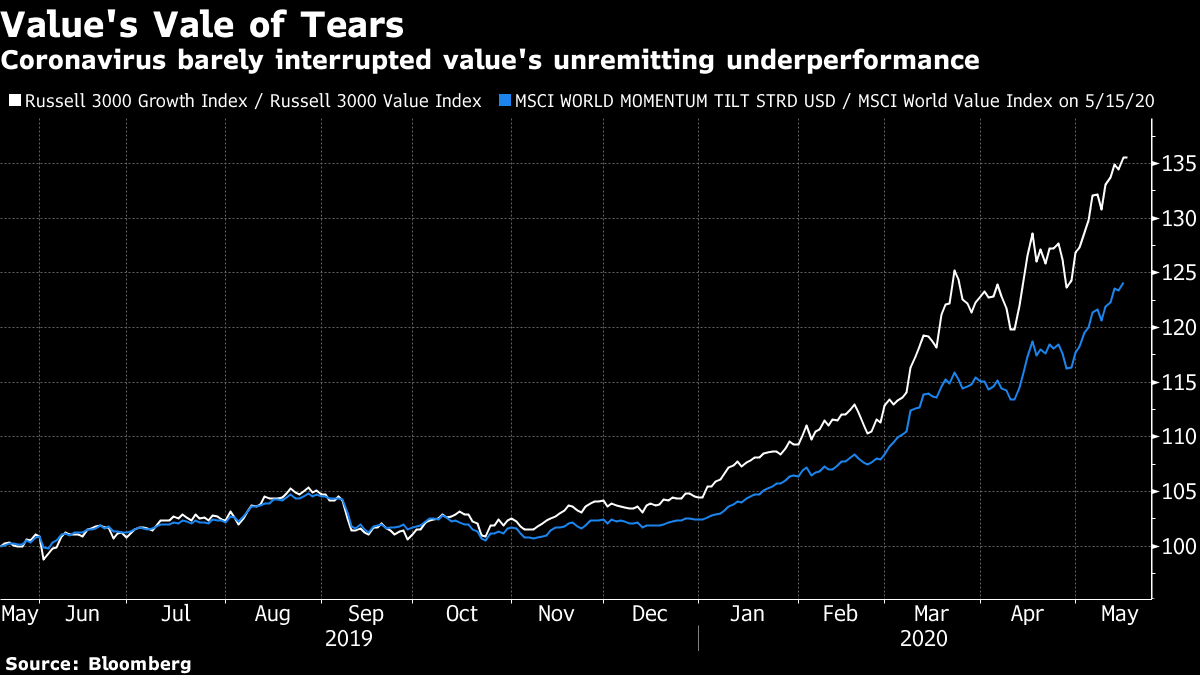

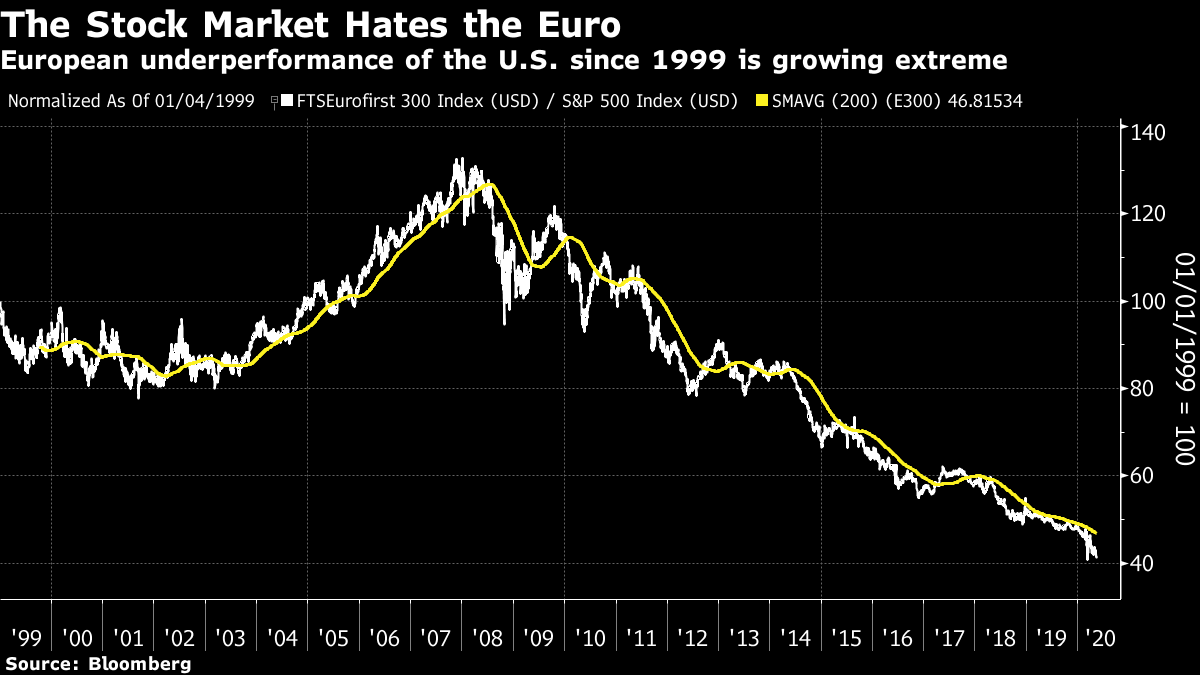

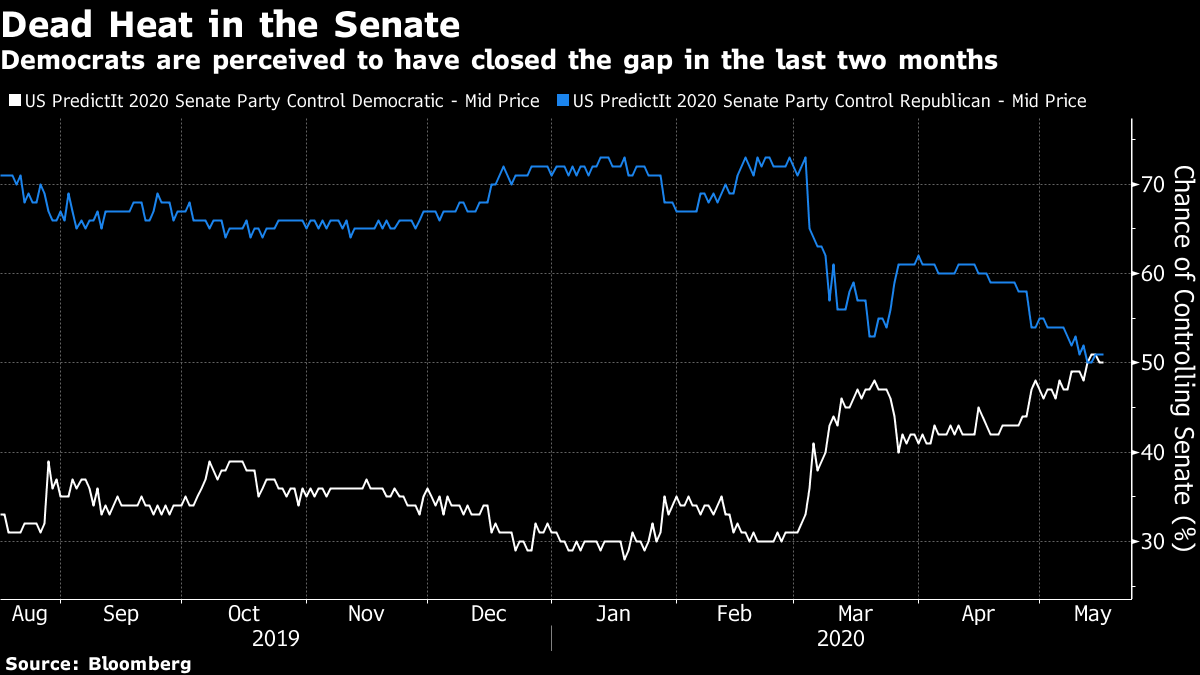

In Case I Missed It So, how was it for you? I took a break last week, so this is a good time to take stock. About two months ago, global capital markets sustained one of their greatest shocks in history, driven by the Covid-19 pandemic. Much still depends on how well public health and economic authorities deal with its impact and aftermath. Rather than wade into the increasingly fraught and tribal debate over the disease, I decided to sit down at my Bloomberg and see where we stand. After coming home to the terminal, so to speak, the broad conclusion is that the issues of concern a few months ago haven't gone away. I don't want to diminish the importance of the coronavirus. But markets have arrived at a decent guess as to its impact. More factors will drive what happens next. The U.S. First, financial conditions in the U.S., as measured by Bloomberg, show that the brief risk of a liquidity-driven crisis has been almost totally eradicated. For a few days it looked as though central banks would lose control. That has been avoided. But stocks haven't recouped much ground compared to bonds, so fears of a solvency-driven longer-term crisis remain. The week I missed, in which stocks had a moderate reverse, did little to change the picture. The chart starts on Oct. 8, 2018, when stocks peaked relative to Treasury bonds (and when I started work at Bloomberg):  Looking at volatility, calm has returned to both main asset classes — particularly bonds, as measured by the ICE BofA MOVE index. The VIX index of equity volatility is higher than in February, but the basic message remains: Markets are assuming they have accounted for pandemic risks:  Meanwhile, the stock market's internal patterns were barely interrupted. It continues to grow narrower. The market cap-weighted version of the S&P 500 is strongly outperforming the equal-weighted version, in which each stock accounts for 0.2% of the index. And the NYSE Fang+ index, featuring the dominant internet groups such as Amazon.com Inc., Apple Inc. and Netflix Inc., continues to beat the average stock to a remarkable extent:  This cannot continue indefinitely. Meanwhile, the travails of value investing are unaffected by the virus. The following chart shows "growth" companies (chosen for increasing earnings) relative to "value" stocks (which look cheap compared to their fundamentals), for the U.S. Russell 3000 index, and "momentum" plays (which have been winning recently) versus value in the MSCI World index. Buying stocks because they are cheap continues to work terribly, wherever you are:  Europe Europe appears to be heading straight backwards. Britain's vote to leave the EU was born of frustration with the bloc's ability to make decisions. Europeans tended to think Brexit