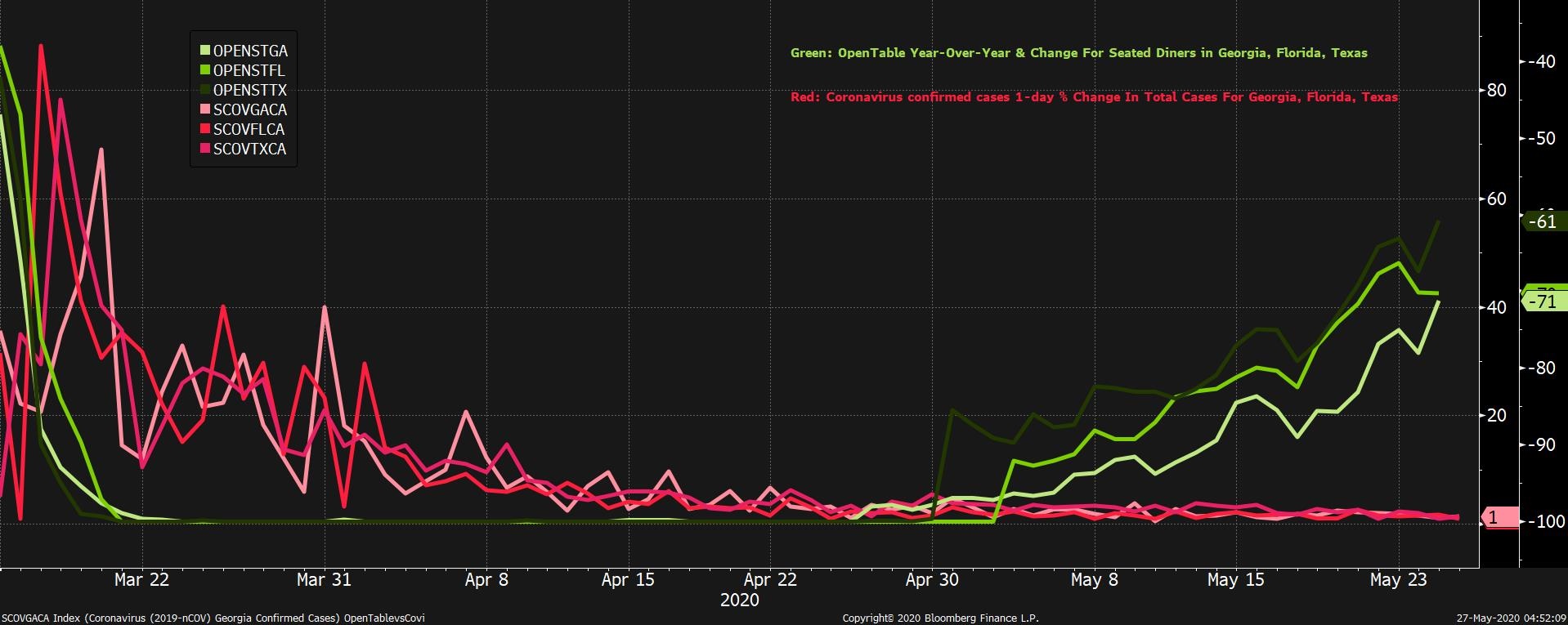

| Want to receive this post in your inbox every morning? Sign up here China back on the sanctions list, Lagarde is not optimistic and a lot more stimulus on the way. Sanctions, threats There is no sign that U.S.-China tensions will ease any time soon. The House of Representatives is poised to give final passage to legislation that would sanction Chinese officials for human rights abuses against the country's Uighur minority and members of other Muslim groups in the Xinjiang region. President Donald Trump has not yet confirmed he would sign the bill which was passed by the Senate earlier this month. The president is also trying to add to pressure on Beijing over the crackdown in Hong Kong, saying his administration will act "very powerfully." China said it would retaliate if there was interference in its internal affairs. Downbeat European Central Bank President Christine Lagarde gave a gloomy outlook for the region's economy this morning, predicting output will likely shrink 8% to 12% this year, adding that estimates for a mild slowdown are "out of date." This morning the European Commission seems to have made a major step forward in fighting the downturn by proposing €500 billion in grants to member states hardest hit by the outbreak -- not quite eurobonds -- and a further €250 billion in loans. The proposal will likely kick off weeks of bargaining between member states until a compromise can be agreed. Après Covid, le deluge Speaking of recovery spending, Japan is set to unveil a new stimulus package worth more than $1 trillion, its second such measure in a month. The U.S. posted the slowest growth in confirmed cases since March, with plans for more testing announced. New York City is seeking authority to borrow as much as $7 billion to make up for the revenue lost due to the pandemic. As well as the Europe-wide package being discussed, France and Germany both are increasing national stimulus. Markets rally Global equity investors are liking the big slice of government spending coupled with the easing of the pandemic, while turning a blind eye to rising U.S.-China tensions. Overnight the MSCI Asia Pacific Index added 0.4% while Japan's Topix index closed 1.0% higher. In Europe, the Stoxx 600 Index got a boost from the announcement of the European Commission proposal, with the gauge gaining 1% by 5:55 a.m. Eastern Time. S&P 500 futures were firmly in positive territory, the 10-year Treasury yield was at 0.698% and oil slipped. Coming up... The Richmond Fed manufacturing Index for May is at 10:00 a.m. The Fed Beige Book is published at 2:00 p.m. St. Louis Fed President James Bullard and Atlanta Fed President Raphael Bostic speak later. President Trump is due to meet New York Governor Andrew Cuomo before attending the launch of SpaceX's first crewed mission. What we've been reading This is what's caught our eye over the last 24 hours And finally, here's what Joe's interested in this morning Futures are soaring again today, following yesterday's solid performance. One important thing to note is that initially the stock market gains were concentrated in areas like e-commerce, software and video games. Lately however we've seen a broadening out to other sectors, such as energy, financials, and even leisure as investors grow more optimistic about an economic recovery and even potentially a return to normal. In the meantime, here's my candidate for the chart to watch most closely.  The green lines show OpenTable seating data for restaurants in Georgia, Florida, and Texas (three of the earliest and most aggressive states in terms of reopening). The red lines show the daily percentage change in total coronavirus cases in each of those states. The key thing is that all the lines keep going in the right direction. If the return to normal starts setting off a new wave of cases, that will be a red flag. Or if dining activity stalls out at a very depressed level, that would be ominous as well. And it's certainly possible that service sector activity could just hit a ceiling as a substantial portion of the public changes their behavior. But for now, all the lines are going in the right direction. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment