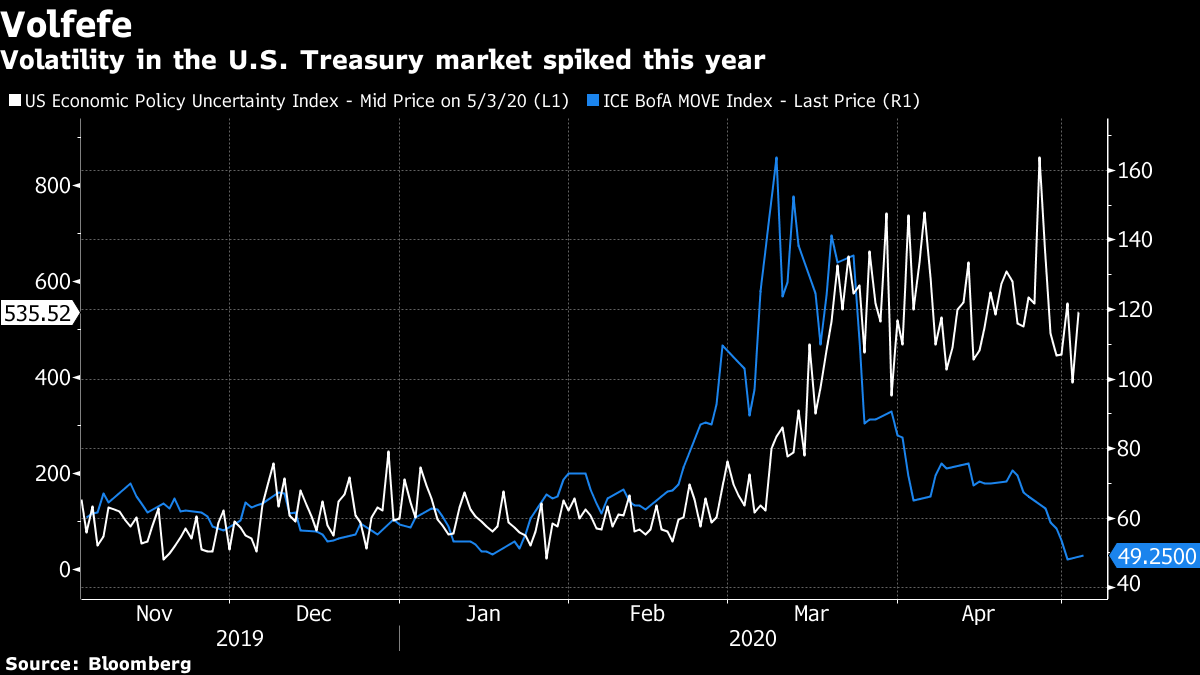

| Scientists create an antibody that can defeat the new coronavirus in a lab. Hong Kong's interest rates are expected to stay relatively elevated as the economy sinks and liquidity tightens. And Australia's GDP will crash by 10% in the June quarter, according to the country's treasurer. Here are some of the things people in markets are talking about today. Scientists created a monoclonal antibody that can defeat the new coronavirus in the lab, an early but promising step in efforts to find treatments and curb the pandemic's spread. The experimental antibody has neutralized the virus in cell cultures. While it's an early point in the drug development process — before animal research or human trials — the antibody may help prevent or treat Covid-19 and related diseases in the future, according to a study published Monday. More research is needed to see whether the findings are confirmed in a clinical setting and how precisely the antibody defeats the virus. Meanwhile, U.S. President Donald Trump acknowledged that the nation's death count would likely be higher than he had predicted, but also said some states "aren't going fast enough" to reopen. Trump also accused Beijing of attempting a cover-up and promised a conclusive report on the pandemic's origins. Elsewhere, Singapore is mulling how to ease its lockdown, even though the fight against the virus is far from over. Globally, deaths topped 250,000. Here's how Bloomberg is tracking the pandemic. Asian stocks are poised for modest gains — with a few markets closed for holidays — following a late-session advance on Wall Street. Crude oil gained for a fourth consecutive day. Equity futures were higher in Australia and Hong Kong. Trading is likely to be subdued with markets closed in Japan, China and South Korea. Equities will likely remain under pressure amid simmering U.S.-China tensions and uncertainty over the impact of some American states beginning to re-open. The S&P 500 Index staged a turnaround late in the session to end higher after California sounded a note of optimism in its fight against the virus. Hong Kong assets will be in focus after the economy contracted 8.9% in the first quarter from a year earlier, its worst quarter ever. West Texas oil futures pushed higher after fluctuating earlier in the day. The dollar strengthened against most major peers. The economy is crashing like never before, yet Hong Kong's interest rates are expected to stay relatively elevated. That's bad news for pretty much everyone apart from those betting on prolonged strength in the city's currency. Liquidity tightness in Hong Kong, partly caused by central bank moves to drain cash from the interbank market several years ago, contrasts with U.S. moves to slash borrowing costs. The resulting gap in interest rates — near the widest since 1999 for the one-month tenor — makes selling the greenback to buy the Hong Kong dollar a profitable trade due to the city's currency peg. While the Hong Kong Monetary Authority is now adding funds when it intervenes to defend the peg at the strong end, the amounts are insufficient to do much to shift the gap. The spread widened last month even as the HKMA injected $2.7 billion. What's the fix? According to Carie Li, an economist at OCBC Wing Hang Bank in Hong Kong, the city, ''needs to see strong capital inflows from overseas funds." Still, she added, "Investor confidence won't return until the pandemic is over, and that won't happen in the near term." A strategy of winning by losing less than its peers paid off for Alliance Bernstein Australia during one of the roughest periods for global equity markets. The AB Managed Volatility Equities Fund, already defensively oriented, turned even more so early this year: It sold all its holdings of Qantas and Sydney Airport in January and throughout the first quarter continued to trim positions in firms whose revenues were put at risk by social distancing, Roy Maslen, chief investment officer for Australian equities, said. The fund's cash level, typically about 2% to 3%, is around 10% now, the most since its inception six years ago, Maslen said. Australia's coronavirus lockdown will see gross domestic product plunge 10% in the June quarter, wiping A$50 billion ($32 billion) from the economy, according to Treasurer Josh Frydenberg. "Notwithstanding Australia's success to date on the health front, and the unprecedented scale and scope of our economic response, our economic indicators are going to get considerably worse in the period ahead before they get better," Frydenberg will say in an a speech on Tuesday. "Some of the hardest hit sectors like retail and hospitality are among the biggest employers." The Treasury forecast cited by Frydenberg is a further indication that Australia may be spiraling toward its first recession since 1991. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning So JPMorgan is back with an update on their "Volfefe" Index, which was created last September to gauge the impact of Donald Trump's tweeting on volatility in U.S. Treasuries. Events since then might suggest that presidential tweeting should be having less of an impact on the market. After all, up until very recently Trump had been posting less about the trade war with China (something which had preoccupied investors for most of last year), and much more about the coronavirus, Democratic presidential candidates and so on. However, JPMorgan's analysis is interesting as it suggests that U.S. interest rate volatility is now more sensitive to the president's social media account than before.  Part of that appears to be down to algorithmic and high-frequency traders becoming more attuned to the tweets and reacting to them much as they might respond to something like a new U.S. jobs report. In fact, by JPMorgan's reckoning, movements in U.S. Treasury yields are now more sensitive to Trump's Twitter account than they are to more traditional sources of monetary and economic policy announcements. You can follow Bloomberg's Tracy Alloway at @tracyalloway. |

Post a Comment