Britain would soon find it couldn't get better trade deals elsewhere. Events since the end of January show both sides had a point. In the U.K., which has had the highest death toll in Europe, confidence in sterling has tanked below its level on Oct. 10 last year, when Prime Minister Boris Johnson's "walk in the woods" with Irish counterpart Leo Varadkar showed that a "no-deal" Brexit could be avoided and sent the pound soaring. It has fallen more than 10% against the dollar since Johnson's December election victory:  This is primarily about Brexit's return as an issue. British and EU delegations aren't making much progress in thrashing out a new free trade deal to replace the one that's due to expire at the end of this year. The British have until the end of next month to request an extension. Without this, there's a risk of a sudden shift to minimal World Trade Organization terms, which would be horrible for the British economy. So, for the next six weeks, we should brace for a repetition of brinkmanship over the possibility of no deal. Meanwhile the euro zone will go back to a soap opera that seemed to have ended years ago. The euro's existence is again creeping on to the agenda. If we look at the relative performance of European and U.S. stocks, using the FTSE-Eurofirst 300 and the S&P 500 in common dollar terms, the continent's performance has been breathtakingly bad. It lags by 60% since the creation of the euro at the beginning of 1990:  Any chance of drawing a line was ended by the coronavirus. Staying within the fiscal limits set by the 1991 Maastricht Treaty isn't an option for several countries. Raising debt in common isn't a possibility for several other countries. It would mean big transfers of taxpayers' money, in particular to Italy. The financial crisis of 2007-09 nearly broke the euro zone. Could coronavirus complete the job? The gold market suggests something is amiss. Whatever else can be said about the euro, it has successfully controlled inflation. Only briefly during the 2008 oil spike has euro-zone inflation exceeded a band from 1% to 3%. But the price of gold in euro terms has hit a fresh record:  Meanwhile another measure from the beginning of the last decade is back in fashion. The yield spread of Italian government bonds, or BTPs over German bunds is getting daily attention. It isn't yet at levels that will force politicians to act, but it is plainly elevated. Expect to get used to watching Italian spreads:  Christine Lagarde is a star of international finance, and was given the job of running the European Central Bank on the understanding that it would require great political skills. Her job looks ever more daunting. China Until the turn of the year, the U.S.-China relationship dominated the investment agenda. The two sides appeared to have reached a mutually convenient trade truce. Now, the rift is widening. Last week saw the U.S. move ahead with long-mooted plans to stop a government fund investing in passive vehicles that held Chinese shares. That escalates a trade war into a capital war — and capital wars are easy to wage, if hard to win. U.S. institutions have hefty holdings of Chinese securities and China holds a pile of U.S. Treasuries. Both sides could escalate swiftly if they wanted. Meanwhile, there are proposals to seek reparations from China for its role in birthing the virus and failing to alert the international community promptly. How exactly China could be made to pay or how the reparations could be calculated remains mysterious. Meanwhile, China's currency has been weakening and is back above 7 to the dollar (shown on an inverted scale on the chart below). China suffered a huge economic hit from the initial coronavirus outbreak, and could do with a much weaker currency. It has maintained a link to the dollar during a period when the U.S. currency has been strong, and when China has had higher inflation than the rest of the world. The result is that in real trade-weighted terms, the yuan isn't much weaker than at its peak in 2015 — when a clumsy devaluation sparked a minor international crisis:  Further weakening would add pressure on markets across the world. Meanwhile, it's noticeable that one of the few significant changes brought by the pandemic remains intact; after years of moving roughly in line with the rest of the emerging market complex, China is now outperforming by far:  China is turning in on itself, and other emerging markets will find life harder now. But unfortunately, if the U.S.-China dispute intensifies, they can still expect to be collateral damage. And that brings us to…. U.S. Politics The U.S. and western Europe locked down just as former Vice President Joe Biden was sewing up the Democratic presidential nomination. Little has happened in the campaign since, and politics seems to matter less to U.S. investors. This chart shows the Republicans' and Democrats' probability of winning the White House (according to Predictit) and the S&P 500:  The steady improvement in President Trump's chances of reelection was accompanied by a steady rally in the stock market. Then both collapsed together, and rallied together. But for a month now, the S&P has managed to keep rising (albeit much more slowly), even though Trump's chances are seen to be falling again. He now lags the Democrats by 4 percentage points. One reasonable explanation might be that for many months it looked as though the Democrats would nominate either Senator Bernie Sanders of Vermont or Senator Elizabeth Warren of Massachusetts, both of whom are proudly anti-market. Biden is seen as far more moderate. So the possibility of a Republican defeat seems less alarming than it did. But there is an important counter-argument. Republicans hold the Senate, and have hitherto been regarded as heavy favorites to maintain control. That is no longer true. This past week, according to Predictit, the Democrats at last closed the gap.  A Democratic president combined with Democratic control of both houses of Congress is an important new proposition. The Biden platform is likely to be more progressive than those of Barack Obama, simply because the party has moved to the left over the last decade. With control of Congress, a Biden administration would have a strong chance to create a "public option" for Obamacare to compete against private sector insurers. That would be awful news for health insurance companies. Yet this is how managed healthcare stocks are performing, compared to the S&P 500:  The sharp dips came in September 2019 as Warren appeared to be the front-runner for the nomination, while their sharp rise earlier this year overlaps with the defeat of Sanders. Yet the Democrats' resurgent chances of reclaiming the Senate haven't dented optimism. This will be an ugly and divisive campaign, as personal attacks are laid bare. For the last two months it hasn't affected the market much. Don't expect that to last. Howard Marks One last reminder: I will be online Monday afternoon interviewing Howard Marks, the legendary credit investor and founder of Oaktree Capital Group, as part of the CFA Institute's annual conference, which will sadly be virtual this year. It is still possible to sign up (for free). Marks' fascinating ideas about investing can be found in his regular memos archived here. They're well worth reading. Survival Tips Many have asked about my health, after my week off. Thank you for your concern. I had a raised temperature and several other flu-like symptoms. It didn't turn into a raging case of Covid-19, for which I am thankful. It's probably the only time in my life that I've been grateful for a dose of the flu. A number of friends have had to deal with Covid, and even for fit and athletic people in their early 30s (as discussed here), it can be horrible. So I don't have a first-hand account of how to survive Covid. I do, however, have a couple of suggestions for maintaining the spirits, both from my lovely wife. First, the most beautiful and uplifting musical collaboration I have yet seen under lockdown conditions is this a cappella version of "We Shall Overcome" produced by the Shades of Yale. Second, I recommend this piece of prose. It's not the kind of thing I normally share, or the kind of thing I expect to receive from my wife. It's about a doting wife's efforts to arrange a menage a trois for her husband's 40th birthday. It's brilliant. You don't need to have worked with the husband in question for many years, as I did, to find it hilarious. But it helps. Enjoy, and let's all try to survive another week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment