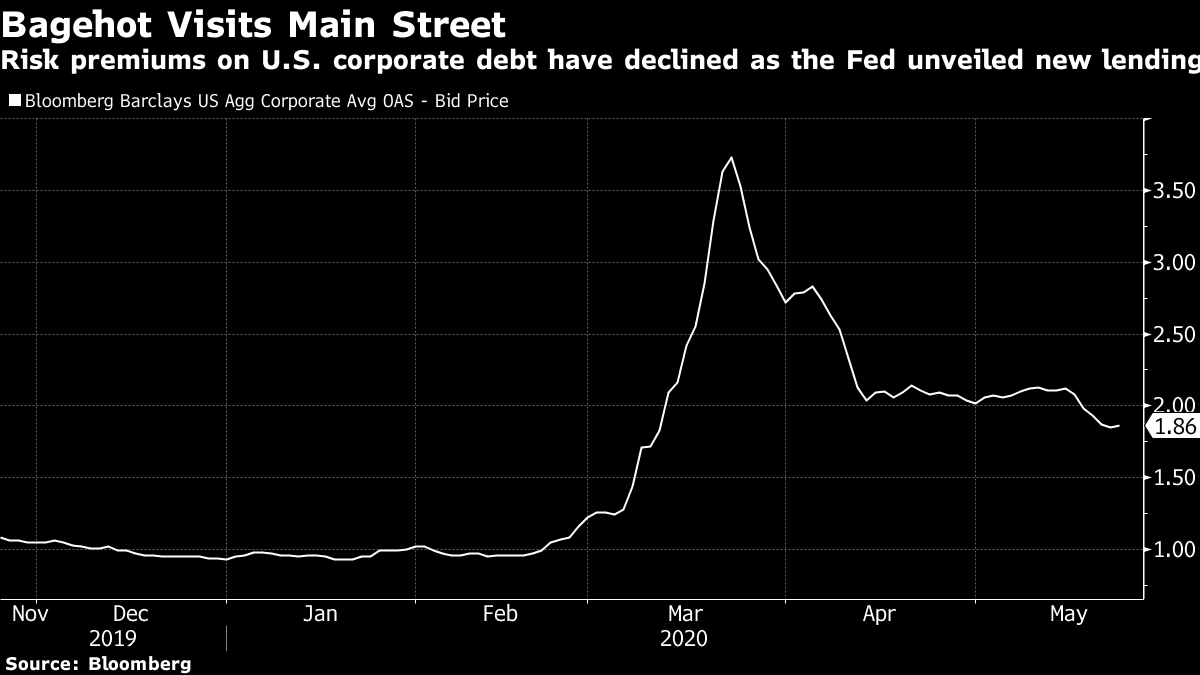

| China seeks to reassure Hong Kong that its judiciary will remain independent. The World Health Organization temporarily stops vaccine tests on hydroxychloroquine after safety concerns. And wealthy Chinese investors are snapping up luxury homes from Singapore to Sydney. Here are some of the things people in markets are talking about today. China sought to reassure Hong Kong that its judiciary would remain independent under a new national security law, as concerns grow that the city may lose one of its key selling points for international companies. "The legislation will not change the one country, two systems policy, Hong Kong's capitalist system, high degree of autonomy, nor will it change the legal system in Hong Kong SAR, or affect the independent judicial power, including the right of final adjudication exercised by the judiciary in Hong Kong," Xie Feng, commissioner of China's Ministry of Foreign Affairs in Hong Kong, said. Still, Xie provided few new details on how the new law would be implemented. Instead he repeated a line that said that Hong Kong protesters breached a red line supporting independence, mischaracterizing a movement that pushed for meaningful elections, an independent review of police abuses and the withdrawal of a bill that would allow extraditions to the mainland for the first time. Meanwhile, fears that capital could flee Hong Kong are visible just about everywhere in the currency market, testing the local dollar's resilience to economic recession. The World Health Organization temporarily halted tests on hydroxychloroquine in its Covid-19 drug trials pending more data because of safety concerns. That's after the Lancet published a study saying the drug, touted by U.S. President Donald Trump as a treatment, was linked to an increased risk of death and heart ailments. Still, the studies may resume if data warrants, Mike Ryan, head of the WHO's health emergencies program, said at a briefing. Meanwhile, U.S. cases rose at less than the weekly average for a third straight day as deaths inched closer to 100,000. Novavax started human tests of its coronavirus vaccine candidate. England will reopen some businesses beginning June 1, Dubai will start easing restrictions this week, and social unrest is lurking in Chile as virus spreads. Cases around the world have topped 5.4 million, and deaths at over 344,000. Here's how Bloomberg is tracking the outbreak. Asian stocks looked set to follow U.S. futures and European shares higher Tuesday as investors weighed more signs of economies reopening around the world against the rise in U.S.-China tensions, while the dollar was steady. Futures on Japanese, Australian and Hong Kong equities pointed higher, but volumes were light with holidays in the U.S. and U.K. S&P 500 contracts rose and benchmark Treasury futures were little changed. Tensions between Washington and Beijing remain in focus with China condemning the U.S. for adding 33 Chinese entities to a trade blacklist, but without announcing any retaliatory steps. Elsewhere, oil rose as the head of the International Energy Agency forecast demand will likely grow past its level before the global pandemic, and gold dipped 0.2%. Nothing has stopped Asia's health-care stocks from beating other industries, and some investors see them rallying even further. The sector is the best performer of 2020, and it's led the market in the past three years. Valuations, a frenzy to get a piece of the industry's initial public offerings and bullish analyst ratings all underscore investors' confidence, even if the rally may look a bit stretched. "You have a lot of fundamental excitements which will keep happening in a decade or multiple decades," said Shan He, a health-care analyst for Asia Pacific at Sanford C. Bernstein. "It's more than a defensive play." The sector in Asia is among the few where valuations have recouped all of the losses triggered by the coronavirus pandemic. A gauge tracking it trades at 26 times estimated earnings for the next year, near the highest since 2018 and compared with 14 times for the MSCI Asia Pacific Index. From Singapore to Sydney, rich Chinese investors are finding luxury real estate is a good hiding place from the economic fallout of the coronavirus. Wealthy buyers are snapping up top-end housing across China and some familiar Asia-Pacific hunting grounds, in many cases to guard their wealth against anticipated inflation and a weakening yuan. The rush to add real estate has led to a jump in upmarket housing prices in China, while offering some support for Asian property markets hit hard by the pandemic. A gradual easing of virus restrictions is making it easier for wealthy Chinese to view properties in nearby Asian hot spots, while in London and New York real estate remains sluggish. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning It's clear that this is the biggest financial crisis since 2008, but at the same time, it's not quite a financial financial crisis, in the sense that financial intermediaries like banks and other lenders haven't been at its epicenter. Instead, non-financial firms whose cash flows have basically completely dried up are the focus. That difference is important, because it suggests that policymakers might need a fresh approach rather than simply dusting off the kind of monetary programs that we saw back in 2008, which were aimed at easing a massive credit crunch in the financial system.  In a new paper, Eric Sims and Jing Cynthia Wu (of "shadow rate" fame) crunch the numbers to show that "Wall Street QE" — or direct lending by the central bank to financial intermediaries — can work to stimulate the economy during the kind of recession that generally sees banks become very reluctant to lend. But when the biggest problem facing the economy is a reduction of cash flows to non-financial companies, that kind of central bank intervention becomes ineffective. Instead, "Main Street QE" — or direct lending to non-financial firms — becomes more useful. Per the authors, "It is not sufficient for a central bank to lend freely to combat an economic crisis. It is just as important for the central bank to lend freely to where constraints are most binding. In the Great Recession, this was the financial system. In 2020, it is non-financial firms." You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia and beyond. Sign up here to get our weekly roundup in your inbox. |

Post a Comment