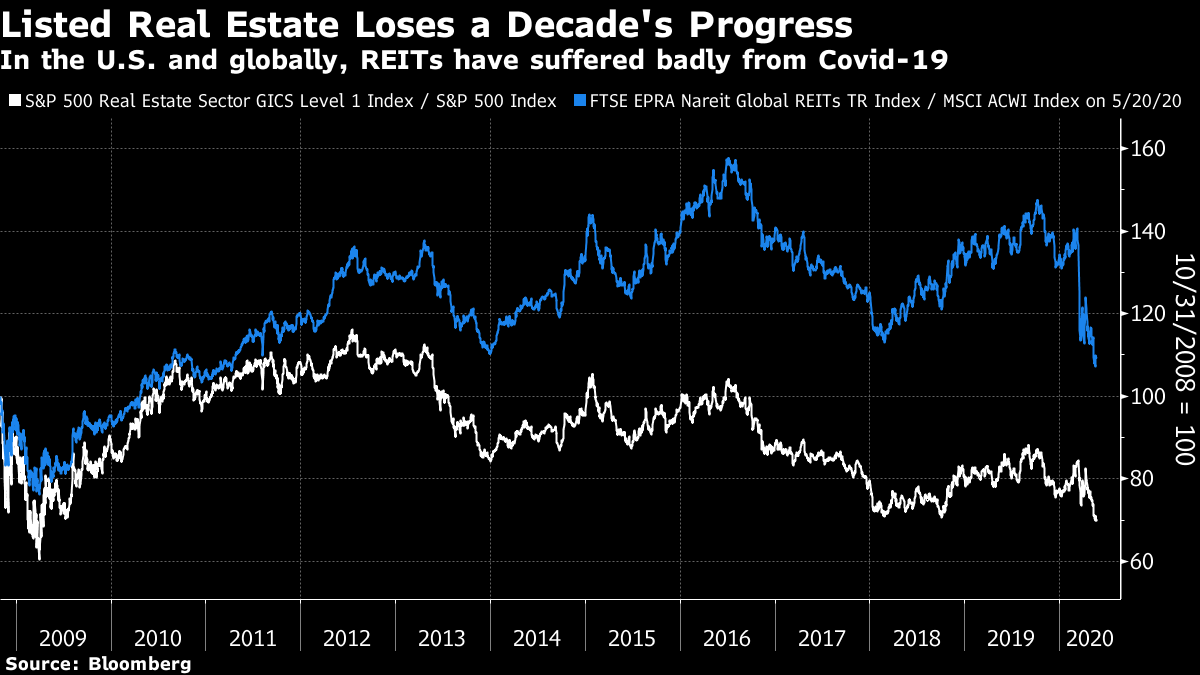

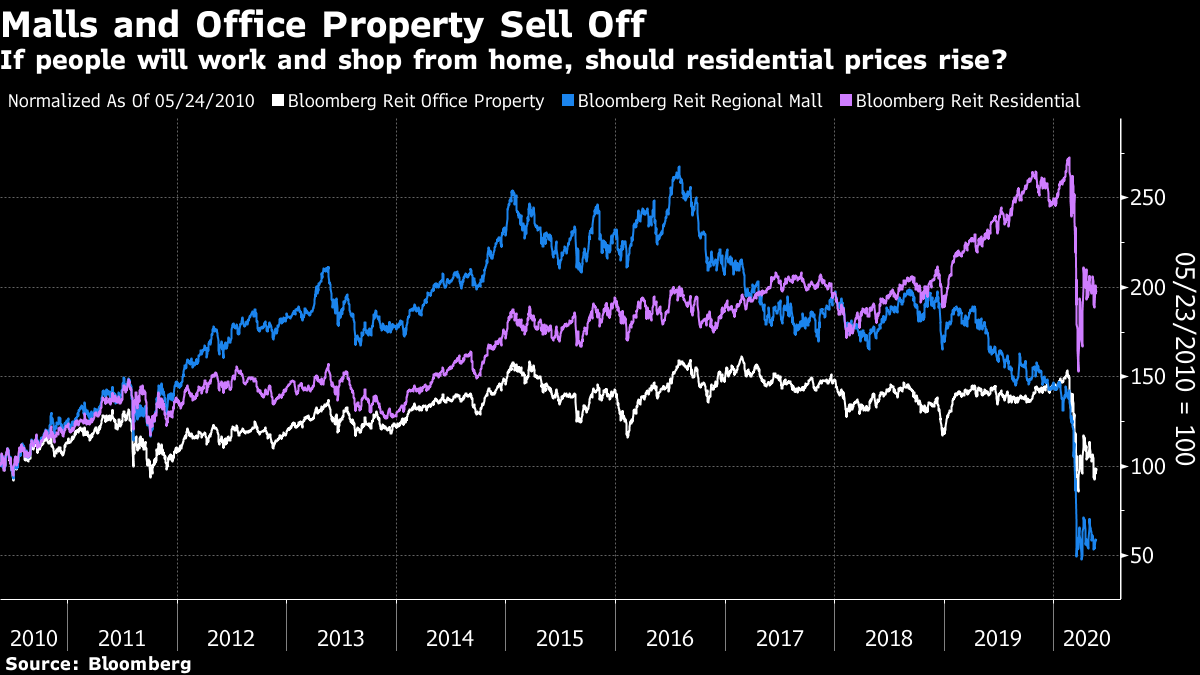

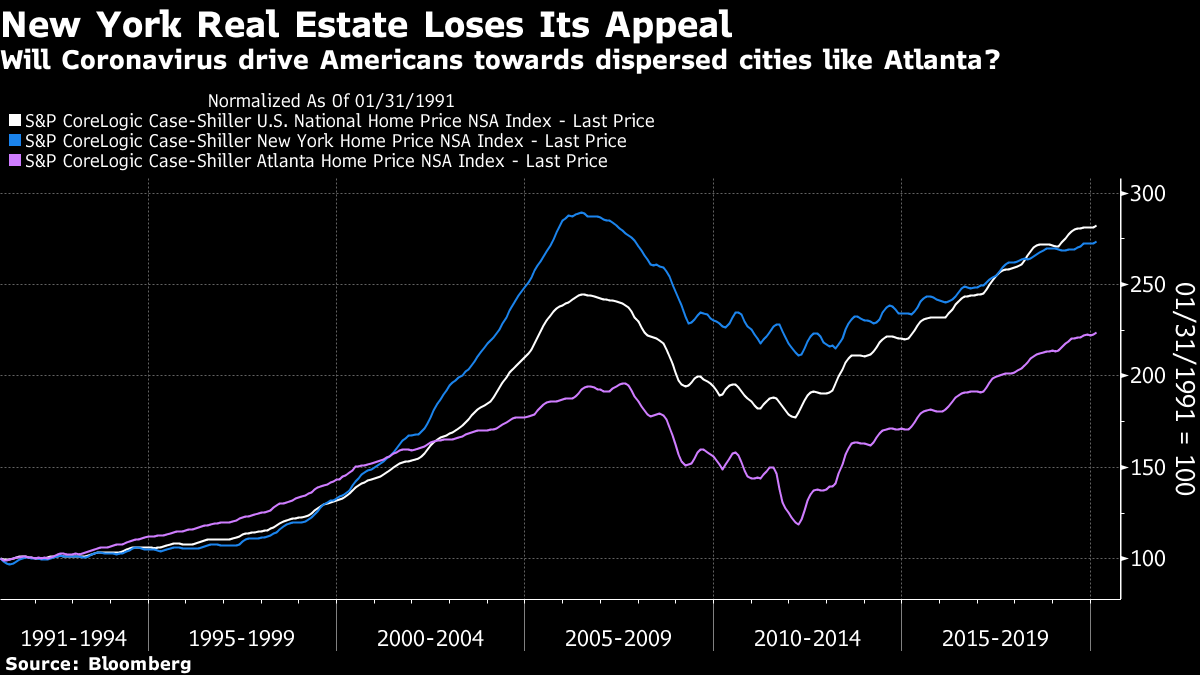

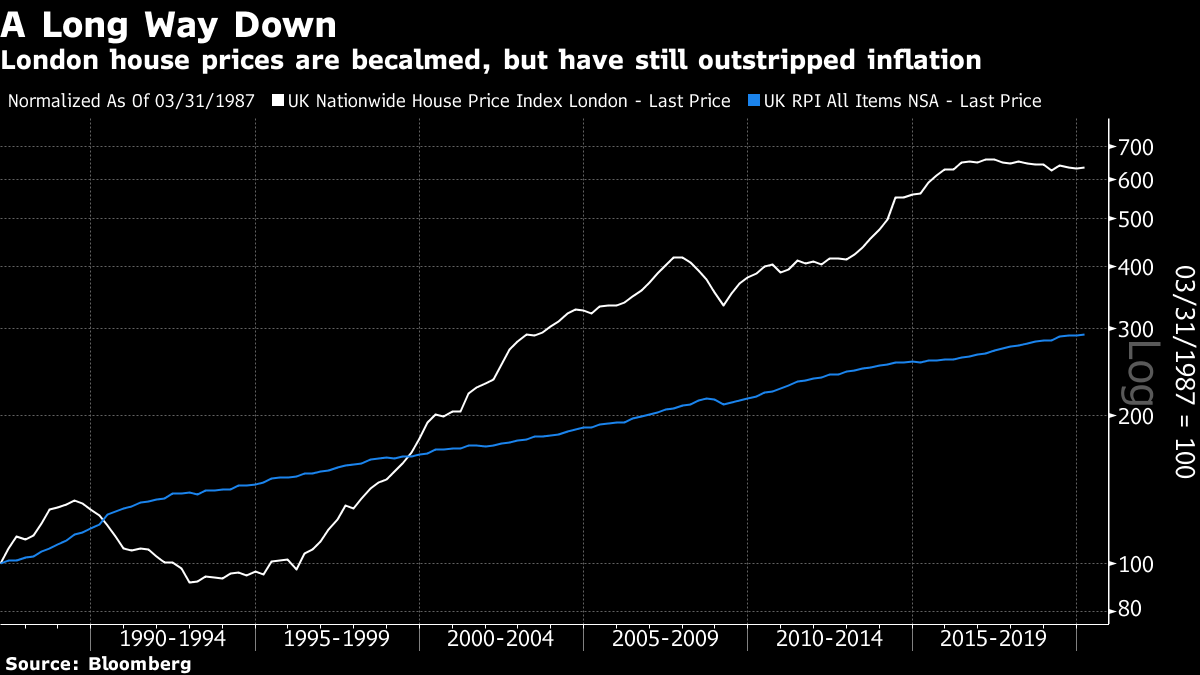

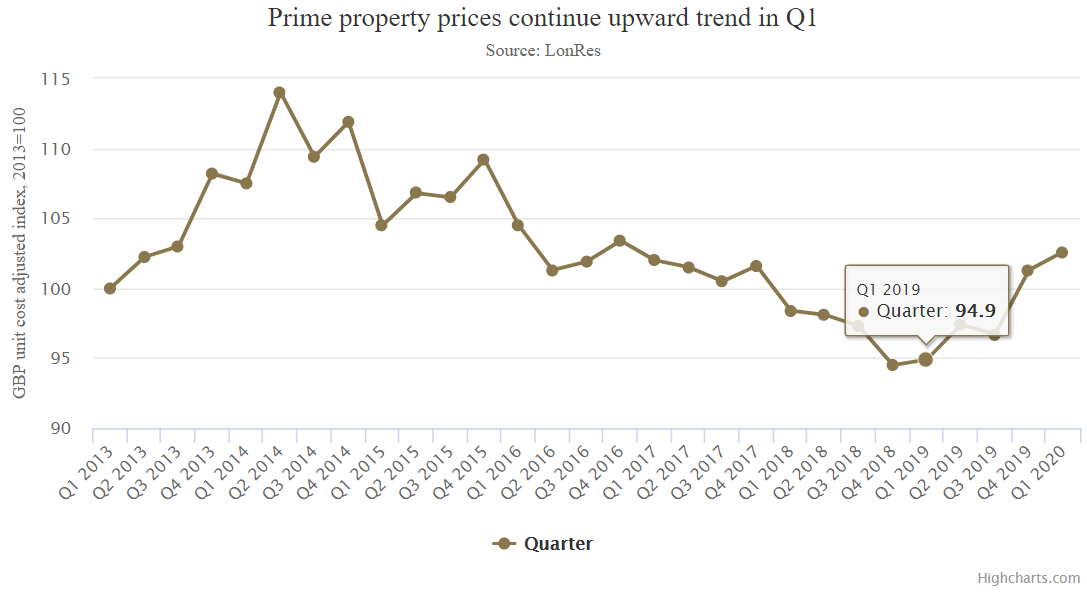

Post-Viral Property Real estate, like education, is one of those dangerous subjects in which everyone thinks they're an expert. We have all been to school, so we think we know about education, and we all live somewhere, so we think we know about property. As the purchase of our living quarters is the biggest transaction most of us ever make, we tend to have strong views about the market. This makes real estate one of those asset classes where there is still some real reason to believe that an actual expert, who can see through everyone else's mistakes, could make a real killing, or generate alpha. It is also one of the sectors that has already been turned upside down by the coronavirus, and where the pandemic might drive sweeping changes in the future. So there are plenty of chances for self-certified experts lose their shirts. First, we have to look at the plunge that has just taken place globally and specifically in the U.S., where listed real estate has had a terrible tumble compared to the market as a whole. For much of the last decade, real estate investment trusts, or REITs, outperformed nicely, thanks to the generous income they pay out from rents compared with the low yields on bonds. That relationship has now broken down, largely because of fears that the second order effect of the lockdowns will see tenants unable to pay rent. Real estate is, ultimately, exposed to the business cycle:  Malls have suffered a particularly brutal sell-off, according to Bloomberg's U.S. REIT indexes, which should surprise nobody. After all, dead shopping malls dot the landscape. Office property is almost at its lowest in a decade, while residential is still relatively robust. The question is what will happen next:  The question for the long term is what will happen to office property. The overwhelming conventional wisdom is that the lockdown has demonstrated office employees can work perfectly well from home. That means big employers will start to sell real estate, or not renew leases, which will be bad for owners. Some are already happy to proclaim the death of the office. That may be an overstatement. Office space will be less in demand, but companies will still want some space where staff can work together and have the kind of chance communications that make a crucial difference. Employees need to get to know and trust each other (or know when to distrust each other) and this is much more likely to happen when they meet occasionally. So how exactly will commercial real estate reduce? Keith Skeoch, CEO of fund management group Standard Life Aberdeen Plc, which is one of the biggest institutional property investors in the U.K., suggested a need for subtlety. "If you go into many offices now, they look like 1980s investment bank trading rooms," he said. "Those kind of battery farm approaches I suspect have gone forever. The insides of buildings will change quite dramatically." He also suggested that off-site emergency continuity sites were gone forever. Against this, there is the Archimedes principle as applied to real estate; displaced office demand will exert its own force elsewhere. In particular, changes as radical as many expect should have an equally radical effect on housing. If people don't need to be in an office very often, location grows less important. And if their home is to be their office, the chances are that they will want a bigger one. As Skeoch put it: "It can't be a zero-sum game. Certainly, we have people who are extremely comfortable working from home. They have a decent garden and a nice house and then can 'leave' for the office by locking the door. But it's very different for new graduates in one-room flats, or people with two or three kids. Over the long term, capacity has to change." Personally, I live in a roomy apartment (by Manhattan standards), which for the last 10 weeks has acted as an office for two adults and a school for three children. It is nowhere near big enough for that purpose. My job can be done much more easily from home than most, but I am really looking forward to going back to the office (I fear the rest of the family feels the same). If this state of affairs were to become permanent, the suburbs would look far more attractive than ever. The same would be true of sprawling metropolises such as Atlanta. And New York City property prices would be in jeopardy. This is the pattern of house prices in New York, the U.S. as a whole and Atlanta according to the S&P Case-Shiller indexes. New York has fallen steadily out of favor for some years now; there is plenty of space for prices in the Atlantas of the world to rally further:  This logic would also point to a need for more housing built on the previously reviled model of large suburban tract developments. The record of share prices in U.S. homebuilders over the last 20 years has been spectacular. With house prices recovering and mortgage rates falling as the crisis approached, they were already doing well, and they have enjoyed a swift snap back. If a "back to the suburbs" narrative gains force, plenty of people will be tempted to try their luck with homebuilding stocks again.  Other places that might have trouble? Try London. Britain's capital has long had a frothy housing market. It took the best part of a decade to recover from a bubble in the last years of the Margaret Thatcher premiership, but the sector bounced back much faster after the global financial crisis, in part because the Conservative-led coalition did its best to prime the market. London's housing prices have been becalmed since the Brexit referendum in 2016 — but there is ample space for them to fall further, if harried Londoners realize they no longer need to be within easy commuting distance of an office:  Then there is the market for "prime" properties in London's trophy postcodes. These boomed at the beginning of the last decade as the wealthy from continental Europe and the Middle East used the British capital as a convenient shelter from the risks of euro-zone disintegration. They peaked in 2014 as the euro-zone crisis began to calm, and sustained another blow with the Brexit referendum. Befor the virus hit, they had been recovering, as this chart of the Coutts London Prime Property index shows:  There are many countervailing factors. Weaker sterling will make London look cheaper, if foreign buyers are confident that the pound won't fall further. And prime property is already well below its high from six years ago. But if anyone were tempted to play another corner of the real estate market that is terribly bubble-prone, they might want to get out of London. None of this is simple. Office space and new residential developments will probably demand different amenities and architectural styles. Someone will catch what property for the post-virus age will need to be, and they stand to make a lot of money. The market is also perfectly poised to make fools of a lot of us. If there is any asset class that presents many opportunities, but that will require active management, it is commercial real estate. China Crisis It looks like hopes to avert a crisis in relations between the U.S. and China were just wishful thinking. Both look ever more belligerent. The fronts are no longer limited to trade, but now also include capital, with the U.S. beginning to tighten restrictions on investing in China, and technology. It looks mightily like a new Cold War. I will need to write much more about this next week. For now, I recommend two new books about the U.S.-China relationship, both of which ominously have "war" in the title: Capital Wars: The Rise of Global Liquidity by Michael Howell, and Trade Wars are Class Wars: How Rising Inequality Distorts the Global Economy and Threatens International Peace by Matthew C. Klein and Michael Pettis. They shine a light on how complicated and dangerous the relationship between the world's two biggest economic powers has become. Also, it grows ever more important to watch the Chinese currency. At the time of writing it has set its weakest point relative to the dollar since last October, when authorities allowed the currency to weaken as part of the skirmishes that came ahead of the trade truce. Should it weaken beyond the October low, that would be a major escalation of the conflict.  Survival Tips Blissfully, we in the U.S. have a long weekend to look forward to. To celebrate, I would suggest getting some sunshine in any way that is responsible. Meanwhile, as I have been thinking about the suburbs after writing a piece about residentialhousing development, I would like to mention that The Suburbs, by Arcade Fire, is clearly the best album to be released in the last 10 years (it came out in late 2010, as a new decade was ready to start). Almost every track on it isflawless. This isn't an empty statement, and I'm sure nobody could possibly disagree. If anyone does, feel free to get in touch. And if times are really bad, take refuge in this fantastic dog Zoom meeting video. My thanks to Dec Mullarkey of Sun Life Investment Management for bringing it to my attention. Have a good weekend everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment