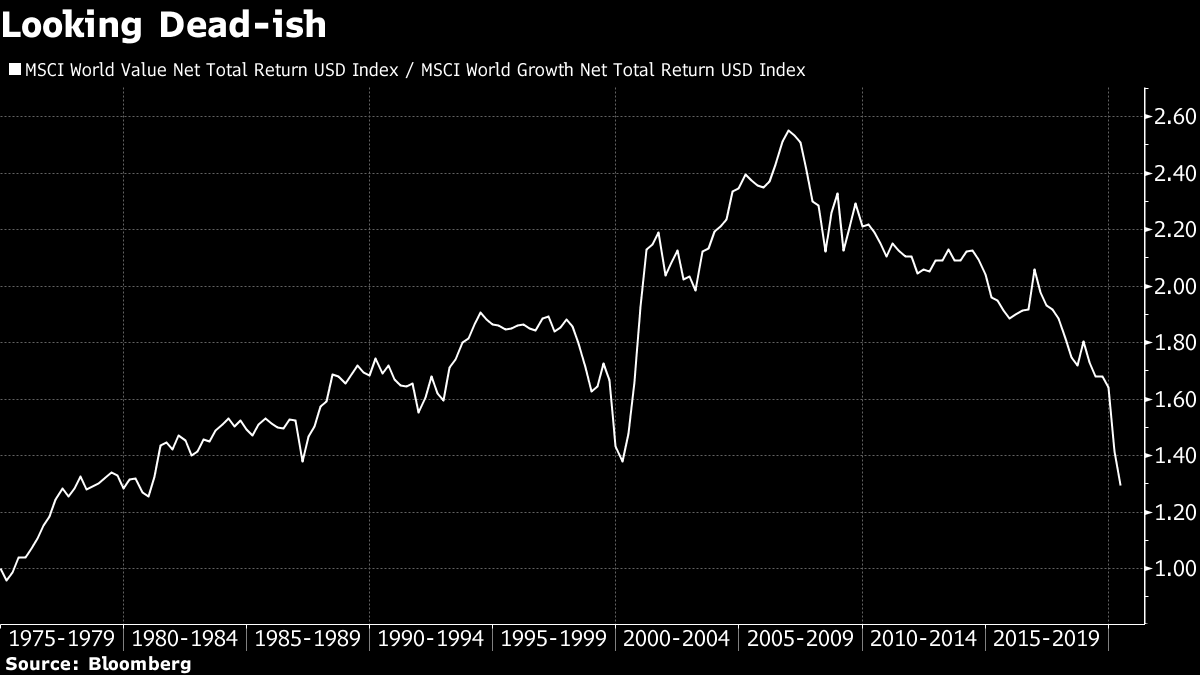

| Want to receive this post in your inbox every morning? Sign up here China pledges to implement U.S. trade deal, Hong Kong stocks plunge on Beijing power grab, and fears of Memorial Day weekend virus spike. Policy meeting The opening day of the delayed annual gathering of lawmakers in China saw a mixed bag of developments for Sino-U.S. relations. Premier Li Keqiang told the assembly that Beijing remained committed to implementing the phase-one trade deal, despite the coronavirus hit to the economy and tensions between both sides. The uncertainty over the growth outlook means the country's government also confirmed that it is abandoning a hard growth target for this year, saying it will instead concentrate on employment. Hong Kong The positive talk on trade has been overshadowed by China's power grab in Hong Kong, with Beijing moving to effectively bypass the city's legislature to implement national security laws. Residents fear the move will erode freedoms of speech, assembly and the press. The Hang Seng Index plunged 5.6%, with real-estate firms the worst hit. Democracy advocates called for protests against the legislation, and President Donald Trump said he would respond "very strongly." Trials AstraZeneca Plc and Oxford University have started recruiting subjects for advanced human trials of its experimental Covid-19 vaccine. The hope is that doses of the vaccine will start to become available in September. Nissan Motor Co. and International Business Machines Corp. announced job cuts as the shutdown continues to crush economic activity across the world. In the more immediate term, pandemic experts are concerned that Americans heading for beaches and parks over the long weekend could lead to a spike in cases. Markets drop Investor worries about worsening relations between the world's two largest economies are putting pressure on global stock markets. Overnight the MSCI Asia Pacific Index dropped 1.9% while Japan's Topix index closed 0.9% lower. In Europe the Stoxx 600 Index had slipped 0.9% by 5:50 a.m. Eastern Time with banks and miners among the biggest losers. S&P 500 futures pointed to more red at the open, the 10-year Treasury yield was at 0.638% and gold gained. Coming up... Canadian retail sales for March are expected to show a double-digit plunge when they are published at 8:30 a.m. Oil investors, who have seen the recent run of price rises come to a halt today, will be watching the Baker-Hughes rig count at 1:00 p.m. for further signs of a U.S. production slowdown. The U.S. eco calendar is blank, and bond markets close at 2:00 p.m. ahead of the holiday weekend. Alibaba Group Holding Ltd., Deere & Co. and Foot Locker Inc. report results. What we've been reading This is what's caught our eye over the last 24 hours And finally, here's what Justina's interested in this morning The next time someone asks me why I cover quants, I can point to the contentious, highly personal and generally entertaining Twitter clash between AQR co-founder Cliff Asness and "Black Swan" author Nassim Taleb to illustrate just how much drama there is in this part of the investing world. I am too much of a wimp to wade into that tail-risk debate, so I will write about another slightly less heated debate in quantland right now: Is value dead? The anti-value camp has by now more than a decade of factor underperformance on their side and perfectly persuasive arguments about how post-crisis trends -- low inflation, a winner-takes-all economy dominated by tech, the ETF boom -- all logically lead to lower premiums. The pro-value camp rarely disagrees with this. They just don't think these are structural shifts. Most factor quants rely on research from decades of data, so given that value is one of the most rigorously studied factors, even this degree of underperformance is unlikely to sway this crowd. In a way, both can be right -- one in the medium term, the other in the long term. The problem with sticking to value is you need investors -- and bosses -- who aren't going to bail on you, especially when you can't tell them when the rotation will occur. So for many fund managers, any personal conviction in value is meaningless. But as Asness himself would say, that's why quants don't have to worry about the factor getting arbitraged away.  Follow Bloomberg's Justina Lee on Twitter at @justinaknope. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment