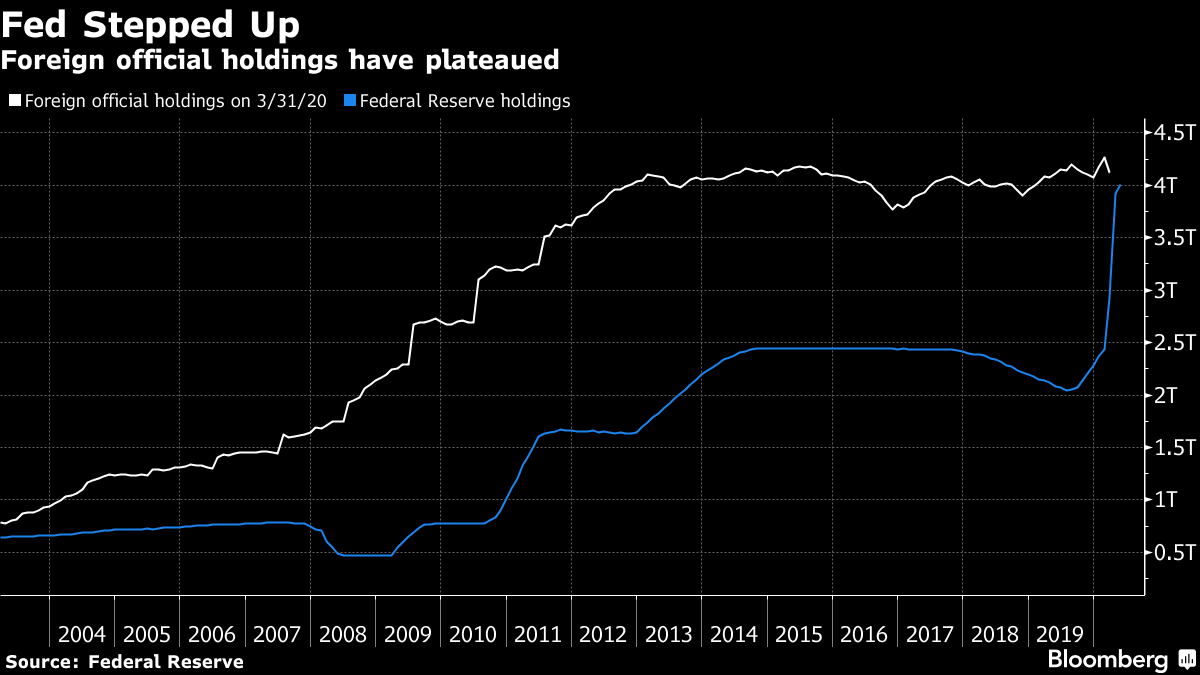

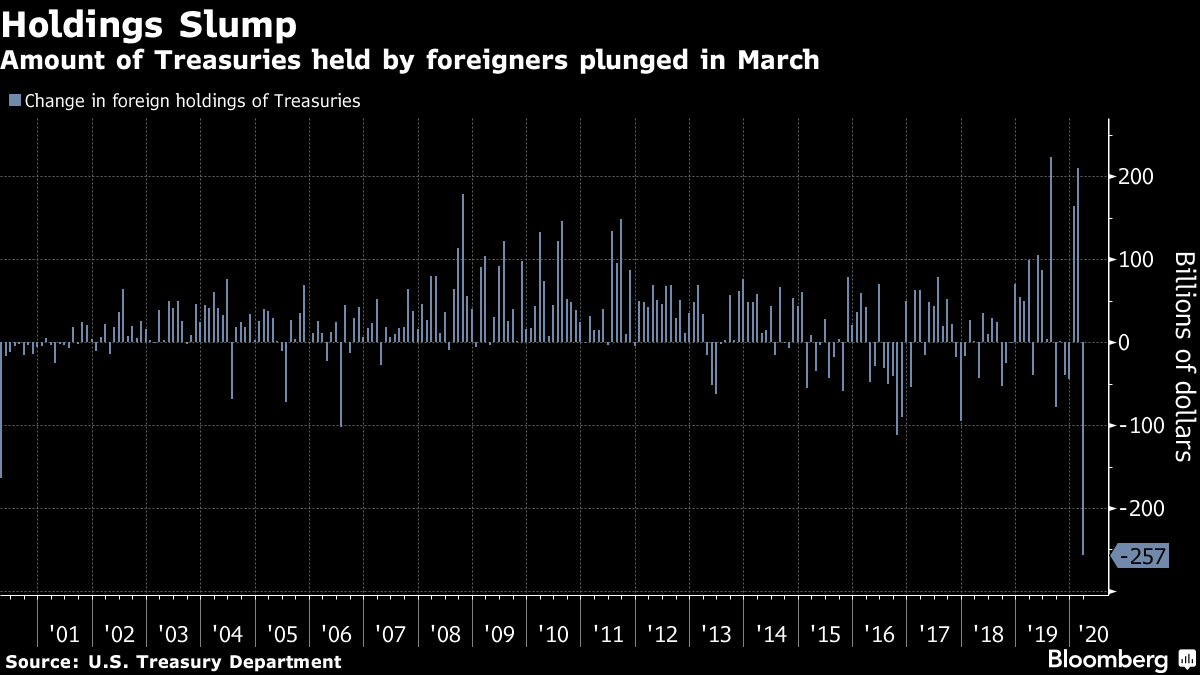

| Welcome to the Weekly Fix, now helmed by Emily Barrett, a distinguished FX and Rates reporter based in New York with decades of experience looking at markets and economies on both sides of the Atlantic and a stint in the Asia-Pacific as well. Senate, Virtually The testimonies of Treasury Secretary Steve Mnuchin and Federal Reserve Chairman Jerome Powell to the Senate Banking Committee this week -- conducted remotely -- were a window into the array of criticism brewing over the emergency lending programs the government is rolling out. It's an historic exercise of monetary and fiscal collaboration: The Fed will buy $3.5 trillion of bonds -- mostly Treasuries -- this year, Bloomberg Economics estimates, which will largely cover a fiscal gap that may well top $3.7 trillion. While many lawmakers applauded the duo's actions to stem the fallout from the pandemic, Mnuchin and Powell faced questions over delays in deploying allocated funds to businesses, and gaps in the Payment Protection Program. The Fed chair assured the committee that those programs still on the blocks -- the Main Street and Municipal lending programs -- will launch by month-end, or thereabouts. And he deflected a broadside at its unprecedented purchases of junk bonds, and ETFs -- this week's update on the Fed's H.4.1 data shows the central bank has bought $1.8 billion of corporate bonds and ETFs since they premiered on its balance sheet last week. If it felt like a roasting, Powell can be assured that he enjoys a larger share of the nation's confidence in his handling of the economy than the president, according to a recent Gallup poll. Trashing Treasuries Meantime, two market luminaries duked it out over one of the Treasury market's biggest enduring questions this week. Institute of International Finance Chief Economist Robin Brooks, facing off against Brad Setser of the Council on Foreign Relations and Exante over what's keeping U.S. borrowing costs from spiraling out of control in this era of gargantuan debt issuance. Setser took issue with New York Fed president John Williams's comment Thursday that "the lesson" of this crisis is the "enormous global demand for U.S. Treasuries." Setser posted a chart of rock-steady foreign official holdings over the past five years, versus turbo-charged Fed purchases.  The chaser is that the Treasury reported the total pile of Treasuries held by foreign investors shrank in March -- when the market was getting lashed -- by the most in data going back to 2000.

