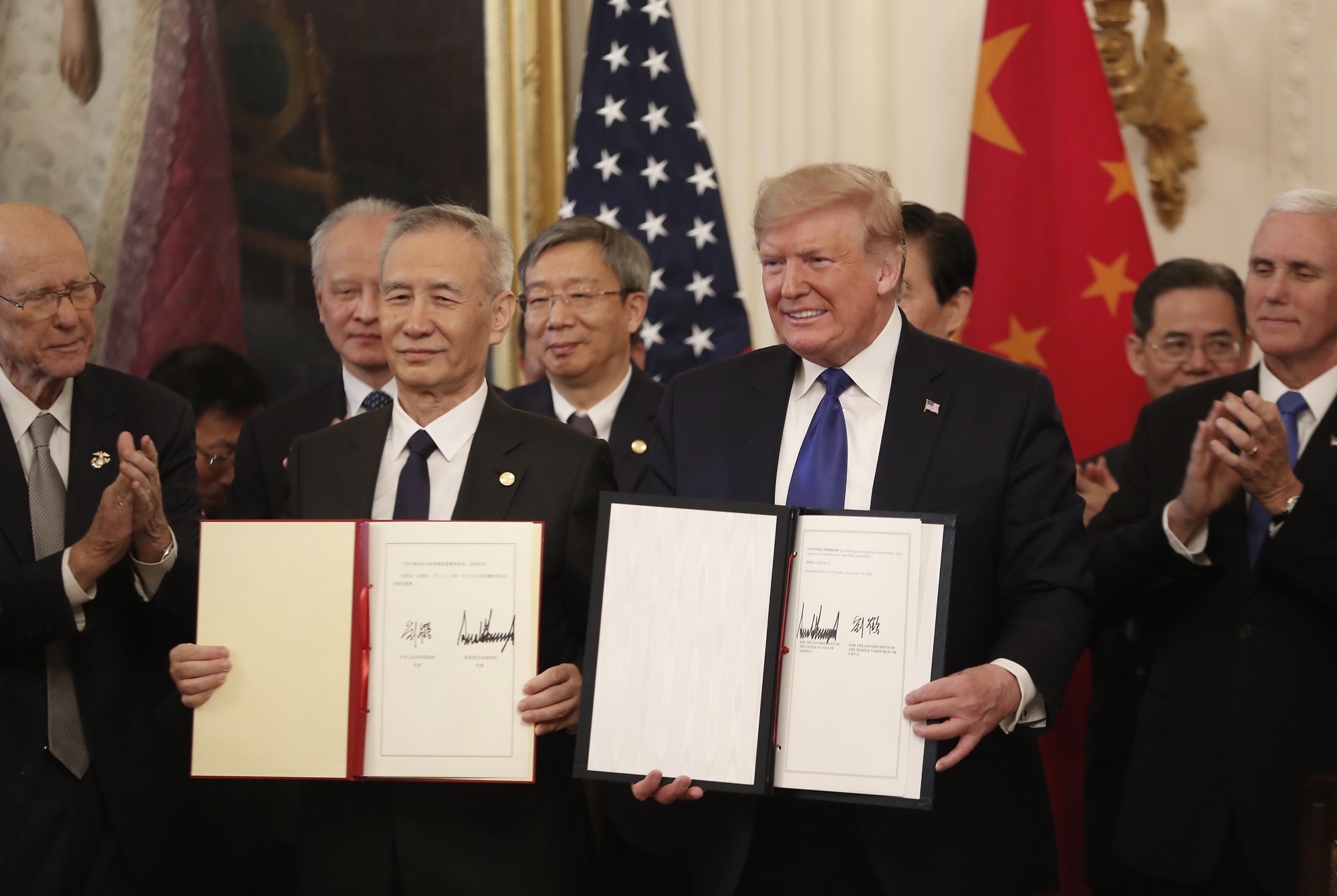

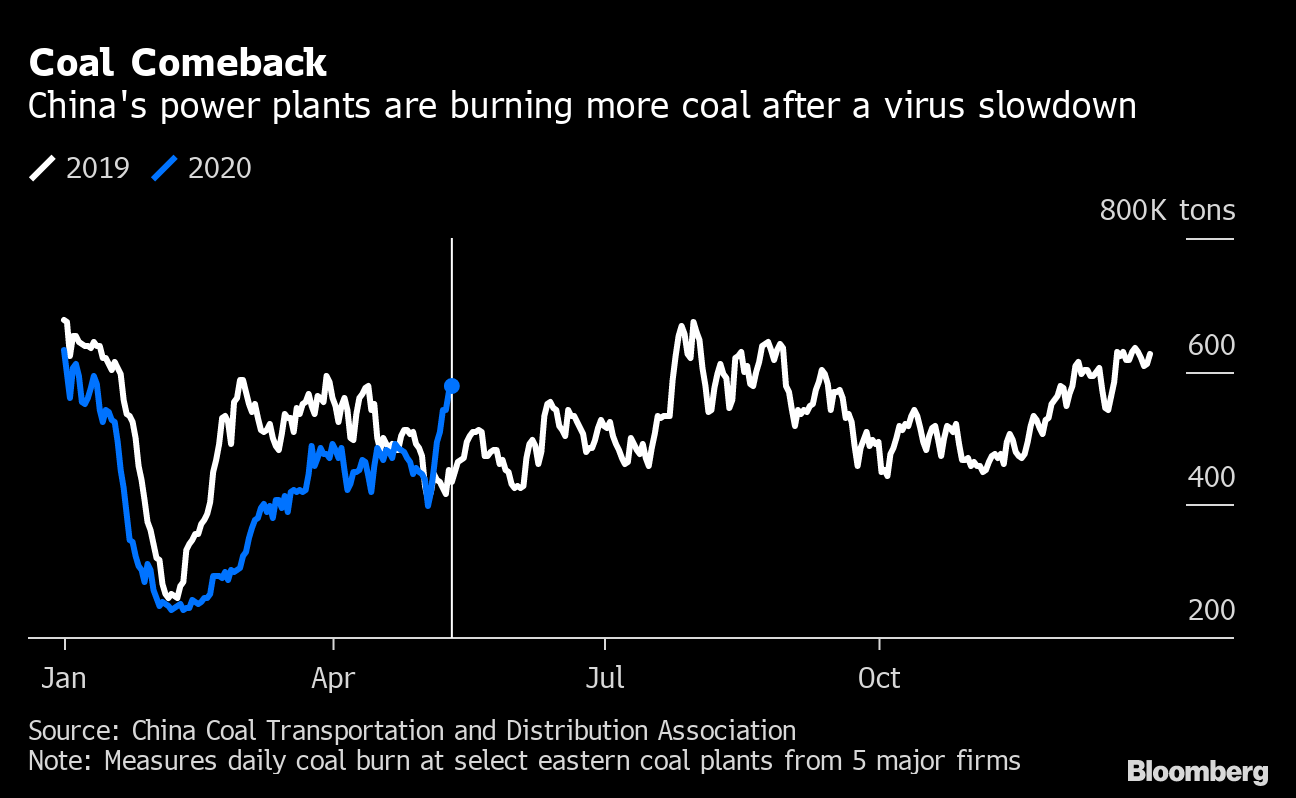

| One of China's main concerns as it negotiated a trade deal with the U.S. last year was how long any agreement they reached might last. Those worries are proving prophetic just months after the pact was signed. This week, President Donald Trump went from musing about canning the agreement in retaliation for Covid-19 to eliminating the trading relationship altogether. Trump, who says China is to blame for the outbreak because it failed to contain the virus, had tweeted that 100 trade deals would not be worth the damage the pandemic has caused. The Global Times, one of China's more nationalistic newspapers, has in turn reported that a growing number of Chinese officials are calling for a renegotiation of the deal in response to American allegations about Covid-19. Trump later weighed in to say he has no interest in reopening talks.  Donald Trump, right, and Chinese Vice Premier Liu He display the signed U.S.-China "phase-one" trade agreement during a ceremony in Washington on Jan. 15. Photographer: Zach Gibson/Bloomberg Financial markets have, however, largely shrugged off the rhetoric. The Nasdaq Golden Dragon China Index, which tracks shares of Chinese companies trading in the U.S., has held near a two-month high. Six-month implied volatility for the yuan has been falling for most of May. Shares of Kingsoft Cloud, the biggest new listing in the U.S. by a Chinese company this year, soared 40% on their first day of trading. One reason might be that the sides are still talking. U.S. Trade Representative Robert Lighthizer, U.S. Treasury Secretary Steven Mnuchin and Chinese Vice Premier Liu He spoke by phone late last week to review how the deal has progressed. Both Washington and Beijing issued positive statements afterward, and White House Economic Advisor Larry Kudlow described the conversation as "very constructive." China is buying more U.S. goods as well. State-owned buyers have purchased more than 1 million metric tons of American soybeans in the past two weeks. Beijing this week also added more U.S. products, including aircraft radar and medical disinfectant, to a list of goods exempt from tariffs and began allowing imports of fresh American blueberries. None of that means Trump's musing should be discounted of course. But with the U.S. presidential election just six months away and political maneuvering in high gear, the old adage about actions speaking louder than words seems to ring truer than ever. Bumpy Restart China this week discovered at least 22 coronavirus cases linked across three cities in the country's northeast, making it the largest cluster to emerge in months. Two of the cities, Jilin and Shulan, were placed under lockdown as authorities trace contacts with those infected. It is the biggest setback yet for China's bid to return to some semblance of normal. But don't expect Beijing to pause the reopening. With the economy still weak and the jobs market grim, policymakers are keen to keep the recovery efforts going. That's all the more true after April credit growth was stronger than expected, demand for air travel showed signs of recovery and coal demand outpaced pre-outbreak levels.  Coffee Buzz The bad news keeps coming for Luckin Coffee. The company, which once set its sights on challenging Starbucks, fired its CEO and COO this week as the repercussions of a scandal involving fake transactions continued to unfold. The coffee chain is also currently being probed by Chinese and American regulators and reeling from store closures because of Covid-19. But if you thought this debacle might dim enthusiasm for China's coffee market, you'd be wrong. With more than a billion consumers, many of them sleepy, the potential is just too large. Tencent, which had partnered with Luckin to explore everything from robot deliveries to facial recognition for payments, revealed this week it's betting on a new horse: Tim Hortons. The Chinese tech giant has signed on to help the Canadian chain grow its presence in China to 1,500 outlets from roughly 50 now. That will still be a fraction of the more than 4,000 locations Starbucks has. Australian Tensions Economically, it's hard to find two countries that are better matched than Australia and China. The commodities Australia excels at producing are in great demand across China. Politically, there's no shortage of discord. The latest spat surrounds Australia's calls for an independent probe into the origins of the coronavirus, an idea China has resisted. So when news came that Beijing had halted imports of meat from four Australian abattoirs and might also slap tariffs on its barley, many wondered if the steps were Chinese retribution. Fortunately, it's a situation that could become clearer as soon as next week, when the European Union plans to propose such a probe at the World Health Assembly. While China worries that such an investigation could be used to blame it for the pandemic, there's just as much concern that resisting a broad consensus would paint Beijing as a bad actor. How China views Australia's position could be very different depending on the way next week unfolds.  What We're Reading: And finally, a few other things that got our attention: |

Post a Comment