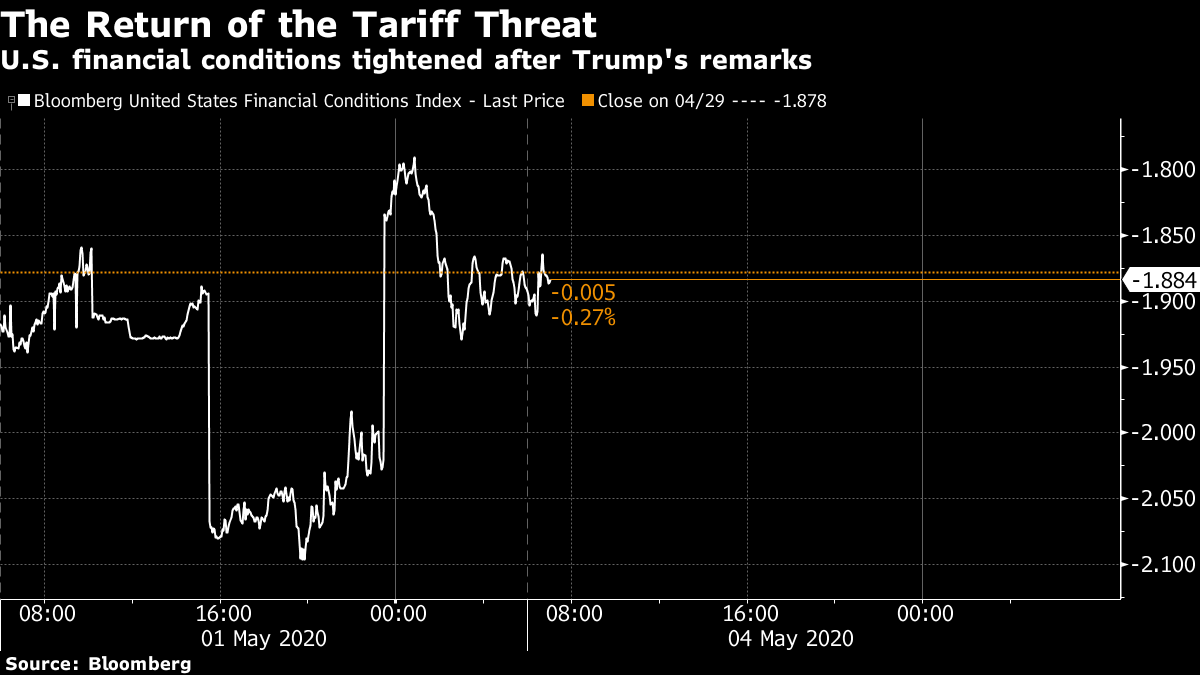

| Warren Buffett says this crisis is different from the global financial crisis as Berkshire Hathaway sits on a mountain of cash, the pace of U.S. Covid-19 cases moderates, and markets are in a for a quiet start to the week with holidays in Japan and China. Here are some of the things people in markets are talking about today. Warren Buffett is treading more carefully this time around. With a record $137 billion of cash piled up at Berkshire Hathaway, Buffett fielded questions over the weekend from shareholders who wanted to know why he hadn't acted as companies clamored for liquidity amid the pandemic-related shutdowns. This crisis is different, Buffett said. The famous investor's reputation allowed him to serve as a lender of last resort during the 2008 financial crisis, racking up deals that generated 10% annual dividends from household-name companies. But as panic about the virus and shutdowns assaulted equities in March and even began to freeze debt markets, the Federal Reserve beat him to the punch with an unprecedented set of emergency measures. While Berkshire bought back $1.7 billion of its shares in the first quarter, it was a net seller of stocks through April as it shed stakes in four major U.S. airlines. U.S. cases increased 2.3% in the past 24 hours, below the one-week daily average. Gilead Sciences plans to get its drug remdesivir to patients within days after getting U.S. backing for emergency use. New York added the fewest new deaths in more than a month as hospitalizations declined. Russia reported more than 10,000 new cases, the highest number of the outbreak. The daily toll fell in the U.K. and Italy as leaders navigate reopening business without sparking new infections. Spain recorded the fewest deaths in more than six weeks. Meanwhile, the U.S. Secretary of State Michael Pompeo said "enormous evidence" shows the novel coronavirus outbreak began in a laboratory in Wuhan, China. And doctors debate the arrival time of a Covid-19 vaccine. Currency markets saw muted moves in early trading on Monday, though sentiment remained fragile after a rough start to the month for risk assets. The New Zealand dollar slipped along with the pound and euro, though moves for most major currency pairs were subdued. Trading volumes may be light due to the Japan holiday and Treasuries won't trade until the London open. Equities traders will be watching the open for S&P 500 futures after global stocks posted a more than 2% slide on Friday. China is also shut for a holiday. Meanwhile, the first full trading week of May could be a test for emerging markets. The Reserve Bank is expected to maintain its three-year yield target at 0.25% and the cash rate at the same level Tuesday. Governor Philip Lowe's post-meeting statement is likely to hint at the economic scenarios to be outlined in Friday's quarterly forecast update. The RBA skipped purchasing bonds in the secondary market on Thursday, the first time since announcing its version of yield curve control six weeks ago, having acquired about A$50 billion ($32.3 billion) of federal and state government securities across a range of maturities. Its buying spree has seen yields on three-year Australian government bonds converging with the target. Governments worldwide have deployed more than $8 trillion to fight the economic fallout from the coronavirus pandemic. In the months and years ahead, nations are going to flood bond markets to raise the cash necessary to finance those programs. Even a calamity of disease, death and economic destruction afflicting the world all at once isn't enough to suppress the notion in some quarters that inflation could return with a vengeance. Economists including former Bank of England official Charles Goodhart, and investors such as BNP Paribas Asset Management, are asking if a different phenomenon lurks in the wreckage of global growth. Such contrarians wonder if an environment of ultra-loose monetary and fiscal easing, commodity shortages, frayed supply chains and braking globalization might be fertile ground for surging consumer prices. Reinforcing that shift, monetary authorities could face pressure to keep interest rates low, capping the cost of servicing ballooned government debt while allowing inflation to erode it too. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Tracy's interested in this morning So we're talking trade again. It's no surprise that — after using the threat of tariffs to help influence U.S. monetary policy — President Donald Trump has reached for the same tool during a time of immense political pressure, suggesting that he could apply trade restrictions to "punish" China for its role in the coronavirus outbreak. Of course, one of the problems of pulling from the same playbook over and over again is that it tends to lose efficacy after a while.  Tightening financial conditions to encourage the Fed to apply additional easing probably wasn't the main intent of this particular Trump threat. Nevertheless, it's worth noting the market impact. U.S. Treasuries did rise while stocks fell and the dollar gained — but the resulting tightening in financial conditions appeared pretty short-lived. You can follow Bloomberg's Tracy Alloway at @tracyalloway. For the latest virus news, sign up for our daily podcast and newsletter. |

Post a Comment