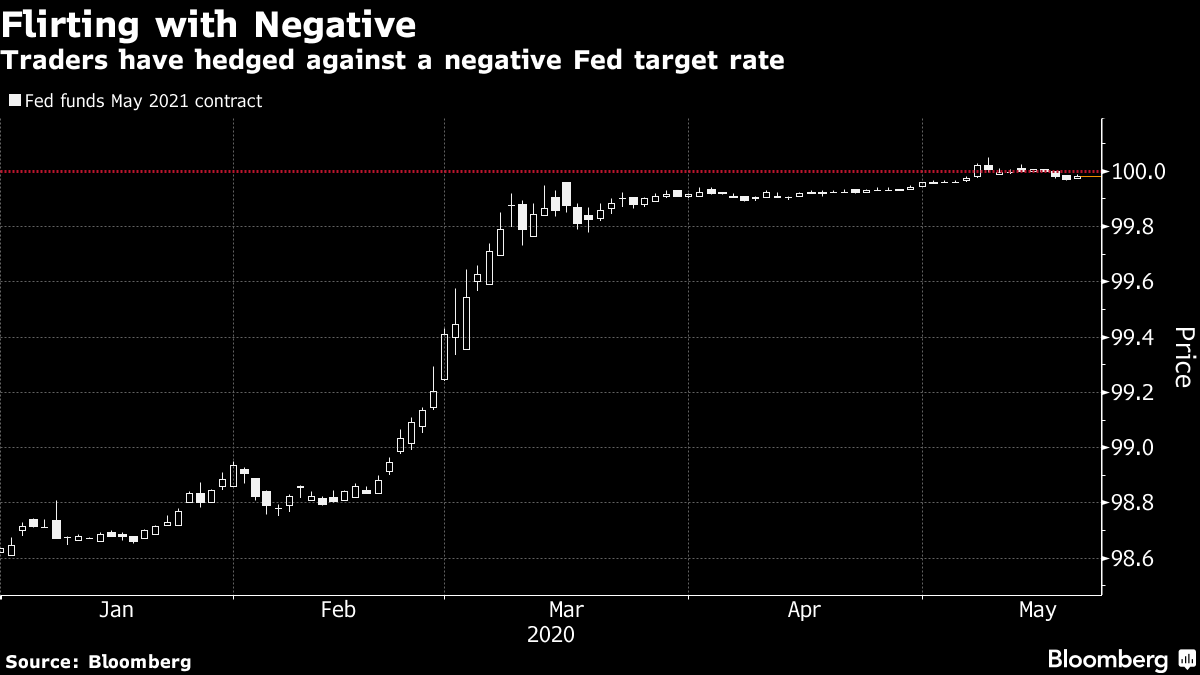

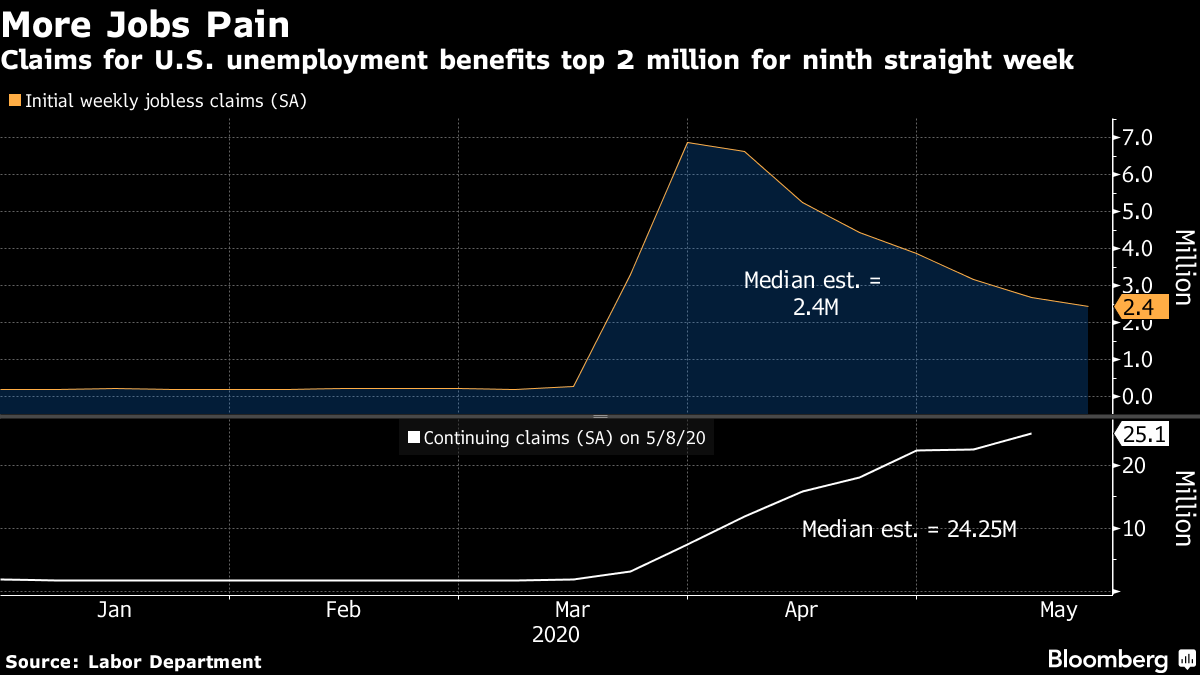

"The lesson of this crisis is that the Fed can buy more than the world can sell," Setser tweeted. The counter-argument on Brooks's side is that the ex-post flows data from the Treasury don't show the counterfactual: what those non-U.S. holders would have done without the Fed's intervention. In other words, the sales might have been motivated by Fed purchases. He pointed to the dollar's rally as exhibit A for foreign appetite for U.S. assets. This all sharpens the focus on how the market will fare as the Fed tapers its purchases -- which fell to $6 billion a day this week from a peak of $75 billion in mid-March. The breakneck pace of Treasury sales isn't dropping off any time soon... Roaring '20s At least some of the market clearly still has a stomach for U.S. government debt. The Treasury re-introduced a 20-year bond this week and it certainly went full throttle on its theme, with a $20 billion sale on May 20, 2020. Those with 20-20 vision might have seen that coming. It was the first auction of this maturity since the 1980s and it sold pretty well, albeit a bit cheap to levels in the when-issued market. It's advanced since, outperforming the rest of the curve. That's in keeping with recommendations from JPMorgan strategists to buy the new bond versus its 10- and 30-year wings. As an experiment with introducing new(ish) products to draw as many buyers as possible into this historic fundraising effort to combat the fallout from the pandemic, this was a success for the Treasury. It fits with what Mnuchin described to the Senate Banking Committee this week as his aim to expand offerings of longer-term debt "to lock in a significant amount at low interest rates." At the same time, he signaled he's backing off earlier proposals to extend the government's borrowing out as far as a century bond. Fiscal EUnion? If Angela Merkel and Emmanuel Macron expected a jubilant response to their united bid to rescue the European Union from the ravages of the pandemic Tuesday, they might have been disappointed. European markets met the proto-accord between the leaders of Germany and France on a possible 500 billion euro package with tepid enthusiasm. None partied harder than Italy, where the 10-year yield dropped 20 basis points, bringing the spread to Germany to its narrowest point in over a month.  The market reaction seems a little meh for what could be considered a significant first step toward the fiscal coordination eurozone enthusiasts have dreamt of, and a major about-face for Germany. But that's because the Emmangela Plan needs approval from all 27 member states and is already suffering pushback from the so-called Frugal Four: Austria, Denmark, Sweden and the Netherlands, which apparently have a rival proposal in the works. At the very least the display of unity by the region's two largest economies can get the ball rolling on the kind of response the ECB, which has been fighting the bloc's demons pretty much single-handedly over the past decade, has long demanded. And that back-up is looking particularly important, as Germany's constitutional court this month set a three-month deadline for the ECB to show how its quantitative easing program hasn't overstepped the law. That caused a small tizzy in European funding markets earlier this month, helping widen the spread between the benchmark European interbank lending and swaps rate. No NIRP And speaking of themes that just won't go away, we're forced again to contemplate the dark world of negative interest rates. Early this month, positioning for the Fed to cut its target rate below zero started showing up in U.S. derivatives markets. The central bank acted quickly to quash speculation, with a string of officials, including arch-doves -- Atlanta's Raphael Bostic and St Louis's James Bullard -- the chairman and Williams saying they're not contemplating further cuts. By midweek most fed funds contracts were trading back below par -- implying a positive target rate -- and the overnight index swaps tied to the April 2021 Federal Open Market Committee meeting had traded back within the Fed's 0-0.25% target range. But eurodollar options still show stray demand for upside hedges targeting another Fed cut.  This may not be simply a punk move on the part of traders. Much of this positioning is likely technically driven, and such fluctuations are to be expected with U.S. rates at the zero bound. But in these times, "never say never" is a reasonable approach. After all, negative rates are still a hot topic on the other side of the Atlantic. The ECB isn't about to scrap its policy, and Bank of England Governor Andrew Bailey said Wednesday he isn't ruling out a similar move. U.K. money markets moved to price in an 11 basis point cut below zero by February. And this is all in the week that the government sold its first bond with a sub-zero yield. Read more: U.K.'s First Negative-Yielding Bond Sale Sharpens Focus on BOE And here: Negative Rates Bets Are Going Global to Ire of Central Banks This all may give U.S. banks some unappetizing food for thought heading into the long weekend. Potpourri The flood of jobless claims is unabated, and millions of Americans are on edge  Behold, the Covid Quarter, with some surprising performances Investors are starting to sweat Stein's Law... "If something can't go on forever, it will stop" Asia bonds are leading the developing world out of crisis  Humans Top Bots in Covid Crisis Electronic Bond Trading Test Citi CEO Michael Corbat is really angling for that World's Best Boss mug. The Weekly Fix hasn't independently verified this, but rumor has it that the European Milky Way chocolate bar is floatier than its U.S. peer. |

Post a Comment