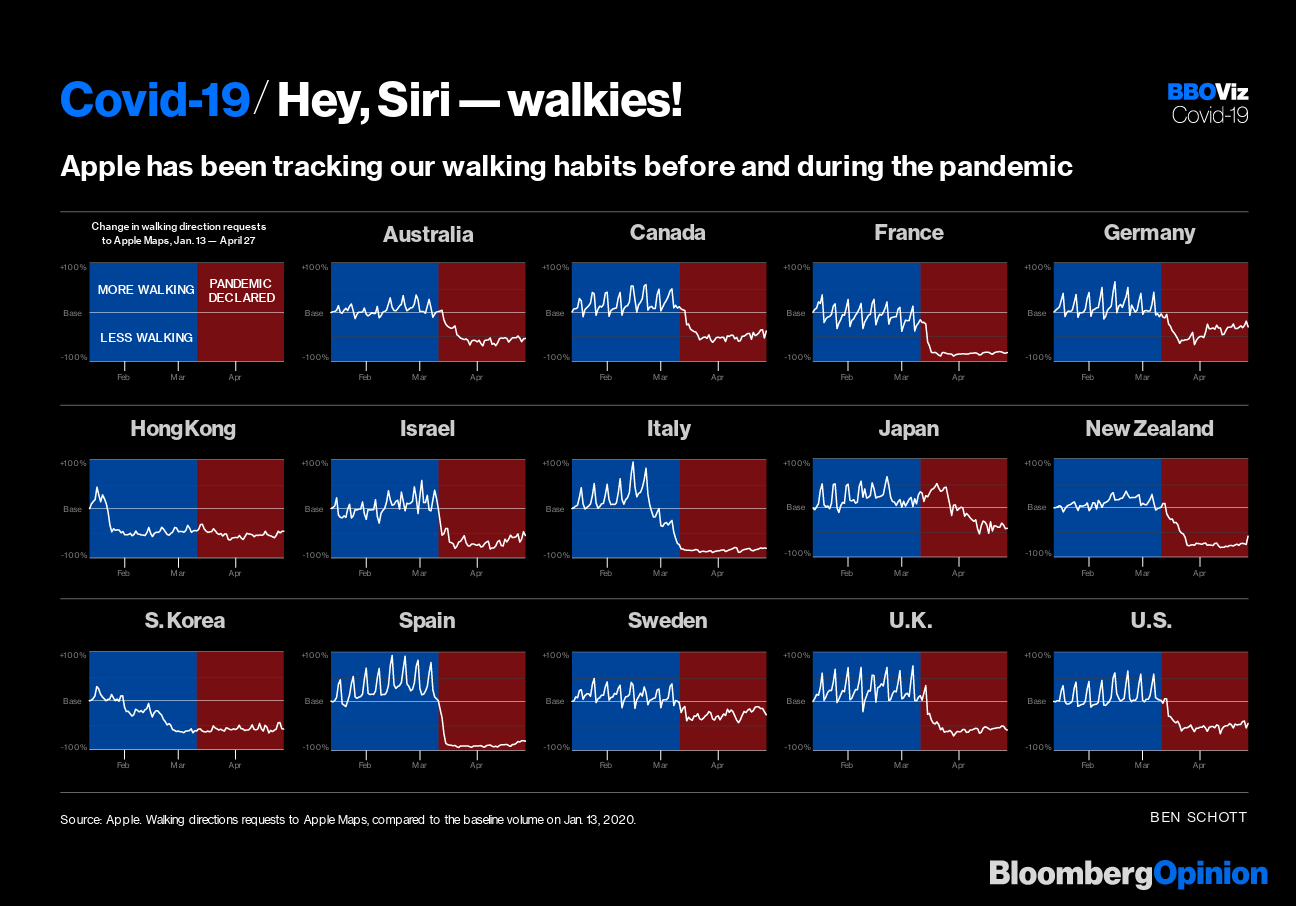

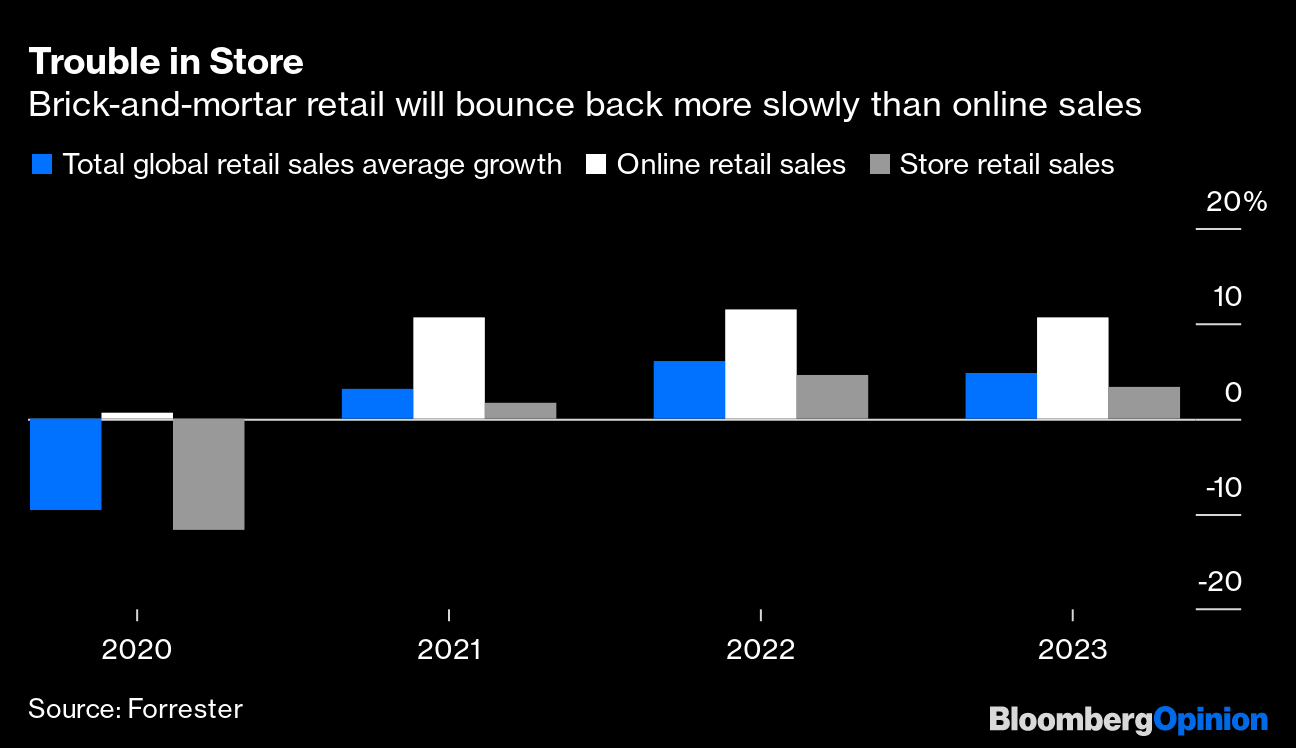

| This is Bloomberg Opinion Today, an armed insurrection of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Your sign says "hoax" but your facemask says otherwise. Photographer: JEFF KOWALSKY/AFP/Getty Images Bailout Backlash A-Brewing Even in this wild age, it's striking to see armed goons in big pants storm a state capitol to protest being kept away from Dave & Buster's or whatever. But today's quarantine protests won't hold a candle to the bigger political backlash that's brewing more quietly — not about lockdowns but about the bailouts meant to ease their economic pain. We've seen this movie before: Congress, the Fed and two different presidential administrations did what they could to keep the Great Recession from turning into a depression. But real or perceived inequities in that process fueled resentment that manifested in Occupy Wall Street, the Tea Party and the presidential campaigns of Bernie Sanders and Donald Trump. Today, Congress, the Fed and the Trump administration are again fighting a financial inferno, this one caused by coronavirus, and resentment is already brewing. It's their own fault; failures of oversight have sent money meant for small businesses to big ones instead. This same failing also has government contract cash flooding to scam artists taking advantage of our desperate scramble for pandemic-fighting equipment, writes Tim O'Brien. There's got to be a better way! Actually, there is: Other countries have sovereign wealth funds that invest in companies and other stuff for profit, which they then spend on their populations, writes Nir Kaissar. It's long past time the U.S. had one. It could be a politically neutral investor in deserving companies that need cash, with any winnings going straight to the common good. It would need oversight, of course, but an established fund would mean we wouldn't need to build huge, leaky bailout machines on the fly at every crisis. Fear of backlash is even starting to rattle Wall Street, writes John Authers. People may get lost trying to follow bailout money, but everybody understands the jarring juxtaposition of stocks soaring while 30 million workers lose their jobs in six weeks. Amazon.com Inc. is that dilemma in (still very large) miniature. The company is raking in sales while everybody hunkers at home, but its costs are soaring too, writes Tae Kim. It's expensive to deliver all this stuff, but, more importantly, it must protect workers from the virus to avoid even more of a backlash than it's already suffering. Some Amazon employees joined other essential workers in a walkout to protest conditions today. They presumably didn't have guns, but they will increasingly have political power. Further Backlash Reading: Landlords aren't the villains of high rent; politicians who keep real estate expensive are. — Stephen Carter Musk and Buffett: A Study in Contrasts It would be unfair to call Elon Musk and Warren Buffett the Goofus and Gallant of American capitalism. Musk's style isn't as refined as Buffett's, but he's done all right for himself. Still, you have to wonder lately. Back in 2018 Musk got in hot water for tweeting that his company Tesla Inc. had "funding secured" to go private, when in fact it did not. That was only the most legally consequential of his recent weird behavior. Today he did what Liam Denning suggests is the opposite of "funding secured," by tweeting his opinion that Tesla stock is too expensive. He has a point, Liam writes: The stock is wildly overpriced, given coronavirus and the company's cash issues. It's about 10% cheaper now! But investors knew, or should have known, what they were getting when they bought Tesla equity: a ticket on the increasingly wild ride that is Elon Musk's whole je ne sais quoi. Buffett has a cult of personality too, only one that involves ukeleles and sweets instead of Grimes and Joe Rogan's pot. His style has also made money for investors, but in a more relaxing, grandfatherly way. Like Musk, he also has a following beyond the corporate world. Unlike Musk, he has kept his thoughts to himself during this pandemic, writes Tara Lachapelle. It's kind of unnerving, in fact. He'll finally speak this weekend, taking investors' questions on Saturday. Tara has five questions she'd like him to answer, including whether he's still bullish on America. Further Corporate Communications Reading: These Aren't the Coronavirus Role Models You're Looking For We all got pretty excited this week about a study finding a Gilead Sciences drug helped coronavirus patients heal a little more quickly. But that was all the trial found; remdesivir isn't the miracle cure that will get us all out of lockdowns tomorrow, unfortunately. Worse, the trial was rushed to get quick FDA approval, without getting helpful information on what kinds of patients it helps or hurts the most, writes Faye Flam. Now that the study is over, we've forever lost a chance to help doctors treat virus patients better. Some of us are also excited about Sweden; not the usual stuff — meatballs, IKEA — but its strategy for fighting the coronavirus. This can be best summed up as "not fighting the coronavirus." Some people suggest this is the right approach, but Lionel Laurent is doubtful. Sweden has an unusually high death rate, and we don't know what sort of immunity its population has developed. The full repercussions of its approach aren't clear yet, but the early signs aren't so good. Telltale Charts People aren't taking as many walks, writes Ben Schott.  Brick-and-mortar retail faces a long, slow walk to even get in the neighborhood of normalcy, writes Andrea Felsted.  Further Reading Some immigration curbs are natural now, but Trump can't make them permanent. America will need more immigrants in the recovery. — Bloomberg's editorial board The comeback from this depression could be like the economic boom after World War II. — Aaron Brown The longer kids stay out of school, the more inequalities among them grow. — Therese Raphael UFO reports should be taken seriously, if there's a chance they lead to interesting answers. — Tyler Cowen How to shore up your finances before you lose your job. — Alexis Leondis ICYMI The pandemic could last two years. Your office won't be the same when you return. Canada banned assault weapons two weeks after a mass shooting. Kickers Japanese aquarium wants you to video-chat its eels so they don't forget humans exist. (h/t Zoe DeStories) These islands cost less than some homes. Sale of defective parrot spawns lawsuit, Monty Python jokes. (h/t Scott Kominers for the past two kickers) Take a virtual tour of the tomb of Pharaoh Ramesses VI. Note: Please send parrots and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment