, it's still very much front of mind. European Union, Now With 18% More Union One positive thing that could come out of this nightmare is a stronger European Union. All it took was a deadly pandemic and the threat of a depression. But the fact that Angela Merkel has joined Emmanuel Macron in backing a $548 billion European Commission lending facility is a very big deal, writes Bloomberg's editorial board. There will be fraught negotiations over this, and it could still fall apart. But Merkel's approval may help drag it across the finish line, writes Andreas Kluth, by convincing skeptical northern countries it's OK. There won't be a United States of Europe any time soon, but the fiscal union Europe needs is a step closer. It helps that the EC has spotless credit and plenty of room to borrow, writes Marcus Ashworth. Investors will be glad to buy these euro bonds. Aspire, Don't Retire The thought of ever returning to a virus-drenched office is unappealing to many of us right now, but especially so to people who are close to retirement age. Why risk your actual life when a sweet, slightly less virus-drenched retirement, awaits? It's not that simple, writes Alexis Leondis. First of all, are you really sure you want to retire in the middle of what could be a depression? If you're like most Americans, you probably don't have nearly enough saved up. Or maybe you'll get bored with fly-fishing or alphabetizing your library or whatever. In either case, you might want to go back to work before too long, as many early retirees do. Except this time you may find all the jobs have been vaporized by the pandemic. There are many other reasons to think twice before checking out. Read them all. Telltale Charts The pandemic is exposing the original sin of America's health-care system, writes Justin Fox: the fact that we pay for individual services rather than a flat fee for total care.  Because America, the coronavirus lawsuits are piling up, writes Ben Schott.  Further Reading Trump's threats to states reveal both his weakness and the danger it poses to democracy. — Jonathan Bernstein To stop the cycle of financial-system rescues, we should give the government more power over money creation. — Mark Whitehouse Treasury's first-ever 20-year bond sale was boring, and that's just the way Treasury likes it. — Brian Chappatta The hot new thing in online shopping is a brick-and-mortar store, thanks to the pandemic. — Brooke Sutherland Nasdaq's tighter listing requirements for Chinese companies are kind of a joke. They wouldn't have kept out Luckin Coffee. — Nisha Gopalan ICYMI Dam failures created a disaster in Michigan. The Senate passed a bill to delist Chinese companies from U.S. exchanges. Bidding wars for houses are back, despite the pandemic. Kickers Retreat to New Zealand in style; its most-expensive home is on the market. (h/t Scott Kominers) The average adult will spend 34 years staring at screens. Why singing makes you feel better. Twelve perfect Fred Willard moments. Note: Please send New Zealand listings and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment