U.S.-China tensions heat up, investors in risk-off moods and economies slowly get back to business. Conclusive reportPresident Donald Trump yesterday promised a "conclusive" report on the Chinese origins of the coronavirus outbreak after Secretary of State Michael Pompeo said there was "enormous" evidence the virus began in a laboratory in Wuhan. Acknowledging the death toll from the pandemic in the U.S. would be between 75,000 and 100,000, Trump also pressed for a reopening of the economy in the virtual town hall hosted by Fox News. Investors, already nervous about the damage the shutdown is doing to growth prospects, are worried that heightened tensions will lead to a reemergence of the trade war between China and the U.S. Knucklehead riskNew Jersey Governor Phil Murphy warned that the pace of the state's relaxation of measures introduced to slow the spread of the virus would in part be governed by how much "knucklehead" behavior emerges. In Florida, state parks will reopen today along with restaurants and retail in most parts of the state. There were more signs of the damage already done to the retail sector by the shutdown with J. Crew Group Inc. filing for Chapter 11 bankruptcy this morning. In Europe, Italy and Spain have started to relax shutdown measures as PMI data confirmed the unprecedented output slump in the region in April. Oil fearThe collapse of oil prices into negative territory last month has investors doing everything they can to avoid getting caught in a repeat performance. That risk aversion was highlighted when a $500 million oil exchange-traded fund in Hong Kong said its broker refused to let it increase holdings of crude futures. Other funds have already announced they are moving their holdings further out the futures curve. While massive build-ups in storage are the immediate problem facing traders, animosity between the U.S. and China risk hampering the global recovery. West Texas Intermediate for June delivery snapped a three-day increase to trade 8% lower, close to $18 a barrel. Markets dropThe risk-off mood in markets continues this morning with most major gauges trading lower. Overnight the MSCI Asia Pacific ex-Japan Index dropped 2.6%. Japanese markets are closed for a three-day holiday. In Europe, the Stoxx 600 Index had dropped 2.6% by 5:50 a.m. Eastern Time as traders there returned from a three-day weekend. S&P 500 futures pointed to a lower open, the 10-year Treasury yield was at 0.597% and gold was higher. Coming up…March factory orders are expected to show a near 10% decline while the final print of durable goods orders numbers is expected to confirm the more than 14% plunge when the data is released at 10:00 a.m. In earnings today there will be close interest in the results from Tyson Foods Inc. as the U.S. meat industry has been thrown into turmoil by the coronavirus outbreak. Air Canada, Lowe's Cos Inc. and Shake Shack Inc. are among the other companies reporting. The Senate returns today. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morning"Capitalism without failure is like religion without sin" is a frequent thing you hear from critics of bailouts and government economic intervention. They insist that, while painful, corporate failure is an essential aspect of the economy's long-term health. There's an important intuition behind this claim. The makers of superior products and services should be allowed to win, and if the government bails out the makers of inferior firms over the long-term we'll be left with unproductive, cronyist zombies. In other words, if a company like Zoom Video comes along and obliterates some old-school videoconferencing companies, there's no good reason to bail out the old player.

But what's true at the micro level -- company A should be allowed to put company B out of business -- isn't necessarily good macro policy. It's one thing to let the maker of the inferior mousetrap go out of business. It's another thing to let all mousetrap makers collapse, causing a massive loss of wealth and layoffs while hampering our ability to catch mice in the future.

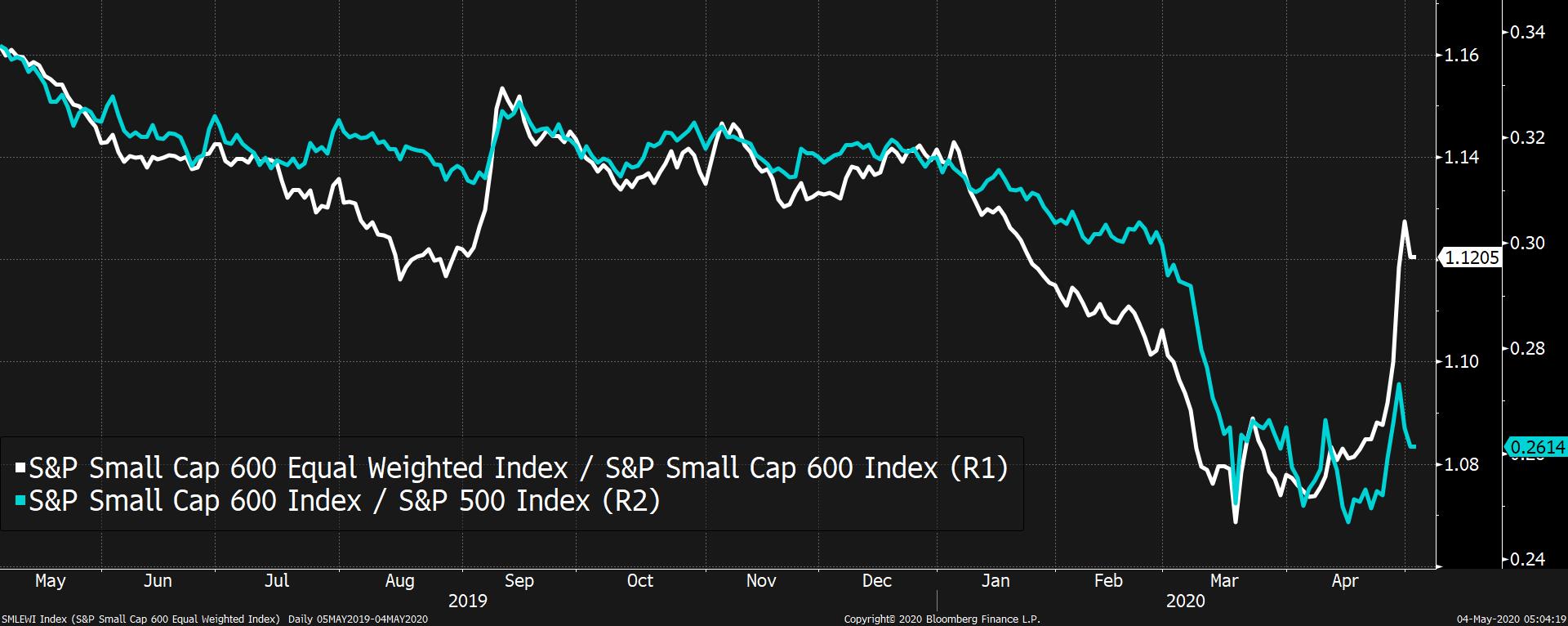

You might like to think that in a generalized collapse, the market will still reward the better micetrap makers, and that when the sun shines again, the better company will be in a position to reap its rewards. But the world doesn't behave so neatly. One thing we've seen during this crisis is that during the worst of the downturn, investors primarily rewarded larger companies over small ones. You can see that in the performance of the S&P 500 (large caps) versus the S&P 600 (small caps). And while that may be distorted somewhat by the inclusion of a few big tech megacaps, even just within the S&P 600 alone, the larger companies have done better than the small ones, as you can see by comparing the S&P 600 equal-weight index vs. the market-cap index of the same stocks, which more heavily weights the larger small cap companies.

Competition and bankruptcy are an important part of a robust economic system. Companies fail in good times and bad times. And ideally the better, more productive players win. But there's nothing particularly good about a general collapse, which as the market shows, doesn't reward better per se. It just rewards bigger.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment