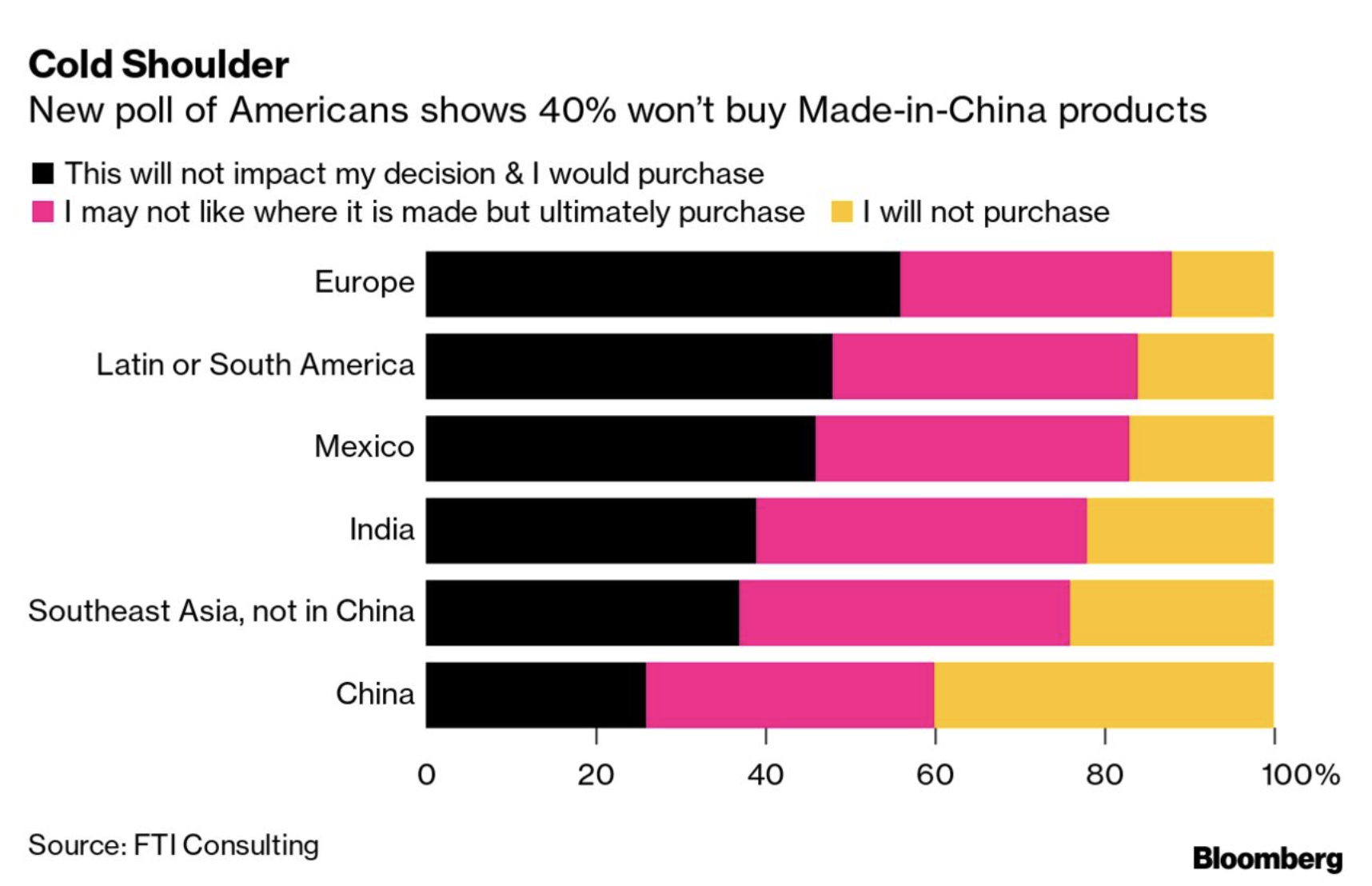

| The Federal Reserve rings alarm bells over asset prices, which lately have defied dismal economic news; the Trump administration hurls more blame at China over the global spread of the virus, and Emirates weighs up the most drastic cuts in the global airline industry as the pandemic rewrites the outlook for travel. Here are some of the things people in markets are talking about today. The recovery of the U.S. economy from the coronavirus pandemic could stretch through the end of next year, and depend on the delivery of a vaccine, said Federal Reserve Chairman Jerome Powell. "Assuming there's not a second wave of the coronavirus, I think you'll see the economy recover steadily through the second half of this year," the U.S. central bank chief said in an excerpt of an interview conducted Wednesday and aired on Sunday on CBS's "Face the Nation" show. More than 36 million Americans have lost their jobs since February as the economy was shuttered to limit the spread of the virus, and countless companies, especially small businesses, are hurtling toward bankruptcy.The Fed chief said people should never "bet" against the American economy, but he took care not to promise a swift, so-called V-shaped rebound. The pound dipped in early trading Monday after a Bank of England official said the central bank is examining a range of unconventional policy tools, including negative interest rates. Asian stock futures pointed to a mixed start. Sterling was about 0.3% lower against the greenback, with moves muted elsewhere across currency markets. U.S. equity futures opened in the green even after a Fed report warned of the danger of "significant price declines" for stocks and other assets if the coronavirus pandemic worsened. Futures edged down in Japan and Hong Kong, while contracts in Australia rose. Global equities are coming off the back of declines last week as the rally from the March lows showed signs of stalling. The Trump administration stepped up its campaign of blaming China for the deadly coronavirus pandemic, with a top aide suggesting Beijing sent airline passengers to spread the infection worldwide. It's the latest in an almost daily barrage of U.S. attacks on China, including past suggestions that the virus escaped from a laboratory in the central city of Wuhan. It comes as political and business leaders are already starting to think about what the world might look like once the worst of the outbreak eases. China's initial handling of the virus will be scrutinized at the first meeting of the World Health Organization's governing body since Covid-19 stormed the globe. Meanwhile, China's annual political centerpiece, the National People's Congress, gets under way this week, two months later than usual due to the pandemic. U.S. coronavirus cases rose 1.5% in the past 24 hours, marking the third straight daily deceleration. New York's western region and the area around Albany are poised to reopen. The U.K. will be first in line to get an AstraZeneca vaccine. Tesla received permission to reopen its California factory after first defying local officials. Here is how Bloomberg is tracking the spread. Emirates Group is considering slashing about 30,000 jobs, the deepest cuts yet in a global airline industry that's been forced into near-hibernation by the coronavirus pandemic. The world's biggest long-haul carrier could shrink a payroll that stood at 105,000 in March by as much as 30% as it reduces costs and realigns its operation to cope with a travel downturn expected to last for years, according to people familiar with the matter. The state-owned group raised $1.2 billion in new financing in the first quarter and is seeking aid from Dubai. Emirates is also considering accelerating the retirement of its fleet of A380s, the massive double-decker jets that can seat more than 500 passengers, some of the people said, asking not to be identified because the information hasn't been made public. New Zealand's lofty ambition to eliminate the coronavirus may pay dividends as it begins to rebuild its economy and promote itself as a safe haven for global business. As Kiwis emerge bleary-eyed from one of the strictest lockdowns in the world, the government says its strategy of hitting Covid-19 early and hard will allow a much faster return to some semblance of normality. To hammer home the advantage, the finance minister has announced fiscal stimulus worth more than 20% of gross domestic product, predicting that will jump-start growth and get the jobless rate back to its pre-virus level of 4.2% within two years. The island nation at the end of the world appears to have succeeded in stamping out the virus, reporting just two new cases in the past six days. Prime Minister Jacinda Ardern claims this gives the country a "safe-haven strategic advantage" that will help it recover ahead of its peers. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning We were talking last week about how rising inequality within countries can produce imbalances that end up spilling across borders and exacerbating trade wars between countries. Right on cue comes this survey from FTI Consulting, which shows that some 40% of Americans now say they won't buy products from China. What's really remarkable, however, is the shift in sentiment on international trade restrictions. Some 66% said they favor raising import restrictions over the pursuit of free-trade deals as a better way to boost the U.S. economy.  That appears to be a big change from Americans' traditional embrace of "free markets." For instance, in a Gallup poll from February, some 79% of respondents said foreign trade was "an opportunity for economic growth through increased U.S. exports." Setting aside the fact that most people don't understand just how intertwined Chinese products actually are with the U.S. supply chain, the FTI survey suggests that a new surge in domestic economic frustrations might end up as cross-border tensions. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia and beyond. Sign up here to get our weekly roundup in your inbox. |

Post a Comment