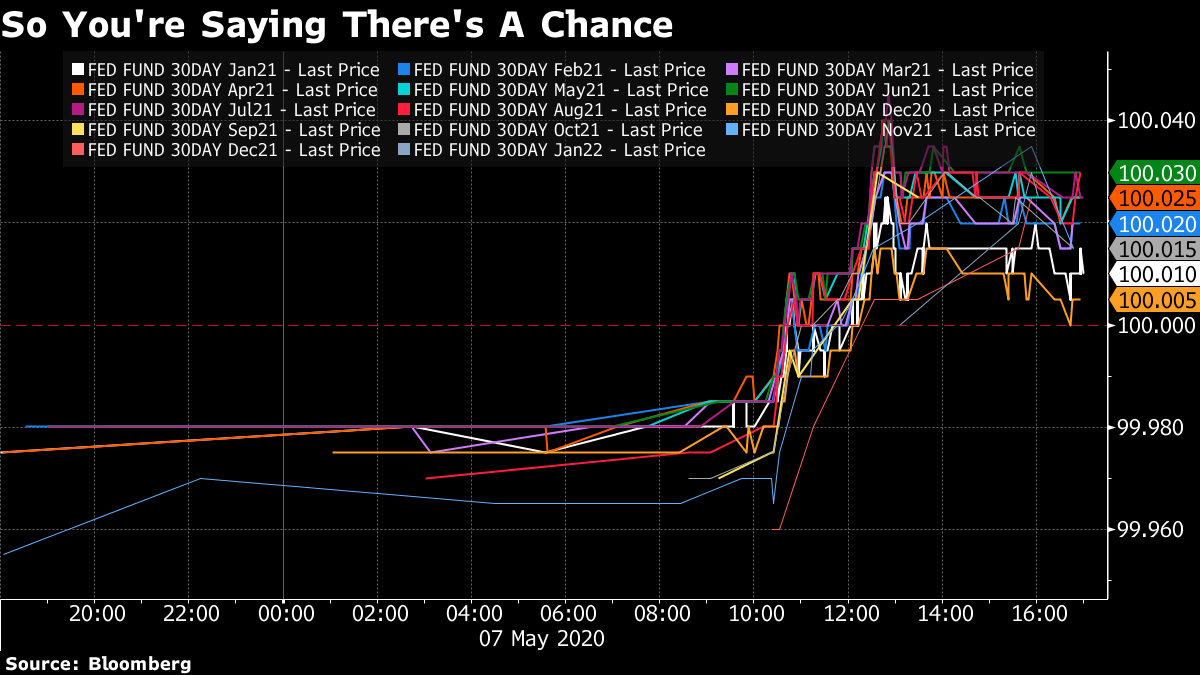

It's jobs day, China and U.S. agree on implementation of trade deal, and reopenings gather pace. PayrollsToday's jobs report will break a raft of records, with economists expecting a decade of employment growth to have been wiped out in a single month. The forecast is for a 22 million drop in positions in April, with the unemployment rate surging to 16%. The weekly drumbeat of multi-million new jobless claims means the numbers will not be a surprise when they are published at 8:30 a.m. Eastern Time. Federal Reserve Bank of Minneapolis President Neel Kashkari said that today's total could be an undercount as many who have lost their jobs cannot actively seek a new one due to the lockdown. Trade deal dealPresident Donald Trump's threat to terminate the phase-one trade deal unless he sees Beijing honoring its commitments has led to an agreement between top negotiators on both sides on a way forward. China's Vice Premier Liu He talked with U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin by phone, with a statement issued afterwards saying "both sides agreed that good progress is being made" and that commitments made will be met in a timely manner. The comments are the first sign of improving relations between the world's two largest economies after they engaged in a war of words over the coronavirus outbreak. OpeningCalifornia has issued guidelines to shops, building sites and factories to begin reopening, with Tesla Inc. among the companies aiming to restart production as soon as today. The economic damage from the lockdown imposed to slow the spread of the virus which has already caused 75,000 deaths in the U.S. is likely to continue for some time, with a wave of corporate bankruptcies building to toward the worst run in years. A rising infection rate in the U.K. means that hopes of a swift opening of the economy will likely be dashed when Prime Minister Boris Johnson addresses the nation on Sunday. Markets riseThe seemingly unstoppable recovery of stocks in the face of dire economic and employment data continues. Overnight the MSCI Asia Pacific Index added 1.6% while Japan's Topix index closed 2.2% higher. In Europe, the Stoxx 600 Index had gained 0.6% by 5:50 a.m. in a session that saw lower than average volumes due to a holiday in the U.K. S&P 500 futures pointed to a positive open ahead of jobs data, the 10-year Treasury yield was at 0.643% and oil remained on track for a second weekly gain. Coming up...As well as U.S. payrolls, Canada also issues its jobs report at 8:30 a.m. with the unemployment rate expected to jump to 18%. March wholesale inventories data is at 10:00 a.m. At 1:00 p.m. the Baker Hughes rig count will likely show another drop in the number in use. Noble Energy Inc. and Exelon Corp. report as earnings season starts to wind down. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningEvery fed funds futures contract from December 2020 through January 2022 closed above par on Thursday, implying a potential for fractionally negative rates during that timeframe. Wall Street was quick to recommend fading the potential for negative rates to be adopted, however. After all, Fed Chairman Jerome Powell himself has said they wouldn't be appropriate policy in the U.S. There's solid evidence behind this view. Powell in his most recent press conference said that the Fed was at its effective lower bound multiple times. And in general, central banks have been running away from negative rates lately. The Bank of Canada declared 25 basis points to be its effective lower bound despite a longstanding understanding since 2015 that -0.5 percent was the lowest its policy rate could go. The European Central Bank and Bank of Japan have refrained from taking rates deeper into negative territory during this downturn, to boot. On the other hand, there's nothing from the past six weeks that proves past precedent is any reliable guide to central bank actions. In the case of the Fed other unconventional options than negative rates would likely be preferred. But just because negative rates seem very unlikely to be enacted stateside doesn't mean they can't – or shouldn't – be priced.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment