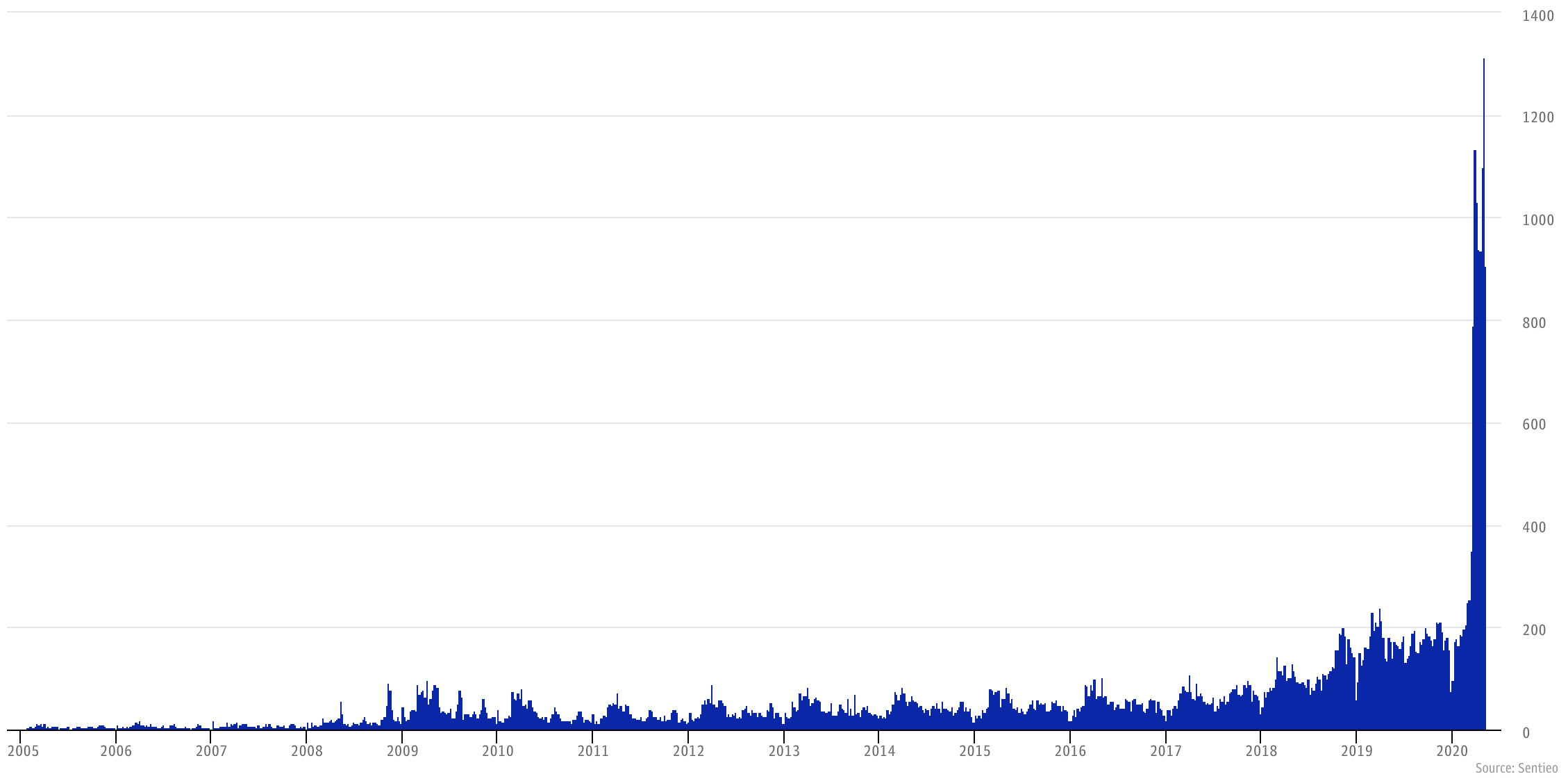

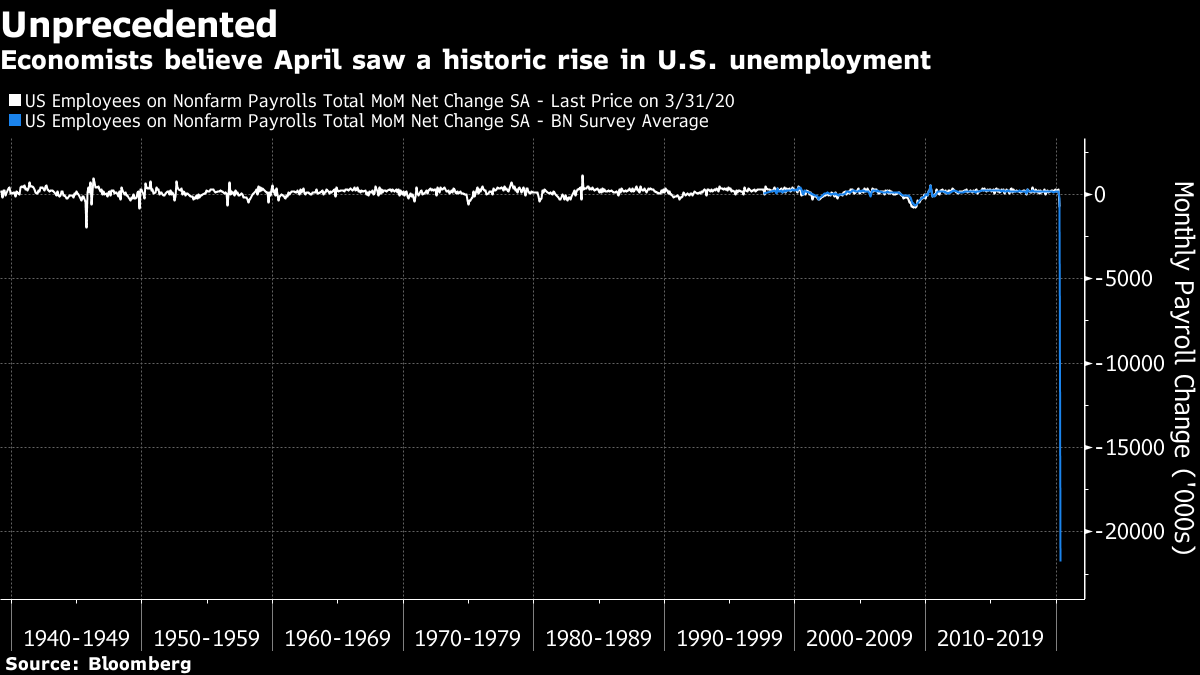

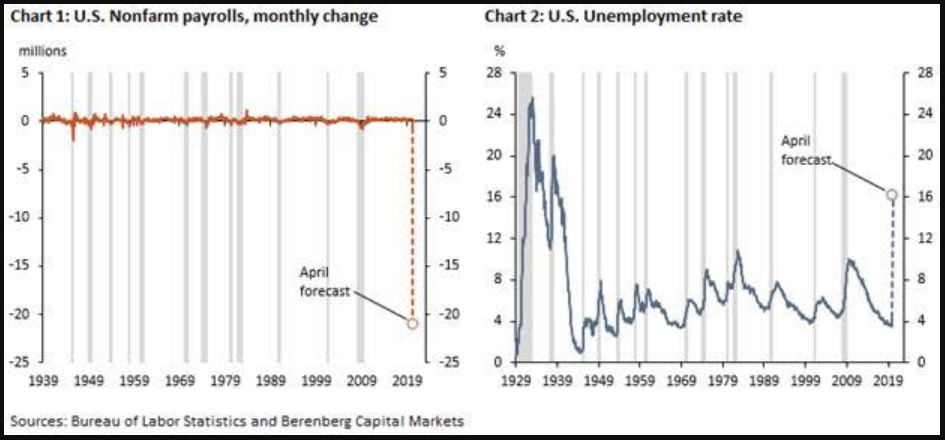

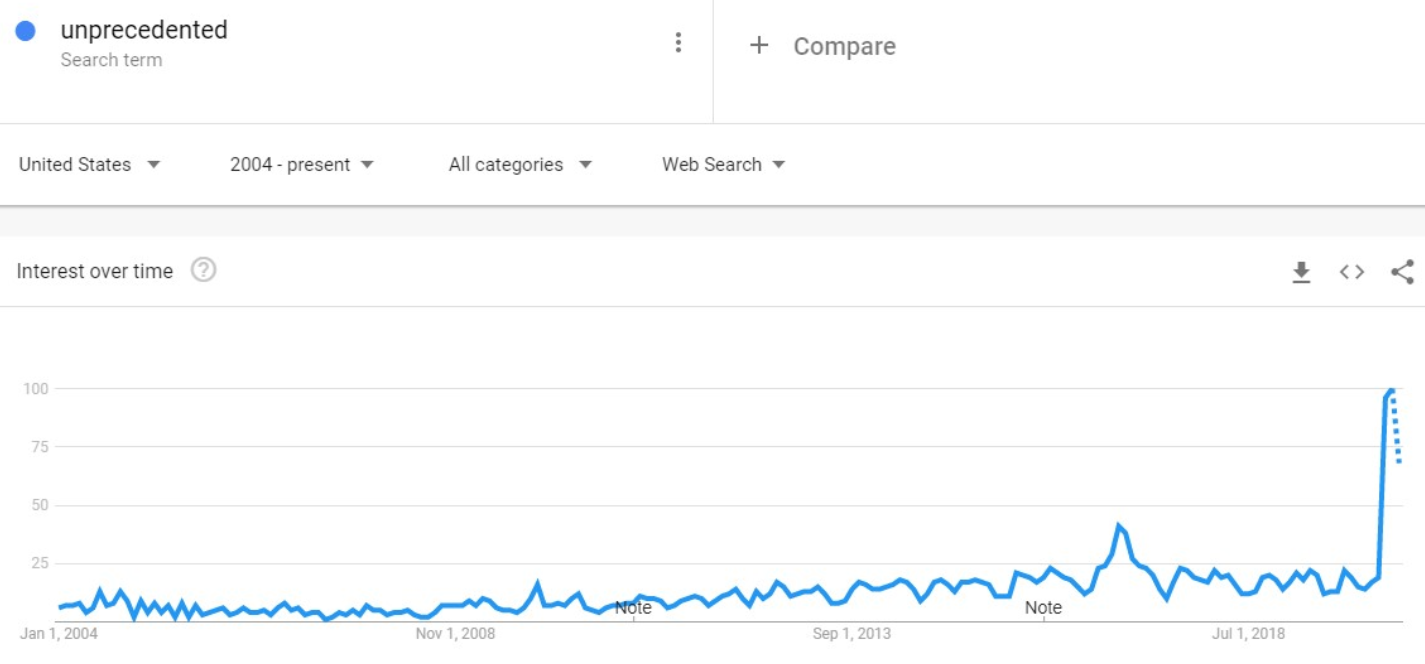

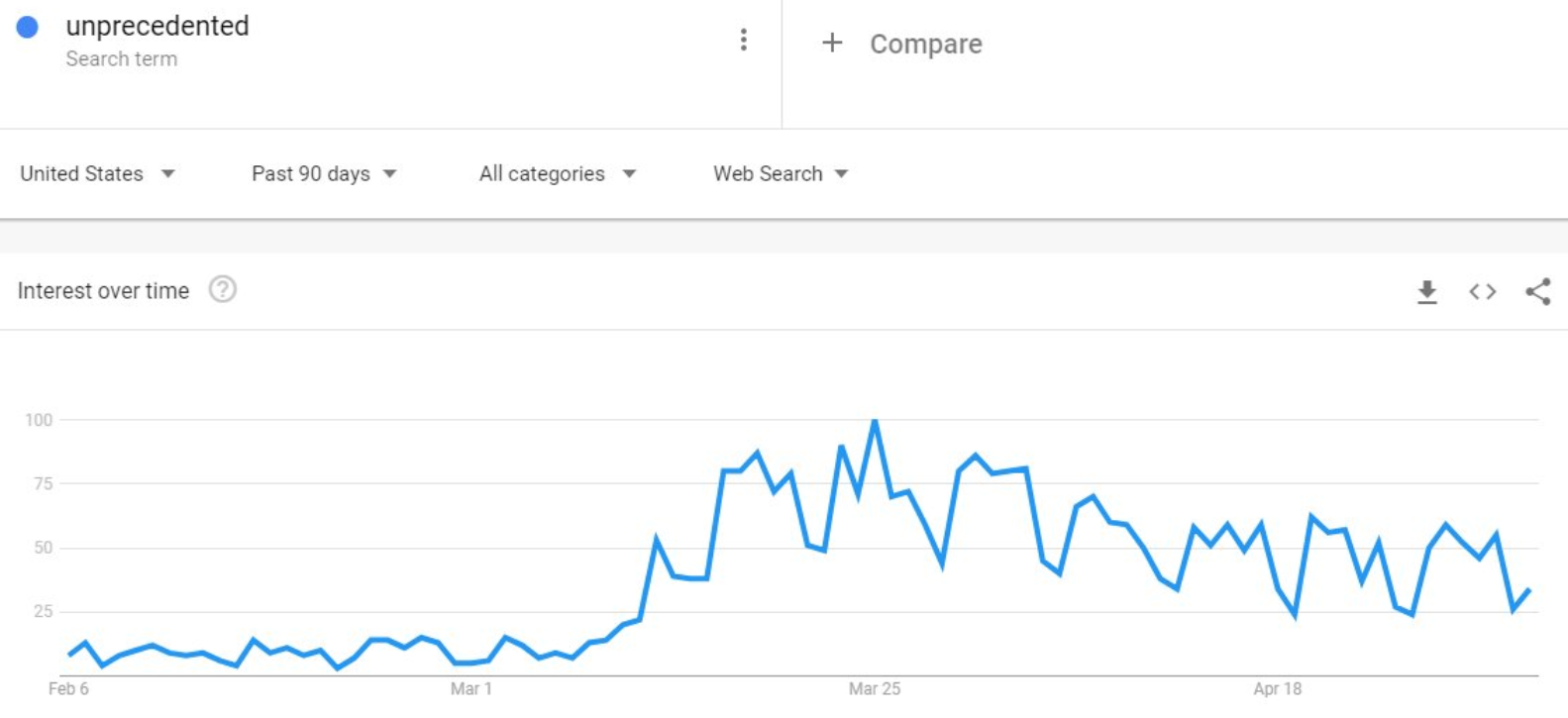

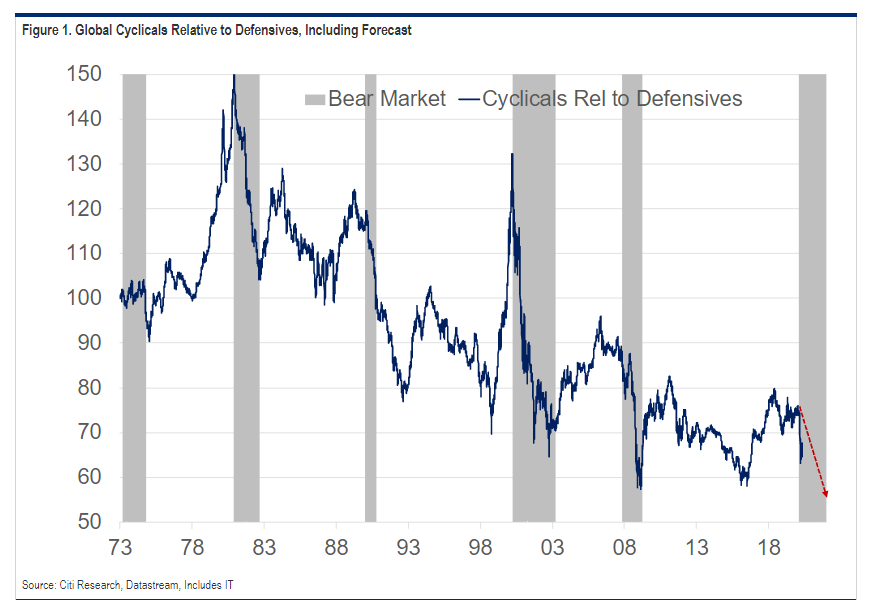

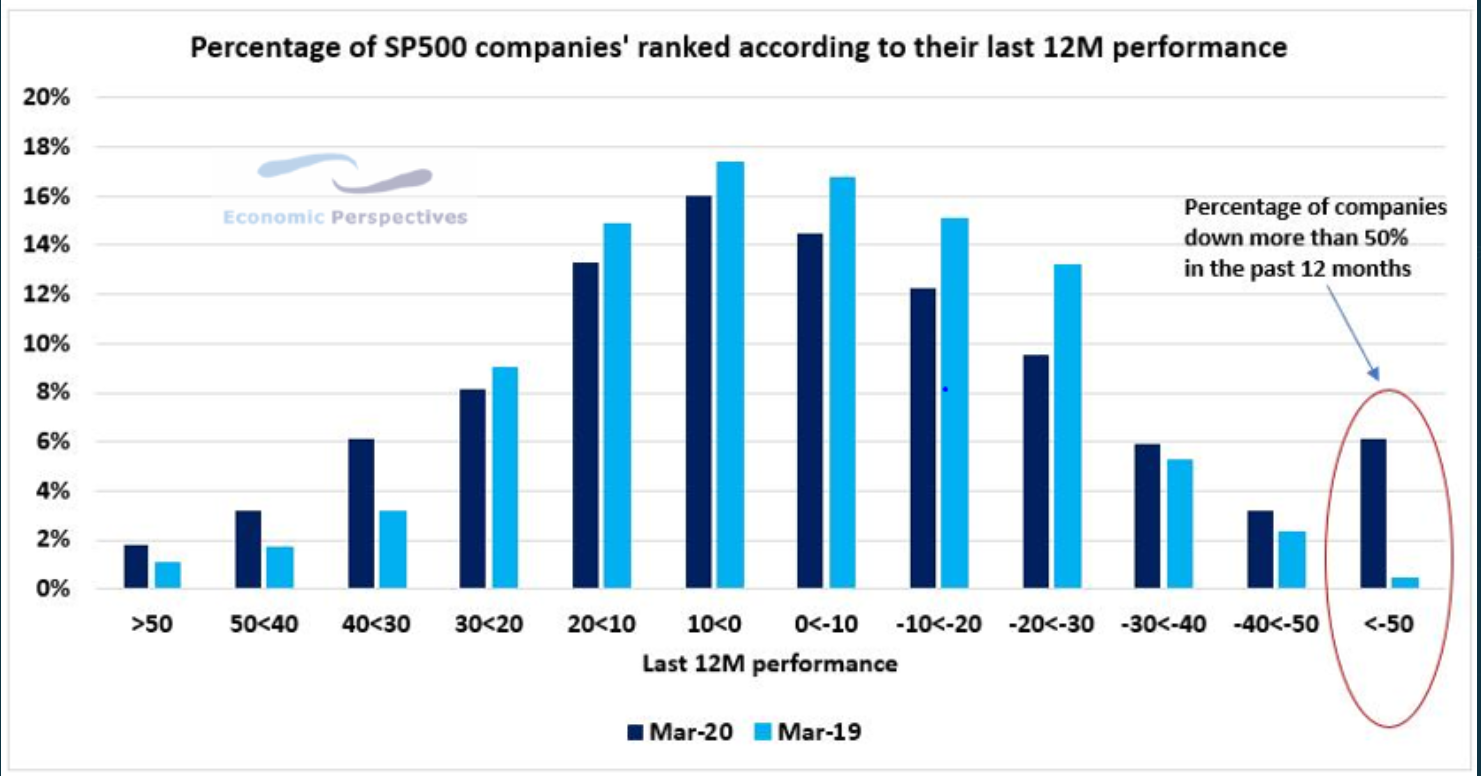

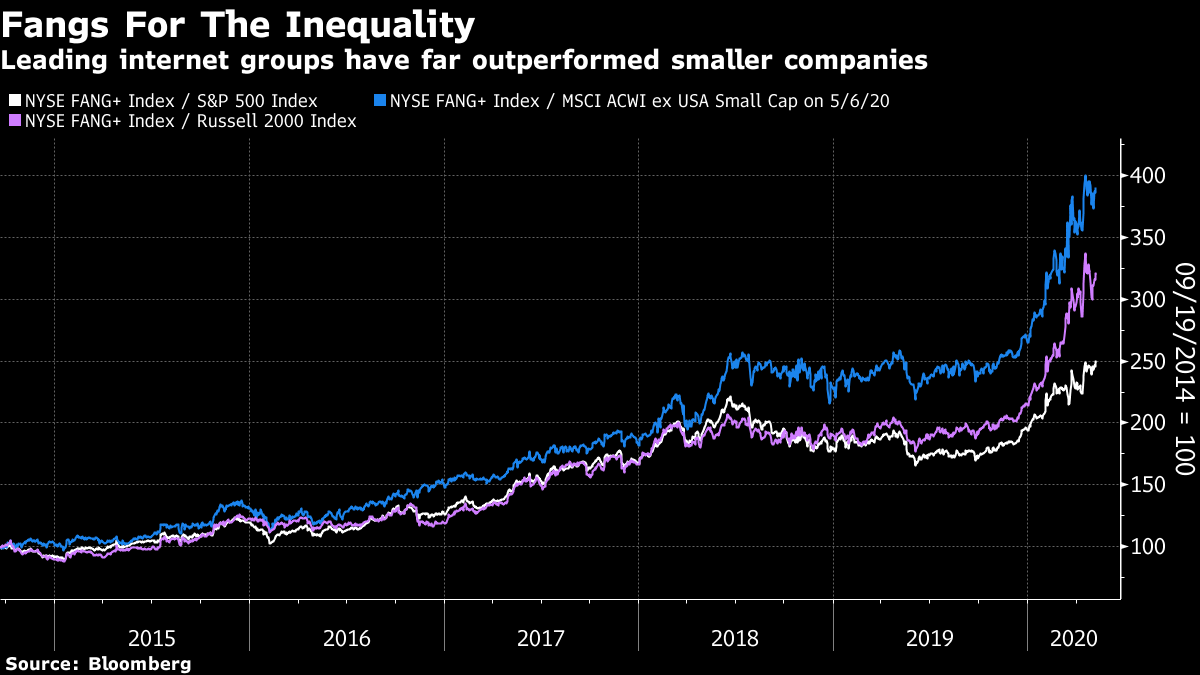

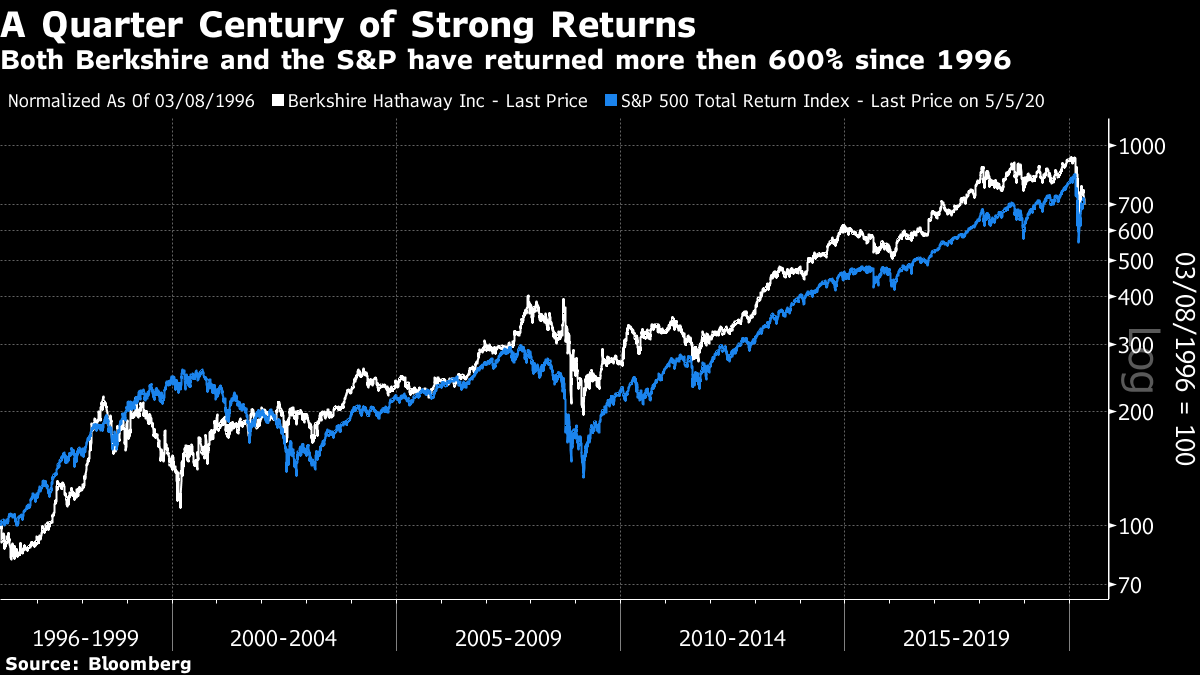

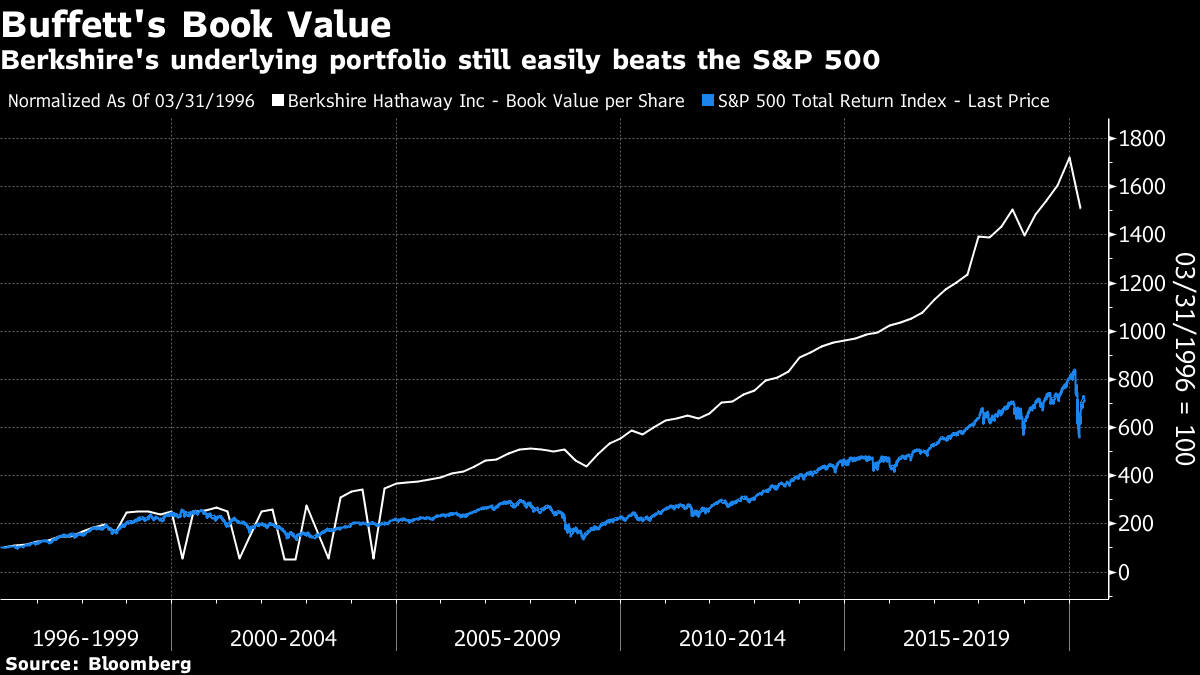

| To get John Authers' newsletter delivered directly to your inbox, sign up here . Unparalleled, Unusual, Aberrant These are unprecedented times. The word "unprecedented" is badly overused, and is often used as an (illegitimate) defense by companies or politicians with bad news to explain away, or good news to exaggerate. As this chart of appearances of the word "unprecedented" in company disclosures from Sentieo demonstrates, corporate executives were already making unprecedented use of the word "unprecedented" last year, before making utterly unprecedented use of the word in the last three months:  Claiming that something is unprecedented can easily be an excuse. But the coronavirus economy is truly unprecedented. Friday morning will bring the announcement of non-farm payrolls for the month of April in the U.S. This figure has been published continuously since 1939. If the economists who have shared their forecasts with Bloomberg are anywhere near right, Friday's release won't be remotely like anything that has been seen before:  We are braced for more than 20 million job losses in April, more than 10 times higher than ever before. That implies a forecast unemployment rate of about 16%, as the following chart from Berenberg Capital Markets LLC shows. That would be the swiftest increase on record, and the worst unemployment rate since the war. It still wouldn't be as bad as the Great Depression of the 1930s:  The biggest problem with unprecedented events is, as the word implies, that we lack any precedents. The effect of being in uncharted waters and without any clear guidance from history as to how to proceed is to ratchet up our feelings of fear and uncertainty. Indeed, Google Trends shows that searches for the word "unprecedented" reached a level last month far in excess of anything seen before.  Closer examination shows that the peak in searches for "unprecedented" overlapped with the peak in fear and the bottom of the stock market at the end of March. My thanks to Peter Atwater of Financial Insyghts for these charts:  Beyond showing that we are scared, the word's prevalence also shows an abdication of responsibility. If we don't have a precedent, we can't be expected to work out how to deal with the situation, or to have a clue what to do next. Bad things aren't our fault, so we needn't try too hard to mitigate them. And — critically, as we brace for the appalling news on joblessness — it means we are free to say that this recession is unlike any other, and so none of the precedents from other recessions apply. This leads to expectations of a "V-shaped" recovery, and to sweeping assumptions that the economy can swiftly reopen. It is true that this recession is very different in its trigger from most if not all of those that preceded it. But that doesn't necessarily mean we can ignore all lessons from history. So far, the way the market has sold off and recovered suggests that investors believe cyclical stocks won't need to take the full lumps that they usually do during a recession. Presumably this is because investors are allowing themselves to believe that after an unprecedentedly swift fall, we can have an unprecedentedly swift rise. Without getting too deep into the public debate over reopening the economy and the risk of fresh coronavirus waves, that seems hugely hopeful to me. Just because we don't have a precedent for a shutdown like this, we aren't barred from working out that the reopening will have to be more gradual than the closing. Citigroup Inc.'s chief global equity strategist, Rob Buckland, points out that if the bottom for cyclical stocks is in, they have underperformed defensive stocks by less than in any recession in the last half-century. In other words, because investors can rightly say that this economic shock is unprecedented, they are also hoping for unprecedented lack of damage for cyclicals:  This doesn't look like a safe bet. Unprecedented Inequality In another version of using "unprecedented" as an absolution from responsibility, look at the way that money is being handed out in programs to soften the economic blow of the virus. There is no precedent for this, so there is no precedent for a collapse of small businesses in the wake of a pandemic either. Neither is there a precedent for a wave of civil disorder in the wake of a botched economic response to a pandemic. Nevertheless, risk managers are spending more and more time worrying about these things. Inequality had been increasing steadily in the developed world before the crisis, and it is growing more serious. People are entitled to be angry about this, and in a democracy they have the ability to do something about it. At the corporate level, inequality as a result of the crisis has a specific manifestation that is very dangerous. Within the S&P 500, the tail of companies whose share prices have halved or worse has grown much longer in the last year. Even within the world of large U.S. companies, inequality is deepening. This chart is from Economic Perspectives.  Meanwhile at the top of the scale, the dominance of the biggest internet groups continues unchecked. On Wednesday, the NYSE Fang+ index, which includes some of the biggest Chinese internet names such as Alibaba Group Holding Ltd., in addition to the biggest American tech groups, set yet another record high relative to the S&P 500. It has now beaten the S&P by more than 150% since inception in 2014. It has also outperformed smaller companies, in the U.S. and particularly outside, by a much wider margin. There is nothing inevitable about this. Over the longer term, smaller companies are expected to outperform:  It is decades since the market has been dominated by a small group of companies to this extent, and arguably unprecedented for the dominant companies all to be drawn from much the same sector. It is also, therefore, unprecedented for governments to take aggressive antitrust action to split up a group of oligopolistic companies that dominate the internet. But the Fangs' dominance is increasingly regarded as unhealthy, and is increasingly provoking a response. Such things may not have happened before (although the original antitrust movement at the beginning of the last century might have provided some kind of a model). It is very possible that we will soon be setting a precedent for just such a thing. Cognitive Dissonance: Warren Buffett Version The market continues to be displeased that Warren Buffett has seen fit to sell some stocks during the coronacrisis and hasn't found any opportunities worth moving him out of cash. The latest sell-off in Berkshire Hathaway Inc. stock has brought us to a position many had been conditioned to believe impossible. I cherry-picked the date in the following chart, but it doesn't lie. At the end of the first week of March 1996, had you been given a choice between buying Berkshire Hathaway stock or the S&P 500, knowing you would have to sell today, you would have been better off buying the S&P. There were Vanguard mutual funds available to make that trade at the time, even if the great boom in exchange-traded funds still lay ahead.  What should we make of this? First, we need to grasp that buying and holding either Berkshire of a Vanguard index fund would have been a perfectly good idea 24 years ago. Few investments would have been better:  We also need to note that this is a market return, which is driven by confidence in Buffett as much as by his actual investment performance. That underlying performance remains much better than that of the S&P. This is how Berkshire's growth in book value per share compares with the total return on the S&P since that date in March 1996. (The earlier data points are obviously a bit funky but the long-term trend seems robust.)  Add to this that the market is getting ever harder to beat, that investors are growing ever more skeptical of the ability of anyone to outperform for a long period, and the fact that Buffett is now almost 90 years old, and you can explain why Berkshire's shares have pulled back. Survival Tips Surviving quarantine grows ever harder. In my household, we have even reached the point where the kids are complaining that the iPad is getting boring. In normal circumstances I would be delighted. Currently, it is less positive. But it does lead to the discovery of artifacts like this, lying around the house:  If you have run out of ideas to make beautiful creations using an Apple product like an iPad, you can always revert to making an elaborate sculpture of a mandarin duck out of an apple. Maybe that's a good survival tip. If anyone is interested, I will see if I can get my daughter Josie to explain how on earth she did this.

Be safe everyone, and rest in peace Florian Schneider of Kraftwerk. Far too many of the musical heroes of my youth have left us this week.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment