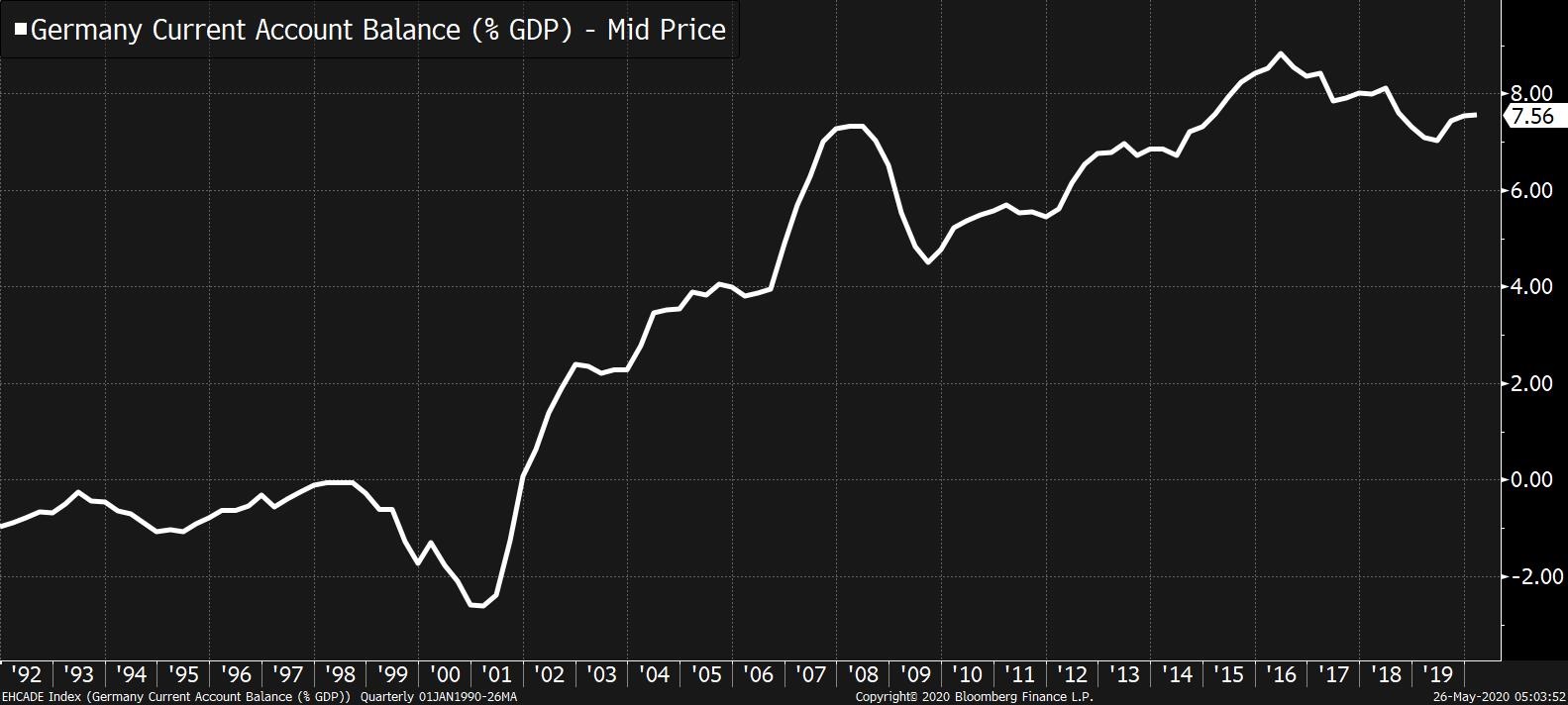

| Want to receive this post in your inbox every morning? Sign up here The world is reopening, protests in Hong Kong, and airlines start to crack. Running out More countries are moving to allow economic activity to return to more normal levels as "stay at home" orders are eased around the world. Japan ended its state of emergency, Britain outlined plans to allow retail outlets to open in the coming weeks and Germany is reportedly set to lift travel warnings. Survey data points to increased optimism of a recovery in economic activity in the second half of the year. Over the Memorial Day weekend in the U.S. there were more signs of things starting to return to normal. Renewed Protests Hong Kong Chief Executive Carrie Lam asserted that local residents supported China's move to impose sweeping national security laws in the territory, after a weekend of protests against the legislation. Authorities in Beijing sought to reassure that the judiciary in Hong Kong would remain independent amid concern the city will lose its allure to international companies as a place to do business. There are already signs of weakening investor appetite for commercial property. Airlines International travel has been one of the hardest-hit sectors by the coronavirus shutdown, and the mixed fortunes of global airlines is laid baer this morning. Latin America's largest carrier Latam Airlines Group SA sought bankruptcy protection in New York as it tries to turn around the business after cutting 95% of its passenger operations. Across the Atlantic, Germany agreed a 9 billion-euro ($9.8 billion) bailout of Deutsche Lufthansa AG. The plan will need EU approval and will almost certainly be challenged by Ryanair Holdings Plc, meaning it could take several weeks to complete. Markets rally Investors are taking a glass-half-full view of the world today, focusing on the lifting of virus restrictions rather than continuing tensions between the U.S. and China. Overnight the MSCI Asia Pacific Index added 2% while Japan's Topix index closed 2.2% higher, boosted by the ending of the state of emergency there. In Europe, a surge in travel stocks helped lift the Stoxx 600 Index 1% by 5:50 a.m. Eastern Time. S&P 500 futures pointed to a strong open, the 10-year Treasury yield was at 0.693% and oil was over $34. Coming up... The April Chicago Fed National Activity Index is published at 8:30 a.m. FHFA House Prices and S&P Corelogic Home Prices for March at 9:00 a.m. April new home sales are expected to show a significant decline when they are released at 10:00 a.m. Minneapolis Fed President Neel Kashkari takes part in a discussion with former Treasury Secretary Lawrence Summers later. The New York Stock Exchange will partially reopen its trading floor today. What we've been reading This is what's caught our eye over the last 24 hours And finally, here's what Joe's interested in this morning If you're looking for a book to read this summer, I recommend checking out Trade Wars Are Class Wars by Matt Klein and Michael Pettis. In many respects, it sets up what is likely to be the biggest macro question in the post-crisis period. Their basic argument is that domestic policies in both Germany and China have the effect of systematically transferring wealth from workers to the elites in both countries. This has the effect of reducing overall demand in both countries because money earned by the wealthy is more likely to be saved, whereas money earned by the poor and middle classes is more likely to be spent. Since Germany and China aren't buying as much as they produce, this contributes to an overall glut of stuff in the world, which harms workers in other countries -- leading to underemployment and household indebtedness alongside high asset prices, as the global wealthy use their unspent money to make investments. Perhaps the biggest macro question going forward is whether the shock caused by this crisis is enough to meaningfully change the domestic policies around the world. Will Germany meaningfully give up on its obsession with balanced budgets? Will the crisis spur China to build out a stronger domestic safety net in the wake of a huge hit to industry? Will the U.S. take advantage of its massive fiscal capacity to spend more aggressively lowering unemployment in a way it's been reluctant to? There's no guarantee of any of this happening, but the possibilities seem more realistic. Anyway, the book is great, and in the meantime, you can check out interviews with both Matt and Michael on our podcast.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment